- Home

- Prelims

- Mains

- Current Affairs

- Study Materials

- Test Series

Legality of Bitcoins: the encrypted digital currency

ABC of BITCOINS

Bitcoin is a cryptocurrency; it is a digital asset designed to work as a medium of exchange that uses cryptography to control its creation and management, rather than to rely on a central authority. The transfer of this currency is like sending the e-mail or text message to a person. To send a bitcoin, a wallet app is used (app: 'Bitcoin Wallet'), the amount to be sent is typed in the wallet app and type the details for the recipient( account number in this case), and you have sent the bitcoin which can later be converted to fiat currency.

Let's take the hypothetical case of Mr. X and Mr. Y. X pays 5 bitcoins to Y, X's balance is reduced by 5 bitcoins and Y's increases by 5. This transaction, when completed will be shown in public ledger. This ledger is maintained by Bitcoin’s public network. When X filled the relevant details and pressed send, the bitcoin network receives a message from X and the message says that Y is being sent so and so number of bitcoins by me. If some thief can replicate that message and send it to the bitcoin network, then he might be able to steal X's money i.e., bitcoins. But this message cannot be replicated because each message comprises a unique signature, after encrypting this unique signature, the message is sent to the Bitcoin network so that it is impossible to replicate.

Cryptocurrency uses a system of cryptography (AKA encryption) to control the creation of coins and to verify transactions. Cryptography, in layman's language, means the art of writing and solving codes. So, each letter/ word/ any component of the language can be mapped to arbitrary characters, letters, pixels and numbers so that it is not readable without the proper key. When X sent the message to bitcoin network, bitcoin account has two keys, i.e. private key and public key. So, the message sent uses both private and the public key. The ledger comprises both the public key and the encrypted information from the X's side. Every transaction uses a different encrypted code. Therefore, it is called a cryptocurrency.

Features of bitcoin

Bitcoin is a currency that is not tied to a bank or government and allows the users to spend the money anonymously.

No single institution controls the bitcoin network.

It is analogous to an online version of cash. Many products and services can be bought by it.

Bitcoin network controls the bitcoin. Bitcoin network comprises the common man who uses bitcoin, and anybody can become a part of it. To understand this network, we must understand the Bitcoin Public Ledger.

All confirmed transactions from the start of Bitcoin's creation are stored in the public ledger. This complete record of the transaction which is a sequence of records called blocks.

On November 1, 2008, a man named Satoshi Nakamoto (a tentative name whose existence is questionable) posted a research paper to an obscure cryptography listserv describing his design for a new digital currency that he called bitcoin. One of the core challenges of designing a digital currency involves something called the double-spending problem.

Bitcoin did away with the third party by publicly distributing the ledger, which Nakamoto called the 'block chain.'

Users willing to devote the CPU power to running a special piece of software would be called miners and would form a network to maintain the blockchain collectively. In the process, they would generate new currency.

Bitcoin Mining

The maintenance of ledger takes up a lot of resources. It solves many vital issues. The incentive to maintain this ledger and to perform such an important task would pay you in the form of bitcoins. They will have the privilege to mine the bitcoins.

Miners install software for bitcoin, this software, by utilizing the power and resources, computes numerous mathematical algorithms. After computing these algorithms, the software provides a reliable algorithm to the ledger. The ledger will use these algorithms to solve the complexity of maintaining it.

How to get 'bitcoins.'

You can buy bitcoins by using real money.

You can sell things and let people pay you with bitcoins.

Or they can be created using a computer.

Why are bitcoins valuable?

There are a lot of things other than money which we consider valuable like diamonds and gold. The Aztecs used cocoa for money!

Bitcoins are valuable because people are willing to exchange them for real goods and services and even cash.

Countries such as Russia and Japan moved to legitimize cryptocurrency. But they can do so because most of their economy has 'white' money and ours (Indian) run on considerable amount of black money, so it would not be suitable for our economy as people would use them to convert them from black to white. Japan has passed the law to bitcoin as a legal payment method. Russia is reportedly looking into ways to regulate bitcoin.

Is it anonymous?

Yes, to a point. Transactions and accounts can be traced, but the account owners are not necessarily known. However, investigators might be able to track down the owners when bitcoins are converted to regular currency. But the people might be able to spend that money online and might be impossible to trace

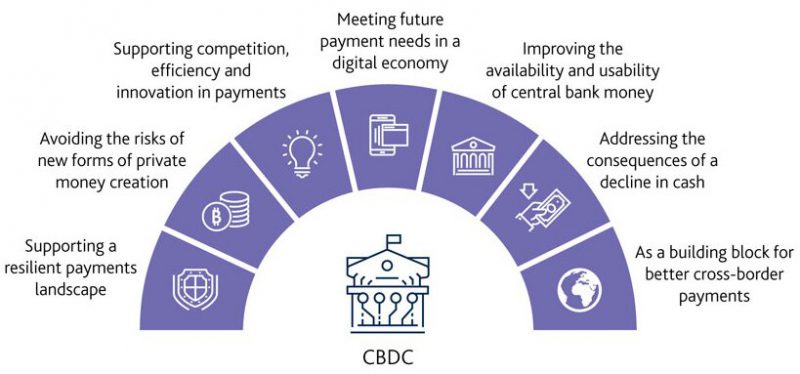

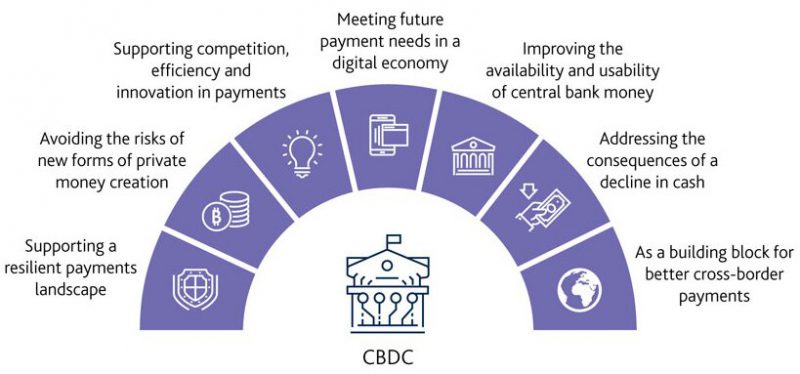

Central Bank issued Digital Currency (CBDC)

The growing popularity of digital currencies (or cryptocurrency) such as Bitcoin, over the last decade, had made most central banks look seriously at launching a digital currency controlled by them that can address the shortcomings of digital currencies while hastening the shift towards a cashless society.

In this context, the European Central Bank has expressed its intention to evaluate a Central Bank issued Digital Currency (CBDC) for the Euro Zone. The RBI had, in 2018, directed financial institutions against facilitating transactions involving cryptocurrencies, leading to many crypto trading platforms shutting down.

However, recently RBI has indicated that it is conducting a feasibility study of developing a government-backed digital currency. As many countries today explore the prospects of a sovereign digital currency, India should not lag behind in developing Digital Rupee.

Note: Digitalisation of Fiat Currency From Digital Currency.

- In order to understand the importance of a Digital Rupee, it is required to distinguish the digitalisation of fiat currency from digital currency.

- The digitisation of fiat currency stems from the advent of electronic payment and interbank IT systems, allowing commercial banks to more efficiently and independently generate the credit flows that expand the broad money supply.

- By contrast, digital currency, enabled by blockchain technology, affects the base currency allowing the central bank to bypass commercial banks and regain control of currency creation and supply end-to-end.

- Addressing the Malpractices: The need for a sovereign digital currency arises from the anarchic design of existing cryptocurrencies, wherein their creation, as well as maintenance, are in the hands of the public.

- With no government supervision and ease of cross-border payments, renders them vulnerable to malpractices like tax evasion, terror funding, money laundering, etc.

- By regulating digital currency, the central bank can put a check on their malpractices.

- Addressing Volatility: As the cryptocurrencies are not pegged to any asset or currency, its value is solely determined by speculation (demand and supply). It is due to this, there has been huge volatility in the value of cryptocurrencies like bitcoin.

- As CBDCs will be pegged to any assets (like gold or fiat currency) and hence will not witness the volatility being seen in cryptocurrencies.

- Next Big Thing: In a survey conducted by Bank for International Settlements, around 80 per cent of the 66 responding central banks said they have begun working on central bank-issued digital currency (CBDC) in some form.

- Moreover, China is quietly bringing about a revolutionary change to the currency and payment system by launching its Digital Renminbi.

- Digital Currency Proxy War: India runs the risk of being caught up in the whirlwind of a proxy digital currency war as the US and China battle it out to gain supremacy across other markets by introducing new-age financial products.

- Today, a sovereign Digital Rupee isn’t just a matter of financial innovation but a need to push back against the inevitable proxy war which threatens our national and financial security.

- Reducing Dependency on Dollar: Digital Rupee provides an opportunity for India to establish the dominance of Digital Rupee as a superior currency for trade with its strategic partners, thereby reducing dependency on the dollar.

- For too long, the dollar has been unchallenged as the world’s reserve currency giving the US leverage over the world’s financial system and also enabling it to impose sanctions against countries.

- However, in wake of the recent trade war, China is now pushing for a more advanced financial system using Digital Renminbi.

- Complete Transmission of Monetary Policy: Digital Rupee will empower the RBI by providing it direct tools to control monetary policy.

- Directly influenced creation and supply flow using a Digital Rupee will immediately reflect the effects of policy changes instead of relying on commercial banks to make those changes when they deem fit.

- Safeguarding the Interest of Deposit Holders: The recent NBFC crisis resulting in the current downturn in the economy and the PMC Bank scandal which has locked out depositors from withdrawing their funds due to high NPAs are a testament to the fragility of our current banking model.

- Officially backed Digital Rupee will empower the regulators to monitor transactions and credit flow across the economy helping them weed out scams and fraud instantly and secure depositors’ money.

- Moreover, it will help distract investors from the current bunch of crypto assets that are highly risky.

- New Paradigm For Banking: Digital Rupee will turn every large technology company into a fintech company without the need for permission or partnership with a bank.

- This will create new incentives for companies to bank the unbanked, while also providing financial services to those who have been at the mercy of banks till date.

- Enabler of Cashless Society: Official digital currencies can play an important role in weaning users away from using cash, which will help control tax evasion.

- Digital Rupee will also make cashback, remittances, loans, insurance, stocks and other financial products a natural extension using programmable smart contracts.

- Fact is many people are still unaware of digital currencies and Bitcoin.

- Bitcoin has volatility because there is a limited amount of coins (21 million bitcoins), and demand for them increases by each passing day.

- Bitcoin is still at its infancy stage, with incomplete features that are in development.

Latest News

Latest News

General Studies

General Studies