- Home

- Prelims

- Mains

- Current Affairs

- Study Materials

- Test Series

Reverse repo normalisation - All you need to know

State bank of India, the largest public sector bank in the country in a recent report has stated that the stage is set for a reverse repo normalisation.

Monetary Policy Normalization

- Functioning of economy by RBI: The Reserve Bank of India keeps on tweaking the total amount of money in the economy to ensure smooth functioning.

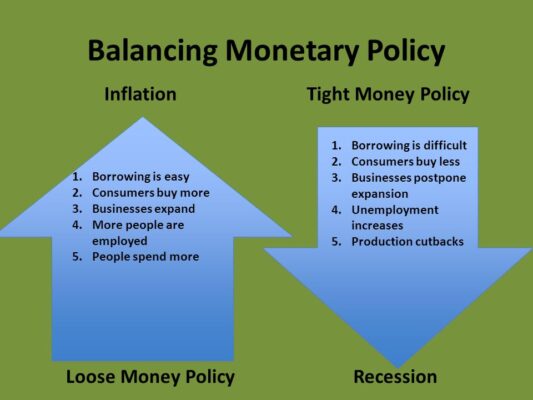

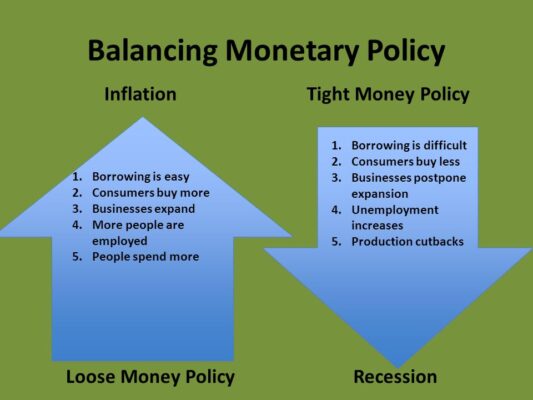

- Loose monetary policy: when RBI wants to boost economic activity and adopt the loose monetary policy.

- RBI buys the government bonds from the market to inject more money i.e. liquidity into the economy.

- As RBI pays back the money to its bondholders on buying the bonds thereby injecting more money into the economy.

- Another way for RBI to do this is to lower the interest-rate charged by it on the banks while lending them money. This rate is called the repo rate.

- By lowering the interest rate at which it lends the money to banks, the RBI hopes that commercial banks would in turn get incentivised to lower interest rates. Lower interest rates and more liquidity are expected to boost consumption and production in an economy.

- RBI buys the government bonds from the market to inject more money i.e. liquidity into the economy.

- Tight monetary policy: RBI drops it when it wants to decrease the flow of cash in the economy.

- It is the reverse of a loose monetary policy and involves raising of interest rates and sucking out liquidity of the economy by selling bonds by the RBI.

- Normalising the policy: the central bank normalises the policy by tightening the monetary policy stance, when it finds that a loose monetary policy has started becoming counterproductive (for example, when it leads to a higher inflation rate).

| Repo Rate | Reverse Repo Rate |

| It is the rate at which the the central bank grant loans to the commercial banks against the government securities for a short period of time. | It is the rate at which the central bank of a country borrows money from commercial banks within the country. It is a monetary policy instrument to control the money supply in the country. |

| RBI repurchases the government securities from the bank depending upon its decision to maintain the level of money supply in the monetary system. | An increase in the reverse repo rate will decrease the money supply and vice-versa, other things remaining constant.It means that banks will get more incentives to park their funds with the RBI, thereby decreasing the supply of money in the market. |

- Reverse Repo: it is the interest-rate paid by the commercial banks to the RBI when they park their excess liquidity with the central bank. It is the exact opposite of the repo rate.

- Benchmark rate in normal circumstances: When the economy is growing at a healthy pace that is under normal circumstances, the repo rate becomes the benchmark interest rate of the economy.

- It is because the repo rate is the lowest rate of interest at which funds can be borrowed. Hence it becomes the floor interest rate for all interest rates in the economy, be it the rate you pay for a car loan or a home loan or the interest you earn on your fixed deposit etc.

- Shift from repo rate to reverse repo: for instance, in a scenario where the RBI pumps more and more liquidity into the market but there are no takers of fresh loans either because of unwillingness of the market to lend or due to lack of genuine demand for new loans in the economy.

- In such cases the action shifts from the repo rate to the reverse repo rate as banks are no longer interested in borrowing money from the RBI, this is how reverse repo becomes the actual benchmark interest rate in the economy.

- It means that reverse repo rates would move up. In the face of rising inflation, several central banks across the world have either increased interest rates or signaled such moves over the past few months.

- It is expected from RBI to raise the repo rate, however it is expected that RBI would raise the reverse repo rate and reduce the gap between the two rates before that.

- The process of normalisation aimed at curbing inflation would not only reduce the excess liquidity but would also result in higher interest rate across the board in the Indian economy thereby reducing the demand for money among the consumers which would make it costlier for businesses to borrow fresh loans.

- The proposed by the US Fed also puts pressure towards a rate hike.

- The traders across the markets have been worrying about the signs that the Fed might be more aggressive about rolling back the stimulus which has been feeding the stock market gains across the geographies.

- The tapering of the bond-buying plans now signals a move towards policy normalisation, and a progressive reversal of the interest rate trajectory in the economy.

- The rates in the US could have a three-pronged impact:

- The difference between the interest rates of the two countries would narrow which would make countries like India less attractive for the currency carry trade

- It would also mean a lower impetus to growth in the US which could be a negative news for global growth especially when China is reeling under the impact of a real estate crisis.

- The higher returns in the US debt markets could trigger a zone in the emerging market equities tempering the foreign investor enthusiasm.

Latest News

Latest News

General Studies

General Studies