- Home

- Prelims

- Mains

- Current Affairs

- Study Materials

- Test Series

Jan 01, 2022

NIA REGISTERS UAPA CASE AGAINST SFJ’s MULTANI

Recently, the central agencies have booked 45-year-old under sections related to criminal conspiracy and waging war against India, among others under Unlawful Activities Prevention Act.

Unlawful Activities Prevention Act (UAPA), 1967

Unlawful Activities Prevention Act (UAPA), 1967

Common reasons for demand of new state

Common reasons for demand of new state

Highlights of the report:

Highlights of the report:

One Nation One Grid One Frequency:

One Nation One Grid One Frequency:

Proposals by EEPC:

Proposals by EEPC:

GST Compensation:

GST Compensation:

Need of new constitution?

Need of new constitution?

Highlights:

Highlights:

Vande Bharat Express

Vande Bharat Express

Unlawful Activities Prevention Act (UAPA), 1967

Unlawful Activities Prevention Act (UAPA), 1967

- It is a law that prevents unlawful activities that may cause harm to the integrity and sovereignty of the government.

- It empowers the government to designate even an individual as a terrorist.

- The objective is to provide for the more effective prevention of certain unlawful activities of individuals and associations and for matters connected there with.

- The UAPA originated from a constitutional amendment enacted in 1963 on the recommendation of the National Integration Council (NIC).

- The amendment allowed Parliament to make laws imposing restrictions on the fundamental rights to freedom of expression, to assemble without arms and to form associations.

- These restrictions were to be imposed only to protect sovereignty and integrity of India.

- The 1967 version of the UAPA gave the central government the power to deal with activities directed against the sovereignty and integrity of India.

- Between 1967 and 2004, the UAPA was not a terror law.

- In December 2004, Parliament inserted a chapter dedicated to punishing terrorist activities.

- The central government may designate an organization as a terrorist organization if it:

- Commits or participates in acts of terrorism

- Prepares for terrorism

- Promotes terrorism

- Otherwise involved in terrorism.

- An investigating officer is required to obtain the prior approval of the Director General of Police to seize properties that may be connected with terrorism.

- Investigation of cases may be conducted by officers of the rank of Deputy Superintendent or Assistant Commissioner of Police or above.

- The Act defines terrorist acts to include acts committed within the scope of any of the treaties listed in a schedule to the Act.

- Convention for the Suppression of Terrorist Bombings (1997)

- Convention against Taking of Hostages (1979)

- International Convention for Suppression of Acts of Nuclear Terrorism (2005).

- It extends the pre-chargesheet custody period from 90 days to 180 days.

- Aim: Seeking a separate homeland for Sikhs a Khalistan in Punjab.

- Under SFJ, a secessionist campaign called Referendum 2020seeked to liberate Punjab from Indian occupation.

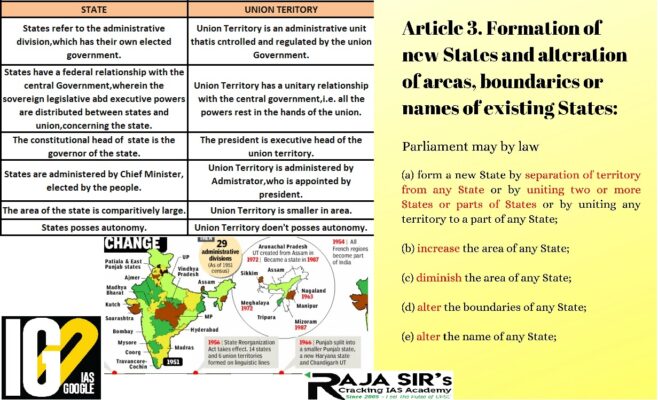

Common reasons for demand of new state

Common reasons for demand of new state

- Improper Utilization of the natural resources.

- Linguistic and cultural difference are among the primary regions of demand.

- Lack of development in some areas of existing state.

- Promote regionalism: Creation of new states promote regionalism because these regions are the particular community dominated areas and this will promote monoculture.

- Interstate water dispute: India is already witnessing interstate water dispute in several states. Creating a new state will further intensify the problem.

- Requirement of huge finance: For creating a new state, huge amount of finance is required for the infrastructure development.

- No or small change in the life of common man: Creation of new state only means the power shift but it is not necessary that new state empowers the grass root structure and solve the misery of common people.

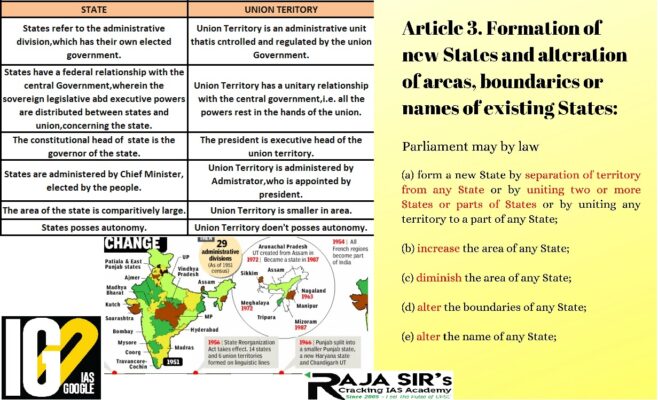

- Article 2 of the Constitution of India vests in the Indian Parliament the exclusive power to admit or establish new states into the Indian Union on such terms and conditions as the Parliament may provide for.

- Under article 3 Parliament may by law:

- Form a new state by separation of territory from any state or by uniting two or more states or parts of states or by uniting any territory to a part of any state;

- Increase the area of any state;

- Diminish the area of any State;

- Alter the boundaries of any state;

- Alter the name if any State.

- Article 4 of the Indian Constitution reflects a mandatory direction to the Parliament while framing a legislation under Article 2 and 3.

- Capital: Puducherry city.

- Formation: 1 November 1954. It got Union territory status in 1962.

- The territories of French India were completely transferred to the Republic of India on 1 November 1954.

- The Union Territory of Puducherry consists of four small unconnected districts:

- Puducherry district, Karaikal district both are in Tamil Nadu and Yanam district is in Andhra Pradesh on the Bay of Bengal.

- Mahé district is in Kerala on the Laccadive Sea.

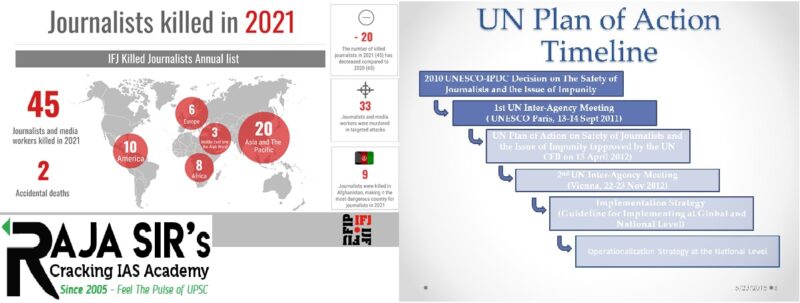

Highlights of the report:

Highlights of the report:

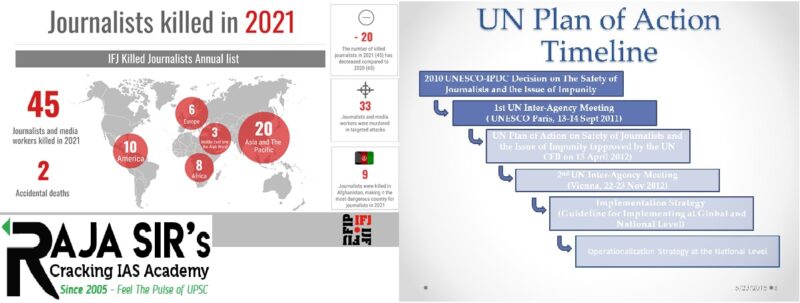

- 2,721 journalists have been killed around the world since 1991.

- A total of 45 reporters and media workers were killed doing their jobs over the last year.

- The Asia Pacific region tops the regional list with 20 killings, followed by American (10), Africa (8), Europe (6) and Middle East and Arab (1) Killings

- It is a set of objectives & actions developed by UNESCO’s member states and endorsed by the UN Chief Executives Board in April 2012.

- Objective: to directly address the problem of journalists’ safety and the problem of impunity.

- To create a free and safe environment for journalists and media workers, both in conflict and non-conflict situations,

- To strengthen peace, democracy, and development worldwide.

- To conduct awareness-raising campaigns on a wide range of issues such as existing international instruments and conventions.

- To overcome the growing dangers posed by emerging threats to media professionals, including non-state actors, as well as various existing practical guides on the safety of journalists.

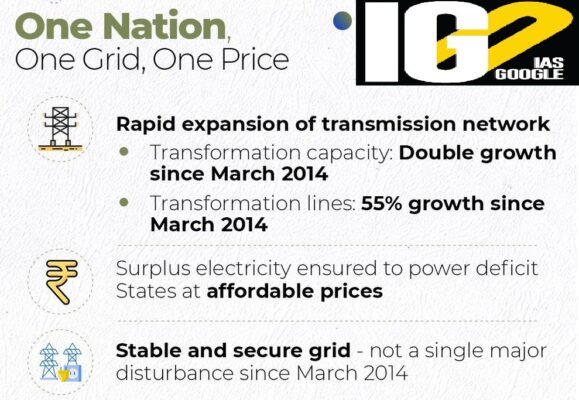

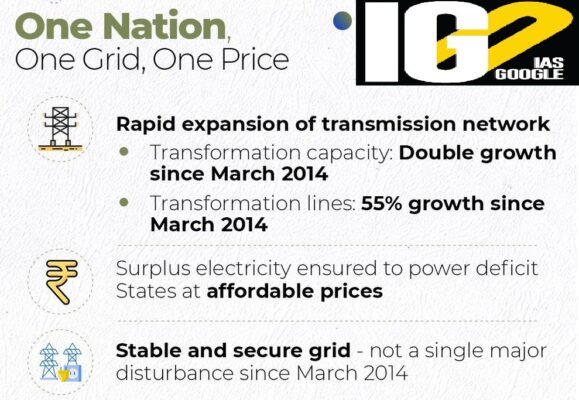

One Nation One Grid One Frequency:

One Nation One Grid One Frequency:

- Initially, grid management in the country was done on a regional basis.

- State grids were interconnected to form a regional grid and India was demarcated into 5 regions namely Northern, Eastern, Western, North Eastern and Southern regions.

- The initial inter-regional links were planned for exchange of operational surpluses amongst the regions.

- Later, when the planning graduated from regional self-sufficiency to National basis, the Inter-regional links were planned associated with the generation projects that had beneficiaries across the regional boundaries.

- One Nation One Grid synchronously connects all the regional grids and there is one national frequency.

- The range of national frequency is kept between 49.9 Hertz to 50.05 Hertz.

- Providing electricity at a national scale multiple frequencies cannot operate alongside each other without damaging equipment. Hence one single frequency is required across the country for seamless transmission of power.

- Matching Demand-Supply:

- Synchronization of all regional grids will help in optimal utilization of scarce natural resources by transfer of power from resource centric regions to load centric regions.

- Development of Electricity Market:

- It will pave the way for establishment of a vibrant Electricity market facilitating trading of power across regions.

Proposals by EEPC:

Proposals by EEPC:

- A reduction in custom duty on copper ores and concentrates from 2.5% to nil was proposed.

- A custom duty exemption for goods used in manufacturing of refrigerator compressors such as air or vacuum pumps, air or other gas compressors and fans.

- The profit margins of Manufacturer-exporters have shrunk due to high raw material prices and a surge in ocean freight cost.

- Availability of the ores at a competitive price would ensure reasonable prices of primary products in the domestic market.

- It would result in the growth of exports of value-added products.

- Indian industry will focus on sourcing copper concentration in the market, If the duty is reduced to zero.

- Remission of Duties and Taxes on Exported Products (RODTEP) was launched in 2020.

- It is applicable to the export of products but not services.

- It was enforced to repeal and reduce taxes for exported products and increasing the amount of export in the country.

- It has replaced Merchandise export incentive schemes (MIES).

- To encourage exports in the country by reducing duties.

- To provide easy refunds of various taxes to the exporters.

- To provide an automatic refund route for Indian Tariff Code (ITC) for avoiding the effect of taxes.

- To help exporters in meeting international export standards.

- Mandi tax, VAT, Coal cess, Central Excise duty on fuel etc. will now be refunded under the scheme.

- Items under the MEIS and the RoSTCL (Rebate of State and Central Taxes and Levies) will come under RoDTEP.

- The refund will be issued in the form of transferable electronic scrips.

- These duty credits will be maintained and tracked through an electronic ledger.

- Verification of the records will be done with the help of an IT-based risk management system to ensure speed and accuracy of transaction processing.

- All sectors including the textiles sector are covered in the scheme to ensure uniformity across all areas.

- A committee will be set up to decide regarding the sequence of introduction of the scheme across the various sectors and what degree of benefit is to be extended to each sector.

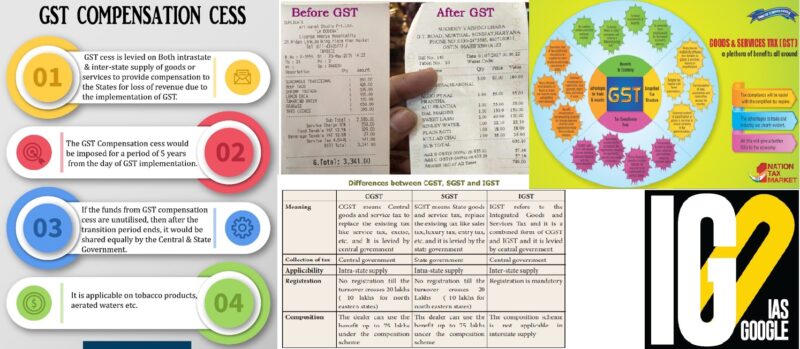

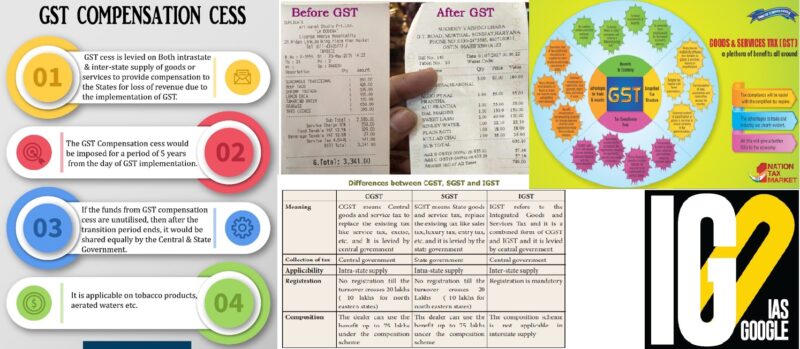

GST Compensation:

GST Compensation:

- The Constitution (101 Amendment) Act, 2016, was the law which created the mechanism for levying a nationwide GST.

- There is a provision in this law to compensate the States for loss of revenue arising out of implementation of the GST.

- GST (Compensation to States) Act, 2017 guarantees all states an annual growth rate of 14% in their GST revenue during the period July 2017- June 2022.

- If a state’s GST revenue grows slower than 14%, such ‘loss of revenue’ is taken care of by the Centre by providing GST compensation grants to the state.

- For that, a non-lapsable Fund known as ‘GST Compensation Fund’ which forms part of the Public Account of India, was created.

- GST compensation cess is levied on different lavish and addictive goods and services for that purpose. It includes tobacco products, vehicles above 1500 cc capacity, etc.

- Cess is a tax on tax.

- GST is an indirect tax that is applied to goods and/or services throughout India, uniformly, making India One Market.

- GST replaced, existing tax regime of Value Added Tax (under control of the state) and Service Tax (under control of the center).

- Currently, the prevailing GST rates are @5%, @12%, @18%, & @28%.

- The total rate of GST is distributed in 3 heads:

- Central Goods and Services Tax (CGST): Tax money goes to the center.

- State Goods and Services Tax (SGST): Tax money goes to the state.

- Integrated Goods and Services Tax (IGST): Tax money distributed in State and center as per the recommendation of GST council.

- GST was proposed by the Kelkar Task Force in 2004.

- GST is a destination-based tax and also has helped to reduce, cascading effect (tax on tax).

- 101st Constitutional Amendment Act, 2016 provided for the Goods and Services Tax.

Need of new constitution?

Need of new constitution?

- Chile prospered by exploiting its natural riches of copper and coal, salmon and avocados.

- Overexploitation and inequalities led the mineral-rich areas of Chile to known as “sacrifice zones” of environmental degradation.

- Over social and environmental grievances, a new constitution is being written amid a declared climate and ecological emergency.

- Chile is a country in the western part of South America.

- It is the southernmost country in the world, the closest to Antarctica.

- It occupies a long, narrow strip of land between the Andes to the east and the Pacific Ocean to the west.

- Chile is world’s second largest producer of lithium and has third largest lithium reserve.

- The country is rich in copper and coal.

- It houses large number of active volcanoes.

- In northern Chile, lies the driest desert in the world, known as Atacama Desert.

- Chile’s central valley, also known as Pampas, lies between Andes and the Pacific Ocean.

- India and Chile cooperate extensively in multilateral fora and share similar views on climate change/renewable energy issues and on expansion and reforms of the United Nations Security Council (UNSC).

- Chile articulated its support for India’s claim to a permanent seat in the UNSC.

- Copper is the major item, along with iodine, chemical wood pulp and walnuts in Chile’s export basket to India.

- Indian export basket to Chile consists of cars, pharmaceuticals, home furnishings, garments, handicrafts and hand tools.

- In the Latin American region, Chile is the fifth largest trading partner of India.

- A sacrifice zone is a geographic area that has been permanently impaired by environmental damage or economic disinvestment.

- They are places damaged through locally unwanted land use (LULU) causing chemical pollution where residents live immediately adjacent to heavily polluted industries or military bases.

- Typically, these areas are located in low-income neighbourhoods or are economically less important than other lands.

- Some of the most famous examples of sacrifice zones are Love Canal (New York), Three Mile Island (Pennsylvania), and the Gulf of Mexico.

- Lithium is a soft, silvery-white alkali

- It does not occur as the metal in nature.

- It is found combined in small amounts in nearly all igneous rocks and in the waters of many mineral springs.

- Spodumene, petalite, lepidolite, and amblygonite are the more important minerals containing lithium.

- The world's top four lithium-producing countries from 2019, as reported by the US Geological Survey are Australia, Chile, China and Argentina.

- The intersection of Chile, Bolivia, and Argentina make up the region known as the Lithium Triangle.

- The Indian government rejected the renaming of places and asserted that the state has always been and will always be an integral part of India.

Highlights:

Highlights:

- China claims 90,000 sq. km of Arunachal Pradesh as its territory and calls the area Zangnan in the Chinese language.

- It also makes repeated references of Andhra Pradesh as South-Tibet.

- China has never recognized the McMahon Line and the Line of Actual Control (LAC) has remained the de-facto border.

- The McMahon Line was drawn from the eastern border of Bhutan to the Isu Razi pass on the China-Myanmar border.

- It was named after Henry McMahon, the chief British negotiator at Shimla.

- China claims territory to the south of the McMahon Line, lying in Arunachal Pradesh.

- China also bases its claims on the historical ties that have existed between the monasteries in Tawang and Lhasa.

- The Simla convention was negotiated by representatives of the Republic of China, Tibet and Great Britain in Simla in 1913 and 1914.

- It deliberated on two themes – the status (autonomy under suzerainty of China) and the limits of Tibet.

- It provided that Tibet would be divided into Outer Tibet and Inner Tibet.

- Outer Tibet would remain in the hands of the Tibetan Government under Chinese suzerainty, but China would not interfere in its administration.

- Inner Tibet would be under the jurisdiction of the Chinese government.

- The convention defines the boundary between Tibet and China proper and that between Tibet and British India (MaCMahon Line).

- The Chinese representative did not consent to the Simla Convention.

- The claim was that Tibet had no independent authority to enter into international agreements.

- China adopted a new law on October 2020, on the protection and exploitation of the land border areas.

- The law is not meant specifically for the border with India.

- China shares its 22,457-km land boundary with 14 countries.

- India’s border is the third longest after the borders with Mongolia and Russia.

- It empowers People's Liberation Army (PLA) and Chinese People's Armed Police Force to maintain security along the border.

- This responsibility includes cooperating with local authorities in combating illegal border crossings.

- As per the law, the People's Republic of China shall set up boundary markers on all its land borders to clearly mark the border.

- It gives more powers to the People’s Liberation Army (PLA) and state agencies to:

- use civilians in border areas as a first line of defence

- to strengthen infrastructure

- to build more border towns

- It prohibits any party from indulging in any activity in the border area which would endanger national security or affect China's friendly relations with neighbouring countries.

- It includes construction of any permanent buildings by any person without authorisation from the concerned authority.

- It also empowers citizens and local organisations to protect the border infrastructure, maintain security and stability of borders.

- It also lays down four conditions under which the state can impose emergency measures, including border shutdown.

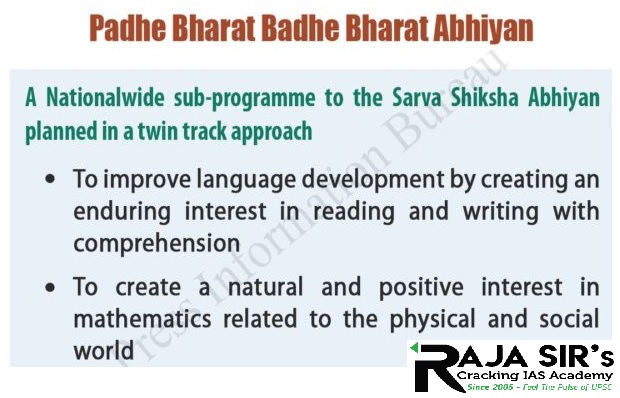

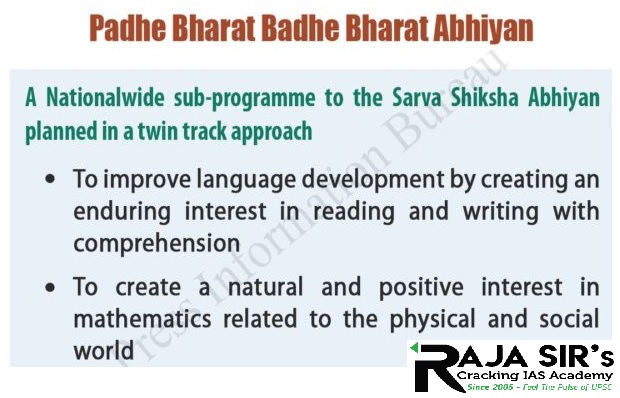

- Aim: To improve learning levels of students as it develops creativity, critical thinking, vocabulary and the ability to express both verbally and in writing.

- It helps children to relate to their surroundings and real-life situation.

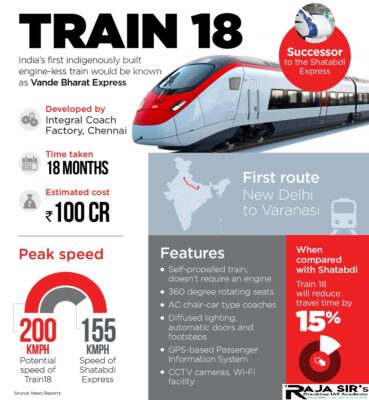

Vande Bharat Express

Vande Bharat Express

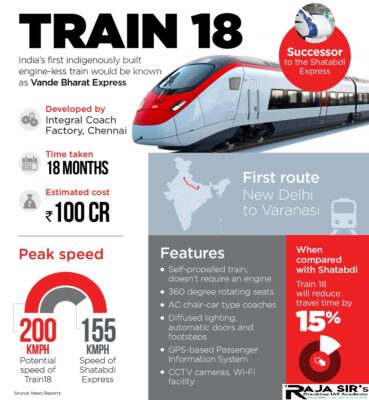

- The Vande Bharat Express is also known as Train 18.

- It is an India’s first semi-high-speed train.

- It is an EMU (Electric multiple unit) train which was designed and manufactured by Integral Coach Factory (ICF) at Perambur, Chennai.

- The train is manufactured under the Indian government's Make in India initiative, over a span of 18 months.

- Key features include GPIS-based passenger information system, bio-vacuum toilets, rotational seats, All air-conditioned chair car, Protection for underslung equipment from floods, centralized coach monitoring system, Disaster lights in case of failure of lights etc.

Latest News

Latest News

General Studies

General Studies