- Home

- Prelims

- Mains

- Current Affairs

- Study Materials

- Test Series

Why banks fail - causal inferences by Nobel laureates 2022?.

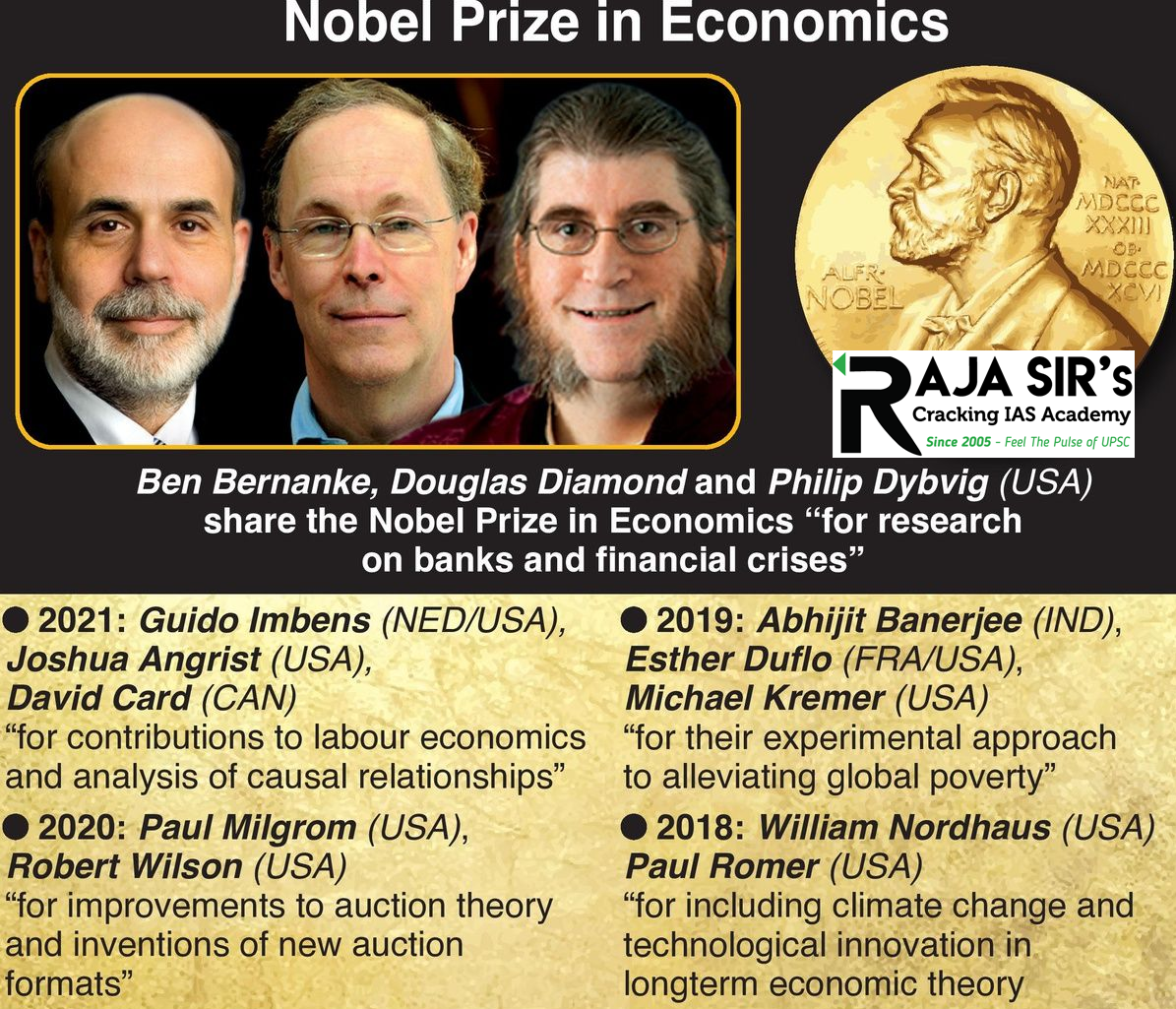

- For significantly improving “our understanding of the role of banks in the economy, particularly during financial crises,” the Sveriges Riksbank Prize in Economic Sciences for 2022 was awarded on 10 October 2022 to three American economists: Ben S Bernanke, Douglas W Diamond and Philip H Dybvi.

- The last of the Nobel Prize announcements for this year, the Economics Prize has gone to the three individuals for their role in research related to how banks function. “Modern banking research clarifies why we have banks, how to make them less vulnerable in crises and how bank collapses exacerbate financial crises. The foundations of this research were laid by Ben Bernanke, Douglas Diamond and Philip Dybvig in the early 1980s. Their analyses have been of great practical importance in regulating financial markets and dealing with financial crises,” said the Royal Swedish Academy of Sciences in its press release.

- It also noted, “Later, when the pandemic hit in 2020, significant measures were taken to avoid a global financial crisis. The laureates’ insights have played an important role in ensuring these latter crises did not develop into new depressions with devastating consequences for society.”

Here is the role each of them played in the development of this research.

Ben S Bernanke

- According to the press release, the research laid the foundation of some crucial questions on banks: “If banking collapses can cause so much damage, could we manage without banks? Must banks be so unstable and, if so, why? How can society improve the stability of the banking system? Why do the consequences of a banking crisis last so long? And, if banks fail, why can’t new ones immediately be established so the economy quickly gets back on its feet?”

- It added: “However, there is a conflict here: savers want instant access to their money in case of unexpected outlays, while businesses and homeowners need to know they will not be forced to repay their loans prematurely.”

- This lays out a fundamental problem that makes banks and money volatile and vulnerable to shocks sometimes. For example, when people were unable to withdraw their money from a few rural banks in China earlier this year, they witnessed bank runs. A bank run may happen where many savers try to withdraw their money at once, which can lead to a bank’s collapse.

- “Through statistical analysis and historical source research, Bernanke demonstrated how failing banks played a decisive role in the global depression of the 1930s, the worst economic crisis in modern history. The collapse of the banking system explains why the downturn was not only deep, but also long-lasting,” said the release. It added the importance of well-functioning bank regulation is also understood thanks to this research.

- Interestingly, Bernanke was the head of the US central bank, the Federal Reserve, when the 2008 crisis hit, and was able to “put knowledge from research into policy,” the Academy said.

Douglas W Diamond and Philip H Dybvi

- Both Diamond and Dybvig worked together to develop theoretical models explaining why banks exist, how their role in society makes them vulnerable to rumours about their impending collapse, and how society can lessen this vulnerability. These insights “form the foundation of modern bank regulation,” said the Academy.

- The model captures the central mechanisms of banking, as well as its weaknesses. It is based upon households saving some of their income, as well as needing to be able to withdraw their money when they wish. That this does not happen at the same time for every household allows for money to be invested into projects that need financing. They argue, therefore, that banks emerge as natural intermediaries that help ease liquidity.

- But with massive financial crises that have been witnessed in history, particularly in the US, it is often discussed how banks need to be more careful about assessing the loans they give out, or how bailing out banks in crisis might turn out to be.

- “How the financial markets should be regulated to fulfil their function – channelling savings to productive investments without causing recurring crises – is a question that researchers and politicians continue to wrestle with. The research being rewarded this year, and the work that builds upon it, makes society much better equipped to take on this challenge,” the Academy noted, and added, “This reduces the risk of financial crises developing into long-term depressions with severe consequences for society, which is of the greatest benefit to us all.”

Latest News

Latest News

General Studies

General Studies