- Home

- Prelims

- Mains

- Current Affairs

- Study Materials

- Test Series

Daily Current Affairs | 13th June 2020

Soil scientist Rattan Lal wins World Food Prize 2020

Indian-American soil scientist - Dr. Rattan Lal - has been declared the winner of the World Food Prize 2020.

9th Schedule

9th Schedule

- He played a major role in developing and mainstreaming a soil-centric approach to increasing food production that conserves natural resources and mitigates climate change.

- Three separate United Nations Climate Change Conferences have adopted his strategy of restoring soil health as a means to sequestering carbon.

- In 2007, he was among those recognised with a Nobel Peace Prize Certificate for his contributions to the Intergovernmental Panel on Climate Change (IPCC) reports, when the IPCC was named co-recipient of the Nobel Prize.

- Objective:The World Food Prize is the foremost international honor recognizing the achievements of individuals who have advanced human development by improving the quality, quantity or availability of food in the world.

- Field Covered:It is an annual award that recognizes contributions in any field involved in the world food supply including plant, animal and soil science; food science and technology; nutrition, rural development, etc.

- Eligibility:It is open for any individual without regard to race, religion, nationality or political beliefs.

- Cash Prize:In addition to the cash award of $2,50,000, the laureate receives a sculpture designed by the noted artist and designer, Saul Bass.

- Presentation of the Award:

- The Prize is presented each October on or around UN World Food Day (16thOctober).

- It is presented by the World Food Prize Foundationwhich has over 80 companies, individuals, etc. as donors.

- The World Food Prize Foundation is located in Des Moines, USA.

- Norman E. Borlaug,winner of the Nobel Peace Prize in 1970 for his work in global agriculture, conceived the Prize. He is also known as the Father of the Green Revolution.

- The World Food Prize was created in 1986 with sponsorship by General Foods Corporation.

- It is also known as the"Nobel Prize for Food and Agriculture".

- M.S. Swaminathan,the father of India’s green revolution, was the first recipient of this award in 1987.

- It is an initiative by the National Cooperative Development Corporation (NCDC)for young professionals. It is expected to be beneficial for both i.e. cooperatives as well as for the young professionals.

- Earlier, the government launched 'The Urban Learning Internship Program (TULIP) Portal'to provide internship opportunities to thousands of fresh graduates and engineers of the country under the 'Smart City' projects.

- Objectives:

- The Sahakar Mitra scheme will help cooperative institutionsaccess new and innovative ideas of young professionals while the interns will gain experience of working in the field to be self-reliant.

- It will provide the young professionalsan opportunity of practical exposure and learning from the working of NCDC and cooperatives as a paid intern.

- It would also provide an opportunity to professionals from academic institutions to develop leadership and entrepreneurial roles through cooperatives as Farmers Producers Organizations (FPO).

- In line with the AtmaNirbhar Bharat (Self Reliant India), it focuses on the importance ofVocal for Local.

- Eligibility:

- Professional graduatesin disciplines such as Agriculture and allied areas, IT, etc.

- Professionals who are pursuing or have completed their MBA degreesin Agribusiness, Cooperation, Finance, International Trade, Forestry, Rural Development, Project Management, etc.

- Financial Support:

- NCDC has designated funds for thepaid internship program under which each intern will get financial support over a 4 months internship period.

- Formation:The National Cooperative Development Corporation (NCDC) was established by an Act of Parliament in 1963 as a statutory Corporation under the Ministry of Agriculture & Farmers’ Welfare.

- Headquarters: NCDC functions through its Head Office at New Delhi and multiple Regional Offices.

- Objectives:

- The objectives of NCDC are planning and promoting programmes for production, processing, marketing, storage, export and import of agricultural produce, foodstuffs, industrial goods, livestock and certain other notified commodities and services on cooperative principles.

- The NCDC has the unique distinction of being the sole statutory organisation functioning as an apex financial and developmental institution exclusively devoted to the cooperative sector.

- It is a major financial institution for cooperatives, and has recently started Mission Sahakar 22,which aims to double farmers’ income by 2022.

- According to the International Labour Organisation (ILO), a cooperative is an autonomous association of persons united voluntarily to meet their common economic, social and cultural needs and aspirations through a jointly owned and democratically controlled enterprise. E.g. FPOs as cooperatives.

- An FPO,formed by a group of farm producers, is a registered body with producers as shareholders in the organisation.

- It deals with business activities related to the farm produceand it works for the benefit of the member producers.

- The Constitution (97thAmendment) Act, 2011 added a new Part IXB right after Part IXA (Municipals) regarding the cooperatives working in India.

- The word “cooperatives” was added after “unions and associations” in 19(1)(c) under Part III of the Constitution.This enables all the citizens to form cooperatives by giving it the status of fundamental right of citizens.

- A newArticle 43B was added in the Directive Principles of State Policy (Part IV) regarding the “promotion of cooperative societies”.

- NCDC should develop some techniques to evaluate the performance of cooperatives and encourage them to perform better.

- The scheme will provide a boost to government-academia-industry-civil society linkages.

- Further, India needs to learn from technical and vocational training/education models in China, Germany, Japan, Brazil, and Singapore,and adopt a comprehensive model that can bridge the skill gaps and ensure employability of youths.

- The minister argued that reservation is not confined just to Scheduled Castes (SCs) and Scheduled Tribes (STs) and is available to Other Backward Classes (OBCs) and poor sections of the upper castes as well and have been attached to Fundamental Rights.

- SC/ST Reservation:

- Both the Centre and the states are permitted to make any special provision for the advancement of SCs and STs.

- Thequota in government jobs and educational institutions for SCs and STs is 15% and 7.5% respectively (total 22.5%).

- Other Backward Class (OBC) Reservation:

- Both the Centre and the states are empowered to make provision for the advancement of OBCs regarding their admission to educational institutions and government jobs.

- Thequota limit for OBCs is 27%.

- However, various state governments have different quota limits for OBCs in their state like Tamil Nadu has 50% reservation for OBCs.

- In the Indra Sawhney & Others vs Union of India, 1992judgement, the Supreme Court fixed the upper limit for the combined reservation quota i.e. should not exceed 50% of seats.

- Economically Weaker Section (EWS) Reservation:

- The 103rdConstitution Amendment Act, 2019 empowers both Centre and the states to provide 10% reservation to the EWS category of society in government jobs and educational institutions.

-

- This demand comes after the Supreme Court’srecent observation that the Right to Reservation is not a Fundamental Right.

- Earlier, SC ruled thatreservation in the matter of promotions in public posts was not a fundamental right and that a state cannot be compelled to offer quota if it chooses not to.

- Apart from that, there have been repeated challenges to the Scheduled Castes and Tribes (Prevention of Atrocities) Act, 1989 and its amendments.

- SC/ST Reservation:

9th Schedule

9th Schedule

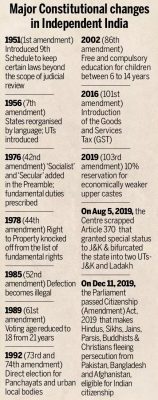

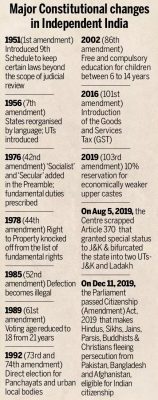

- The Schedule contains a list of central and state laws which cannot be challenged in courts and was added by the Constitution (First Amendment) Act, 1951.

- The first Amendment added 13 laws to the Schedule. Subsequent amendments in various years have taken the number of protected laws to 284 currently.

- It was created by the new Article 31B, which along with Article 31A was brought in by the government to protect laws related to agrarian reform and for abolishing the Zamindari system.

- While Article 31A extends protection to ‘classes’ of laws, Article 31B shields specific laws or enactments.

- While most of the laws protected under the Schedule concern agriculture/land issues, the list includes other subjects.

- Article 31B also has a retrospective operation which means that if laws are inserted in the Ninth Schedule after they are declared unconstitutional, they are considered to have been in the Schedule since their commencement, and thus valid.

- Although Article 31B excludes judicial review,the apex court has said in the past that even laws under the Ninth Schedule would be open to scrutiny if they violated Fundamental Rights or the basic structure of the Constitution.

- Although reservation is necessary, it should also be open to judicial scrutiny in order to ensure any abrupt or irrational policy initiative by the Executive or the Legislature.

- Any loophole or shortcomings in reservation policy must be addressed by involving various stakeholders. The need of the hour is not to go to extremes of either scrapping or shielding reservation policy, rather a rational framework on this contentious policy must be developed.

- GST Collections:

- In the first two months of the current financial year, 2020-21, the cumulative GST revenues of states and the Centrehas been only 45% of the monthly target.

- In 2020-21, the combined monthly GST revenue target is estimated at Rs. 1.21 lakh crore taking into account the budget estimate and states’ protected revenue.

- Market Borrowing:

- As revenue has fallen for both the Centre and states, the GST Council has decided to hold a single-point agenda meeting in July, 2020 which will discuss market borrowing by the Council itselfas one of the ways to raise money and compensate states for GST revenue losses.

- TheGST Act, 2017 extends a guarantee to states that any loss in revenues in the first five years (2017-2022) of GST implementation will be compensated through a cess that accrues to the Compensation Fund.

- The shortfall is calculated assuming a 14% annual growth in GST collections by states over the base year of 2015-16.

- In the 8thGST Council meeting it was discussed that in case the amount in the GST Compensation Fund fell short of the compensation payable, the Council shall decide the mode of raising additional resources including borrowing from the market.

- The borrowing could be repaid by collection of cess in the sixth year or further subsequent years.

- Issues Involved:

- There is a question about thelegality of the GST Council to borrow; for instance, can it be accorded sovereign status like Centre and states.

- The burden and the impact of market borrowing on the Fiscal Responsibility and Budget Management Act (FRBM Act), 2003is not clear.

- Tax Rationalisation:

- The Council discussed correction of inverted duty structurefor footwear, fertilisers and textiles.

- Inverted duty structure is a situation where the rate of tax on inputs used is higher than the rate of tax on the finished good.

- Take an imaginary situation of the tyre industry, the tax rate on natural rubber (input) purchased is 10% whereas the tax rate on rubber tyre is 5%. Here since the tax rate on input is higher than that on the finished good, there is an inverted tax structure.

- However, the decision was deferred because it would have resulted in increase in the prices of fertiliser, footwear and ready-made garments, which would have affected the process of economic revival.

- The Council discussed correction of inverted duty structurefor footwear, fertilisers and textiles.

- Compliance-related Relief:

- The GST Council also provided compliance-related relief to small taxpayers with turnover up to Rs. 5 crore.

- It reduced the interest by half on delayed filing of GST returnsfor February, March and April, 2020 to 9%, provided the returns are filed by September 2020.

- For May-July, 2020 the deadline for filing GST returns has been extended till 30 September, 2020 without any penalty.

- The GST Council also provided compliance-related relief to small taxpayers with turnover up to Rs. 5 crore.

- It is a constitutional body under Article 279A. It makes recommendations to the Union and State Government on issues related to Goods and Service Tax and was introduced by the Constitution (One Hundred and First Amendment) Act, 2016.

- The GST Council is chaired by the Union Finance Ministerand other members are the Union State Minister of Revenue or Finance and Ministers in-charge of Finance or Taxation of all the States.

- It is considered as a federal bodywhere both the centre and the states get due representation.

- The Economic Survey 2017-18also hailed the GST Council for its cooperative federalism technology which brings together the Center and States and can be applied to many other policy reforms.

- Every decision of the Goods and Services Tax Council shall be taken at a meeting by a majority of not less than three-fourths of the weighted votes of the members present and voting,in accordance with the following principles, namely:

- The vote of the Central Government shall have a weightage of one third of the total votes cast, and

- The votes of all the State Governments taken together shall have a weightage of two-thirds of the total votes cast in that meeting.

- There is immediate need to clarify whether the GST Council can be accorded sovereign status or not, so that it can borrow from the market to meet the states’ compensation requirement.

- If provided the authority to borrow from the market then on whom the burden of borrowing shall lie, need to be clarified.

- Established:SFAC was established in 1994 under Societies Registration Act, 1860 as an autonomous body promoted by the Ministry of Agriculture & Farmers' Welfare.

- Objectives:Promoting agribusiness by encouraging institutional and private sector investments and linkages to ensure the empowerment of all farmers in the country.

- Organising small and marginal farmers as Farmer Interest Groups, Farmer Producer Organisations and Farmer Producer Company for endowing them with bargaining power and economies of scale.

- Few Important Schemes Implemented by SFAC:Equity Grant & Credit Guarantee Fund (EGCGF) Scheme , Venture Capital Assistance (VCA) Scheme, Farmer Producer Organization (FPO) Scheme, National Agriculture Market (NAM) Scheme, etc.

- Recent Initiatives/Developments:SFAC launched the Kisan Rath app with the help of officials of the Ministry of Agriculture which lessened the problem of transport of farm produce during lockdown.

- It signed a Memorandum of Understanding (MoU)with the Agricultural and Processed Food Products Export Development Authority (APEDA) to bring in better synergy in the agricultural activities.

- The Equity Grant Fund has been set up with the primary objectives of :

- Enhancingviability and sustainability, credit worthiness of Farmer Producer Companies (FPCs),

- Enhancing the shareholding of members to increase their ownership and participation in their FPCs.

- The Credit Guarantee Fund Schemeprovides a Credit Guarantee Cover to the Eligible Lending Institution (ELI) to enable them to provide collateral free credit to FPCs.

- Venture Capital Assistance is financial support in the form of an interest free loanprovided by SFAC to meet the shortfall in the capital requirement for implementation of the project.

Latest News

Latest News

General Studies

General Studies