- Home

- Prelims

- Mains

- Current Affairs

- Study Materials

- Test Series

11th April 2021

Reversing Trump, Biden Restores Aid to Palestinians

The United States, in a significant reversal to the earlier policy, has announced the restoration of at least USD 235 million in financial assistance to the Palestinians.

The 'Tika Utsav (vaccination festival)', started on the birth anniversary of Mahatma Jyotirao Phule (11th April) will continue till the birth anniversary of Babasaheb Ambedkar on 14th April 2021.

The 'Tika Utsav (vaccination festival)', started on the birth anniversary of Mahatma Jyotirao Phule (11th April) will continue till the birth anniversary of Babasaheb Ambedkar on 14th April 2021.

- The US administration had already announced USD 15 million in coronavirus relief to the Palestinians.

- Financial Aid:

- The financial aid includes USD 75 million economic help for the West Bank & Gaza, USD 10 million for ‘peacebuilding’ programmes of the US Agency for International Development (USAID) and USD 150 million in humanitarian assistance to the UN Relief and Works Agency (UNRWA).

- The UNRWA funds would include educational assistance for at least 5,00,000 Palestinian children living in West Asia.

- The Trump administration (former administration) had almost ended all funding to the organisation in 2018.

- The UN welcomed the move, hoping it would attract more funds to the body. There were a number of countries that had greatly reduced or halted contributions to UNRWA after the US stopped the aid.

- The Prime Minister of Palestine welcomed the move and called it a new political path that meets the rights and aspirations of the Palestinian people based on international law and UN resolutions.

- However, Israel, which has accused UNRWA of anti-Semitism (hostility to, prejudice, or discrimination against Jews), objected to the funding plans.

- The financial aid includes USD 75 million economic help for the West Bank & Gaza, USD 10 million for ‘peacebuilding’ programmes of the US Agency for International Development (USAID) and USD 150 million in humanitarian assistance to the UN Relief and Works Agency (UNRWA).

- Israel - Palestine Issues:

- The decades-long conflict between Israelis and Palestinians is rooted in competing claims to the Holy Land, and includes disputes over borders, Jerusalem, security, and Palestinian refugees.

- The Israel-Palestine Conflict can be traced back to 1917.

- Holy Land is a Middle Eastern region with great religious and historical significance to Christians, Jews, and Muslims.

- Mideast War, 1967 was a major turning point. It is also known as the six-day war or Third Arab-Israeli war.

- Israel captured the West Bank, east Jerusalem and Gaza Strip in the war. In the decades since, Israel has built settlements in the West Bank and east Jerusalem that now house a million Israelis.

- The decades-long conflict between Israelis and Palestinians is rooted in competing claims to the Holy Land, and includes disputes over borders, Jerusalem, security, and Palestinian refugees.

- US Recent Policy:

- US President Donald Trump’s decision in 2017, to relocate the US Embassy to Jerusalem, was criticized for being heavily tilted towards Israel.

- Mideast Plan or Middle East Peace Plan: It was unveiled by the then US government in January, 2020.

- Under it, the Palestinians would have a limited statehood contingent on a list of stringent requirements while Israel would annex some 30% of the West Bank.

- The Palestinians rejected the plan and threatened to withdraw from key provisions of the Oslo Peace Accords, which are a series of agreements between Israel and the Palestinians signed in the 1990s.

- Present US President Joe Biden has reaffirmed the United States’ commitment to a two-state solution.

- India’s Stand:

- India recognised Israel in 1950 but it is also the first non-Arab country to recognise Palestine Liberation Organisation (PLO) as the sole representative of the Palestinian.

- India is also one of the first countries to recognise the statehood of Palestine in 1988.

- In 2014, India favored UNHRC’s resolution to probe Israel’s human rights violations in Gaza. Despite supporting the probe, India abstained from voting against Israel in UNHRC in 2015.

- As a part of Link West Policy, India has de-hyphenated its relationship with Israel and Palestine in 2018 to treat both the countries mutually independent and exclusive.

- In June 2019, India voted in favor of a decision introduced by Israel in the UN Economic and Social Council (ECOSOC)that objected to granting consultative status to a Palestinian non-governmental organization.

- So far India has tried to maintain the image of its historical moral supporter for Palestinian self-determination, and at the same time to engage in the military, economic, and other strategic relations with Israel.

- India recognised Israel in 1950 but it is also the first non-Arab country to recognise Palestine Liberation Organisation (PLO) as the sole representative of the Palestinian.

- West Bank: The West Bank is sandwiched between Israel and Jordan. One of its major cities is Ramallah, the de facto administrative capital of Palestine.

- Israel took control of it in the 1967 war and has over the years established settlements there.

- Gaza: The Gaza Strip located between Israel and Egypt. Israel occupied the strip after 1967, but relinquished control of Gaza City and day-to-day administration in most of the territory during the Oslo peace process.

- In 2005, Israel unilaterally removed Jewish settlements from the territory, though it continues to control international access to it.

- Golan Heights: The Golan Heights is a strategic plateau that Israel captured from Syria in the 1967 war. Israel effectively annexed the territory in 1981.

- The US has officially recognized Jerusalem and Golan Heights as part of Israel.

- Fatah: Founded by the late Yasir Arafat in the 1950s, Fatah is the largest Palestinian political faction.

- Unlike Hamas, Fatah is a secular movement, has nominally recognized Israel, and has actively participated in the peace process.

- Hamas: Hamas is regarded as a terrorist organization by the US government. In 2006, Hamas won the Palestinian Authority's legislative elections.

- It ejected Fatah from Gaza in 2007, splitting the Palestinian movement geographically, as well.

- Balanced Approach Towards the Israel-Palestine: The world at large needs to come together for a peaceful solution but the reluctance of the Israeli government and other involved parties have aggravated the issue more.

- Thus a balanced approach would help to maintain favorable relations with Arab countries as well as Israel.

- Abraham Accords, a Positive Step: The recent normalization agreements between Israel and the UAE, Bahrain, Sudan, and Morocco, known as the Abraham Accords, are the steps in the right direction.

- All regional powers should envisage peace between the two countries on line of Abraham Accords.

- In the underwater world, too, anthrophony (human-made sounds) reduced substantially for long months.

- Noise in the Ocean:

- The three broad components of oceanic acoustics are:

- Geophony: Sounds created by non-biological natural events like earthquakes, waves and bubbling.

- Biophony: Sounds created by the ocean’s living creatures.

- Anthrophony: Sounds created by human beings (a large portion of which is shipping noise).

- According to ‘the Soundscape of the Anthropocene Ocean report’ published in Science Journal in 2021, geophony and biophony dominated the soundscape of oceans before the industrial era.

- However, now, anthrophony interferes with and alters these natural components.

- The three broad components of oceanic acoustics are:

- Noise Level in Modern Times:

- The oceans of the current geological era (Anthropocene era - when human-made disruptions largely influence the environment) are noisier than the pre-industrial times.

- During the first few days of the pandemic, ocean sound monitors at several places recorded a decibel (dB) drop.

- The hydrophones at the Endeavour node of Canada’s Neptune Ocean Observatory showed an average decrease of 1.5 dB in year-over-year mean weekly noise power spectral density at 100 hertz.

- Impact of Anthrophony:

- In the short term anthrophony masks the auditory signal processing by marine animals, weakening their ability to forage for food, escape a predator or attract a mate.

- In the long run, it can thin out the population of some underwater species.

- The International Quiet Ocean Experiment (IQOE):

- It is an international scientific program to promote research, observations, and modelling to improve understanding of ocean soundscapes and effects of sound on marine organisms.

- It started in 2015 and will go on till the end of 2025. The IQOE team has gathered large quantities of data during the Covid-19 pandemic.

- IQOE is developing methods to make ocean acoustic data more comparable. These data will be compiled into a global dataset to establish trends in ocean sound and look for effects of the Covid-19 pandemic on ocean sound.

- The IQOE has identified a network of over 200 non-military hydrophones (underwater microphones) in oceans across the world.

- Most of the hydrophones in the network of this project are along the shores of the USA and Canada. Now the presence is increasing in several other parts of the world, especially Europe.

- These hydrophones (that pick up even faraway low-frequency signals) have recorded sounds from whales and other marine animals, as well as those emanated by human activities.

- Just as a microphone collects sound in the air, a hydrophone detects acoustic signals under the water.

- Most hydrophones are based on a special property of certain ceramics that produces a small electrical current when subjected to changes in underwater pressure.

- When submerged in the ocean, a ceramic hydrophone produces small-voltage signals over a wide range of frequencies as it is exposed to underwater sounds emanating from any direction.

- By amplifying and recording these electrical signals, hydrophones measure ocean sounds with great precision.

- Mutation is an alteration in the genetic material (the genome) of a cell of a living organism or of a virus that is more or less permanent and that can be transmitted to the cell’s or the virus’s descendants.

- Double Mutant (B.1.617):

- Earlier Genome sequencing of a section of virus samples by the Indian SARS-CoV-2 Consortium on Genomics (INSACOG), revealed the presence of two mutations, E484Q and L452R.

- Though these mutations have individually been found in several countries, the presence of both these mutations together have been first found in coronavirus genomes from India.

- This double mutant from India has been scientifically named as B.1.167. However, it is yet to be classified as ‘Variant of Concern’.

- Till now only three global ‘Variants of Concern’ have been identified: the U.K. variant (B.1.1.7), the South African(B.1.351) and the Brazilian (P.1) lineage.

- Earlier Genome sequencing of a section of virus samples by the Indian SARS-CoV-2 Consortium on Genomics (INSACOG), revealed the presence of two mutations, E484Q and L452R.

- Spread of B.1.617: According to the INSACOG, sequencing a sample of genomes from coronavirus patients in India, B.1.617 was first detected in India in December, 2020.

- Today, nearly 70% of the genome sequences with the mutations characterising B.1.617 are from India.

- This is followed by the United Kingdom (23%), Singapore (2%) and Australia (1%).

- These are variants for which there is evidence of an increase in transmissibility, more severe disease (increased hospitalizations or deaths), significant reduction in neutralization by antibodies generated during previous infection or vaccination, reduced effectiveness of treatments or vaccines, or diagnostic detection failures.

- Issues Associated with Mutants:

- Mutant virus is associated with large spikes of Covid-19 cases in some countries.

- It enables viruses to become more infectious as well as evade antibodies.

- It has also been associated with a reduction in vaccine efficacy. International studies have shown reduced efficacy of vaccines particularly those by Pfizer, Moderna and Novavax to certain variants.

- However, the vaccines continue to be significantly protective in spite of this.

- Another Mutation:

- According to INSACOG, there is also a third significant mutation, P614R other than the two mutations (E484Q and L452R).

- All three concerning mutations are on the spike protein. The spike protein is the part of the virus that it uses to penetrate human cells.

- Virus' spike protein may increase the risks and allow the virus to escape the immune system.

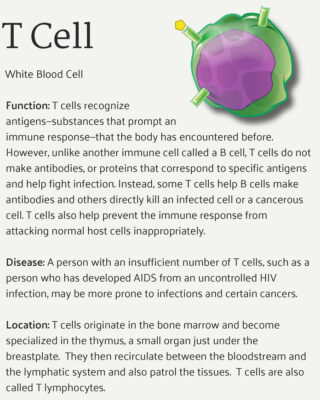

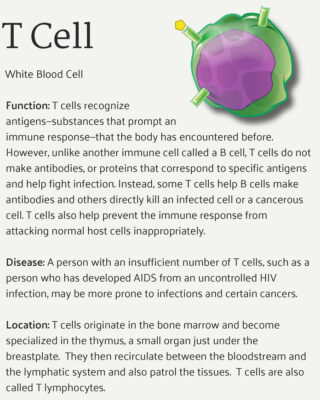

- Resistant to T cells:

- L452R could even make the coronavirus resistant to T cells, that is the class of cells necessary to target and destroy virus-infected cells.

- T cells are different from antibodies that are useful in blocking coronavirus particles and preventing it from proliferatin

- L452R could even make the coronavirus resistant to T cells, that is the class of cells necessary to target and destroy virus-infected cells.

- A type of white blood cell that is of key importance to the immune system and is at the core of adaptive immunity.

- It creates the body's immune response to specific pathogens.

- The T cells are like soldiers who search out and destroy the targeted invader.

- Indian SARS-CoV-2 Consortium on Genomics (INSACOG) is a multi-laboratory, multi-agency, pan-India network to monitor genomic variations in the SARS-CoV-2.

- It helps in the understanding of how the virus spreads and evolves.

- Genomic surveillance can generate a rich source of information for tracking pathogen transmission and evolution on both national and international levels.

- It is an attempt to reverse a “30-year race to the bottom” in which countries have resorted to slashing corporate tax rates to attract multinational corporations (MNCs).

- Proposal on a Global Minimum Corporate Tax Rate:

- The US proposal envisages a 21% minimum corporate tax rate, coupled with cancelling exemptions on income from countries that do not legislate a minimum tax to discourage the shifting of multinational operations and profits overseas.

- The proposal for a minimum corporate tax is tailored to address the low effective rates of tax shelled out by some of the world’s biggest corporations, including digital giants such as Apple, Alphabet and Facebook, as well as major corporations such as Nike and Starbucks.

- These companies typically rely on complex webs of subsidiaries to hoover profits out of major markets into low-tax countries such as Ireland or Caribbean nations such as the British Virgin Islands or the Bahamas, or to central American nations such as Panama.

- US’ Reasons for the Proposal:

- The proposal aims to somewhat offset any disadvantages that might arise from the proposed increase in the US corporate tax rate.

- The proposed increase to 28% from 21% would partially reverse the previous cut in tax rates on companies from 35% to 21% by way of a 2017 tax legislation.

- The increase in corporation tax comes at a time when the pandemic is costing governments across the world, and is also timed with the US’s push for a USD 2.3 trillion infrastructure upgrade proposal.

- The proposal aims to somewhat offset any disadvantages that might arise from the proposed increase in the US corporate tax rate.

- Significance:

- A global compact on this issue, at the time of pandemic, will work well for the US government and for most other countries in western Europe, even as some low-tax European jurisdictions such as the Netherlands, Ireland and Luxembourg and some in the Caribbean rely largely on tax rate arbitrage to attract MNCs.

- The plan to peg a minimum tax on overseas corporate income seeks to potentially make it difficult for corporations to shift earnings offshore.

- The average headline corporate tax rate in advanced economies has fallen from 32% in 2000 to just over 23% by 2018.

- That is largely because smaller countries such as Ireland, the Netherlands and Singapore have attracted footloose businesses by offering low corporate tax rates.

- Footloose industry is a general term for an industry that can be placed and located at any location without effect from factors such as resources or transport.

- Multinational companies with increasingly intangible assets such as the global tech firms have shifted some actual business and a lot of profits into these tax havens and low-tax jurisdictions, lowering their global tax bills.

- That is largely because smaller countries such as Ireland, the Netherlands and Singapore have attracted footloose businesses by offering low corporate tax rates.

- International Response:

- The European Commission backed the proposal, but the global minimum rate should be decided after discussions in the Organisation for Economic Cooperation and Development (OECD).

- The European nations, including Germany and France have supported the US proposal.

- The OECD and Group of Twenty (G20) have been leading the Base Erosion and Profit Shifting (BEPS) initiative—a multilateral negotiation with over 135 countries, including the United States—since 2013.

- BEPS refers to tax planning strategies used by multinational enterprises that exploit gaps and mismatches in tax rules to avoid paying tax.

- China is not likely to have a serious objection with the US call, but an area of concern for Beijing would be the impact of such a tax stipulation on Hong Kong, the seventh-largest tax haven in the world and the largest in Asia.

- The US proposal also has support from the International Monetary Fund (IMF).

- The European Commission backed the proposal, but the global minimum rate should be decided after discussions in the Organisation for Economic Cooperation and Development (OECD).

- Challenges:

- The proposal impinges on the right of the sovereign to decide a nation’s tax policy.

- Taxation is ultimately a sovereign function, and depending upon the needs and circumstances of the nation, the government is open to participate and engage in the emerging discussions globally around the corporate tax structure.

- A global minimum rate would essentially take away a tool that countries use to push policies that suit them. A lower tax rate is a tool they can use to alternatively push economic activity.

- For instance, in the backdrop of the pandemic, IMF and World Bank data suggest that developing countries with less ability to offer mega stimulus packages may experience a longer economic hangover than developed nations.

- Also, a global minimum tax rate will do little to tackle tax evasion.

- The proposal impinges on the right of the sovereign to decide a nation’s tax policy.

- Cut in Corporate Tax:

- In a bid to revive investment activity, the Finance Minister announced, in September 2019, a sharp cut in corporate taxes for domestic companies to 22% and for new domestic manufacturing companies to 15%.

- The Taxation Laws (Amendment) Act, 2019 resulted in the insertion of a section (115BAA) to the Income-Tax Act, 1961 to provide for the concessional tax rate of 22% for existing domestic companies subject to certain conditions including that they do not avail of any specified incentive or deductions.

- Also, the existing domestic companies opting for the concessional taxation regime will not be required to pay any Minimum Alternate Tax.

- The cuts effectively brought India’s headline corporate tax rate broadly at par with the average 23% rate in Asian countries.

- China and South Korea have a tax rate of 25% each, while Malaysia is at 24%, Vietnam at 20%, Thailand at 20% and Singapore at 17%.

- The effective tax rate, inclusive of surcharge and cess, for Indian domestic companies is around 25.17%.

- The average corporate tax rate stands at around 29% for existing companies that are claiming some benefit or the other.

- In a bid to revive investment activity, the Finance Minister announced, in September 2019, a sharp cut in corporate taxes for domestic companies to 22% and for new domestic manufacturing companies to 15%.

- Equalisation Levy:

- To address the challenges posed by the enterprises who conduct their business through digital means and carry out activities in the country remotely, the government has the ‘Equalisation Levy’.

- The equalization levy is aimed at taxing foreign companies which have a significant local client base in India but are billing them through their offshore units, effectively escaping the country’s tax system.

- The Income-tax Act, 1961 has been amended to bring in the concept of “Significant Economic Presence” for establishing “business connection” in the case of non-residents in India.

- Agreements for Exchange of Information:

- India has been proactively engaging with foreign governments with a view to facilitating and enhancing exchange of information under Double Taxation Avoidance Agreements, Tax Information Exchange Agreements and Multilateral Conventions to plug loopholes.

- Such agreements promote cooperation in tax matters.

- Besides, effective enforcement actions including expeditious investigation in foreign assets cases have been launched, including searches, enquiries, levy of taxes, penalties, etc.

- India has been proactively engaging with foreign governments with a view to facilitating and enhancing exchange of information under Double Taxation Avoidance Agreements, Tax Information Exchange Agreements and Multilateral Conventions to plug loopholes.

- Corporation Tax or Corporate Tax is a direct tax levied on the net income or profit of a corporate entity from their business, foreign or domestic.

- The rate at which the tax is imposed as per the provisions of the Income Tax Act, 1961 is known as the Corporate Tax Rate.

- The Corporate Tax rate is based on a slab rate system depending on the type of corporate entity and the different revenues earned by each of corporate entities.

- At times it may happen that a taxpayer, being a company, may have generated income during the year, but by taking the advantage of various provisions of Income-tax Law (like exemptions, deductions, depreciation, etc.), it may have reduced its tax liability or may not have paid any tax at all.

- Due to an increase in the number of zero tax paying companies, Minimum Alternate Tax (MAT) was introduced by the Finance Act, 1987 with effect from assessment year 1988-89. Later on, it was withdrawn by the Finance Act, 1990 and then reintroduced by Finance Act, 1996.

- MAT is calculated at 15% on the book profit (the profit shown in the profit and loss account) or at the usual corporate rates, and whichever is higher is payable as tax.

- All companies in India, whether domestic or foreign, fall under this provision. MAT was later extended to cover non-corporate entities as well.

- MAT is an important tool with which tax avoidance can be prevented.

- Domestic company is one which is registered under the Companies Act of India (2013) and also includes the company registered in the foreign countries having control and management wholly situated in India.

- A domestic company includes private as well as public companies.

- Foreign company is one which is not registered under the Companies Act of India and has control & management located outside India.

- A tax haven is generally an offshore country that offers foreign individuals and businesses little or no tax liability in a politically and economically static environment.

- FIA announced its intent to make F1 carbon neutral by 2030 and to have sustainable races by 2025.

- Formula One, also called F1 in short, is an international auto racing sport. F1 cars are the fastest regulated road-course racing cars in the world.

- F1 is the highest level of single-seat, open-wheel and open-cockpit professional motor racing contest.

- Formula One racing is governed and sanctioned by a world body called the Fédération Internationale de l'Automobile (FIA) or the International Automobile Federation. The name ‘Formula’ comes from the set of rules that the participating cars and drivers must follow.

- F1 Current Carbon Footprint:

- Direct Effect:

- F1’s driving activities produce approximately 2,56,000 tonnes of carbon dioxide per year, which is the equivalent to powering roughly 30,000 houses in the UK over the same time period.

- Indirect Effect:

- The main issue is not the cars themselves, which accounted for only 0.7% of the sport’s emissions in 2019, but the logistics of transporting teams and equipment across the globe.

- In 2019, road, sea and air logistics for equipment transportation accounted for 45% of F1’s emissions with business travel for teams contributing an additional 27.7%.

- Rounding up the list, factories and facilities servicing the sport represent 19.3% of emissions, and event operations, another 7.3%.

- Uncounted Emission:

- The 2,56,000 number doesn’t even factor in the impact of fans, millions of whom require transportation and accommodation on and around the race weekend.

- If one were to include the emissions generated by fans, the total carbon footprint of F1 catapults to approximately 1.9 million tonnes of carbon dioxide generated by the sport annually.

- Direct Effect:

- 100% Sustainable Fuels:

- Background:

- One of the most high-profile ways in which F1 plans to reduce its environmental impact is through the continued evolution of energy-efficient engines.

- Starting from 1989 when the FIA Alternative Fuel Commission was formed, F1 has committed to a number of initiatives designed to improve engine efficiency, with the most notable being its global fuel economy initiative in 2007 which aims to reduce fuel consumption by 50% across the competition.

- In 2020, the FIA announced that it had developed a 100% sustainable fuel and that engine manufacturers were already in the process of testing it, intending to start using it by 2026.

- About:

- A 100% sustainable fuel essentially represents the third generation and most advanced iteration of biofuels, which typically are made from by-products of industrial or agricultural waste.

- F1 cars already use biofuels but current regulations only mandate that the fuel include 5.75% of bio-components.

- In 2022 that number will increase to 10% and by 2025, when new power units are proposed to enter the competition, the FIA hopes to transition completely to 100% advanced sustainable fuels.

- Background:

-

- Any hydrocarbon fuel that is produced from an organic matter (living or once living material) in a short period of time (days, weeks, or even months) is considered a biofuel.

- Biofuels may be solid, liquid or gaseous in nature.

- Solid: Wood, dried plant material, and manure

- Liquid: Bioethanol and Biodiesel

- Gaseous: Biogas

- These can be used to replace or can be used in addition to diesel, petrol or other fossil fuels for transport, stationary, portable and other applications. Also, they can be used to generate heat and electricity.

- Categories of Biofuels:

- First generation biofuels:

- These are made from food sources such as sugar, starch, vegetable oil, or animal fats using conventional technology.

- Common first-generation biofuels include Bioalcohols, Biodiesel, Vegetable oil, Bioethers, Biogas.

- Second generation biofuels:

- These are produced from non-food crops or portions of food crops that are not edible and considered as wastes, e.g. stems, husks, wood chips, and fruit skins and peeling.

- Thermochemical reactions or biochemical conversion processes are used for producing such fuels.

- Examples: Cellulose ethanol and biodiesel.

- Third generation biofuels:

- These are produced from micro-organisms like algae.

- Example: Butanol

- Micro-organisms like algae can be grown using land and water unsuitable for food production, therefore reducing the strain on already depleted water sources.

- These are produced from micro-organisms like algae.

- Fourth Generation Biofuels:

- In the production of these fuels, crops that are genetically engineered to take in high amounts of carbon are grown and harvested as biomass.

- The crops are then converted into fuel using second generation techniques.

- The fuel is pre-combusted and the carbon is captured. Then the carbon is geo-sequestered, meaning that the carbon is stored in depleted oil or gas fields or in unmineable coal seams.

- Some of these fuels are considered as carbon negative as their production pulls out carbon from the environment.

- First generation biofuels:

- India’s Initiatives:

- E20 Fuel: The Indian government has invited public comments for introducing adoption of E20 fuel (a blend of 20% ethanol with gasoline).

- Pradhan Mantri JI-VAN Yojana, 2019: The objective of the scheme is to create an ecosystem for setting up commercial projects and to boost research and development in the 2G Ethanol sector.

- Reduction in GST: The Government has also reduced GST on ethanol for blending in fuel from 18% to 5%.

- National Biofuel Policy 2018: The Policy categorises biofuels as "Basic Biofuels'' viz. First Generation (1G) bioethanol & biodiesel and "Advanced Biofuels'' - Second Generation (2G) ethanol, Municipal Solid Waste (MSW) to drop-in fuels, Third Generation (3G) biofuels, bio-CNG etc. to enable extension of appropriate financial and fiscal incentives under each category.

-

- Shaphari is based on the United Nations’ Food and Agriculture Organization’s technical guidelines on aquaculture certification.

- Shaphari is a Sanskrit word that means superior quality of fishery products suitable for human consumption.

- It is a market-based tool for hatcheries to adopt good aquaculture practices and help produce quality antibiotic-free shrimp products to assure global consumers.

- Shaphari is based on the United Nations’ Food and Agriculture Organization’s technical guidelines on aquaculture certification.

- Components and Process:

- Two Components:

- Certifying hatcheries for the quality of their seeds.

- Those who successfully clear multiple audits of their operations shall be granted a certificate for a period of two years.

- Approving shrimp farms that adopt the requisite good practices.

- Certifying hatcheries for the quality of their seeds.

- Process:

- The entire certification process will be online to minimise human errors and ensure higher credibility and transparency.

- Two Components:

- Significance:

- The certification of hatcheries will help farmers easily identify good quality seed producers.

- Certified aquaculture products will help exporters to export their consignments to markets under stringent food safety regulations without the fear of getting rejected.

- It will bolster confidence in India’s frozen shrimp produce, the country’s biggest seafood export item.

- India’s Shrimp Exports:

- About:

- India exported frozen shrimp worth almost USD 5 billion in 2019-20, with the US and China its biggest buyers.

- Frozen shrimp is India’s largest exported seafood item. It constituted 50.58% in quantity and 73.2% in terms of total USD earnings from the sector during 2019-20.

- Andhra Pradesh, West Bengal, Odisha, Gujarat and Tamil Nadu are India’s major shrimp producing States, and around 95% of the cultured shrimp produce is exported.

- Concern:

- Container shortages and incidents of seafood consignments being rejected because of food safety concerns.

- Consignments sourced from Indian shrimp farms have been rejected due to the presence of antibiotic residue and this is a matter of concern for exporters.

- About:

- Other Initiative for Food Safety of Exported Products:

- National Residue Control Programme:

- National Residue Control Plan (NRCP) is a statutory requirement for export to European Union countries.

- It is regulated and carried by MPEDA, under NRCP, definite sampling schedule and sampling strategies are drawn every year for monitoring the residues of substances like Antibacterial/Veterinary Medicinal Products and environmental contaminants.

- Samples are collected from hatcheries, feed mills, aquaculture farms and processing plants, located in maritime states and tested for the presence of any residue/contaminant.

- National Residue Control Programme:

- MPEDA is a nodal coordinating, state-owned agency engaged in fishery production and allied activities.

- It was established in 1972 under the Marine Products Export Development Authority Act (MPEDA), 1972.

- It functions under the Union Ministry of Commerce and Industry.

- It is headquartered in Kochi, Kerala.

- Its mandate is to increase exports of seafood including fisheries of all kinds, specifying standards, marketing, processing, extension and training in various aspects.

The 'Tika Utsav (vaccination festival)', started on the birth anniversary of Mahatma Jyotirao Phule (11th April) will continue till the birth anniversary of Babasaheb Ambedkar on 14th April 2021.

The 'Tika Utsav (vaccination festival)', started on the birth anniversary of Mahatma Jyotirao Phule (11th April) will continue till the birth anniversary of Babasaheb Ambedkar on 14th April 2021.

- The aim of the four day festival is to vaccinate as many people as possible for the priority groups and zero wastage of Covid-19 vaccine.

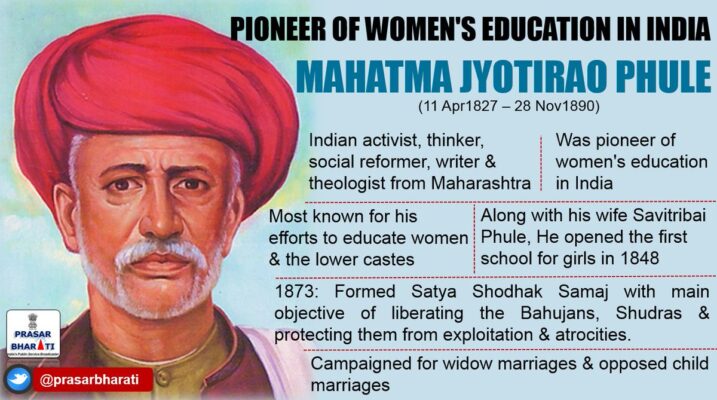

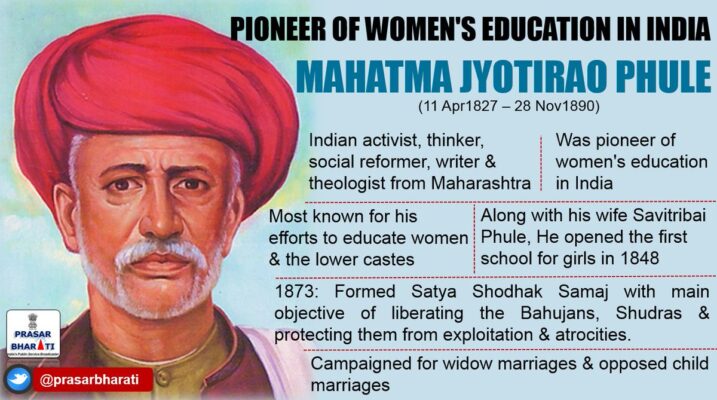

- Jyotirao Phule was an Indian social activist, thinker, anti-caste social reformer and writer from Maharashtra. He is also known as Jyotiba Phule.

- Brief Profile:

- Birth: Phule was born on 11th April, 1827 in present-day Maharashtra and belonged to the Mali caste of gardeners and vegetable farmers.

- Education: In 1841, Phule was enrolled at the Scottish Missionary High School (Pune), where he completed education.

- Ideology: His Ideology was based on: Liberty; Egalitarianism; Socialism.

- Phule was influenced by Thomas Paine’s book titled The Rights of Man and believed that the only solution to combat the social evils was the enlightenment of women and members of the lower castes.

- Major Publications: Tritiya Ratna (1855); Powada: Chatrapati Shivajiraje Bhosle Yancha (1869); Gulamgiri (1873), Shetkarayacha Aasud (1881).

- Related Association: Phule along with his followers formed Satyashodhak Samaj in 1873 which meant ‘Seekers of Truth’ in order to attain equal social and economic benefits for the lower castes in Maharashtra.

- Municipal Council Member: He was appointed commissioner to the Poona municipality and served in the position until 1883.

- Title of Mahatma: He was bestowed with the title of Mahatma on 11th May, 1888 by a Maharashtrian social activist Vithalrao Krishnaji Vandekar.

- Social Reformer:

- In 1848, he taught his wife (Savitribai) how to read and write, after which the couple opened the first indigenously run school for girls in Pune where they both taught.

- He was a believer in gender equality and he exemplified his beliefs by involving his wife in all his social reform activities.

- By 1852, the Phules had established three schools but all of them had shut by 1858 due to the shortage of funds after the Revolt of 1857.

- Jyotiba realised the pathetic conditions of widows and established an ashram for young widows and eventually became an advocate of the idea of Widow Remarriage.

- Jyotirao attacked the orthodox Brahmins and other upper castes and termed them as "hypocrites".

- In 1868, Jyotirao constructed a common bathing tank outside his house to exhibit his embracing attitude towards all human beings and wished to dine with everyone, regardless of their caste.

- He started awareness campaigns that ultimately inspired the likes of Dr. B.R. Ambedkar and Mahatma Gandhi, stalwarts who undertook major initiatives against caste discrimination later.

- It is believed by many that it was Phule who first used the term ‘Dalit’ for the depiction of oppressed masses often placed outside the ‘varna system’.

- He worked for abolishment of untouchability and caste system in Maharashtra.

- In 1848, he taught his wife (Savitribai) how to read and write, after which the couple opened the first indigenously run school for girls in Pune where they both taught.

- Death: 28th November, 1890. His memorial is built in Phule Wada, Pune, Maharashtra.

Latest News

Latest News

General Studies

General Studies