- Home

- Prelims

- Mains

- Current Affairs

- Study Materials

- Test Series

What are Repo and Reverse Repo Rates?

Every day, people go to commercial banks (such as the State Bank of India) either to deposit their savings or to get a loan — say for a car or home.

On their savings/deposits, the bank pays them interest at a certain rate. On loans, the bank charges them interest at a certain rate. Typically, the interest rate banks charge on loans is higher than the interest they pay on deposits.

How does a bank decide what these rates should be?

A key deciding factor — although not the only one — is the interest rates that commercial banks themselves pay (or get) when they borrow (or deposit) money from (or in) the Reserve Bank of India.

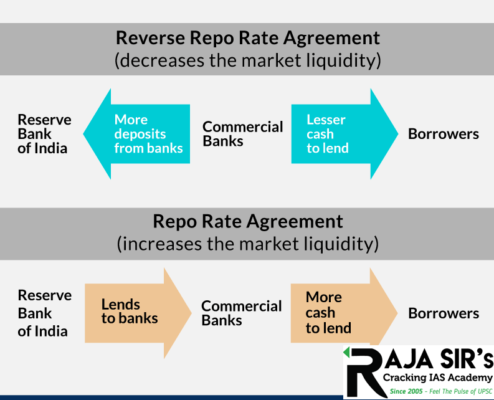

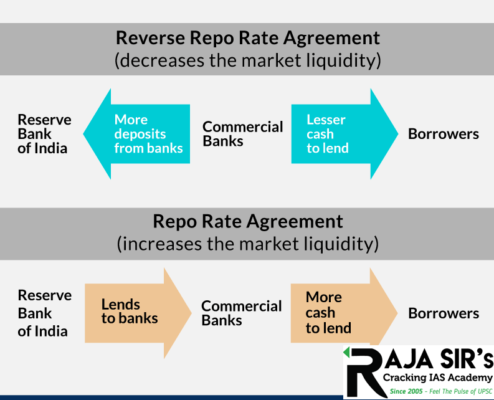

The interest rate that the RBI charges when commercial banks borrow money from it is called the repo rate. The interest rate that the RBI pays commercial banks when they park their excess cash with the central bank is called the reverse repo rate. Since RBI is also a bank and has to earn more than it pays, the repo rate is higher than the reverse repo rate. At present, the repo rate is 4%, and the reverse repo rate is 3.35%.

How do they affect the economy?

Using these two rates, the RBI sets the tone for all other interest rates in the banking system, and through that route, in the broader economy. For instance, when the RBI wants to encourage economic activity in the economy, it reduces the repo rates.

Doing this enables commercial banks such as the SBI to bring down the interest rates they charge (on their loans) as well as the interest rate they pay on deposits. This, in turn, incentivises people to spend money, because keeping their savings in the bank now pays back a little less, and businesses are incentivised to take new loans for new investments because new loans now cost a little less as well.

It is for this reason that the repo and reverse repo rates are often referred to as the “benchmark” interest rates in the economy.

Latest News

Latest News

General Studies

General Studies