- Home

- Prelims

- Mains

- Current Affairs

- Study Materials

- Test Series

Infrastructure investment as a G20 priority for India

- Infrastructure sector is a key driver for the Indian economy. The sector is highly responsible for propelling India’s overall development and enjoys intense focus from the Government. Numerous initiatives have been taken to facilitate infrastructure projects across the country at centre as well as at state level.

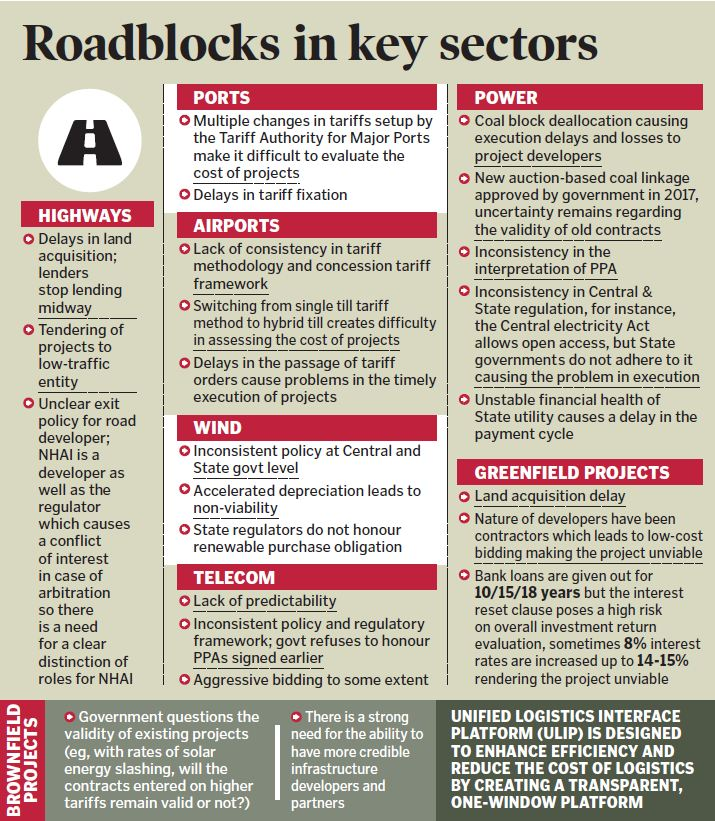

- But there are still several roadblocks to building class, state-of-the-art infrastructure across the sectors. India’s road to sustainably higher growth and a competitive manufacturing sector will go through robust and reliable national infrastructure.

Status of Infrastructure in India

- Infra-Deficit India:India has the second largest infrastructure deficit in the world (after Brazil) as it has grown at a rapid pace of over 6% since the early 1990s without commensurate increase in supply.

- As per the World Bank’s Financing India’s Urban Infrastructure Needsreport, by 2036, 600 million people will be living in urban cities in India, representing 40% of the population.

- This is likely to put additional pressure on the already stretched urban infrastructure and services of Indian cities.

- Only 5% of the infrastructure needs of Indian cities are currently being financed through private sources.

- As per the World Bank’s Financing India’s Urban Infrastructure Needsreport, by 2036, 600 million people will be living in urban cities in India, representing 40% of the population.

- Significance of the Sector:

- Infrastructure sector acts as a catalyst for India’s economic growth as it drives the growth of the allied sectorslike townships, housing, built-up infrastructure and construction development projects.

- Global investors have started to view India as one of their top destinations for infrastructure projects. Indiaoffers a higher rate of return on infrastructure projects, given its youth bulge, rise of the middle class, and a huge domestic market.

- Related Initiatives:

- The government has launched the National Infrastructure Pipeline (NIP)for the period FY 2020-25 for supporting development of infrastructure, urban infrastructure being one of the key focus areas.

- The Government also launched the ambitious Gati Shakti schemewith the aim of coordinated planning and execution of infrastructure projects to bring down logistics costs.

- TheNational Investment and Infrastructure Fund (NIIF) is a government-backed entity established to provide long-term capital to the country’s infrastructure sector. It was set up in December 2015 as a Category-II Alternate Investment Fund.

- In November 2021, India, Israel, the US, and the UAE (I2U2)established a new quadrilateral economic forum to focus on infrastructure development projects in the region and strengthen bilateral cooperation.

- In March 2021, the Parliament passed a bill to set up the National Bank for Financing Infrastructure and Development (NaBFID)to fund infrastructure projects in India.

Challenges

- India’sbiggest challenge is the huge infrastructure financing gap, which is estimated to be more than 5% of GDP.

- Land acquisition, aggressive bidding and non-performing assetsare key challenges to infrastructure PPPs (public-private partnerships).

- India is dealing with a high level of stressed assets, and there is a need to restore credit growth for public sector banksas fundamental to the future growth of the economy.

- Stressed assets in banks combined with little bank capitalcould lead to additional and potentially crippling losses on these assets.

- Also, thelack of stability of credit interest rates poses a significant risk for investments in the sector.

- The fact that infrastructure investments in India are generally based on the expected return on USDand not on user charges creates an imbalance and affects the total inflow of foreign infrastructure investments in the country.

Strengthening the Infrastructure Sector

Strengthening the Infrastructure Sector

- Ensuring Consistency in Policy/Regulatory Framework:There is a need for a better regulatory environment and consistency in the tendering process. Lack of consistency and policy coherence across different government departments should be addressed as a priority.

- Between the government and the RBI, there needs to be a holistic way to deal with the issue of stressed assets.A dedicated policy needs to be formed across sectors for non-performing assets, revamp of PSUs.

- Reasonable User Charges:It is necessary for augmenting infrastructure financing, financial viability of infrastructure service providers, and for environmental and resource use sustainability.

- User charges are crucial because in many areas across the country, partly because of zero or very low user charges, there is over-use and wastage of the precious resources(for instance, groundwater).

- Besides the environmental sustainability and resource use efficiency that would emanate from reasonable user prices, this policy priority hasimmense resource generation potential.

- Autonomous Regulation of Infrastructure:As India and the world opens up more sectors to private participation, the private sector would essentially demand autonomous infrastructure regulation.

- The world-wide trend is towards multi-sectoral regulatorsas the regulatory role is common across infrastructure sectors, and such institutions build regulatory capacity, conserve resources and prevent regulatory capture.

- Asset Recycling (AR) and BAM:The basic idea of BAM (Brownfield Asset Monetisation) is to augment infrastructure resources through brownfield AR for accelerated greenfield investment by freeing up funds tied up in de-risked brownfield public sector assets.

- These assets can be transferred to a trust (InvITs)or a corporate structure (TOT model), which receive investment from institutional investors against a capital consideration (which captures value of future cash flows from these underlying assets).

- India has alarge stock of brownfield assets across infrastructure sectors.

- Utilising Domestic Funds: Domestic sources such as India Pension Funds which have been lying dormant could give a big boost to the sectorif utilised efficiently.

- India can emulate the practices in Canada, the Netherlands, Australia and the likes on efficient usage of domestic funds to push infrastructure development.

- Leveraging Global Leadership:India will assume the G20 presidency beginning December 2022. G20 countries, in their presidencies, have set the agenda for infrastructure, such as Roadmap to Infrastructure as an Asset class (Argentina, 2018), Principles of Quality Infrastructure Investment (Japan, 2019), InfraTech (Saudi Arabia, 2020), and Financing Sustainable Infrastructure for Recovery (Italy, 2021).

- The Indian G20 presidency is an occasion for India to set the infrastructure agenda for itself and the world.

Latest News

Latest News

General Studies

General Studies