- Home

- Prelims

- Mains

- Current Affairs

- Study Materials

- Test Series

A rare earths roadmap for India

Rare Earth Metals

- They are a set of seventeen metallic elements.These include the fifteen lanthanides on the periodic table in addition to scandium and yttrium that show similar physical and chemical properties to the lanthanides.

- The 17 Rare Earths are cerium (Ce), dysprosium (Dy), erbium (Er), europium (Eu), gadolinium (Gd), holmium (Ho), lanthanum (La), lutetium (Lu), neodymium (Nd), praseodymium (Pr), promethium (Pm), samarium (Sm), scandium (Sc), terbium (Tb), thulium (Tm), ytterbium (Yb), and yttrium (Y).

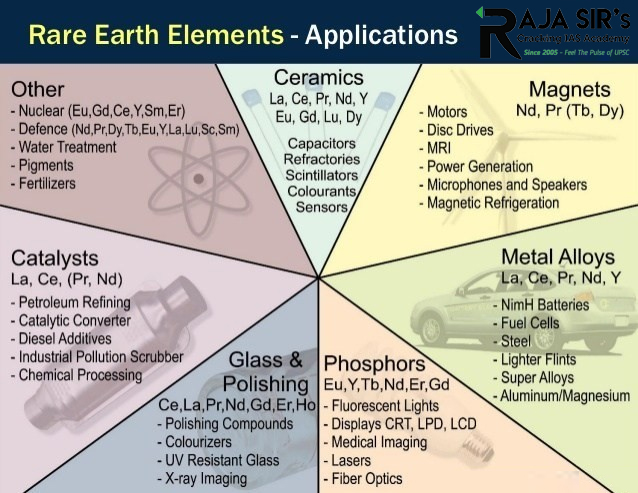

- These minerals haveunique magnetic, luminescent, and electrochemical properties and thus are used in many modern technologies, including consumer electronics, computers and networks, communications, health care, national defense, clean energy technologies etc.

- Even futuristic technologies need these REEs.

- For example, high-temperature superconductivity, safe storage and transport of hydrogen for a post-hydrocarbon economy etc.

- They are called''rare earth'' because earlier it was difficult to extract them from their oxides forms technologically.

- They occur in many minerals but typically in low concentrations to be refined in an economical manner.

Strategic significance of Rare Earth Elements

Multiple Uses: They are used in multiple hi-tech applications and processes like EVs, Medicinal appliances, LEDs etc. that domestic production of such elements becomes inevitable.

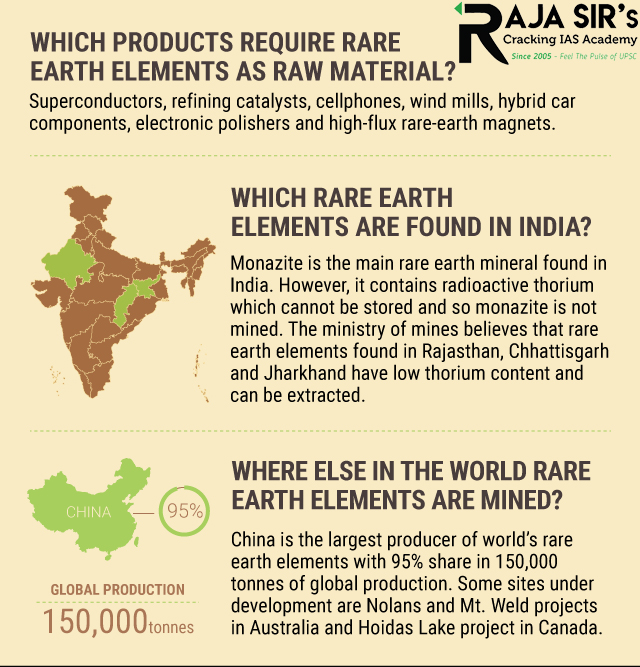

Rising Demand: The multifarious uses of rare earth elements in new age technologies shows that their demand is going to rise in future. For instance, the current demand of neodymium in India is small, at around 900 tonnes per annum, because domestic manufacturing of EVs and wind turbines is still limited. However, as manufacturing of EVs and wind turbines picks up, the demand for neodymium is estimated to rise sharply by 6-7 times by 2025 (6,000 tonnes) and by 18-20 times by 2030 (20,000 tonnes).

Reducing Import Bill: India is almost 100% import dependent for most rare earths which creates a huge pressure on foreign exchange. Further, prices of rare elements are consistently rising due to the rising demand. For instance, the global price of neodymium has risen sharply from under US$ 100 per kg in 2018 to over US$ 200 per kg at present.

Highly Concentrated Supply Chain: The global supply scenario for rare earths is highly concentrated, much more than oil and hydrocarbons, which poses a strategic challenge. Until a few years ago, China controlled 90% of the supply of rare earths. Now, after aggressive production by the US, Australia and Canada, China’s share is down to 60% but still dominant. In 2010, following dispute with Japan over Senkaku Islands in the East China Sea; China shut down exports of Rare Earth Elements to Japan. Given India’s border dispute, China might resort to similar tactics in future.

Huge potential: India has greater reserves than the US and Australia, only behind China, Vietnam, Russia, and Brazil. With Russia embroiled in conflict, the onus is on India to emerge as a supplier not just for domestic use but for international consumption.

China’s Monopoly

- China has over time acquired global domination of rare earths, even at one point, it produced 90% of the rare earths the world needs.

- Today, however, it has come down to 60% and the remaining is produced by other countries, including the Quad(Australia, India, Japan and United States).

- Since 2010, when China curbed shipments of Rare Earths to Japan, the US, and Europe, production units have come up in Australia, and the US along with smaller units in Asia, Africa, and Latin America.

- Even so, the dominant share of processed Rare Earths lies with China.

Reasons behind the limited production of Rare Earth Elements in India

First, rare earth materials are not concentrated enough in many geographical locations with respect to commercial viability. It is expensive to commercially produce them.

Second, at present they are classified as atomic minerals. The mining for rare earths is reserved exclusively for government companies. Currently, there are only two companies – Indian Rare Earths Ltd (IREL, owned by GoI) and Kerala Minerals and Metals Ltd (owned by Kerala government) that can mine them. Further, their production capacities and technological capabilities are limited which is why India is import dependent.

Third, IREL’s primary source of revenues is not rare earths. Most of its income comes from the production and marketing of other minerals contained in beach sands. Since its revenue does not depend upon rare earth elements, IREL has little need to produce and research. IREL has poor incentives to refocus itself as a globally competitive rare earth extraction and processing firm. This has restricted India to be a low-cost exporter of rare earth oxides instead of higher value-added products.

Fourth, the present system (clubbing rare earth elements with atomic minerals) ends up separating the rare earths ecosystem from other R&D ecosystems like electronics or metallurgy. This severely impacts the overall umbrella of strategic research, undercutting the interdisciplinary nature of modern research work. R&D is dominated by DAE and the Bhabha Atomic Research Centre (BARC), with negligible participation by the Academia and private sector. The situation is similarly disintegrated with regards to exploration. The Geological Survey of India (GSI), Mineral Exploration Corporation Limited (MECL) and Atomic Minerals Directorate for Exploration and Research (AMD) operate in overlapping spheres while working in siloes.

Fifth, Beach sand mining was permitted until a few years ago but was banned in 2016 in an attempt to conserve strategic minerals including rare earths and thorium.

India''s Current Policy on Rare Earths

- Exploration in India has been conducted by the Bureau of Mines and the Department of Atomic Energy. Mining and processing has been performed by some minor private players in the past, but is today concentrated in the hands of IREL (India) Limited (formerly Indian Rare Earths Limited),a Public Sector Undertaking under the Department of Atomic Energy.

- India has granted government corporations such as IREL a monopolyover the primary mineral that contains REEs: monazite beach sand, found in many coastal states.

- IREL produces rare earth oxides (low-cost, low-reward “upstream processes”), selling these to foreign firms that extract the metals and manufacture end products (high-cost, high-reward “downstream processes”) elsewhere.

- IREL’s focus is to provide thorium — extracted from monazite — to the Department of Atomic Energy.

Related Steps taken

- Globally:

- The Multilateral Minerals Security Partnership (MSP)was announced in June 2022, with the goal of bringing together countries to build robust critical minerals supply chains needed for climate objectives.

- Involved in this partnership are the United States (US), Canada, Australia, Republic of Korea, Japan, and various European countries.

- India is not included in the partnership.

- By India:

- Ministry of Mines has amended Mines and Minerals (Development and Regulation) (MMDR) Act, 1957 through the Mines and Minerals (Development and Regulation) Amendment Act, 2021for giving boost to mineral production, improving ease of doing business in the country and increasing contribution of mineral production to Gross Domestic Product (GDP).

- The amendment act provides that no mine will be reserved for particular end-use.

Suggestions of CII

- Amid India''s reliance on China for rare earth minerals imports, theConfederation of Indian Industry (CII) has urged the government to encourage private mining in the sector and diversify supply sources.

- Though India has 6% of the world’s rare earth reserves,it only produces 1% of global output, and meets most of its requirements of such minerals from China.

- In 2018-19, for instance, 92% of rare earth metal imports by value and 97% by quantity were sourced from China.

- CII suggested that an ''India Rare Earths Mission''be set up manned by professionals, similar to the India Semiconductor Mission, as a critical component of the Deep Ocean Mission.

- The industry group has also mooted making rare earth minerals a part of the ‘Make In India’ campaign,citing China’s ‘Made in China 2025’ initiative that focuses on new materials, including permanent magnets that are made using rare earth minerals.

Looking ahead

- India must take lessons from other advanced economies on how they are planning to secure their mineral needsand attempt to join multinational fora on assuring critical mineral supply chains – or use existing partnerships, such as Quad and BIMSTEC, to foster such dialogues.

- There must also betop-level decision making within the government to strategize on how to create vertically integrated supply chains of green technologies manufacturing, or we may be in serious danger of missing out on our climate change mitigation targets.

- India needs to create a new Department for Rare Earths (DRE),which would play the role of a regulator and enabler for businesses in this space.

Latest News

Latest News

General Studies

General Studies