- Home

- Prelims

- Mains

- Current Affairs

- Study Materials

- Test Series

Latest News

Latest News

ABC of India’s Minerals Diplomacy

- Today, India’s clean energy transitions are impossible without imported critical minerals and rare earths. The country needs these minerals now, and China’s tightening export controls only heighten the urgency. Just like other countries around the world, India is also committing to diversify mineral trade linkages, promote responsible production and build standards-based markets.

- As India aims for Net Zero by 2070, its clean energy transition depends heavily on Critical Minerals (CMs) and Rare Earth Elements (REEs).

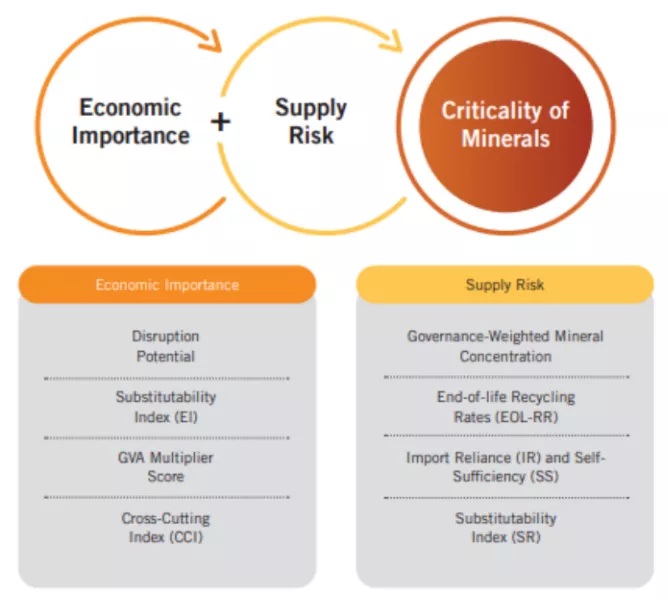

Critical Minerals:-

- Definition: These are the minerals which are essential for economic development and national security but the scarcity and limitation of its geographical availability leading to supply chain vulnerability and disruption constitute its criticality.

- Major Critical Minerals: The Report of the Committee on Identification of Critical Minerals constituted by Ministry of Mines has identified 30 critical minerals:

- Antimony, Beryllium, Bismuth, Cobalt, Copper, Gallium, Germanium, Graphite, Hafnium, Indium, Lithium, Molybdenum, Niobium, Nickel, PGE, Phosphorous, Potash, REE, Rhenium, Silicon, Strontium, Tantalum, Tellurium, Tin, Titanium, Tungsten, Vanadium, Zirconium, Selenium and Cadmium.

- Top Producers: According to the International Energy Agency (IEA), the major producers of critical minerals are:

- China (rare earths, graphite, and refining)

- The Democratic Republic of the Congo (cobalt)

- Chile (copper and lithium)

- Indonesia (nickel)

- South Africa (platinum and manganese)

- Australia (lithium)

Usage:-

- Advanced Electronics: They are critical for making semiconductors and high-end electronics manufacturing.

- Clean Energy Technology: These minerals are an essential component in many clean energy technologies, from wind turbines and solar panels to electric vehicles.

- Transport and Communications: They are also used in manufacturing fighter jets, drones, and radio sets, Aircrafts and mainly power the transition to Electric Vehicles

- India’s Minerals Diplomacy Diverse Sectors: To manufacture advanced technologies in diverse sectors such as mobile phones, tablets, electric vehicles, solar panels, wind turbines, fibre optic cables, and defence and medical applications.

- Battery and Storage Technology: These minerals are critical to develop the storage technology in terms of advancements in battery technology like Lithium-Ion.

Components of Value Chain

- Geoscience and Exploration

- Upstream: Mining and Extraction

- Midstream: Processing, Refining and Metallurgy

- Downstream: Component Manufacturing and Clean Digital Advanced Technology production Example: Zero-Emission Vehicles (ZEV) Manufacturing, Semiconductors, chips etc.

- Material Recovery and Recycling

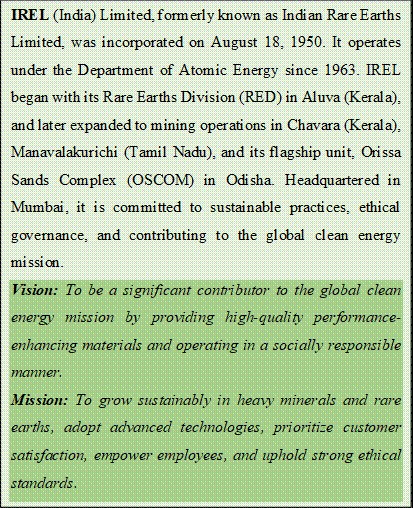

Status of India’s Mineral Ecosystem

- High Import Dependence: According to the Ministry of Mines, India is fully import dependent for lithium, cobalt, nickel sulphate and rare earth magnet-grade materials, which are essential for batteries and renewable energy technologies.

- Skewed Global Strength: India is among the top global producers of iron ore and aluminium, yet remains marginal in critical and strategic minerals, highlighting a structural imbalance.

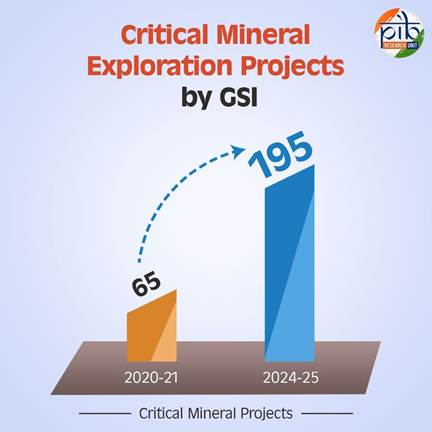

- Exploration Expansion: The Geological Survey of India has significantly expanded critical mineral exploration, identifying lithium resources in Jammu and Kashmir and launching hundreds of targeted exploration blocks since 2021.

- Processing Deficit: Reports by NITI Aayog and the International Energy Agency note that India’s key vulnerability lies in limited refining and separation capacity, especially for battery-grade and rare earth materials.

- Public Investment Push: The National Critical Mineral Mission, approved in 2025, provides long-term public funding to bridge gaps across exploration, processing and recycling.

Major Reserves of Critical and Rare Minerals in India

|

Sl. no. |

Mineral / Category |

Estimated Reserves |

Major Locations in India |

|

1. |

Rare Earth Elements (REEs) |

~7.23 million tonnes of Rare Earth Oxides (REO) embedded in ~13.15 million tonnes of monazite sand (containing thorium and REE minerals).

India holds ~5th largest global REE reserves.

|

Coastal sands of Andhra Pradesh, Odisha, Tamil Nadu, Kerala, West Bengal, Gujarat, Jharkhand, Maharashtra; hard rock in Gujarat & Rajasthan.

|

|

2. |

Lithium |

Lithium deposits identified in inferred category; precise national reserve figures are still being evaluated.

|

Inferred: Reasi district, Jammu & Kashmir (Salar-Haimana area).

|

|

3. |

Graphite |

Identified critical mineral blocks auctioned including graphite, though exact published tonnage is not centrally consolidated.

Auction blocks exist across several states.

|

Bihar, Madhya Pradesh, Karnataka, Odisha, Tamil Nadu, Uttar Pradesh, Chhattisgarh.

|

|

4. |

Cobalt & Nickel |

Some cobalt resources reported, but no large commercially proven lithium/cobalt mining production yet.

Commercial extraction is absent; ongoing exploration.

|

Ongoing survey by the Geological Survey of India (GSI) across multiple terrains; exact reserve estimates pending.

|

|

5. |

Titanium-bearing Minerals (e.g., rutile, ilmenite, zircon)

|

Substantial deposits in placer sands.

India is a major global source of titanium minerals in beach sands.

|

South and East coastal belts (Tamil Nadu, Kerala, Odisha, Andhra Pradesh, Gujarat).

|

|

6. |

Other Critical Minerals (Platinum Group Elements, Vanadium, etc.) |

Blocks of Platinum Group Metals (PGMs), vanadium, nickel, chromium, phosphorite etc. have been auctioned and explored, indicating presence.

Precise central reserves pending comprehensive national figures.

|

Spread across Bihar, MP, Chhattisgarh, Odisha & other states.

|

|

Rare Earth Elements

|

India’s Import Dependency on Critical Minerals

|

Sl.no. |

Mineral |

Dependency |

Primary Sources & Context |

|

1. |

Lithium |

100% |

Mainly Chile, Russia, and China.

India recently signed a ₹200 crore deal with Argentina to secure five lithium blocks. |

|

2. |

Cobalt |

100% |

Sourced from China, Belgium, Netherlands, and DR Congo.

Crucial for the cathode in NCM (Nickel–Cobalt–Manganese) -type EV batteries. |

|

3. |

Nickel |

100% |

Primarily from Indonesia, Sweden, and China.

India has some ore reserves in Odisha, but refining capacity is limited. |

|

4. |

Vanadium |

100% |

Sourced from Kuwait, Germany, and South Africa.

Essential for steel alloys and emerging Vanadium Redox Flow Batteries. |

|

5. |

Germanium |

100% |

Entirely from China, South Africa, and France.

A critical component for fiber optics and night-vision equipment. |

|

6. |

Rhenium |

100% |

Sourced from Russia, UK, and China.

Used in high-temperature superalloys for jet engines. |

|

7. |

Beryllium |

100% |

Fully imported; no domestic mining reported. |

|

8. |

Tantalum |

100% |

Fully imported : While substantial resources (16.42 million tonnes of Nb+Ta ore) exist in Rajasthan''s Rewat Hill, significant commercial production has not been established.

Tantalum is vital for capacitors in smartphones and aerospace. |

|

9. |

Silicon |

High |

India produces some raw silicon but is heavily dependent on China, Malaysia, and Norway for high-purity polysilicon (Solar Photovoltaic grade). |

Why India Needs Minerals Diplomacy?

Minerals Diplomacy refers to the strategic use of international partnerships, alliances, and multilateral mineral clubs to secure reliable access to critical minerals (e.g., Lithium, Cobalt, Nickel, Rare Earths).

- Energy Transition Requirements: India’s target of 500 gigawatts of non-fossil fuel capacity by 2030 will sharply increase demand for lithium, rare earth elements, copper and nickel. The International Energy Agency estimates that clean energy mineral demand will triple by 2030.

- Supply Chain Concentration Risk: Global processing of several critical minerals remains concentrated in a few countries, exposing India to export controls and geopolitical leverage, as seen in recent global restrictions on mineral trade.

- Technological Capability Gaps: Advanced refining, battery recycling and rare earth separation technologies are capital intensive and dominated by a few countries, making international collaboration essential.

- Economic Stability: Long-term mineral partnerships help reduce price volatility and supply shocks, protecting domestic industries such as electric vehicles, electronics and renewable energy manufacturing.

- Strategic Autonomy: Minerals diplomacy supports India’s broader goals of Atmanirbhar Bharat and strategic autonomy, ensuring that future technologies are not constrained by external supply disruptions.

- Termed the “new oil” of the 21st century, these minerals are the building blocks of green technologies, semiconductors, and defense aerospace.

- Global South Leadership: India is emerging as a connector and partner for mineral-rich developing countries, promoting shared value creation rather than pure extraction.

- Its recent lithium cooperation with Namibia emphasises local processing, skills transfer, and industrial development, offering a development-centric alternative to exploitative resource models.

India’s Key Initiatives on Critical Mineral Security

- Institutional Governance & Strategic Funding

National Critical Mineral Mission (NCMM): A flagship mission launched in January 2025 with a total outlay of ₹34,300 crore. It acts as the “nerve center” to coordinate exploration, mining, and recycling across India.

Strategic Stockpiling: The mission mandates the creation of Strategic Mineral Reserves to buffer against global supply chain shocks for essential minerals like Lithium, Cobalt, and Rare Earths.

Fiscal Incentives: To lower the cost of domestic production, the government has removed customs duties on 25 critical minerals and offers 20% Capex subsidies for new processing units.

|

National Critical Mineral Mission

|

- Domestic Exploration & Legislative Reforms

- Amendments to Mines and Minerals (Development and Regulation) Act: Recent reforms empower the Central Government to exclusively auction 24 strategic minerals. It introduced the National Mineral Exploration and Development Trust (NMEDT), widening the scope to include offshore and overseas exploration.

- Exploration Licenses (EL): A new regime designed to attract private investment for deep-seated minerals (like Nickel and Copper) that are technically difficult to mine but vital for high-tech sectors.

- Accelerated GSI Roadmap: The Geological Survey of India is executing 227 projects in FY2025–26, moving beyond initial surveys to establish proven reserves in Jammu & Kashmir, Rajasthan, and Chhattisgarh.

- Overseas Mineral Diplomacy & Partnerships:

- KABIL’s Global Assets: India’s joint venture, Khanij Bidesh India Ltd, has secured exclusivity rights for five lithium blocks in Argentina (15,703 hectares) and is finalizing due diligence for lithium and cobalt projects in Australia.

|

KABIL

National Aluminium Company Ltd. (NALCO), Hindustan Copper Limited (HCL), and Mineral Exploration & Consultancy Limited (MECL). |

- Mineral Security Partnership (MSP): India is the only developing nation in this US-led elite club, allowing it to collaborate on ESG-aligned supply chains and access advanced extraction technologies from 13 other partner economies.

|

Minerals Security Partnership (MSP)

|

- The TRUST Initiative: A strategic framework with the USA and Japan to co-finance mineral processing and reduce reliance on geographically concentrated suppliers.

Regional Focus of India’s Minerals Diplomacy

- Australia and Africa: Serve as key partners for upstream extraction, offering mineral abundance and scope for long-term contracts.

- Japan and West Asia: Emerging as potential hubs for midstream processing, refining and stockpiling, supported by technological expertise and financial capacity.

- European Union and United States: Crucial for downstream innovation, including advanced battery technologies, recycling systems and clean processing methods.

- Latin America: Identified as a future pillar for lithium, copper and nickel access, though competition from global players remains intense.

- Russia: Acts as a diversification option, constrained by sanctions and logistical uncertainties.

Challenges in India’s Minerals Diplomacy

- The Refining Gap:

- Infrastructural Deficit: India successfully discovers ore but lacks the high-purity refining and separation facilities required to convert raw minerals into “battery-grade” materials.

- The Refining Trap: For instance, while KABIL has secured lithium blocks in Argentina, the raw brine still necessitates foreign processing due to a lack of domestic hydro-metallurgical capacity, keeping India tethered to overseas value chains.

- Asymmetric Geopolitical Competition:

- Predatory Economics: India faces oligopolistic dominance, primarily from China, which controls over 90% of global rare-earth refining.

- Financing Hurdles: Indian firms struggle against state-backed global giants who offer “infrastructure-for-minerals” deals. In regions like Zambia, Indian bids often face rejection due to the more aggressive, coordinated financial warfare deployed by rival powers.

- Resource Nationalism & Trade Fragmentation:

- Policy Protectionism: Partner nations are increasingly adopting Resource Nationalism, prioritizing domestic needs.

- Friend-shoring Challenges: Strategic incentives like the US Inflation Reduction Act (IRA) often create “club-exclusivity,” favoring North American production and inadvertently marginalizing Indian exports in the global green-tech market.

- Geological & Environmental Constraints:

- Low Exploration Intensity: Only 10% of India’s Obvious Geological Potential (OGP) is explored. Deep-seated minerals remain undiscovered due to a historical lack of 3-D geophysical data and high-risk capital.

- The ESG Litmus Test: Aligning domestic mining with strict Global ESG (Environmental, Social, and Governance) standards is difficult.

- Projects like the Nayakkarpatti tungsten site face delays as India balances tribal rights (PESA Act) and biodiversity concerns with industrial urgency.

Way Forward

1. Developing Integrated, Value-Chain Oriented Partnerships:

Securing raw ore is no longer the end goal; the real strategic leverage lies in controlling the Midstream Processing.

- Upstream (Extraction): Focus on Africa (Copper/Cobalt in Zambia, Lithium in Namibia), Australia, Canada, and Latin America (The Lithium Triangle) for long-term ore extraction and equity stakes.

- Midstream (Refining & Separation): Partner with Japan and West Asia (specifically the UAE and Saudi Arabia) for advanced mineral processing. These regions offer the capital and industrial infrastructure to refine raw ore into high-purity materials before they reach Indian shores.

- Downstream (Technology & Innovation): Collaborate with the EU and the U.S. (via the TRUST Initiative) for cutting-edge technology creation, including Next-Gen Battery Chemistries and high-efficiency Permanent Magnets.

- The AI & Silicon Horizon: While India is not a founding member of the US-led Pax Silica initiative (launched in December 2025), the January 2026 invitation by the US Ambassador marks a turning point. Joining this alliance will integrate India into the global Silicon-to-AI supply chain, linking minerals directly to semiconductor fabrication.

- Strategic Diversification: Maintain Russia as a critical backup partner, utilizing their vast reserves and long-standing scientific ties to diversify away from concentrated global suppliers.

2. Sovereign Support & Private Sector De-risking:

The government is now using the ₹34,300 crore National Critical Mineral Mission (NCMM) to provide “Patient Capital” for long-term projects.

- Risk-Sharing: By offering Sovereign Guarantees, India aims to de-risk private sector entry into volatile overseas markets.

- Market Certainty: Implementing Price-Floor Mechanisms and Assured Domestic Offtake Agreements ensures that Indian refiners are protected against “predatory pricing” from global monopolies.

| Japan’s Model of Mineral Resilience: Japan exemplifies systematic, long-term, and institutional strategies for critical mineral security, developed after facing supply shocks from China. |

3. Scaling the “Third Pillar”- Circular Economy:

- Urban Mining Revolution: With a ₹1,500 crore incentive scheme, India aims to recover 40,000+ tonnes of minerals annually by 2030.

- Secondary Supply Base: By formalizing e-waste and battery recycling, India can create a resilient secondary mineral supply, reducing the environmental and geopolitical cost of primary mining.

4. Diplomatic Expansion & Institutional Agility:

- Mineral Attachés: India should establish a dedicated Mineral Diplomacy Division within the MEA, stationing specialized Mineral Attachés in mining capitals like Santiago and Perth to monitor market volatility in real-time.

- Strategic Stockpiling: Similar to strategic petroleum reserves, India must build Sovereign Mineral Buffer Stocks of Lithium and Cobalt to insulate domestic industries from predatory pricing and export bans.

5. R&D and Material Substitution:

- Innovation Leapfrogging: Investing in Sodium-ion or Zinc-air chemistries can reduce the absolute dependency on Lithium.

- Patenting the Future: Linking Centres of Excellence with industry to generate 1,000+ patents by 2030 will ensure that India owns the intellectual property (IP) for the next generation of mineral processing.

Conclusion

- India’s mineral diplomacy is shifting from ad-hoc imports to strategic resource planning through a two-pronged approach– building domestic capabilities while securing immediate international access. Success will hinge on operational mines, processing capacity, and resilient value chains, not merely on agreements signed.

General Studies

General Studies