- Home

- Prelims

- Mains

- Current Affairs

- Study Materials

- Test Series

EDITORIALS & ARTICLES

EDITORIALS & ARTICLES

December 21, 2023 Current Affairs

Sahitya Akademi Awards for 2023

- Nine books of poetry, six novels, five short story collections, three essays and one literary study have won the Sahitya Akademi Awards this year.

- Tamil author Rajasekaran has been chosen for his novel Neervazhi Padooum, Telugu writer Patanjali Sastry for his short story collection and Malayalam litterateur,EV Ramakrishnan for his literary study Malayala Novelinte Deshakalangal.

- The authors who will receive the honour for their poetry collections include Vijay Verma in Dogri, Vinod Joshi in Gujarati, and Ashutosh Parida in Odia.

- The authors who have been chosen for their short stories include Pranavjyoti Deka in Assamese, Nandeswar Daimary in Bodo, and Taraceen Baskey in Santali.

- Sanjeev will get Sahitya Akademi Award for his Hindi novel Mujhe Pahachaano and Neelam Saran Gour will get the award for her English Novel Requiem in Raga Janki.

- The award, in the form of a casket containing an engraved copper plaque, a shawl, and one lakh rupees.

- The Award will be presented at the award presentation function on 12th March next year.

Sahitya Akademi awards:-

- Established: 12 March 1954.

- Given By: Sahitya Akademi, Government of India.

- Sahitya Akademi Award is a literary honour that is conferred annually.

- It was the First Time Conferred in 1955.

- It is awarded in Languages

- The Award is presented to the most outstanding books of literary merit published in any of the twenty-four major Indian languages recognized by the Akademi (including English).

- Sahitya Akademi Award is the second highest literary honour by the Government of India, after the Jananpith award.

Decoration:-

- The Award in the form of an engraved copper-plaque, and a cash prize of Rs. 1,00,000/-

Eligibility:-

- The author must be of Indian Nationality.

Selection process:-

- For the main award/ Bhasha Samman conducted through a rigorous and confidential process overseen by experts – the body comprises one writer chosen from each of the 24 regional languages.

- Each member suggests 200 names, following which an expert committee finalises 50 in phase one → 5 in the next phase and finally, one of the five is shortlisted.

LS Passes Bills to Replace British-Era Criminal Laws

- Lok Sabha (the Lower house of the Parliament of India) passed the Bharatiya Nyaya (Second) Sanhita (2023), the Bharatiya Nagarik Suraksha (Second) Sanhita (2023), and the Bharatiya Sakshya (Second) Bill (2023)to replace British-era criminal laws.

- All three were discussed and passed with a voice-vote.

The Bharatiya Nyaya (Second) Sanhita Bill (BNSS):

- It replaced the Indian Penal Code (IPC), 1860, and it has 358 sections instead of 511 in the IPC.

- However, it retains most offences from the IPC, and adds community service as a form of punishment.

- Sedition: It is no longer an offence. Instead, there is a new offence for acts endangering the sovereignty, unity and integrity of India.

- Rajdroha(sedition or offence against the government) has been replaced with Deshdroha (offence against the nation or country).

- Terrorism:It adds terrorism as an offence, and defines it as an act that intends to threaten the unity, integrity, security or economic security of the country, or strike terror in the people.

- Unlawful Activities (Prevention) Act, 1967 (UAPA)’sdefinition of ‘terrorist act’ adopted: Section 113 of the revised Bill has modified the definition of the crime of terrorism to entirely adopt the existing definition under Section 15 of the UAPA.

- Organised Crime:It has been added as an offence. It includes crimes such as kidnapping, extortion and cyber-crime committed on behalf of a crime syndicate. Petty organised crime is also an offence now.

Issues and Analysis of BNSS:

- Age of criminal responsibility is retained at seven years. It extends to 12 years depending upon the maturity of the accused.

- It may contravene recommendations of international conventions.

- BNSS defines a child to mean a person below the age of 18. However, for several offences, the age threshold of the victim for offences against children is not 18.

- BNSS removes sedition as an offence, but the provision on endangering the sovereignty, unity and integrity of India may have retained aspects of sedition.

- It retains the provisions of the IPC on rape and sexual harassment, and does not consider recommendations of the Justice Verma Committee (2013)such as making the offence of rape gender neutral and including marital rape as an offence.

- BNSS omits Section 377 of IPCwhich was read down by the Supreme Court.

- It removes rape of men and bestiality as offences.

The Bharatiya Sakshya (Second) Bill (BSS):

- It replaced the Indian Evidence Act (IEA), 1872,by incorporating 170 sections and expanding the definition of documents to include electronic records.

- However, it retains most provisions of the IEA including those on confessions, relevancy of facts, and burden of proof.

- The BSB expands secondary evidenceto include oral and written admissions, and the testimony of a person who has examined the document and is skilled in the examination of documents.

|

– The IEA provides for two kinds of evidence: Documentary and Oral. |

Issues and Analysis of BSS:

- Tempering of Electronic Records:The Supreme Court has recognised that electronic records may be tampered with.

- However, the BSB provides for the admissibility of such records, there are no safeguards to prevent the tampering and contamination of such records during the investigation process.

- Incorporating the Law Commission Recommendations:It has made several recommendations, including the presumption that the police officer caused the injuries if an accused was injured in police custody, which have not been incorporated.

- The IEA (and the BSB) allows information to be admissibleif it was obtained when the accused was in police custody, but not if he was outside.

- However, the Law Commission recommended to remove the above distinction.

The Bharatiya Nagarik Suraksha (Second) Sanhita Bill (BNSSS):

- It replaced the Code of Criminal Procedure, 1898, having 531 sections, and it enabled Zero FIR nationwide. It provides for the procedure for arrest, prosecution, and bail.

- Use of Technology:All trials, inquiries, and proceedings may be held in electronic mode. Production of electronic communication devices, likely to contain digital evidence, will be allowed for investigation, inquiry, or trial.

- Forensic investigation:Along with specimen signatures or handwriting, finger impressions and voice samples may be collected for investigation or proceedings.

- Samples may be taken from a person who has not been arrested.

- It mandates forensic investigation for offences punishable with seven years of imprisonment or more. Forensic experts visit crime scenes to collect forensic evidence and record the process.

Issues and Analysis:

- BNSSS allows up to 15 days of police custody, which can be authorised in parts during the initial days period of judicial custody.

- It may lead to denial of bailfor the entire period if the police have not exhausted the 15 days custody.

- Clause 187 of the BNSSS permits police custody of up to 90 days, as against the 15-day custody allowed till now. The law also prevents any third party from filing mercy petitions on behalf of convicts on death-row.

- The BNSSS denies this facility for anyone facing multiple charges. As many cases involve charges under multiple sections, it may limit such bail.

- The CrPC provides for bail for an accused who has been detained for half the maximum imprisonment for the offence.

- The power to attach property from proceeds of crime does not have safeguards provided in the Prevention of Money Laundering Act.

- Recommendations of high level committeeson changes to the CrPC such as reforms in sentencing guidelines and codifying rights of the accused have not been incorporated in the BNSSS.

Conclusion:

- These three Bills stressed justice rather than punishment, and have been designed to last for the next century, keeping technological advancements in mind. It is a pure Indian law after removing all the British imprints.

- Their significant impact on the criminal justice system, emphasising a shift towards a more humane approach. The laws prioritise justice, equality, and fairness, addressing loopholes in existing legislation.

- The bills focus on transparency, accountability, and protecting the rights of victims and accused individuals.

- These bills use modern technology to streamline legal processes, and leverages to prevent the misuse of police powers, with compulsory video recording of evidence.

Ennore oil leak

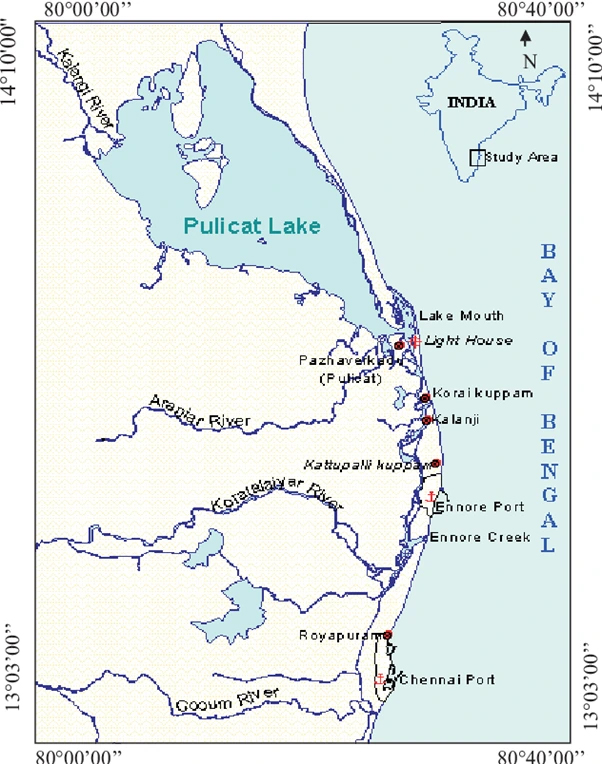

- During the recent Cyclone Michaung, an oil spill occurred from the Chennai Petroleum Corporation Limited (CPCL) into the Buckingham Canal and Ennore Creek in Tamil Nadu.

- The wetland has suffered from pollution caused by industries and neglect, as evidenced by the continuous presence of fly ash and hot water. Despite NGT directives, little progress has been made in restoring and protecting the fragile ecosystem of the Ennore wetlands.

- Ennore Creek in Chennai, situated along the Coromandel Coast, serves as a crucial buffer for the aquifers of the Araniyar-Kosasthalaiyar Basin, protecting them from the sea. Positioned in the floodplains of three rivers on a disaster-prone coastline, Chennai relies on wetlands like Ennore Creek as natural shock absorbers during calamities.

- Tar balls and thick layers of oil have been deposited along the coastline. A trail of oil deposits can also be seen on the shores and the fishing boats.

- Tarball is a dark-coloured piece of oil.

- Suo Moto Case by NGT: The National Green Tribunal(NGT) took up the case suo moto demanded comprehensive reports from the Tamil Nadu Pollution Control Board (TNPCB) and Chennai Petroleum Corporation Limited (CPCL) regarding oil spillage.

- It directed the state to compensate for the loss of livelihood.

|

National Oil Spill-Disaster Contingency Plan (NOS-DCP)

|

Impacts of Oil Spillage

- Health Impact: Residents in affected localities face unbearable odour, leading to respiratory issues among vulnerable groups like women, children, and the elderly, along with physical symptoms such as eye irritation, dizziness, and skin itching.

- Impact on Livelihoods: It damaged fishing boats and equipment, severely impacting the livelihoods of the fishing community.

- Impact on Aquatic Life: Oil spill obstructs the passage of sunlight into the sea, thereby destroying the photosynthesizing phytoplankton and, as a result, other organisms such as fishes, water-dependent mangroves, and sea birds.

- The fish can become tainted as the oil will get absorbed by their skin.

- Rich Diversity of Birds: Many birds, including migratory and near-threatened birds such as the Spot-billed Pelican, Whiskered Tern, and Painted Stork, are present here.

- Feathers from birds are waterproof because of the cuticle layer covering them. Oil and other hydrophobic chemicals dissolve that cuticle layer. As a result, a cormorant (a medium- to large-sized bird) that comes into touch with oil drowns when it goes into water again.

Clean Up Oil Spills

- Bioremediation: It uses bacteria to clean up oil spills in the ocean through bioremediation.

- Spill Containment methods: It includes oil boomers, skimmers and gully suckers, etc to remove the floating oil, which will be safely disposed of at the designated location for storing hazardous wastes.

- Oil Spill Dispersants (OSD): They are sprayed over the affected area.

Oil Zapper:

- An oil zapper is used to remove the oil by using a bio-remediation method. Oilzapping is a method for cleaning up significant oil spills from a surface. This method involves releasing bacteria that consume hydrocarbon compounds found in waste hydrocarbon and crude oil.

- It is a patented light brown powder made of four different bacteria to break down these hydrocarbons. The powder may be applied to both land and water.

Uses of Oilzapper:

- Five distinct bacterial strains are immobilized and then released onto the oil spill in an oil zapper along with a carrier substance. An oil zapper can be used for the following purposes:

- To clear up shorelines after major oil spills.

- To clear out the hydrocarbon waste generated by oil refineries.

- To reduce the impact of harmful oil spills on the environment by converting the harmful compounds into simple carbon dioxide and water.

Ennore Creek:

- It is a backwater located in Ennore, Chennai along the Coromandel Coast of the Bay of Bengal.

- It is located in the zone comprising lagoons with salt marshes and backwaters, submerged under water during high tide and forming an arm of the sea with the opening to the Bay of Bengal at the creek.

- Once a flourishing mangrove swamp, the creek has been degraded to patches in the fringes mainly due to human activities in the region.

- The depth of the creek varies from 1 to 2 m and is shallow near the mouth.

- The north–south trending channels of the creek connect it with the Pulicat Lake to the north and to the distributaries of the Kosasthalaiyar River in the south.

Kosasthalaiyar river:

- It originates near Pallipattu in Thiruvallur district and drains into the Bay of Bengal.

- Its northern tributaryNagari River originates in the Chitoor district of Andhra Pradesh and joins the main river in the backwaters of Poondi reservoir.

- Its catchment area is spread over Vellore, Chitoor, North Arcot, Thiruvallur and Chennai districts.

- It branches near Kesavaram Anicut and this tributary flows to the Chennai city as Cooum River, while the main river flows to the Poondi reservoir.

- From Poondi reservoir it joins the sea at Ennore Creek.

Kamaraj Port in Ennore:

- Earlier known as the Ennore Port, is the 12th major port of India.

- It is located on the Coromandel Coast about 24 km north of Chennai, Tamil Nadu.

- It is the only corporatized major port in India and is registered as a company.

- The port was declared as a major port under the Indian Ports Act, 1908 in March 1999.

World Bank Sets up Task Force on MDB Reforms

- The World Bank Group has established a task forceto examine the recommendations of the Independent Expert Group (IEG) regarding the reform of multilateral development banks (MDBs).

- The group has suggested adopting a triple mandate of eliminating extreme poverty, boosting shared prosperity, and contributing to global public goods, tripling sustainable lending levels by 2030.

- It also recommended creating a third funding mechanism,which would permit flexible and innovative arrangements for purposefully engaging with investors willing to support elements of the MDB agenda.

What are Multilateral Development Banks (MDB)?

- Multilateral Development Banks are institutions whose members include multiple developed and developing countries,which have to fulfil certain lending obligations to facilitate developmental objectives.

- They provide financial and technical assistance to developing countries.

- Usually, developed countriesin MDBs contribute to the lending pool while developing countries primarily borrow from these institutions to fund development projects.

- While commercial banks seek to make profits on loans and other financial services, the goal of MDBs is to issue grants and low-cost loans to improve the economic conditions of developing nations.

- Some Multilateral Development Banks include:World Bank Group, International Monetary Fund (IMF), Asian Development Bank (ADB), African Development Bank (AfDB).

Need for the Reforms

- Efficacy in Dealing Challenges:A reformed MDB ecosystem can equip stakeholders to better deal with global challenges in effective ways.

- MDBs should operate more in sync with the developmental priorities of individual nations.

- Involvement of Private Sector:The expert group called for bringing private sector engagement to the centre of MDB operations by breaking away from the culture of limited operational interaction between their private and sovereign financing arms.

- Given that MDBs need to ramp up financing to $390 billion by 2030, the private sector can play a pivotal role in making that happen by reversing the current trend of disappointingly low private financial flows.

- Greater Involvement of Governments:To mitigate coordination failures, the expert group has called for greater involvement of national governments to develop a home-grown unified vision of goals, policies, investments and financing.

Role of MDBs in India

- MDBs have played a crucial role in India’s development journey by financing key infrastructure projects with longer gestation periods.

- The World Bank,established in 1944, has committed to lending worth $97.6 billion in India, including all active and closed projects.

- Of the total commitments, 19 percent have been committed to projects in the public administration sector, 15 percent to the agriculture, fishing and forestry sector, and 11 percent to the transport sector.

- The Asian Development Bank,formed in 1969, has cumulatively committed to assistance worth $59.7 billion in India for project and technical assistance.

- The Beijing-headquartered Asian Infrastructure Investment Bank (AIIB), which was formed in 2016, has approved financing worth $9.9 billion in India.

- The European Investment Bank,established in 1958, has signed off on 22 projects in India with a cumulative value of Euro 4.5 billion.

Public Accounts Committee (PAC) Report on Agriculture Insurance Schemes

- The Public Accounts Committee (PAC) in its 78th Report, raised concerns regarding failure of Agricultural Insurance Company of India Ltd (AIC) to comply with the guidelines under National Agricultural Insurance Scheme (NAIS).

Concerns raised by PAC report

- According to the PAC report the NAIS guidelines provided that Insurance Agency (AIC) is responsible for arranging re-insurance support for the entire scheme claims under NAIS.

- However AIC had arranged re-insurance support only for its own share of claims under NAIS and did not arrange for the share of claims to be borne by Central and the State governments.

- Delay in the release of funds by the state governments towards share in premium subsidy observed.

- The coverage of farmers in the country as well as in the nine selected States under the erstwhile schemes was very low compared to their population.

What is Reinsurance?

- Reinsurance, referred to as “insurance for insurance companies”. It is a contract between a reinsurer and an insurer.

- In this contract, the insurance company—the cedent—transfers risk to the reinsurance company, and the latter assumes all or part of one or more insurance policies issued by the cedent.

History of Crop Insurance Schemes

- The Centre introduced the Comprehensive Crop Insurance Scheme (CCIS)in 1985. Later the CCIS was replaced by NAIS from 1999-2000.

- From 2010-11, Modified National Agricultural Insurance Scheme (MNAIS) was introduced in 50 districts as pilot.

- In 2013-14, MNAIS was merged with Weather Based Crop Insurance Scheme (WBCIS) and a new National Crop Insurance Programme (NCIP)

- However, NAIS was allowed to be continued in some States, until 2015-16.

- From 2015-16 Kharif season, the Centre introduced the flagship Pradhan Mantri Fasal Bima Yojana (PMFBY).

Recommendations

- The report emphasizes the need for devising a robust compliance mechanism and timely release of funds.

- The factors attributable for the poor performance of the schemes are required to be identified and appropriately addressed.

- Integrate the database of different schemes for efficient and fast implementation of insurance schemes.

|

Public Accounts Committee |

Dhangars to revive demand for reservation as tribals

The Dhangar community’s demand for ST status has been dismissed.

- Dhangars – They are large cluster of pastoral groups and they live mostly in Western Maharashtra and Marathwada.

- Population – In Maharashtra, they are estimated to range from 4 to 12% of the total population (unofficially estimate).

- Reservation status – In Maharashtra, there is an exclusive quota of 3.5% under a separate category called NT (No Tribe).

- In central list, they are recognised as Other Backward Classes (OBC) community.

- Demand for ST status – It started in 1955, when there was no reservation for them either in the state or at the Centre.

- Reason for demand – Better constitutional safeguards to SC and ST than to OBCs.

|

Article 340 directs the President to constitute a commission to identify backward communities and make recommendations for their upliftment. Process of inclusion under ST list · This process follows a set of modalities established in 1999. · The respective state or union territory shall send the initial proposal for ST status. · It is forwarded to Union Tribal Affairs Ministry and subsequently sent to the Office of the Registrar General of India (ORGI). · If the ORGI approves the inclusion, the proposal is then sent to the National Commission for Scheduled Tribes (NCST). · If the NCST concur, the proposal is forwarded to the Cabinet for amendment to the Constitution (Scheduled Tribes) Order, 1950. |

- Discretion of executive government in implementing welfare activities for OBC

- The 1st BC commission’s (Kaka Kelkar) report came in 1955, whose recommendations were never implemented.

- The 2nd BC Commission’s (Mandal) report came in 1980 whose recommendations were implemented partially only in 1990.

|

Historical - Dhangar |

|

Outcomes of COP 28

- The 28th Sessionof the UN Climate Change Conference (COP 28) was held in Dubai, United Arab Emirates.

The Major Outcome from COP 28

- Loss and Damage (L&D) Fund:It was created during COP 27, it was made operational in COP28.

- COP 28 approved the Governing instrumentof the Loss and Damage Fund and decided that the Fund will be serviced by a new, dedicated and independent secretariat.

- However, a meagre $790 million has been pledged so far, by a few nations, despite the corpus requiring $100 billion to more than $400 billion a year.

- Notably, the U.S., the largest historical emitter, committed only $17.5 million.

- Ambitious Emissions Reduction Targets:The first global stocktake (GST) concluded. GST enables countries and other stakeholders to see their progress towards meeting the goals of the Paris Agreement.

- Countries’ decision at COP28 to transition away from fossil fuels was coupled with an ambition to triple renewable energy capacity by 2030.

- More than 20 countries also pledged totriple their nuclear energy capacity.

- Global green-finance Mechanisms: The COP28 witnessed the establishment of innovative global green-finance mechanisms to support developing nations in their transition to sustainable practices.

- The Green Climate Fund received fresh support of $3.5 billion, allowing it to finance adaptation and mitigation projects in vulnerable regions.

- The COP28 Presidency also introducedALTÉRRA, an investment initiative with an ambitious goal to globally mobilise an unprecedented sum of $250 billion by 2030.

- Climate and Health Declaration: TheA.E.declaration on climate and health came into being at COP28 through a partnership of the COP28 Presidency with the World Health Organisation.

- It recognises the growing health impacts of climate change including a reduction in air pollution and lowering the cost of healthcare.

- The declaration, signed by 123 countries,has collectively committed $1 billion to address the growing climate-health crisis.

- India didn’t sign this declarationas India’s healthcare infrastructure is still growing to meet demand, such a commitment could compromise the healthcare requirements of a growing population.

- The Global Methane Pledge:It was launched at COP26 and received renewed attention at COP28, with the Climate and Clean Air Coalition becoming the new secretariat.

- It announced more than $1 billion in new grants for funding projects to reduce methane emissions from the agriculture, waste, and gas sectors.

- More than 150 countriessigned the pledge to reduce methane pollution.

- India isn’t a signatoryto this pledge because it shifts focus from carbon dioxide to methane, a GHG with a lower lifetime.

- Methane emissions in India are also primarily from rice cultivation and enteric fermentation (livestock rearing), which support the livelihoods of small and marginal farmers.

Issues that Saw Difference of Opinions

- Fossil-fuel Subsidies: While developed countries advocated for phasing them out, developing countries, including India, refused over a phase-out’s implications on economic growth and development.

- Common and Differentiated Responsibilities:The historical responsibility of developed countries for GHG emissions, developing countries argued to increase the flow of climate finance and technologies to facilitate just job transitions and inclusive development.

- Some other contentious issuesspanned the market mechanisms, financial resource allocation, the role of the World Bank as the agency for managing the L&D fund, and private sector engagement in climate action.

|

UN Climate Change Conference |

India''s ethanol conundrum

- While ethanol blended petrol (EBP) increased from 1.6% in 2013-14 to 11.8% in 2022-23, the 20% target by 2025 has run into trouble with low sugar stocks in 2022-23 and impending shortfall in sugarcane production this year.

- NAFED and National Cooperatives Consumers’ Federation of India (NCCF) have authorised to procure maize (corn) for supplying ethanol distilleries.

Ethanol from maize (corn):

- Only 5-7% of the world’s corn output was used for ethanol production and the U.S. has a corn based ethanol programme.

- Challenge: Using corn for producing ethanol directly reduces its use as food or livestock feed. It directly links food prices to cruid oil prices through the demand side.

- High corn prices also increases the price of other soft grains like wheat/barley.

Ethanol from sugarcane:

- Sugarcane based ethanol production is preferred in tropical countries like Brazil and India.

- Challenge: More land under water-intensive sugarcane production can displace food production and also degrade water table.

- In case of sugarcane, ethanol is produced by processing the molasses (C-heavy/B-heavy) and constitutes minimal trade-off with sugar output.

- The B-heavy molasses path produces less sugar and ethanol simultaneously from sugarcane.

- Ethanol can also be produced from cane juicewithout the extraction of sugar, but it may lead to conflict between sugar production and ethenol production. This process gives substantially higher yield of ethanol.

Sugarcane molasses:

- It is a viscous, dark and sugar-rich by-product of sugar extraction from the sugarcane (Saccharum officinarum L.). It is a major feed ingredient, used as an energy source and as a binder in compound feeds.

- Both the sugar extraction process and the sugar refining process yield molasses, and each step of these processes output specific types of molasses:

- Integral high-test molasses is produced from unclarified sugarcane juice. Because it is concentrated from unclarified sugarcane juice, heavy incrustations and scum deposits lead to frequent mill interruptions and, therefore, to increased factory maintenance costs.

- A molasses (first molasses) is an intermediate by-product resulting from first sugar crystal extraction (A sugar), from initial processing at the sugar factory. A molasses contains 80-85% DM. If it has to be stored, it should be inverted in order to prevent crystallization.

- B molasses (second molasses): It has approximately the same DM content as A molasses but contains less sugar and does not spontaneously crystallize.

- C molasses (final molasses, blackstrap molasses, treacle) is the end by-product of the processing in the sugar factory. It still contains considerable amounts of sucrose (approximately 32 to 42%). C molasses does not crystallize and can be found in liquid or dried form as a commercial feed ingredient.

- Syrup-off (liquor-off, jett) is the end by-product from the centrifugation of the final refined masecuite in a raw sugar refinery. Normally, syrup-off is sent to the raw sugar section of the refinery where it is further processed in order to recover more sucrose. Due to its high content of sucrose (90-92% DM), it is an excellent energy source for monogastrics but can be an expensive ingredient.

- Refinery final molasses is the by-product of refined sugar extraction. It has a very similar composition to that of C molasses produced in a raw sugar factory and it is stored in the same tanks.

- In some countries the juice is extracted in a simple animal or mechanically driven press, then boiled in open vats. In this rudimentary process, pan (uncrystallized) sugar is produced and the by-product molasses is called “melote”. It contains only 50% DM.

Kolattam Dance

- In Vijayawada, Andhra Pradesh Girls performed Kolattam dance during Balotsav, a children’s festival.

- The Kolattam dance is predominantly a dance performed by women,in Southern India.

- Men mostly take up the role as drummers or play the background music.

- In Tamil Nadu and Keralathe dance is known as Kummi and in Andhra Pradesh it is known as

- The dance form resembles the Dandiya and garbafolk dances of

Performance of Dance

- The group comprises dancers in the range of 8 to 40. It is performed by using sticksto represent the rhythm of the dance.

- The sticks are stroked against each other in a calibrated form for creating harmony.

- The dancers are led by a leader and move about in two circles.The inner circle receive the strikes on their sticks from the artists in the outer circle that deliver them.

Greenwashing

- Recently, the United Kingdom (UK) banned Air France, Lufthansa, and Etihad ads over ‘greenwashing’ claims.

- It is the process of conveying a false impression or providing misleading information about how a company’s products are more environmentally sound.

- It is considered an unsubstantiated claim to deceive consumers into believing that a company’s products are environmentally friendly.

- For example, companies involved in greenwashing behaviour might make a claim that their products are from recycled materials or have energy-saving benefits.

- Although some of the environmental claims might be partly true, companies engaged in greenwashing typically exaggerate their claims or the benefits in an attempt to mislead consumers.

|

Additional Information (Aviation industry and emissions) |

All-India Consumer Price Index Numbers for Agricultural and Rural Labourers – November, 2023

The All-India Consumer Price Index Number for Agricultural Labourers and Rural Labourers for the month of November 2023 was increased recently.

Highlights

- CPI increased by 12 points and 11 points respectively to stand at 1253 and 1262 points respectively.

- There has been an upward trend in the index across all the states except West Bengal (both CPI-AL and CPI-RL indices decreased) and Himachal Pradesh (the CPI-AL index decreased).

- In the case of Agricultural Labourers, it recorded an increase of 1 to 10 points in 11 States, 11 to 20 points in 4 states and an increase of more than 20 points in 3 states.

- In the case of Rural Labourers, it recorded an increase of 1 to 10 points in 11 states, 11 to 20 points in 5 states and an increase of more than 20 points in 3 states.

- Andhra Pradesh and Tamil Nadu with 1439 points each topped the index table whereas Himachal Pradesh with 1015 points stood at the bottom.

- Among states, the maximum increase for CPI-AL was experienced by Maharashtra of 27 points which was mainly driven by the increased prices of jowar, rice, wheat atta, tapioca, arhar dal, onion and sugar etc.

- Point to point rate of inflation based on the CPI-AL and CPI-RL stood at 7.37% and 7.13% in November, 2023 compared to 7.08% and 6.92% respectively in October, 2023 and 6.87% and 6.99% respectively during the corresponding month of previous year.

Consumer Price Index:-

- The Consumer Price Index (CPI) examines the weighted average of prices of a basket of consumer goods and services, such as transportation, food and medical care.

- The CPI calculates the difference in the price of commodities and services such as food, medical care, education, electronics etc, which Indian consumers buy for use.

Type of CPI:-

- There are 4 different types of CPI measured:-

CPI for Industrial Workers (CPI-IW)

- It attempts to quantify changes in the pricing of a fixed basket of products and services used by Industrial Workers over time.

- Released by: Labour Bureau, Ministry of Labour and Employment.

- Base Year: 2016.

CPI for Agricultural Laborers (CPI-AL)

- It helps to revise minimum wages for agricultural labor in different States.

- Released by: Labour Bureau, Ministry of Labour and Employment.

- Base Year:1986-87.

CPI for Rural Labourer (CPI-RL)

- Released by: Labour Bureau, Ministry of Labour and Employment.

- Base Year:1986-87.

CPI (Rural/Urban/Combined)

- Released by: National Statistical Office (NSO), Ministry of Statistics and Program Implementation

- Base Year: 2012.

Calculation:–

- It is calculated by taking price changes for each item in the predetermined basket of goods and averaging them.

- The formula to calculate the Consumer Price Index (CPI) is as follows:

- CPI = (Total cost of basket of goods and services in the current period / Total cost of the basket of goods and services in the base period) x 100.

Uses:-

- To calculate the inflation levels CPI’s annual percentage change is also used to assess inflation.

- To compute the cost of living.

- Determine the purchasing power of a country’s currency.

- Understanding the real value of wages, salaries, pensions, etc.

- Price regulation.

- Provides insights into consumer spending

Significance:-

- Changes in the CPI are used to assess price changes associated with the cost of living.

Arctic Report Card documents evidence of accelerating climate change

Recently the National Oceanic and Atmospheric Administration (NOAA) released the annual Arctic report card 2023.

Arctic report card

- Launch year-2006

- Released by- National Oceanic and Atmospheric Administration.

- Published- Annually since 2006

- About- It is a comprehensive assessment of the current state and trends of the Arctic environment relative to the historical records.

- Data source- It is a peer reviewed analysis done by 82 scientists from 13 countries.

- Significance-It is intended for a wide audience, including scientists, teachers, students, decision-makers and the general public interested in the Arctic environment and science.

Key highlights of the report

|

About |

Description |

|

Warmest summer |

|

|

Feedback loops |

|

|

Arctic sea ice extent |

|

|

Greenland ice sheet |

|

|

Arctic tundra |

|

|

Arctic ocean |

|

|

Arctic precipitation |

|

|

Arctic wildfires |

|

|

Arctic climate change |

|

Most severe consequences of the soaring temperatures in Arctic

- Subsea permafrost thawing- Frozen soil under the sea bed is melting faster due to warmer oceans.

- This releases greenhouse gases that worsen climate change and ocean acidification.

- Food insecurity- Warming of freshwater and marine habitats makes the chinook and chum salmon smaller and less abundant than usual in Western Alaska due to warming freshwater and marine habitats.

- Impact on livelihood- The reduced salmon availability causes problems for fishing activities, livelihoods, and traditions of the Indigenous people who rely on salmon.

- Raging wildfires- The Arctic and Northern regions of Canada faced record-breaking wildfires that burned over 10 million acres of land in 2023.

- Climate change- The wildfires were fuelled by high temperatures, dry vegetation and soil, and low rainfall, all linked to climate change.

- Mendenhall glacier melting- The glacier in Alaska has thinned significantly due to rising temperatures in the past 20 years.

- Severe flooding- The meltwater formed a lake that broke its ice dam and flooded Juneau, causing damage and disaster.

Road ahead

- Sustainable solution- In Finland peatland restoration is done as a nature-based climate solution led by traditional knowledge, it will help to capture and store carbon away from the atmosphere.

- Habitat preservation- In Finland, an effort to restore damaged reindeer habitat is done in collaboration with Sámi reindeer herders (Indigenous population). It is helping to preserve their way of life.

- Rewilding- It requires partnership, recognition of Indigenous and community rights, and the use of Indigenous knowledge alongside science to succeed and avoid replication of past inequities.

- Data collection-The Alaska Arctic Observatory and Knowledge Hub (AAOKH) works with a network of coastal Indigenous observers to document long-term and holistic observations of environmental change and impacts in northern Alaska.

House nod to raise age limit for GST appellate tribunal

- The Rajya Sabha has returned a bill to raise the age limit of the President and members of the Goods and Services Tax (GST) Appellate Tribunals from 67 to 70 years and 65 to 67 years, respectively, aligning them with the age limits of other tribunals.

- The Central GST (Second Amendment) Bill, 2023, was introduced by Union Finance Minister Nirmala Sitharaman.

- The amendment aims to address issues arising from the Madras High Court’s 2019 decision to strike down the formation of GST Appellate Tribunals, necessitating amendments to the GST Act in July 2023.

- The Bill also allows members of the Bar with 10 years of experience to serve as judicial members of the tribunals.

- The Rajya Sabha also returned the Provisional Collection of Taxes Bill, 2023, which replaced the Provisional Collection of Taxes Act, 1931. Both bills were passed by the Lok Sabha on the preceding day.

Goods and Services Tax (GST)

- GST is an indirect tax that came into effect from 1 July 2017 through the implementation of the 101st Amendment to the Constitution of India by the Indian government.

- It has actually replaced various indirect taxes such as – service taxes, VAT, excise and others in the country.

- GST rates are divided into five different tax slabs for collection of tax – 0%, 5%, 12%, 18% and 28%.

- There are three types of GST i.eState Goods and Services Tax (SGST), Central Goods and Services Tax (CGST) and the Integrated Goods and Services Tax(IGST)

GST Council

- GST Council is a constitutional body for making recommendations to the Union and State Government on issues related to Goods and Service Tax.

- It makes recommendations to the Union and State Government on issues related to Goods and Service Tax and was introduced by the Constitution (One Hundred and First Amendment) Act, 2016.

- As per Article 279A of the amended Constitution, the GST Council which will be a joint forum of the Centre and the States, shall consist of the following members: –

- Union Finance Minister – Chairperson

- The Union Minister of State, in-charge of Revenue of finance – Member

- The Minister In-charge of finance or taxation or any other Minister nominated by each State Government – Members

- As per Article 279A (4), the Council will make recommendations to the Union and the States on important issues related to GST, like the goods and services that may be subjected or exempted from GST, model GST Laws, principles that govern place of Supply, threshold limits, GST rates including the floor rates with bands, special rates for raising additional resources during natural calamities/disasters, special provisions for certain States, etc.

- Every decision of the Goods and Services Tax Council shall be taken at a meeting by a majority of not less than three-fourths of the weighted votes of the members present and voting, in accordance with the following principles, namely:

- The vote of the Central Government shall have a weightage of one third of the total votes cast, and

- The votes of all the State Governments taken together shall have a weightage of two-thirds of the total votes cast, in that meeting.

GST Appellate Tribunal

- The Central Goods and Service Tax Act, 2017 in Section 109 mandates for the constitution of a GSTAT and its Benches.

- The GSTAT is the specialized appellate authority for resolving disputes under the GST laws.

- Composition:

- The GST Tribunal will have one principal bench in New Delhi and as many benches or boards in states as decided by each state, subject to approval of the council.

- North-eastern states could opt for one bench for 2-3 states and an additional bench for very far-flung areas.

- The principal bench and state boards would have two technical and two judicial members each, with equal representation from the Centre and states.

- All four members would not sit for hearing each case. It depends on the threshold or value of dues involved.

Blue dragons (Glaucus atlanticus)

- The blue dragon (Glaucus atlanticus) is a small, shell-less, blue sea slug that floats upside down in the open ocean.

- It is also known as the blue sea dragon, blue angel, sea swallow, and blue ocean slug.

- They are found in tropical and subtropical waters throughout the Atlantic, Pacific, and Indian Oceans.

- Blue dragons are mobile prey feeders, meaning they prey on organisms that move on their own.

- Conservation Status

- IUCN – Endangered.

Sub-Schemes Under RAMP Programme

- In the 2nd meeting of the National MSME Council three sub-schemes were launched under the aegis of the RAMP programme.

Sub-schemes under RAMP programme

- The MSME Green Investment and Financing for Transformation Scheme (MSME GIFT Scheme): Itintends to help MSMEs adopt green technology with interest subvention and credit guarantee support.

- The MSE Scheme for Promotion and Investment in Circular Economy (MSE SPICE Scheme): It is the first ever scheme in the Government to support circular economy projects which will be done through credit subsidy and will lead to realizing the dream of MSME sector towards zero emissions by 2070.

- The MSE Scheme on Online Dispute Resolution for Delayed Payments: The scheme to synergise legal support with modern IT tools and Artificial Intelligence to address the incidences of delayed payments for Micro and Small Enterprises.

Other initiatives taken by MSME Ministry

- The Support for Commercialisation of IP Programme (MSME – SCIP Programme):It will enable the innovators in the MSME sector to commercialize their IPR.

- Zero Defect and Zero Effect (ZED) Scheme:It aims to promote manufacturing without any negative impact on the environment. It has now been made free for women-led MSMEs. The government guarantees payment of 100 percent financial support for the certification cost.

|

National MSME Council |

Pradhan Mantri Bhartiya Janaushadhi Pariyojana

- Pradhan Mantri Bhartiya Janaushadhi Pariyojana (PMBJP) achieved their target of Rs. 1000 Crore in sales of generic medicines in FY 2023-24.

- It was launched in 2008by the Department of Pharmaceuticals, Ministry of Chemicals and Fertilizers under the name Jan Aushadi Campaign.

- Aim:To provide quality medicines at affordable prices to the masses.

- Jan Aushadhi Stores:The initiative involves the establishment of Jan Aushadhi Kendras, or Jan Aushadhi Stores, which serve as retail outlets for the distribution of generic medicines.

- Progress Made:There has been more than 100 times growth in the number of Kendras since the scheme has been launched covering almost all the districts of the country.

- The Government launched the 10,000th Janaushadhi Kendra at AIIMS, Jharkhand in 2023.

- Accordingly, the Government has set a target to open 25,000 Janaushadhi Kendras across the country by March, 2026.

PM-AJAY For Upliftment of SC Community

Pradhan Mantri Anusuchit Jaati Abhyuday Yojana is a 100% Centrally Sponsored Scheme for the welfare of Scheduled Caste (SC) population.

- Launched in – 2021-22.

- Launched by – Ministry of Social Justice & Empowerment.

- It has been framed after merging the 3 erstwhile schemes

- Pradhan Mantri Adarsh Gram Yojana (PMAGY)

- Special Central Assistance to Scheduled Caste Sub Plan (SCA to SCSP)

- Babu Jagjivan Ram Chatrawas Yojana (BJRCY)

- Objectives

- To increase the income of SC population by income generating schemes, skill development and infrastructure development.

- To reduce the poverty among the SC population and bring them above the poverty lines.

- To increase literacy and enrolment of SCs in schools and higher education institutions.

- 3 components

- Development of SC dominated villages into an ‘Adarsh Gram’.

- Grants-in-aid for district/state-level projects for socio-economic betterment of SCs.

- Construction of hostels in higher educational institutions.

- Eligibility Criteria - For income generating and skill development schemes, the SC persons belonging to BPL category are eligible.

- In case of infrastructure development, the villages having 50% or more SC population are eligible.

- Coverage – It is implemented in 28 States/UTs.

- Budget – It is Rs. 2050 crore for FY 2023-24.

Latest News

Latest News General Studies

General Studies