- Home

- Prelims

- Mains

- Current Affairs

- Study Materials

- Test Series

EDITORIALS & ARTICLES

EDITORIALS & ARTICLES

Hit List Questions 60-PPP 100 PRELIMS 2024 - 78

Questions & Explanations:

|

1. |

Effective Revenue Deficit is the difference between (a) Revenue deficit & investment in securities (b) Revenue deficit & interest payments (c) Revenue deficit and grants for creation of capital assets (d) Revenue deficit and grants for creation of current assets

|

|

2. |

Which of the following correctly describes “countercyclical fiscal policy”?. (a) reducing spending during a boom period (b) cutting taxes during a recession (c) Both (a) & (b) (d) Neither (a) Nor (b)

|

|

3. |

1. Under this Act, the beneficiaries are identified by the Central Government, while ration cards are given by the State Government. 2. State-wise coverage of the scheme is decided by NITI Aayog. 3. Price of food grains is revised based on inflation in the country. Which of the statements given above is/are incorrect w.r.t. National Food Security Act, 2013? (a) 1 and 2 only (b) 1 and 3 only (c) 1, 2 and 3 (d) None of the above

|

|

4. |

''Liquidity Trap'' is best defined by (a) is a situation when expansionary monetary policy does not increase the interest rate. (b) is a situation of a very high rate of interest in the economy. (c) is a situation when the monetary policy is powerless to affect the interest rate. (d) is a situation when the general public is prepared to spend fully the amount of money supplied.

|

|

5. |

Which of the following methods is best suited to infuse liquidity quickly in the economy?. (a) Reduction in repo rate (b) Reduction in reverse repo rate (c) Reduction in SLR (d) Reduction in CRR

|

|

6. |

1. A high CRAR implies high risk of bank’s insolvency and risk over depositor’s money. 2. RBI has mandated all categories of banks to maintain minimum CRAR of 9%. Which of the statements given above is/are correct about ‘Capital Risk-Weighted Adjusted Ratio (CRAR)’? (a) 1 only (b) 2 only (c) Both 1 and 2 (d) Neither 1 nor 2

|

|

7. |

The free rider problem is associated with (a) Public Goods (b) Merit Goods (c) Private Goods (d) Veblen Goods

|

|

8. |

Which of the statements regarding ''Capital Account Convertibility'' is/are correct? 1. It refers to the removal of restraints on international flows on a country’s capital account and enabling full currency convertibility. 2. Full capital account convertibility will encourage more FDI inflow into India. 3. India has recently faciliatted full capital account convertibility. (a) 1 only (b) 1 and 2 only (c) 2 only (d)1, 2 and 3

|

|

9. |

Article 15 (6) and Article 16 (6) were inserted in the Indian constitution by (a) The 103rd Amendment (b) The 102nd Amendment (c) The 93rd Amendment (d) The 92nd Amendment

|

|

10. |

1. Only accredited investors can contribute money to hedge fund. 2. Hedge Fund is an alternative investment fund. Which of the statements given above is/are correct about ‘Hedge Fund’? (a) 1 only (b) 2 only (c) Both 1 and 2 (d) Neither 1 nor 2

|

|

11. |

Which of the following would have inflationary effect on the economy?. 1. RBI releasing new bonds in the market. 2. RBI decreasing the SLR 3. RBI increasing the Bank Rate 4. Abolition of CRR (a) 1, 2 and 3 only (b) 1 and 4 only (c) 2 and 4 only (d) 3 and 4 only

|

|

12. |

1. The Second Five-Year Plan emphasized on the establishment of heavy industries. 2. The Third Five-Year Plan introduced the concept of import substitution as a strategy for industrialization. Which of the statements given above is/are correct regarding Indian Planning? (a) 1 only (b) 2 only (c) Both 1 and 2 (d) Neither 1 nor 2

|

|

13. |

The money multiplier in an economy increases with which one of the following? (a) Increase in the Cash Reserve Ratio in the banks. (b) Increase in the Statutory Liquidity Ratio in the banks (c) Increase in the banking habit of the people (d) Increase in the population of the country

|

|

14. |

“DK Basu Principles” seen in news refer to (a) police atrocities (b) safety of women in private cabs (c) federal issues (d) ecofeminism

|

|

15. |

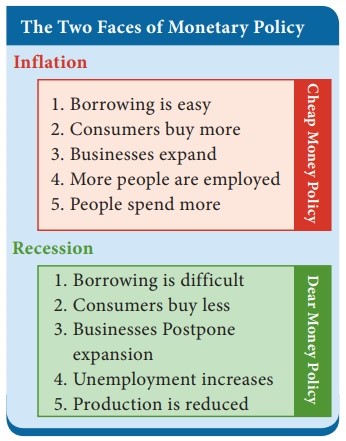

1. When the RBI lowers the bank rate, it is known as cheap money policy. 2. When the RBI raises the bank rate, it is known as dear money policy. 3. When the RBI wants to squeeze the money from the economy, it raises the CRR. Which of the above is/are correct? (a) 1 only (b) 1 and 2 only (c) 3 only (d) 1, 2 and 3

|

|

16. |

When in an economy aggregate demand exceeds “aggregate supply at full employment level”, the demand is said to be ü (a) Inflationary gap ü (b) An excess demand ü (c) Both (a) & (b) ü (d) Neither (a) Nor (b) ü |

|

17. |

1. It examines the degree of correspondence between budgeted projections of revenue and expenditure, and actual receipts and spending. 2. It is defined in FRBM Act, 2003. Which of the statements given above is/are correct w.r.t. Fiscal marksmanship? (a) 1 only (b) 2 only (c) Both 1 and 2 (d) Neither 1 nor 2

|

|

18. |

IMF ranks the nations of the world at Purchasing Power Parity on the basis of (a) Net Domestic Product (b) Net National Product (c) Gross Domestic Product (d) Gross National Product

|

|

19. |

Which of the following is the most likely to cause the reduction in current account deficit in India? I. Reducing import duty II. Restrictive monetary policy III. Devaluation of rupee Code: (a) Only I & II (b) Only II & III (c) Only I & III (d) I, II & III

|

|

20. |

Beveridge curve represents relationship between (a) Unemployment and rate of inflation (b) Unemployment and the job vacancy rate (c) Genderisation of employment and the job vacancy rate (d) Sexual Division of labour and the rate of globalization

|

|

21. |

''Technical Recession”, sometimes seen in the news is best described by (a) Decline in the GDP growth rate, due to reduction in technical services in a given year. (b) Contraction in the GDP for 2 consecutive quarters. (c) Contraction in the GDP in a particular year. (d) Decline in the GDP growth rate, due to reduction in investment in R&D in a given year.

|

|

22. |

Which of the statements given below is/are correct? 1. Core inflation is more volatile and is prone to inflationary spikes. 2. Headline inflation includes food and energy prices in India and is a better indicator to follow. 3. Core inflation is representative of underlying long term price rise. (a) 1 and 2 only (b) 2 and 3 only (c) 3 only (d) 1, 2 and 3

|

|

23. |

Consider the following statements w.r.t. Alternative Investment Fund. 1. It is regulated by RBI. 2. Family trusts, employee welfare trusts, and gratuity trusts are counted as AIFs. 3. All Indians, which contain PIOs, NRIs, and OCIs, components are qualified to infuse in AIFs. Which of these statements are correct? (a) 1 only (b) 1 and 2 (c) 3 only (d) 2 and 3

|

|

24. |

The term “FGD system” that frequently appear in news is in the context of (a) Environmental Pollution (b) Tariff reduction measures (c) Combination Drugs (d) Fishing subsidies issue at WTO

|

|

25. |

Zig Zag Technology in news refer to the context of (a) Reducing Air Pollution (b) Gene Editing with precision (c) Bit Coin minting (d) Reducing Nuclear accidents

|

EXPLANATIONS

|

1. |

Effective Revenue Deficit is the difference between revenue deficit and grants for the creation of capital assets. (i.e) the Effective Revenue Deficit excludes those revenue expenditures which were done in the form of grants for the creation of capital assets. Effective Revenue Deficit signifies the amount of capital receipts that are being used for actual consumption expenditure of the Government |

ü C |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

2. |

A ''countercyclical'' fiscal policy refers to the opposite approach: reducing spending and raising taxes during a boom period, and increasing spending/cutting taxes during a recession. |

C |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

3. |

New changes in NFSA: · Beneficiaries will now get 35kg of foodgrains free for the next year and others will get 5kg for free in a month till December 2023. · The Union government has estimated an additional amount of ?2 lakh crore for the scheme. Entire expenses for the scheme would be borne by the Union Government. What is NFSA? · The Union government provides food grains (rice at Rs 3 per kg, wheat at Rs 2 per kg, and coarse grains at Rs 1 per kg) under the NFSA. · The act aims to ensure people''s food and nutritional security by assuring access to enough high-quality food at reasonable prices. · The NFSA covers 50 per cent of the urban population and 75 per cent of the rural population. · There are two categories of beneficiary households under the NFSA: 1. Antyoday Anna Yojana (AAY): the AAY households are entitled to 35 kg of foodgrains per month irrespective of the number of family members. 2. The Priority Households: the priority households get food grains depending on the number of family members (each member 5 kg per month). · The government has discontinued the Pradhan Mantri Garib Kalyan Anna Yojana: 1. It was launched in 2020 amid Covid-19 under which 5 kg of free food grains was provided to every person on top of the NFSA entitlement of 5 kg of foodgrains at subsidised rates. 2. The scheme has now been merged with the NFSA. · The Cabinet Committee on Economic Affairs also approved the Minimum Support Price (MSP) for copra for the 2023 season. · It is chaired by the PM. · The approval is based on the recommendations of the Commission for Agricultural Costs and Prices. · The National Agricultural Cooperative Marketing Federation of India Ltd. [NAFED] and the National Cooperative Consumers’ Federation [NCCF] will continue to act as Central Nodal Agencies for the procurement of copra and de-husked coconut under the Price Support Scheme. Significance of the move · Food security legislation: for the first time India will have a Central food security legislation which gives the poor the right to receive 5 kg of food grains free of cost. · The decision softens the blow as the poor may suffer with the PM Garib Kalyan Anna Yojana being discontinued. · Saving revenue: Discontinuing the PMGKAY would save the government Rs 15,000 crore a month or about Rs 1.8 lakh crore a year. Way forward · PM’s vision: He has taken a historic decision to provide food security to the poor free of cost across the country. The Prime Minister’s Garib Kalyan Ann Yojna also ensured 5kg of foodgrains for the poor for free for a long time. · Buffer stocks: The Government has been maintaining that the country has adequate storage of foodgrains to meet the welfare schemes. · Reforms needed: The NITI Aayog has suggested that the national rural and urban coverage ratio be reduced from the existing 75-50 to 60-40. If this reduction happens, the number of beneficiaries under the NFSA will drop to 71.62 crores based on the projected population in 2020. · |

C |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

4. |

A liquidity trap is an economic situation where people hoard financial capital instead of investing or consuming it as the interest rates are low and savings rates are high which renders the monetary policy ineffective. So, people believe that the interest rates will soon rise which might decrease the prices of the bonds. Therefore, the demand for money depends on the rate of interest in the economy which hence makes the demand for money perfectly interest elastic.

|

C |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

5. |

Cash Reserve Ratio (CRR) is the proportion of total deposits of banks that they must park with Reserve Bank of India (RBI). Statutory Liquidity Ratio (SLR) is the proportion of deposits, that banks must hold with themselves in the form of gold, government securities etc. CRR will help in easing or tightening liquidity, whereas SLR is to address the adhoc requirements of the bank liabilities, like customer deposits etc. Banks earn interest on SLR, whereas they do not earn any interest on CRR. Suggestions by economists and bankers to phase out CRR is due to the following reasons. -It will help in generating liquidity in the market and in turn help in investments for new ventures. -CRR is a burden to banks which, in order to maintain, resorts to high interest borrowings from other banks overnight. -It can help in meeting Basel III norms, otherwise which needs capital infusion by the governments. |

D |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

6. |

Capital Adequacy Ratio (CAR) is the ratio of a bank’s capital in relation to its risk weighted assets and current liabilities. It is decided by central banks and bank regulators to prevent commercial banks from taking excess leverage and becoming insolvent in the process. It is measured as Capital Adequacy Ratio = (Tier I + Tier II + Tier III (Capital funds)) /Risk weighted assets The risk weighted assets take into account credit risk, market risk and operational risk. o The Basel III norms stipulated a capital to risk weighted assets of 8%. However, as per RBI norms, Indian scheduled commercial banks are required to maintain a CAR of 9% while Indian public sector banks are emphasized to maintain a CAR of 12%. |

D |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

7. |

A Veblen good is a good for which demand increases as the price increases. Veblen goods are typically high-quality goods that are well made, exclusive, and a status symbol. Veblen goods are generally sought after by affluent consumers who place a premium on the utility of the good. Merit goods are those goods and services that the government feels that people will under-consume, and which ought to be subsidised or provided free at the point of use so that consumption does not depend primarily on the ability to pay for the good or service.

Some examples of the free rider problem might include: · People who use public parks or recreational facilities without paying for them · People who download music or movies illegally instead of paying for them · People who do not pay for a subscription to a news website, but still read the articles that are published · People who do not donate to a charity, but still benefit from the services that the charity provides The free rider problem can be addressed through a variety of policy measures, such as taxes, subsidies, or regulations. These measures can help to internalise the costs of providing a good or service and encourage more equitable and efficient resource allocation. |

A |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

8. |

|

B |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

9. |

102nd Amendment Act, 2018, granted constitutional status to the National Commission for Backward Classes (NCBC). The 92nd Amendment Act, 2003 included four more languages in the Eighth Schedule. They are: 1. Bodo 2. Dogri (Dongri) 3. Mathilli (Maithili) and 4. Santhali. With this, the total number of constitutionally recognised languages increased to 22. The 93rd Amendment Act of 2005, added a provision in article 15 that the state is empowered to make any special provision for the advancement of any socially and educationally backward classes of citizens or for the scheduled castes or scheduled tribes regarding their admission to educational institutions including private educational institutions, whether aided or unaided by the state, except the minority educational institutions. Through this amendment, clause 5 was added to Article 15 of the Indian Constitution, which enables the reservation for socially and economically backward classes in private educational institutes. |

A |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

10. |

· A hedge fund is a limited partnership of private investors whose money is managed by professional fund managers who use a wide range of strategies, including leveraging or trading of non-traditional assets, to earn above-average investment returns. · Hedge fund investment is often considered a risky alternative investment choice and usually requires a high minimum investment or net worth, often targeting wealthy clients. Regulatory requirements · Hedge funds in India do not need to be necessarily registered with the Securities and Exchange Board of India. Different types of hedge funds in the market · Domestic hedge funds: Domestic hedge funds are open to only those investors that are subject to the origin country’s taxation. · Offshore hedge funds: An offshore hedge fund is established outside of your own country, preferably in a low taxation country. · Fund of funds: Fund of funds is basically mutual funds that invest in other hedge mutual funds rather than the individual underlying securities.

RBI Strengthens Norms for Lenders in AIFs In a move aimed at curbing evergreening of stressed loans, the Reserve Bank of India (RBI) recently directed Regulated entities (REs) like banks, non-banking financial companies (NBFCs) and other lenders not to invest in any scheme of alternative investment funds (AIFs) which has downstream investments in a debtor company. § Regulated entities (REs) make investments in units of AIFs as part of their regular investment operations. RBI, however, stated that certain transactions of REs involving AIFs, raise regulatory concerns. Recent RBI’s Directives to REs Related to AIFs § RBI emphasized “replacing direct loans given to borrowers with investments in AIF units by REs, which indirectly links to the borrowers. This raised concerns about the practice of loan evergreening to avoid marking them as defaults. o Evergreening of loans is a process whereby a lender tries to revive a loan that is on the verge of default or in default by extending more loans to the same borrower. § RBI''s directive explicitly prohibits REs from investing in AIFs schemes with downstream investments in debtor companies related to the RE. o According to the directive, in instances where an AIF in which an RE is already an investor makes downstream investments in debtor companies, the RE must liquidate its investment within 30 days. o In case the REs are not able to liquidate their investments within the prescribed time limit, they will have to make a 100% provision on such investments. · A provision is an amount set aside or reserved by a company or financial institution to cover anticipated future expenses or losses. Note § Downstream investments refer to the actual investments made by AIFs in companies using raised funds from investors. Alternative Investment Fund § About: An AIF refers to a fund established or formed in India, serving as a privately pooled investment mechanism. o It gathers funds from sophisticated investors, whether domestic or international, with the aim of investing according to a specific investment policy, ultimately benefiting its investors. o These investment vehicles adhere to the SEBI (Alternative Investment Funds) Regulations, 2012. · As of December, 2023, 1,220 AIFs were registered with the Securities and Exchange Board of India (SEBI). § Types of AIFs in India: SEBI has classified AIFs into three main categories: o Category I: AIFs that invest in startups, early-stage ventures, social initiatives, SMEs, infrastructure, or sectors deemed socially and economically beneficial by authorities. · This includes venture capital, social venture funds, infrastructure funds, and any other specified Alternative Investment Funds. o Category II: AIFs which do not fall in Category I and III and which do not undertake leverage or borrowing other than to meet day-to-day operational requirements. · These include real estate funds, private equity funds (PE funds), distressed asset funds, and similar types. o Category III: AIFs which employ diverse or complex trading strategies and may employ leverage including through investment in listed or unlisted derivatives. · Various types of funds such as hedge funds, PIPE (private investment in public equity) Funds, etc. are registered as Category III AIFs. § Legal forms: An AIF can be established in the form of a trust or a company or a limited liability partnership or a body corporate. o Most of the AIFs registered with SEBI are in trust form.

Tax buoyancy

It depends upon:

Tax Elasticity

Elasticity vs buoyancy

Laffer Curve It is an economic theory pioneered by economist Arthur Laffer suggesting that tax rates above a certain threshold reduce tax revenue since they incentivize people not to work. As such, it suggests that lowering tax rates motivates people to earn more money, resulting in greater tax revenue. |

C |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

11. |

To identify inflationary effect, we must identify which action will release more money in the market. RBI releasing new bonds will suck out money from the market. Increase in bank rate means borrowing for banks from RBI becomes expensive, and in turn the rate of loans to customers will also increase. This will reduce inflation. Decrease in SLR means banks will have more cash. Similarly abolition of CRR will also mean more cash with the banks. This in turn would mean lending by banks to customers will become cheaper, and will possibly have an inflationary effect. |

C |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

12. |

Rolling Plan After the termination of the fifth Five Year Plan, the Rolling Plan came into effect from 1978 to 1990. In 1980, Congress rejected the Rolling Plan and a new sixth Five Year Plan was introduced. Three plans were introduced under the Rolling plan: (1) For the budget of the present year (2) this plan was for a fixed number of years– 3,4 or 5 (3) Perspective plan for long terms– 10, 15 or 20 years. The plan has several advantages as the targets could be mended and projects, allocations, etc. were variable to the country’s economy. This means that if the targets can be amended each year, it would be difficult to achieve the targets and will result in destabilization in the Indian economy. Annual Plans Eighth Five Year Plan could not take place due to the volatile political situation at the centre. Two annual programmes were formed for the year 1990-91& 1991-92. |

A |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

13. |

The money multiplier is the amount of money created by commercial banks for a given fixed amount of base money and reserve ratio. An increase in the cash reserve ratio prevents the banks from lending more money and reduces the money multiplier. An increase in the banking habit of the population will increase the lending, thereby will lead to more deposits in the banking system, hence increasing the money multiplier. Even if there is an increase in the population of the country, the money multiplier in an economy does not necessarily increase. |

C |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

14. |

https://blog.ipleaders.in/dk-basu-vs-state-of-west-bengal-1997-case-analysis/

Disinflation Prices don’t fall during disinflationary periods, they just don’t rise as much. Prices are still rising in the Indian economy, though the pace has slowed down. This means, India is currently witnessing disinflation: the price rise has slowed down significantly as compared to, say, 2 years ago. Unlike deflation, disinflation is considered a positive sign and capital markets, especially the bond markets, tend to react positively to it. But disinflation without economic growth can be a cause for worry. If inflation slows down quickly, and is not accompanied by a faster growth of gross domestic product (GDP), it could lead to a slowdown of economic growth, followed by falling productivity and rising unemployment. Deflation Deflation refers to fall of prices. It may seem like a good thing, but in reality no economy wants deflation. Deflation usually accompanies economic slowdowns, lower productivity and loss of jobs. Inflation decreases the value of money, deflation increases its value. This incentivises people to save money now, to buy later when things become cheaper. And this economic behaviour leads to further slowing of growth. During deflation, value of money increases and goods become cheaper. However, your earnings could reduce due to the economic slowdown. During the Great Depression in the 1930s, deflation was in double digits. In recent times, Japan has been struggling with deflation for two decades. A positive impact of deflation could be increased export competitiveness, if most other economies are experiencing inflation. |

C |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

15. |

|

D |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

16. |

Ø When Aggregate demand exceeds aggregate supply in an economy the inflationary gap is created as demand for goods exceeds supply. Since full employment is assumed we can’t create additional goods. Thus Demand Pull creates a inflationary gap. Reasons · Increased money supply · Increased propensity to consume i.e. amount from income spent by households · increase in investment expenditure and exports. Measures to Correct the Inflationary Gap : (1) Statutory Liquidity Ratio: SLR refers to a fixed percentage of the total assets of a bank in the form of cash or other liquid assets that are required to be maintained by the bank. During the situation of Infiationary Gap, SLR is increased. This reduces the credit creation capacity of Commercial Banks and reduces, the flow of money in the economy. As a result of that, the aggregate demand comes down ultimately the economv attains equilibrium. (2) Repo rate: is the rate at which the Central Bank lends money, to the Commercial Banks. To correct the situation of Inflationary Gap, Repo Rate is increased. As a follow-up action, the Commercial banks raise the market rate of interest (the rate at, which the Commercial Banks lends money to the consumers and the investors). This reduces demand for credit. Consequently, consumption expenditure and investment expenditure are reduced. Implying a reduction in Aggregate Demand, as required to correct inflationary Cap. (3) Legal reserves: refer to that part of bank deposits which Commercial Banks are legally required to keep in the form of cash partly with themselves (Statutory Liquidity Ratio) and partly with the Central Bank (Cash Reserve Ratio). In case of Inflationary Gap, the Central Bank can increase the Legal Reserve Ratio (LRR) so that less money is available to the banks for lending. Borrowings are reduced. AD falls. |

C |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

17. |

Fiscal marksmanship:

Significance of fiscal marksmanship:

However, if these fiscal forecasts turn out to be way off the mark repeatedly, it will undermine the credibility of the Budget numbers and reflects poor fiscal marksmanship. |

A |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

18. |

GNP = GDP + NR – NP Where, GDP = Gross domestic product NR = Net income receipts NP = Net outflow to foreign assets

|

D |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

19. |

Read:- Which of the following is the most likely to cause the reduction in current account deficit in India?. Current account deficit is a measurement of a country’s trade where the value of the goods and services it imports exceeds the value of the goods and services it exports. The current account also includes net income, such as interest and dividends, as well as transfers, such as foreign aid, though these components make up only a small percentage of the current account when compared to exports and imports. The current account is essentially a calculation of a country’s foreign transactions and, along with the capital account, is a component of a country’s balance of payment. Government can reduce substantial current account deficit by increasing exports or by decreasing imports which can be through import restrictions, quotas, or duties or by subsidizing exports. Manipulating of exchange rate for cheaper exports tends to increase balance of payments through devaluing of domestic currency. Further current account deficit can be lowered by promoting investor friendly environment. In capital account, capital inflows results from instruments and maturity which includes foreign investment, loans and banking capital. |

B |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

20. |

https://www.thehindu.com/opinion/op-ed/what-is-beveridge-curve-in-economics/article26130968.ece |

b |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

21. |

B |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

22. |

· Wholesale price index is based on commodities only. It includes 676 commodities while Consumer price Index includes commodities as well as services. · Headline inflation is referred to as inflation measured on the basis of Wholesale price Index. Headline inflation includes prices of food and energy and hence it is more volatile in nature. · Core inflation is a long run inflation as excludes the components susceptible to high price variability and hence is a better measure of real inflation in the system as it avoids spikes caused to sudden rise and fall of prices. |

C |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

23. |

Alternative Investment Fund or AIF is a fund established or incorporated in India that is a privately pooled investment vehicle that collects funds from sophisticated investors, whether Indian or foreign, for investing in accordance with a defined investment policy for the benefit of its investors. What are Alternative Investment Funds?

AIFs are classified into three categories by the Securities and Exchange Board of India: Category 1 AIFS

Category 2 AIFS

Category 3 AIFS

Benefits of Alternative Investment Funds

Drawbacks of Alternative Investment Funds

Every investment has advantages and disadvantages. According to industry experts, while Alternative Investment Funds are a lucrative investment, there is a significant learning curve associated with understanding them. As a result, it is critical for investors to invest through platforms that are transparent and can assist them in making informed decisions. |

C |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

24. |

Flue gas desulfurization is the process of removing sulphur compounds from the exhaust emissions of fossil-fueled power stations. This is done through the addition of absorbents, which can remove up to 95% of the sulphur dioxide from the flue gas. https://www.wwdmag.com/what-is-articles/article/10940461/what-is-flue-gas-desulfurization |

A |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

25. |

A |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Latest News

Latest News

General Studies

General Studies