- Home

- Prelims

- Mains

- Current Affairs

- Study Materials

- Test Series

9th November 2020

15th Finance Commission - Report

The Fifteenth Finance Commission (XVFC) led by Chairman Shri NK Singh has submitted its Report for the period 2021-22 to 2025-26 to the Hon’ble President of India.- Article 280 of the Constitution of India provides for a quasi-judicial body, the Finance Commission.

- It is constituted by the President of India every fifth year or at such earlier time as he considers necessary.

- The recommendations made by the Finance Commission are only advisory in nature and hence, not binding on the government.

- As per the terms of reference (ToR), the Commission was mandated to give its recommendations for five years from 2021-22 to 2025-26 by 30 October, 2020.

- Last year, the Commission had submitted its report containing recommendations for the year 2020-21 which was accepted by the Union Government and tabled in the Parliament on 30 January 2020.

- The Commission was asked to give its recommendations on many unique and wide-ranging issues in its terms of reference. Apart from the vertical and horizontal tax devolution, local government grants, disaster management grant, the Commission was also asked to examine and recommend performance incentives for States in many areas like power sector, adoption of DBT, solid waste management etc.

- The Commission was also asked to examine whether a separate mechanism for funding of defence and internal security ought to be set up and if so how such a mechanism could be operationalised. The Commission has sought to address all its ToRs in this Report to the Union government.

- The Commission has analysed the finances of each State in great depth and has come up with State-specific considerations to address the key challenges that individual States face.

- The cover and title of the Report are also unique in this Report- “Finance Commission in Covid Times” and the use of Scales on the cover to indicate the balance between the States and the Union.

- An interim report of the 15th Finance Commission was submitted in Parliament during the budget session in February 2020. The report largely preserved the devolution mathematics of its predecessor, belying concerns of a sizeable cut in States’ share.

- The report had recommended a one percentage point reduction in the vertical split of the divisible pool of tax revenues accruing to States to 41%. This was done after the reorganisation of the erstwhile State of Jammu and Kashmir into the Union Territories of Jammu and Kashmir and Ladakh.

- Even though the former State’s notional share based on the parameters for horizontal devolution would have been about 0.85%. But, the FC has cited the security and other special needs of the two territories to enhance their aggregate share to 1%, which would be met by the Centre.

- Urban local bodies, especially municipalities in cities with populations of more than one million, were given a larger share of the devolution.

- The demographic performance was introduced as the new crucial parameter. The mandate to adopt the population data from the 2011 Census is the reason why the FC has incorporated this additional criterion. This was done to ensure that the States which have done well on demographic management are not unfairly disadvantaged. The norm has been assigned a 12.5% weight, as it indirectly evaluates performance on the human capital outcomes of education and health.

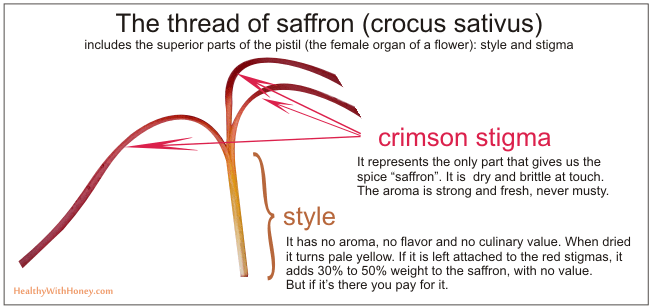

Kashmir - Saffron bowl of India

The saffron bowl which was so far confined to Kashmir , may soon expand to the North East of India. Plants from seeds transported from Kashmir to Sikkim and acclimatised there are now flowering in Yangyang in the Southern part of the North-East state.

The saffron bowl which was so far confined to Kashmir , may soon expand to the North East of India. Plants from seeds transported from Kashmir to Sikkim and acclimatised there are now flowering in Yangyang in the Southern part of the North-East state.

- Saffron production has long been restricted to a limited geographical area in the Union territory of Jammu & Kashmir.

- Pampore region, in India, commonly known as Saffron bowl of Kashmir, is the main contributor to saffron production, followed by Budgam, Srinagar, and Kishtwar districts.

- Saffron has traditionally been associated with the famous Kashmiri cuisine. Its medicinal values were considered as part of the rich cultural heritage of Kashmir.

- As saffron growing was confined to very specific areas in Kashmir, its production remained limited. Though the National Mission on Saffron focused on several measures to improve its farming, the measures were still limited to the specified areas of Kashmir.

- In India, the annual demand for Saffron spice is 100 tons per year but its average production is about 6-7 tons per year. Hence a large amount of Saffron is imported.

- At present, about 2825 hectares of land is under cultivation of Saffron in Jammu and Kashmir. Recently, the Kashmir saffron got Geographical Indication (GI) tag status.

- Pampore Saffron Heritage of Kashmir is one of the Globally Important Agricultural Heritage systems (GIAHS) recognised sites in India. GIAHS recognised sites are traditional agricultural systems that represent models of sustainable agricultural production. The other two sites in India are Kuttanad Below Sea Level Farming of Kerala and Koraput Traditional Agriculture of Odisha.

- Institute of Himalayan Bioresource Technology (IHBT) has also introduced its cultivation in non-traditional areas of Himachal Pradesh and Uttarakhand. The Institute has also developed tissue-culture protocol for the production of disease-free corms.

TRAI - New norms for OSPs

Nearly a year-and-a half after the Telecom Regulatory Authority of India had suggested relaxations of registration, submission of bank guarantee and other norms for other service providers (OSP) in the business process outsourcing (BPO) and information technology-enabled services (ITes), the Department of Telecom has eased these rules. The new rules do away with the registration requirement for OSPs, with such BPOs that are engaged only in data work have been taken out of the category of OSPs altogether. OSPs- OSPs or other service providers are companies or firms which provide secondary or tertiary services such as telemarketing, telebanking or telemedicine for various companies, banks or hospital chains, respectively.

- As computers made their foray into the Indian information technology space, a number of such OSPs, which were either voice or non-voice based, came into the market. The sector required minimal investment but gave great returns in business, which prompted a large number of individuals and companies to float other service providing firms.

- Since most of these firms used leased telephone lines, which in turn used the telecom spectrum auctioned by the Department of Telecommunications (DoT), the new telecom policy of 1999 suggested that all OSPs register themselves so that the government could keep a check on the usage of its resources.

- Further, the registration was also made mandatory to ensure that firms did not establish fake OSPs which swindled customers under the garb of providing telebanking and other such sensitive services.

- To start services in India, OSPs had to register themselves with the DoT and declare to the government as to how many employees were working in the firm as well as the area of service it was engaged in. For example, if a firm wished to provide telebanking services, it had to tell the government the number of people working with the BPO and the state that firms catered to.

- Further, the OSPs also have to declare whether they were providing services to domestic firms or international firms, and the nature of services being offered. The OSPs, which had to register themselves with the Ministry of Corporate Affairs also had to provide a detailed network diagram along with the details of the lines they had leased from an authorised and licensed telecom service provider.

- In addition to all these norms, OSPs also had to furnish a bank guarantee to the DoT, which was kept as a security measure, and could be forfeited if the firm did not adhere strictly to the guidelines.

- In order to prevent the spread of Covid-19 pandemic, the government in March decided to go for a complete nationwide shutdown, in which all companies, barring those providing essential services, were asked to shut shop temporarily. Owing to this, the OSPs, like many other firms were unable to provide services to their clients such as banks and hospitals, which were under the category of essential services.

- In order to facilitate work-from-home for such OSPs, the DoT on March 23, came out with a new format in which it sought the details of the OSP, their registration number and name of the telecom service provider again. Along with that, the DoT also sought the details of its employees working from home, their physical addresses, and the static internet protocol (IP) address from where the login would be made.

- Subsequently, on April 15, to further ease the work-from-home process for OSPs, the DoT released new guidelines, under which it said that OSPs no longer had to make a security deposit or submit the work from home agreement it had with its employees. These rules were first extended till July 31, and later till December 31 this year.

- On November 5, the DoT completely changed the guidelines and allowed permanent work from home or work from anywhere in India for OSP employees. Such employees working either from home or from remote locations would be treated as an extended agent or remote agent of the OSP. The new guidelines also do away with the need to furnish any bank guarantees for any of their location in India.

- The guidelines, released on November 5, will make it easier for BPOs and ITes firms in many ways, such as cutting down on the cost of location, rent for premises and other ancillary costs such as electricity and internet bills.

- With the government recognising OSP employees as extended or remote agent, companies providing such services will no longer have to carry the additional compliance burden of providing the details of all such employees to the DoT. The doing away of registration norms will also mean that there will be no renewal of such licenses and therefore will invite foreign companies to set up or expand their other service providing units in India.

- An important change, which takes data-based OSPs completely out of the ambit of BPOs would mean that such firms can function like any other service firm without the strict and cumbersome guidelines such as presence of agent on location. This change, in line with the norms of countries in the West can also allow employees to opt for freelancing for more than one company while working from home, thereby attracting more workers in the sector.

DISCOMs UNDER Energy Conservation Act, 2001

The Ministry of Power has issued notification to cover all the Electricity Distribution Companies (DISCOMs) under the purview of the Electricity Conservation Act, 2001. After this notification, all the DISCOMs will be governed under the various provisions of EC Act, such as Appointment of Energy Manager, Energy Accounting & Auditing, identification of Energy Losses Category wise, Implementation of energy conservation & efficiency measures etc. for each DISCOMs. Earlier, the DISCOMs whose annual energy losses were equal to or above 1000 MU (Million Units) were covered under the EC Act. Now with this notification, the number of DISCOMs covered under the EC Act will increase from 44 to 102. Impact- This decision will facilitate Energy Accounting & Auditing as mandatory activity for all the DISCOMs, leading to the actions towards reducing losses and increase profitability of DISCOMs.

- The amendment is expected to help DISCOMs to monitor their performance parameters and bring in transparency in the Distribution sector through professional inputs.

- It will also assist in developing projects for reducing the electricity losses by DISCOMs and implementing effective solutions.

- The amendment is expected to improve the financial state of the DISCOMs.

- The quarterly data of these DISCOMs will be collected and monitored by the government to suggest measures for increasing the efficiency and reduce the energy loss.

- This move is expected to gradually become more effective if extended upto the level of end consumers.

- specify energy consumption standards for notified equipment and appliances;

- direct mandatory display of label on notified equipment and appliances;

- prohibit manufacture, sale, purchase and import of notified equipment and appliances not conforming to energy consumption standards;

- notify energy intensive industries, other establishments, and commercial buildings as designated consumers;

- establish and prescribe energy consumption norms and standards for designated consumers;

- prescribe energy conservation building codes for efficient use of energy and its conservation in new commercial buildings having a connected load of 500 kW or a contract demand of 600 kVA and above;

- amend the energy conservation building codes prepared by the Central Government to suit regional and local climatic conditions;

- direct every owners or occupier of a new commercial building or building complex being a designated consumer to comply with the provisions of energy conservation building codes;

- direct, if considered necessary for efficient use of energy and its conservation, any designated consumer to get energy audit conducted by an accredited energy auditor in such manner and at such intervals of time as may be specified;

- Under the provisions of the Energy Conservation Act, 2001, Bureau of Energy Efficiency has been established with effect from 1st March, 2002 by merging the erstwhile Energy Management Centre, a society under the Ministry of Power.

- The Bureau would be responsible for spearheading the improvement of energy efficiency of the economy through various regulatory and promotional instruments.

- The mission of the Bureau of Energy Efficiency is to develop policy and strategies with a thrust on self-regulation and market principles, within the overall framework of the Energy Conservation Act, 2001 with the primary objective of reducing energy intensity of the Indian economy. This will be achieved with active participation of all stake holders, resulting in accelerated and sustained adoption of energy efficiency in all sectors of the economy.

- The primary objective of BEE is to reduce energy intensity in the Indian economy through adoption of result oriented approach.

Latest News

Latest News

General Studies

General Studies