- Home

- Prelims

- Mains

- Current Affairs

- Study Materials

- Test Series

EDITORIALS & ARTICLES

EDITORIALS & ARTICLES

The biggest win in the global minimum tax deal is a return to multilateralism

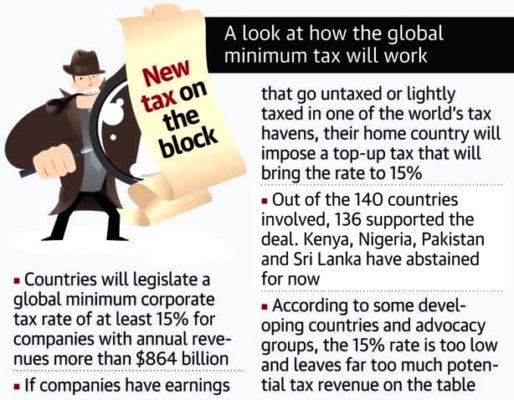

Recently, the Organisation for Economic Cooperation and Development (OECD) has announced that a global deal to ensure big companies pay a Global Minimum Tax (GMT) rate of 15% has been agreed by 136 countries (including India).

Recently, the Organisation for Economic Cooperation and Development (OECD) has announced that a global deal to ensure big companies pay a Global Minimum Tax (GMT) rate of 15% has been agreed by 136 countries (including India).

- The countries behind the accord together accounted for over 90% of the global economy.

Organisation for Economic Cooperation and Development

|

- GMT:

- Objective: GMT is tailored to address the low effective rates of tax shelled out by some of the world’s biggest corporations, including Big Tech majors such as Apple, Alphabet and Facebook.

- These companies typically rely on complex webs of subsidiaries to hoover profits out of major markets into low-tax countries or Tax Havens such as Ireland, the British Virgin Islands, the Bahamas, or Panama.

- GMT aimed at squeezing the opportunities for MultiNational Enterprises (MNEs) to indulge in profit shifting, ensuring they pay at least some of their taxes where they do business.

- Proposed Two Pillar Solution: The global minimum tax rate would apply to overseas profits of multinational firms with $868 million in sales globally.

- Pillar 1 (Minimum tax and subject to tax rules): Governments could still set whatever local corporate tax rate they want, but if companies pay lower rates in a particular country, their home governments could “top up” their taxes to the 15% minimum, eliminating the advantage of shifting profits.

- Pillar 2 (Reallocation of additional share of profit to the market jurisdictions): Allows countries where revenues are earned to tax 25% of the largest multinationals’ so-called excess profit – defined as profit in excess of 10% of revenue.

- Timeline: The agreement calls for countries to bring it into law in 2022 so that it can take effect by 2023.

- Countries that have in recent years created national digital services taxes (For example, equalization levy by the Indian Government) will have to repeal them.

- Impact: The minimum tax and other provisions aim to put an end to decades of tax competition between governments to attract foreign investment.

- The economists expect that the deal will encourage multinationals to repatriate capital to their country of headquarters, giving a boost to those economies.

- Objective: GMT is tailored to address the low effective rates of tax shelled out by some of the world’s biggest corporations, including Big Tech majors such as Apple, Alphabet and Facebook.

- Need for GMT:

- Stopping Financial Diversion to Tax Havens: Increasingly, income from intangible sources such as drug patents, software and royalties on intellectual property has migrated to Tax Havens, allowing companies to avoid paying higher taxes in their traditional home countries.

- Mobilising Financial Resources: With budgets strained after the Covid-19 crisis, many governments want more than ever to discourage multinationals from shifting profits – and tax revenues – to low-tax countries regardless of where their sales are made.

- The OECD has estimated that the minimum tax will generate $150 billion in additional global tax revenues annually.

- Global Tax Reforms: Since the inception of the Base Erosion and Profit Shifting (BEPS) programme, the proposal for GMT is another positive step towards global taxation reforms.

- BEPS refers to tax avoidance strategies that exploit gaps and mismatches in tax rules to artificially shift profits to low or no-tax locations. OECD has issued 15 Action Items to address this.

- Concerns:

- Impending Sovereignty: It impinges on the right of the sovereign to decide a nation’s tax policy.

- A global minimum rate would essentially take away a tool countries use to push policies that suit them.

- Tight Timeline: Also, bringing in laws by next year so that it can take effect from 2023 is a tough task.

- Question of Effectiveness: The deal has also been criticised for lacking teeth: Groups such as Oxfam said the deal would not put an end to tax havens.

- Impending Sovereignty: It impinges on the right of the sovereign to decide a nation’s tax policy.

Latest News

Latest News General Studies

General Studies