- Home

- Prelims

- Mains

- Current Affairs

- Study Materials

- Test Series

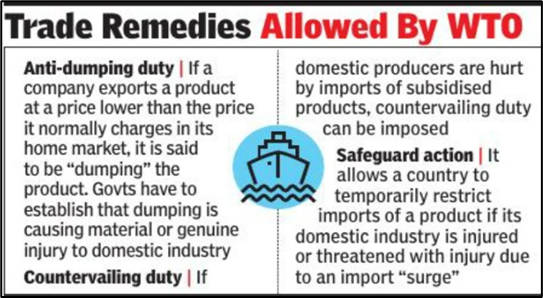

Countervailing duty v/s Anti-dumping duty

Anti-Dumping Duty

- It is a protectionist tariff that a domestic government imposes on foreign imports that it believes are priced below fair market value.

- Dumping is a process wherein a company exports a product at a price that is significantly lower than the price it normally charges in its home (or its domestic) market.

- The duty is priced in an amount that equals the difference between the normal costs of the products in the importing country and the market value of similar goods in the exporting country or other countries that produce similar products.

- It is imposed to protect local businesses and markets from unfair competition by foreign imports.

- Thus, the purpose of anti-dumping duty is to rectify the trade distortive effect of dumping and re-establish fair trade.

- The use of anti-dumping measures as an instrument of fair competition is permitted by the World Trade Organization (WTO).

- The WTO allows the government of the affected country to take legal action against the dumping country as long as there is evidence of genuine material injury to industries in the domestic market.

- The government must show that dumping took place, the extent of the dumping in terms of costs, and the injury or threat to cause injury to the domestic market.

- While the intention of anti-dumping duties is to protect local businesses and markets, these tariffs can also lead to higher prices for domestic consumers.

- In India, the Ministry of Finance makes the final decision on whether to impose anti-dumping duties.

Countervailing duty (CVD)

- It is a specific form of duty that the government imposes to protect domestic producers by countering the negative impact of import subsidies.

- CVD is thus an import tax by the importing country on imported products.

- Why is CVD imposed?

- Foreign governments sometimes provide subsidies to their producers to make their products cheaper and boost their demand in other countries.

- To avoid flooding the market in the importing country with these goods, the government of the importing country imposes CVD, charging a specific amount on the import of such goods.

- The duty nullifies and eliminates the price advantage enjoyed by an imported product.

- The WTO permits the imposition of CVD by its member countries.

Safeguard Measures

- Safeguard measures are measures introduced by a country that qualify as “emergency” actions under the WTO Agreement on Safeguards.

- A WTO member may take a “safeguard” action (i.e., restrict imports of a product temporarily) under the WTO Agreement on Safeguards to protect a specific domestic industry from an increase in imports of any product which is causing, or which is threatening to cause, serious injury to the industry.

- These actions are intended to prevent or mitigate serious injury to the member state’s domestic industry.

- Such measures, which in broad terms take the form of suspension of concessions or obligations, can consist of quantitative import restrictions or duty increases to higher than bound rates.

- They are one of three types of contingent trade protection measures, along with anti-dumping and countervailing measures, available to WTO members.

- The guiding principles of the agreement with respect to safeguard measures are that such measures

- Must be temporary;

- That they may be imposed only when imports are found to cause or threaten serious injuryto a competing domestic industry;

- That they (generally) beapplied on a non-selective (i.e., most-favoured-nation, or “MFN”) basis;

- That they be progressively liberalized while in effect;

- And that the member imposing them (generally) must pay compensation to the members whose trade is affected.

- Thus, safeguard measures, unlike anti-dumping and countervailing measures, do not require a finding of an “unfair” practice.

- The agreement defines “serious injury” as a significant overall impairment in the position of a domestic industry.

In determining whether serious injury is present, investigating authorities are to evaluate all relevant factors having a bearing on the condition of the industry.

|

Directorate General of Trade Remedies

|

Latest News

Latest News

General Studies

General Studies