Revamping - Bretton Woods Institutions World Bank and IMF

- The IMF and World Bank continue to be amongst the most relevant and significantly powerful norm-setters, conveners, knowledge-holders, and influencers of the international development and financial landscape. This Inside the Institutions sets out some of the most common criticisms of the World Bank and IMF under three broad lenses: democratic governance, human rights, and the environment.

- Wrongdoings by the World Bank and the IMF, unsuitability of these institutions’ heads, and various steps that these institutions must take to maintain their credibility and legitimacy.

- The World Bank and IMF heads are chosen using a dual monopoly selection procedure in which only an American can lead the World Bank and only a European can lead the IMF. This is the result of a long-standing agreement between the Western powers.

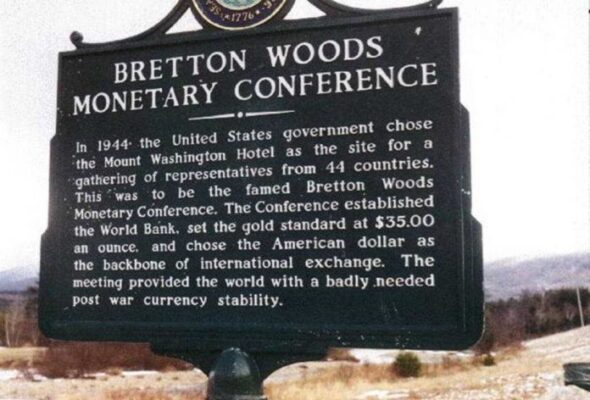

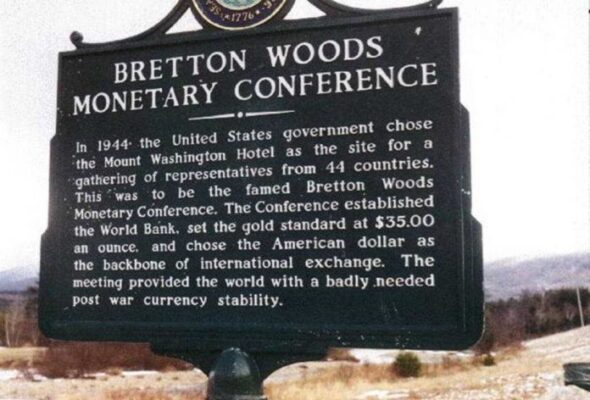

Genesis

- The General Agreement on Tariffs and Trade (GATT) traces its origins to the 1944 Bretton Woods Conference, which laid the foundations for the post-World War II financial system and established two key institutions, the International Monetary Fund (IMF) and the World Bank.

- Meanwhile, an agreement as the GATT signed by 23 countries in Geneva in 1947 came into force on Jan 1, 1948, with the following purposes-to phase out the use of import quotas and to reduce tariffs on merchandise trade.

- The GATT became the only multilateral instrument governing international trade from 1948 until the WTO was established in

- The Uruguay Round, conducted from 1987 to 1994, culminated in the Marrakesh Agreement, which established the World Trade Organization (WTO).

- The GATT was concluded in 1947 and is now referred to as the GATT 1947. The GATT 1947 was terminated in 1996and WTO integrated its provisions into GATT 1994.

- The GATT 1994 is an international treaty binding upon all WTO Members. It is only concerned with trade in goods.

Reforms Needed in IMF

- IMF Quota: a member can borrow up to 200 percent of its quota annually and 600 percent cumulatively. However, access may be higher in exceptional circumstances.

- IMF quota simply means more voting rights and borrowing permissions under IMF. But, unfortunately, IMF Quota’s formula is designed in such a way that the USA itself has a 17.7% quota which is higher than the cumulative of several countries. The G7 group contains more than 40% quota whereas countries like India & Russia have only 2.5% quota in the IMF.

- Due to discontent with IMF,BRICS countries established a new organization called BRICS bank to reduce the dominance of IMF or World Bank and to consolidate their position in the world as BRICS countries account for 1/5th of World GDP and 2/5th of the world population.

- The hegemony of US-It is almost impossible to make any reform in the current quota system as more than 85% of total votes are required to make it happen. The 85% votes do not cover 85% of countries but countries which have 85% of voting power and the only USA has a voting share of around 17% which makes it impossible to reform quota without consent of developed countries.

- 2010 Quota Reforms approved by the Board of Governors were implemented in 2016 with a delay because of reluctance from US Congress as it was affecting its share.

- Combined quotas (or the capital that the countries contribute) of the IMF increased to a combined SDR 477 billion (about $659 billion) from about SDR 238.5 billion (about $329 billion). It increased the 6% quota share for developing countries and reduced the same share of developed or over-represented countries.

- More representative Executive Board: 2010 reforms also included an amendment to the Articles of Agreement established an all-elected Executive Board, which facilitates a move to a more representative Executive Board.

- The 15thGeneral Quota Review (in the process) provides an opportunity to assess the appropriate size and composition of the Fund’s resources and to continue the process of governance reforms.

Reforms needed in WB

- Structural Adjustment Programme –Some critics have pointed out that the World Bank caters to the agenda of World Capitalism in the garb of its “Structural Adjustment Programme’ (SAP)and continues to be dominated by rich countries. SAP is a set of “free market” economic policy reforms imposed on developing countries by the World Bank as a condition for receipt of loans.

- It is argued SAP policies have increased the gap between rich and poor in both local and global terms.

- Space for emerging economies–The emerging new economic powers, particularly India and China, and some other Asian and Latin American countries of the world should be given due place and role.

- The leadership succession debate should be used to create space for reflection on the purpose of the multilateral body, the substantive role it should play in the future, the need to strengthen inclusive multilateralism, and the actions needed to bolster the position of emerging economies and developing countries.

- Failure of the World Bank to adapt to the changing world order may see rising economies going their own way.

- Eg. the Establishment of the Asia Infrastructure Investment Bank (AIIB) by China.

- Such a development would signify the emergence of multi-polarity without multilateralism, and create a climate of conflicting interests and values among a diverse group of countries.

- Deep reforms of the World Bank are necessary as part of rethinking the current world order, and giving rising powers and developing countries a meaningful voice in this institution.

- The world bank’s governing structure need to be made more democratic

- Developing countries should be given a chance to shape the agenda

- There should be more transparency on the issues that come to the table.

- More resources(increase the capital base) need to be put in so that it continues lending to poorer countries

Summing up

- An extensive academic literature, with which the Bank and Fund rarely engage, challenges the robustness of the theoretical and evidence bases for Bank and Fund’s principles and policies. Volumes of documents testify to the experiences of millions of people negatively impacted by Bank and Fund policies and programmes. Together they suggest that Bank and Fund’s policies have failed to achieve their stated objectives and instead support an economic order that benefits elites and private sector interests at the expense of poor and marginalised communities.

- As the Bank and Fund and others now face a challenge from ‘populists’ and far-right groups about the continued relevance of multilateralism amidst a changing global order, the BWIs continue to deny their role in creating the social, political, and economic conditions that have led to the frustration and disenfranchisement that brought us here.

- The two institutions are trying to reorient themselves as per the changed geo-economic realities and changing developmental requirements. The internal assessment has also been catalysed by the geopolitical and geo-economic impact of the BRICS bank and the AIIB as a challenge to the Bretton Woods institutions. Hence, the national governments should undertake a calibrated economic liberalization maintaining the due autonomy of their decision-making to have a win-win situation in tune with the sustainable development ethics.

Next

previous

Latest News

Latest News

General Studies

General Studies