- Home

- Prelims

- Mains

- Current Affairs

- Study Materials

- Test Series

EDITORIALS & ARTICLES

EDITORIALS & ARTICLES

News Information Bureau | 3rd August 2020

“Operation Breathing Space”: Israeli Team In India Begins Work On Developing ‘30 Second’ Rapid Diagnostic Covid-19 Testing Kits

Recently, an Israeli team arrived in India with a multi-pronged mission, codenamed Operation Breathing Space to work with Indian authorities on the Covid-19 response.

Given the level of contraction in the economy, the fiscal deficit is expected to be higher this year. In the current scenario, the most important thing is to bring back confidence among consumers as well as businesses. This will help in fuelling the economic recovery.

ICT tariff case: WTO to set up dispute panels against India on request of Chinese Taipei, Japan

Recently, the Dispute Settlement Body (DSB) of the World Trade Organisation (WTO) has set up two dispute settlement panels targeting import duties imposed by India on a number of Information and Communication Technology (ICT) productsincluding mobile phones.

- Development of Test Kits:

- India’s Defence Research and Development Organisation (DRDO) and Israel’s defence ministry research and development team are working together to develop four different kinds of rapid testing kit for Covid-19 which can give the result within 30 seconds.

- Types of Tests:

- The tests include an audio test, a breath test, thermal testing, and a polyamino test which.

- In the audio test, a patient’s voice would be recorded and evaluated through artificial intelligence and machine learning.

- In the breath test the patient will blow into a tube that will detect the virus using terra-hertz (high frequency) waves.

- Thermal testing will enable identification of the virus in a saliva sample.

- Polyamino acids test seeks to isolate proteins related to Covid-19.

- The tests include an audio test, a breath test, thermal testing, and a polyamino test which.

- India Specific Approach:

- The kits will be jointly developed after trials on Indian Covid-19 patients. The tests have already been tried on a small sample of Israeli patients.

- Other Assistance:

- The Israeli team has brought robotic equipment, and wrist monitors that will help doctors and nurses monitor a patient without increasing risks of infection to themselves.

- The team has also brought 83 advanced respirators to help patients with severe symptoms.

- Benefits:

- The success of rapid tests will help India’s overworked health-care professionals, who are experiencing fatigue. It will also help to address the public impatience over the Covid-19 test.

- The quicker test will help authorities to take quicker prevention measures, which will reduce the spread of the virus among people.

- As a vaccine or a cure is not yet visible and the country is gradually moving towards unlocking, it is time the testing should be made available on demand as close to home as possible.

- With most cases turning out to be asymptomatic, wider and cheaper availability of testing must be a thrust area for the government now. Easy, early diagnosis of infections, even when asymptomatic, will go a long way in containment. The concerns regarding increased dependence on rapid antigen tests in some places must also be addressed.

- Further, the proclivity shown by some States and cities to conceal data has been self defeating. There must be efforts to harvest accurate data, and with ease of availability. Normalcy, albeit a new one, could be reached faster with the right efforts.

- Aspirin is a popular medication used to reduce pain, fever, or inflammation and now it has been found to be an effective non-invasive small molecule-based nanotherapeutics against cataract.

- INST is an autonomous institute under the Department of Science and Technology, Government of India.

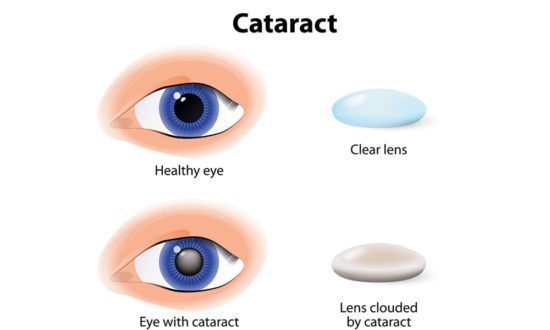

- Cataract:

- It is a major form of blindness that occurs when the structure of crystallin proteins that make up the lens in human eyes deteriorates.

- Such deterioration causes damaged or disorganised proteins to aggregate and forms a milky blue or brown layer, which ultimately affects lens transparency.

- As with ageing and under various conditions, the lens protein crystallin aggregates to form opaque structures in the eye lens, which impairs vision and causes cataract.

- Thus, prevention of the formation of these aggregates as well as their destruction in the early stage of disease progression is a major treatment strategy for cataracts.

- Usage of Aspirin:

- The scientists have used the anti-aggregation ability of self-build aspirin nanorods as an effective non-invasive small molecule-based nanotherapeutics against cataract.

- It prevents the protein from aggregation through biomolecular interactions, which convert it into coils and helices and consequently fail to aggregate.

- Significance:

- Aspirin nanorods due to their nano-size are expected to enhance the bioavailability, improve drug loading, lower toxicity, etc.

- Hence, the delivery of the aspirin nanorods as eye drops is going to serve as an effective and viable option to treat cataract non-invasively.

- It is easy to use and a low-cost alternative nonsurgical treatment method and will benefit patients in developing countries who cannot access expensive cataract treatments and surgeries.

- Four-point Plan:

- China proposed a four-point plan to contain the Covid-19 pandemic, boost economic recovery and resumption of the Belt and Road Initiative (BRI) infrastructure projects.

- The four-point plan included:

- To share consensus in fighting the pandemic as good neighbours.

- To learn from China and Pakistan’s joint prevention and control model of the pandemic.

- To look at opening up green channels as soon as possible by the four countries.

- Green channel is the route followed in passing through customs in an airport, etc by passengers claiming to have no dutiable goods to declare.

- China's expertise to the three countries in fighting Covid-19. It also included the vaccines that are being developed, to be shared with the three countries.

- Pakistan, Nepal and Afghanistan actively supported the four-point cooperation initiative proposed by China.

- Other Discussed Issues:

- China also proposed extending the China-Pakistan Economic Corridor (CPEC) to Afghanistan, as well as taking forward an economic corridor plan with Nepal, called the Trans-Himalayan Multi-dimensional Connectivity Network.

- All the four countries supported the maintenance of multilateralism, strengthened the role of the World Health Organisation (WHO), backed the realisation of a ceasefire in Afghanistan during the epidemic, and the peace and reconciliation process in Afghanistan.

- Concerns for India:

- China asked the three countries at the quadrilateral meet to take advantage of their geography, strengthen exchanges and connectivity between the four countries and central Asian countries, and safeguard regional peace and stability.

- The remarks assume significance as it came amid the border tensions between India and China.

- The quadrilateral meeting also came at a time of deepening concerns over the India-Nepal relationship due to border disputes at Kalapani region.

- Nepal’s Prime Minister K.P. Oli also accused India of trying to destabilize his government.

- China is making concrete strategic inroads in South Asia which will necessarily impact India's interests. Experts are of the opinion that attempting to rope in three members of the South Asian Association for Regional Cooperation (SAARC)grouping, without including India, is a provocative move by China and should be seen as a message.

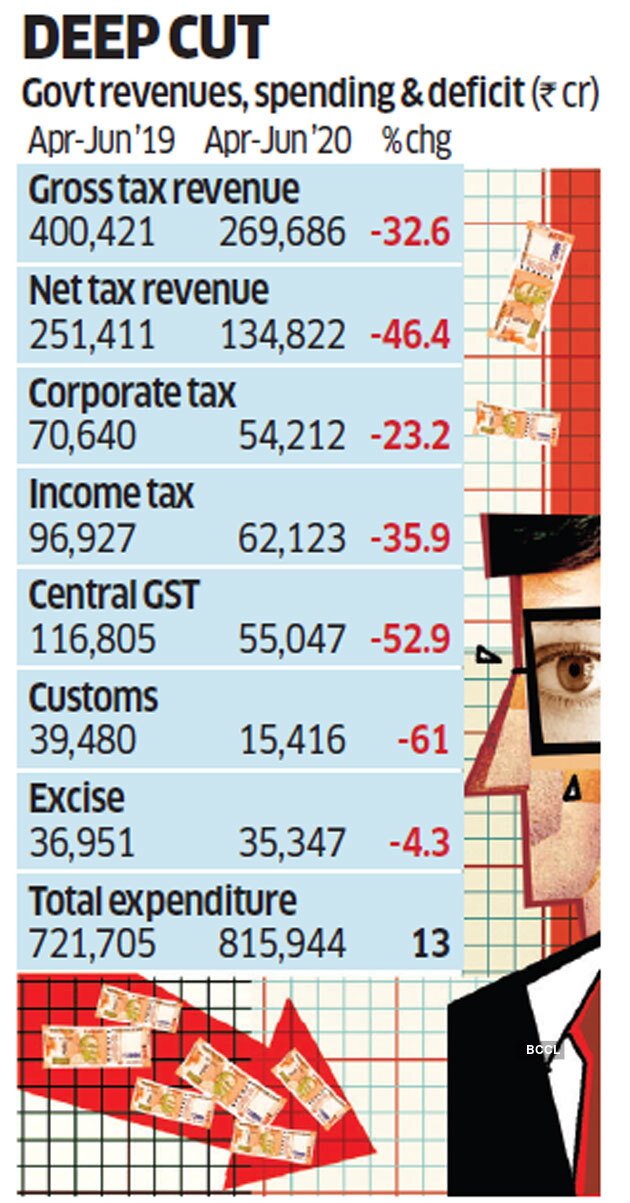

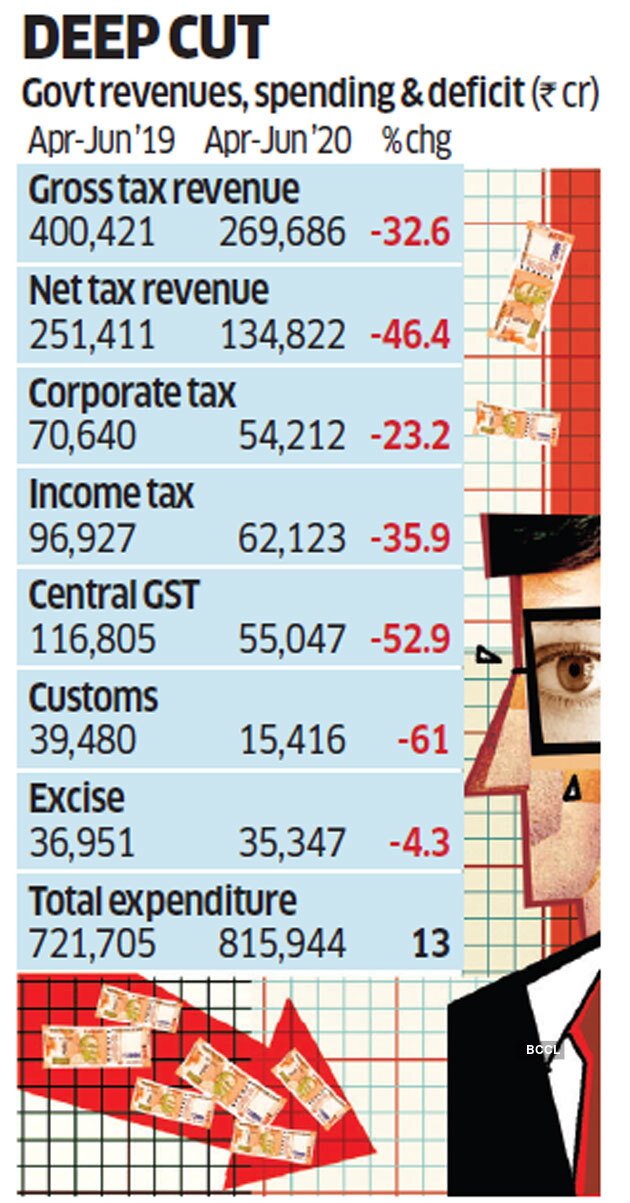

- As per the economists, the fiscal deficit may end up as high as 8% of the Gross Domestic Product (GDP), far exceeding the budget’s goal of 3.5%.

- Fall in Income Component:

- The Union government has received Rs. 1.53 lakh crore (in terms of tax, non-tax revenue and loan recoveries) from April to June 2020.

- This is less than 7% of budget estimates for the full year.

- When economic activity has been stopped because of the pandemic and lockdown, government revenues are also going to come down.

- The Centre has also transferred Rs. 1.34 lakh crore to States as their share of taxes, which is Rs. 14,588 crore lower than the previous year.

- Increase in Expenditure:

- The Centre’s total expenditure for April-June was Rs. 8.15 lakh crore, almost 27% of budget estimates for the year.

- Due to spending on free food grains and rural job programmes for millions of migrant workers.

- There has been a 40% growth in the first quarter capital expenditure to Rs. 88,273 crore.

- This is historically high (in comparison to data from the last 20 years), in terms of year-on-year percentage growth for the first quarter.

- Increased capital expenditure implies increased spending on creation of assets such as infrastructure.

- The Centre’s total expenditure for April-June was Rs. 8.15 lakh crore, almost 27% of budget estimates for the year.

- Borrowings: The reduced collections have forced the government to raise the amount it’s borrowing this fiscal to a record Rs. 12 lakh crore from earlier estimates of Rs. 7.8 lakh crore to meet spending needs.

- The government describes fiscal deficit of India as “the excess of total disbursements from the Consolidated Fund of India, excluding repayment of the debt, over total receipts into the Fund (excluding the debt receipts) during a financial year”.

- In simple words, it is a shortfall in a government's income compared with its spending.

- The government that has a fiscal deficit is spending beyond its means.

- It is calculated as a percentage of Gross Domestic Product (GDP), or simply as total money spent in excess of income.

- In either case, the income figure includes only taxes and other revenues and excludes money borrowed to make up the shortfall.

- Formula:

- Fiscal Deficit = Total expenditure of the government (capital and revenue expenditure) – Total income of the government (Revenue receipts + recovery of loans + other receipts).

- Expenditure component: The government in its Budget allocates funds for several works, including payments of salaries, pensions, etc. (revenue expenditure) and creation of assets such as infrastructure, development, etc. (capital expenditure).

- Income component: The income component is made of two variables, revenue generated from taxes levied by the Centre and the income generated from non-tax variables.

- The taxable income consists of the amount generated from corporation tax, income tax, Customs duties, excise duties, GST, among others.

- Meanwhile, the non-taxable income comes from external grants, interest receipts, dividends and profits, receipts from Union Territories, among others.

- It is different from revenue deficit which is only related to revenue expenditure and revenue receipts of the government.

- The government meets the fiscal deficit by borrowing money. In a way, the total borrowing requirements of the government in a financial year is equal to the fiscal deficit in that year.

- A high fiscal deficit can also be good for the economy if the money spent goes into the creation of productive assets like highways, roads, ports and airports that boost economic growth and result in job creation.

- The Fiscal Responsibility and Budget Management Act, 2003 provides that the Centre should take appropriate measures to limit the fiscal deficit upto 3% of the GDP by 31st March, 2021.

- The NK Singh committee (set up in 2016) recommended that the government should target a fiscal deficit of 3% of the GDP in years up to March 31, 2020 cut it to 2.8% in 2020-21 and to 2.5% by 2023.

What constitutes the government’s total income or receipts? It has two components revenue receipts and non-tax revenues.

1. Revenue receipts of the government

|

- It was done on the request of Japan and Taiwan, taking up the number of panels constituted to examine the same tariff-related issue to three.

- In June 2020, the European Union (EU) had a panel established against India on the same issue.

- The panels would determine whether India’s customs duties on imports of certain ICT products infringe the WTO’s norms or not.

- The panels have been set up to decide on 20% customs duty levied by India on mobile phones and some other ICT products.

- India decided to levy 10% customs duty on these products for the first time in July 2017 which was increased to 15% in the same year.

- These custom duties were further increased to 20% despite opposition from a number of WTO members.

- The EU, USA, China, Singapore, Taiwan, Canada, Japan and Thailand initiated consultations with India on the matter claiming that the move substantially affects them.

- The goods covered in the complaint include telephones for cellular networks or for other wireless networks; base stations; machines for the reception, conversion and transmission or regeneration of voice, images or other data, etc.

- Complainants’ Arguments:

- Japan and Taiwan said that their failed consultations with India prompted them to submit the requests for panels.

- Japan, Taiwan and the EU have argued that these products fall within the scope of the relevant tariff lines for which India has set the bound rate of 0% for its WTO schedule of commitments.

- Bound Rates are the legally bound commitments on customs duty rates, which act as ceilings on the tariffs that member governments can set.

- Once a rate of duty is bound, it may not be raised without compensating the affected parties

- Bound Rates are the legally bound commitments on customs duty rates, which act as ceilings on the tariffs that member governments can set.

- They held that India is applying tariffs on ITC goods falling under five tariff lines in excess of the 0% bound rate and that for some products, the applied tariff rate was as high as 20% some times.

- Tariff Line refers to the classification codes of goods, applied by individual countries, that are longer than the 6-digit level of the Harmonized System (HS).

- HS is a system of code numbers for identifying products. The codes are standard up to six digits. Beyond that countries can introduce national distinctions for tariffs and many other purposes.

- Tariff Line refers to the classification codes of goods, applied by individual countries, that are longer than the 6-digit level of the Harmonized System (HS).

- India’s Stand:

- India managed to block Japan’s first request for a panel on the grounds that the complaint undermined India’s sovereignty.

- India also rejected the EU’s suggestion of agreeing to one consolidated panel combining complaints from all three of them and saving time and resources.

- India argued that all three complainants are seeking to get the country to take on commitments under the Information Technology Agreement-II (ITA-II) which it never agreed to.

Information Technology Agreement

- It is a plurilateral agreement enforced by the WTO and concluded by 29 participants in the Ministerial Declaration on Trade in Information Technology Products at Singapore in 1996.

- It entered into force on 1st July 1997.

- It seeks to accelerate and deepen the reduction of trade barriers for the critically important ICT industry.

- Currently, the number of participants has grown to 82, representing about 97% of world trade in IT products.

- India is a signatory.

- Few developed countries proposed to broaden the scope and coverage of the ITA.

- At the Nairobi Ministerial Conference in December 2015, over 50 members concluded the expansion of the Agreement, which now covers an additional 201 products valued at over USD 1.3 trillion per year.

- Its aim was to increase the coverage of IT products on which customs duty would be bound at zero, addressing non-tariff measures and expanding the number of signatory countries to include countries such as Argentina, Brazil and South Africa.

- India has decided not to participate in this for the time being because India’s experience with the ITA-I has been most discouraging, which almost wiped out the IT industry from India.

- The real gainer from that agreement has been China which raised its global market share from 2% to 14% between 2000-2011. China is a significant exporter of ICT goods.

Latest News

Latest News General Studies

General Studies