- Home

- Prelims

- Mains

- Current Affairs

- Study Materials

- Test Series

EDITORIALS & ARTICLES

EDITORIALS & ARTICLES

IMF Quota Review

Recently, the Reserve Bank Governor pitched for the “expeditious completion” of the 16th general review of the quotas at the International Monetary Fund (IMF).

International Monetary Fund (IMF)

- It was set up in 1945 out of the Bretton Woods conference.

- Goal: To bring about international economic coordination to prevent competing currency devaluation by countries trying to promote their own exports.

- It evolved to be a lender of last resort to governments of countries that had to deal with severe currency crises.

- Headquarter: Washington, D.C., United States

- India is the Founding Member of IMF.

IMF Membership:

- IMF membership is a prerequisite for membership in the International Bank for Reconstruction and Development (IBRD).

- Quota Subscription: Upon joining, member countries contribute a quota subscription, determined by their economic performance and wealth.

- Quotas are denominated in Special Drawing Rights (SDRs), the IMF’s unit of account.

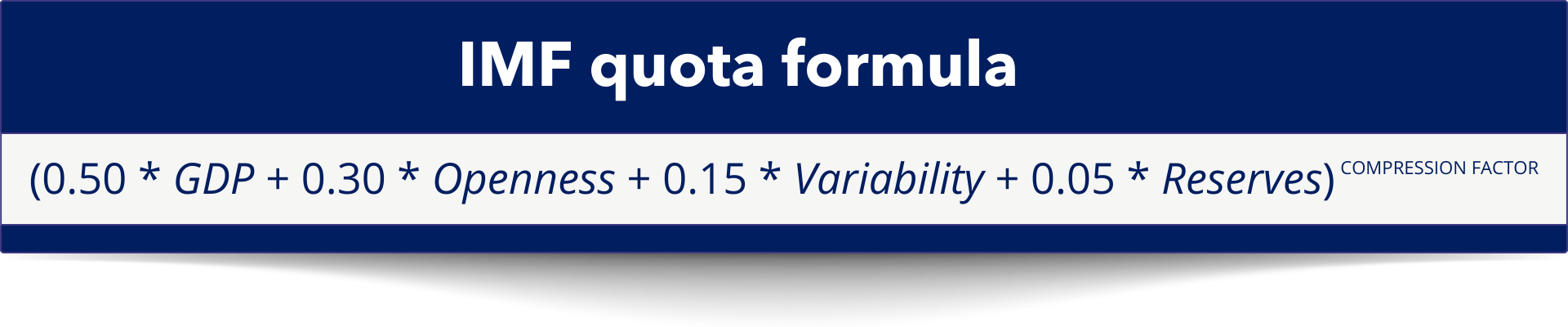

- Quota formula includes GDP (50%), openness (30%), economic variability (15%), and international reserves (5%).

- Special Drawing Rights (SDRs):

- SDRs are IMF’s unit of account, not a currency.

- SDR value is based on a basket of currencies: U.S. dollar, Euro, Japanese yen, pound sterling, and Chinese renminbi (added in 2016).

- Quotas expressed in SDRs.

- Voting Power: Voting power of members tied directly to their quotas.

Key Functions of the IMF:

- Provision of Financial Assistance: The IMF extends financial aid to member countries grappling with balance of payments challenges.

- Its assistance aims to restore currency stability, reinforce international reserves, and foster economic growth.

- Surveillance by the IMF: The IMF exercises diligent oversight over the global monetary system.

- It meticulously monitors the economic and financial policies pursued by each of its 190 member nations.

- Capacity Development Initiatives: The IMF offers a spectrum of technical assistance and training to bolster various economic institutions.

- This support benefits central banks, finance ministries, and other pertinent bodies, facilitating modernization initiatives.

- Moreover, these endeavors align with advancing the realization of the Sustainable Development Goals (SDGs).

How does the IMF use Quotas?

- Resource Contribution: Quotas determine the maximum amount of financial resources a member is obliged to provide to the IMF.

- Voting Power: Quotas are a key determinant of voting power in IMF decision.

- Access to Financing: Quotas determine the maximum amount of loans a member can obtain form the IMF under normal access.

- SDR Allocations: Quotas determines a member’s share in a general share in a general allocation of SDRs.

|

The Governance setup of the IMF:

|

How does the IMF help countries?

- Special Drawing Rights: The IMF basically lends money, often in the form of special drawing rights (SDRs), to troubled economies that seek the lender’s assistance.

- Other lending methods: The IMF carries out its lending to troubled economies through a number of lending programs such as the extended credit facility, the flexible credit line, the standby agreement, etc.

Reasons a country may seek an IMF Loans:

- Macroeconomic risks;

- Currency crises;

- To meet external debt obligations;

- To buy essential imports and

- Push the exchange value of their currencies.

Concern raised by RBI Governor:

Quota formula - The current quota formula is a weighted average of GDP (weight of 50 percent), openness to the global economy (30 percent), economic variability (15 percent), and international reserves (5 percent). For this purpose, GDP is measured through a blend of GDP based on market exchange rates (weight of 60 percent) and on purchasing-power-parity exchange rates (40 percent). The formula also includes a “compression factor” that reduces the dispersion in calculated quota shares across members.

- Urgent Quota Review: He emphasized the need for the speedy completion of the 16th general review of quotas at the IMF.

- He suggested that this completion would enable the IMF to better support distressed countries.

|

Conditions attached to IMF Loans:

|

- Funding Conditions Concerns: He criticized the IMF’s funding conditions, which often discourage countries in urgent need due to the associated conditions, requirements, and stigmas.

- Alternative Sources Due to Stigma: He noted that poor countries facing financial difficulties often seek support from entities other than the IMF due to perceived stigma or limited access.

- Limitations of Funding Mechanisms: The Governor pointed out the limitations of the IMF’s funding methods.

- He discussed how precautionary programs and stand-by arrangements may not be suitable for countries with varying macroeconomic fundamentals.

- The Stand-by Arrangement (SBA) provides short-term financial assistance to countries facing balance of payments problems. It has been the IMF lending instrument most used by advanced and emerging market countries.

- IMF’s precautionary programmes such as the precautionary lending line are available for countries with sound macro-fundamentals.

- Other Concern:

- Delays in Funding Approval: IMF funding serves as a crucial financial lifeline for countries facing severe debt crises.

- Delays in obtaining this funding can intensify economic challenges, straining government finances, impacting businesses, and adversely affecting populations.

- Countries like Sri Lanka and Ghana, facing shortages of essential resources and requiring significant reforms to manage debt crises, are particularly vulnerable to funding delays.

- Governance Imbalance: The practice of having a European lead the IMF and an American lead the World Bank is criticized for perpetuating a lack of representation for emerging economies.

- During the pandemic, the wealthy Group of Seven nations, with a population of 772 million, received the equivalent of $280 billion from the IMF while the least developed countries, with a population of 1.1 billion, were allocated just over $8 billion.

- Intrusive Conditions and Sovereignty Concerns: Critics argue that the conditions attached to IMF loans are too intrusive and often compromise the economic and political sovereignty of borrowing countries.

- Stringent conditions, known as “conditionality,” can impose policies that turn loans into tools for enforcing specific economic and policy changes.

- Policy Imposition without Local Context: The IMF has been criticized for imposing policies on countries without fully understanding their unique economic and social circumstances.

- Quota Reforms: Each member country is assigned a quota proportional to its economic size globally. Quotas determine voting power and borrowing capacity.

- This system has led to overrepresentation of wealthy nations in decision-making and rule-setting processes.

Road ahead

- Governance Reform: The IMF should reform its leadership selection process to ensure equal representation and voice for emerging economies, breaking away from traditional Western dominance.

- Address Underrepresentation: Special attention should be given to addressing the underrepresentation of economically growing countries, such as the BRICS nations, by ensuring their quotas and voting power align with their increasing economic significance.

- Local Context: Policymaking should be more inclusive, involving local experts and considering a nation’s specific economic, social, and political factors to develop strategies that align with domestic realities.

- Recommendation by RBI Governor:

- Timely and Non-Stigmatized Measures: He stressed the importance of implementing corrective measures, including financing, in a timely and non-stigmatized manner. This would require a stronger IMF capable of managing country risks effectively.

- Link between Support and Quota Size: The Governor explained that the IMF’s support is linked to the quota size of member countries. Hence, reforms in the IMF’s quota system would enhance the organization’s legitimacy in overseeing the international monetary and financial system.

- Reducing Conditionalities: He suggested that IMF programs could be designed with fewer conditionalities for countries with reasonably resilient macro-fundamentals that aren’t heavily affected by balance of payments stress.

Latest News

Latest News General Studies

General Studies