- Home

- Prelims

- Mains

- Current Affairs

- Study Materials

- Test Series

EDITORIALS & ARTICLES

EDITORIALS & ARTICLES

The economic rationale of bank nationalisation

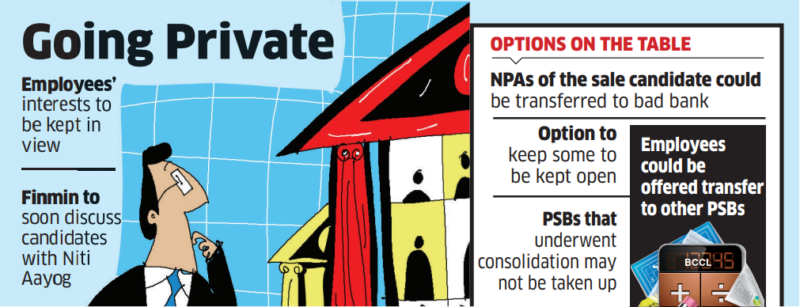

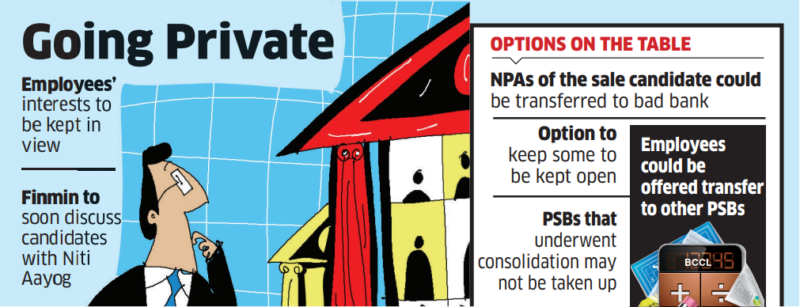

Banking plays a very important role and is the key driving force in any economy. However, in recent years, the Indian banking sector has witnessed multiple Public Sector Banks (PSBs) getting scammed and faced huge losses due to high Non-Performing Assets (NPAs).

Due to this, many economists have suggested the government privatizing PSBs and now the RBI and the government are contemplating privatizing banks in the sector.

However, before taking any decision, the government should actively consider the pros and cons of PSBs remaining nationalized.

For

Against

Privatization means selling whole or partially a government-owned company to the private sector or it simply means transferring ownership to the private sector. This step was taken as a part of a new economic policy, 1991 to liberalize India’s economy from being a relatively closed economy.

However, in recent years, the following factors have been pushing the Government of India to privatize the nationalized banks.

Against

Privatization means selling whole or partially a government-owned company to the private sector or it simply means transferring ownership to the private sector. This step was taken as a part of a new economic policy, 1991 to liberalize India’s economy from being a relatively closed economy.

However, in recent years, the following factors have been pushing the Government of India to privatize the nationalized banks.

- Democratization of Banking: Banks in India were nationalized for the first time in 1969. Before which they had been lending 67% of their funds to industry and virtually nothing to agriculture.

- Also, the commercial banks couldn’t lend money to farmers because they were only present in less than 1% of villages.

- Farmers were unable to get bank loans just when the Green Revolution was getting underway and they needed credit to buy the expensive inputs required to increase output.

- Thus, nationalizing banks helped in the democratization of banking services of the masses.

- Undermining Social Welfare: Public banks open branches, ATMs, banking facilities, etc even in the non-profitable rural areas of India or the poorer sides where the possibility of getting big deposits or making money is less.

- However, Private banks are not inclined to do so and they may prefer opening such facilities mostly in megacities or urban areas.

- If the corporate sector is allowed to dominate banking again, profit will become the prime motive rather than the desire to serve the public.

- International Precedent: Most East Asian success stories have been underpinned by financial systems effectively controlled by governments.

- On the other hand, the governments of western countries, where banking is largely in the hands of the private sector, have had to rescue private banks from bankruptcy.

Against

Privatization means selling whole or partially a government-owned company to the private sector or it simply means transferring ownership to the private sector. This step was taken as a part of a new economic policy, 1991 to liberalize India’s economy from being a relatively closed economy.

However, in recent years, the following factors have been pushing the Government of India to privatize the nationalized banks.

Against

Privatization means selling whole or partially a government-owned company to the private sector or it simply means transferring ownership to the private sector. This step was taken as a part of a new economic policy, 1991 to liberalize India’s economy from being a relatively closed economy.

However, in recent years, the following factors have been pushing the Government of India to privatize the nationalized banks.

- Bulk of NPAs: The banking system is overburdened with the non-performing assets (NPAs) and the majority of which lies in the public sector banks.

- Lack of Regulatory Oversight: PSBs are dually controlled by RBI (under the RBI Act, 1934) and Finance Ministry (under the Banking Regulation Act, 1949).

- Thus, RBI does not have all the powers over PSBs that it has over private sector banks, such as the power to revoke a banking license, merge a bank, shut down a bank, or penalize the board of directors.

- Lack of Autonomy: Public sector bank boards are still not adequately professionalized, as the government still has a major say in board appointments.

- This creates an issue of politicization and interference in the normal functioning of Banks.

- This results in the practice called telephone banking, whereby the politicians ringing bank officials with instructions to lend money to their cronies.

- Draining of Profits: Private banks are profit-driven whereas the business of PSBs is disrupted by government schemes like farm loan waivers etc.

- In general, PSBs have to respond to public demand to finance unproductive projects.

- Improving Governance: In order to improve the governance and management of PSBs, there is a need to implement the recommendations of the PJ Nayak committee.

- De-Risking Banks: There is a need to follow prudential norms for lending and effective resolution of NPAs.

- In this context, the establishment of the bad bank and speedy resolution of NPAs through the Insolvency Bankruptcy Code steps in the right direction.

- Corporatization of PSBs: Rather than blind privatization, PSBs can be made into a corporation like Life Insurance Corporation (LIC). While maintaining government ownership, will give more autonomy to PSBs.

Latest News

Latest News General Studies

General Studies