Atmospheric rivers are shifting poleward

- Atmospheric rivers are shifting toward higher latitudes, and that’s changing weather patterns around the world.

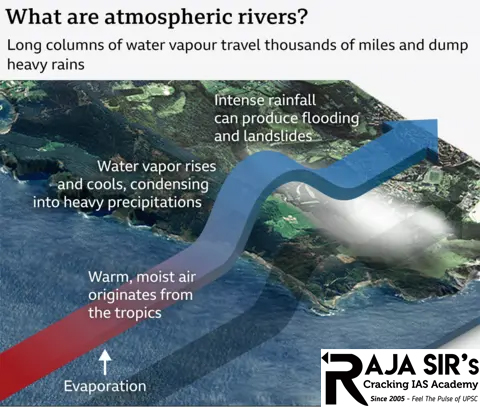

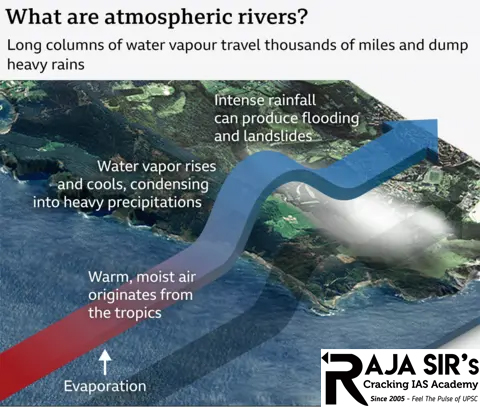

What are Atmospheric Rivers?

- Atmospheric riversare large, narrow sections of the Earth’s atmosphere that carry moisture from the Earth’s tropics near the equator to the poles.

- Similar to terrestrial rivers, atmospheric rivers can vary in strength and size. They carry massive amounts of moisture.

- On average, the Earth has four to five active atmospheric rivers at any time.

- Occurrence: They can occur both in the:

- Northern hemisphere – typically between December and February

- Southern hemisphere – typically between June and August, when extratropical cyclones are prevalent

- Each moves the equivalent of the liquid water that flows through the mouth of the Amazon River. When they reach land, atmospheric rivers release this moisture, producing heavy snow and rain.

Role of atmospheric rivers:

- Atmospheric rivers are responsible for 90 percent of the movement of moisture from the tropics toward the poles.

- They are a major factor in the formation of cloudsand therefore have a significant influence on air temperatures, sea ice, and other components of the climate.

|

Candy leaf has Potential beyond its Natural Sweetening properties

- Candy Leaf (Stevia rebaudiana (Bertoni) Bertoni) a plant recognized for its natural non-caloric sweetening characteristics, also has therapeutic properties for diseases like endocrine, metabolic, immune, and cardiovascular diseases, because of its effect on cellular signalling systems.

- Assam exports Stevia worldwide. The North Eastern Council (Government of India) also highlighted stevia cultivation''s potential to help the northeast Indian economy due to high demand and use.

- At the Institute of Advanced Study in Science and Technology (IASST) in Guwahati, pioneering research on Stevia''s medicinal properties, effects on cellular signalling mechanisms to prove the Assam''s Stevia''s therapeutic qualities.

- Their multimodal strategy integrated network pharmacology with in vitro and in vivo techniques, showing that the plant used phosphorylation of Protein Kinase C (PKC) to inhibit a crucial cellular signalling route.

- PKC is connected to inflammatory, autoimmune, endocrine, and cardiovascular illnesses. Stevia suppresses PKC phosphorylation, which alters downstream pathways that cause inflammation, a significant cause of endocrine metabolic and cardiovascular issues.

- Stevia has potential medical benefits for immunological endocrine and cardiovascular problems . It could have therapeutic effect on diabetes, type 1, type 2, autoimmune diabetes, pre-diabetes, chronic inflammation related auto immune disease - rheumatoid arthritis; chronic kidney diseases and cardiovascular diseases like hypertension; vasculopathy .

|

|

Copper plates from Vijayanagara Kingdom

Copper plate inscriptions from the 16th Century CE, bearing the Vijayanagara Kingdom’s seal, were recently discovered at the Sri Singeeswarar temple in Mappedu village, Tiruvallur district.

Details of the Inscription

- Era: The inscriptions date back to the 16th Century CE, specifically to the year 1513 during the reign of Krishnadevaraya of the Vijayanagara Empire.

- Script and Language: The inscriptions are written in Sanskrit using the Nandinagari script.

- Nandinagar is a Brahmic script derived from the Nāgarī script that was used between the 11th and 19th centuries AD

- For producing manuscripts and inscriptions in Sanskrit in south Maharashtra, Karnataka and Andhra Pradesh.

- Village Donation: The inscription records the donation of the village Vasalabattaka, renamed Krishnarayapura, by King Krishnadevaraya.

- Beneficiaries: The village was gifted to several Brahmins.

- Boundaries: It details the boundaries of the donated village, which was under the control of the Raja of Chandragiri (modern-day Tirupati district, Andhra Pradesh).

Sri Singeeswarar temple at Mappedu

- Deity: Singeeswarar Temple is dedicated to Lord Shiva.

- Construction: The temple was built in 976 A.D. by Aditya Karikalan Chola II, the elder brother of Rajaraja Chola.

Krishnadevaraya

- Reign: Krishnadevaraya belonged to the Tuluva Dynasty and ruled the Vijayanagara Empire from 1509-1529 AD.

- Contributions: He is credited with constructing fine temples and adding gopurams (gateway towers) to several significant South Indian temples.

- He founded Nagalapuram, near Vijayanagar, in honour of his mother.

- He composed a Telugu work on statecraft known as Amuktamalyada.

Vijayanagara Empire

- Foundation: The Vijayanagara Empire was founded in 1336 AD by Harihara and Bukka of the Sangama Dynasty.

- Capital: Hampi.

- It was declared a UNESCO World Heritage Site in 1986.

- Geographical Extent: The empire stretched from the river Krishna in the north to the extreme south of the Indian peninsula.

- Dynasties of Vijayanagara: The Vijayanagara Empire was ruled by four major dynasties: Sangama Dynasty, Saluva Dynasty, Tuluva Dynasty and Aravidu Dynasty

|

Global Public Debt

- Global public debt is set to surpass USD 100 trillion this year, signalling urgent calls for stronger fiscal measures from major economies, according to a recent report from the International Monetary Fund (IMF).

What Is Global Public Debt?

- Global public debt refers to the total amount of money that governments around the world owe to creditors.

- This debt can include domestic and foreign loans, bonds, and other forms of borrowing. Public debt is usually expressed as a percentage of a country’s Gross Domestic Product (GDP), which measures the economic output of a nation.

- A rising public debt ratio can indicate that a country is borrowing more than it is producing, raising concerns about its long-term financial health.

Causes of Rising Global Public Debt

- COVID-19 Pandemic: The pandemic forced governments to implement expansive spending strategies to support their economies. This included financial aid for businesses, unemployment benefits, and healthcare spending, leading to increased borrowing.

- Economic Stimulus: Major economies, particularly the U.S. and China, have engaged in substantial fiscal stimulus plans to boost growth. This has contributed significantly to the rise in global debt levels.

- Inflation and Interest Rates: As inflationary pressures ease and central banks lower borrowing costs, governments have more incentive to borrow. However, the need for long-term fiscal sustainability remains pressing.

- Aging Populations and Security Issues: Challenges like an aging population and increasing security concerns further strain public finances, requiring governments to borrow more to meet these needs.

Impact of Rising Global Public Debt

- Economic Stability: High levels of public debt can jeopardize economic stability, making it more challenging for governments to respond to future crises. The IMF warns that without decisive action, future debt levels may exceed current projections, requiring significant fiscal adjustments.

- Government Bond Markets: Escalating borrowing levels have already led to sell-offs in government bond markets, raising borrowing costs for countries. This can create a cycle of increasing debt as governments struggle to finance their obligations.

- Fiscal Policies: The IMF has recommended that governments prioritize their spending, reform entitlements, and find new revenue sources to stabilize their finances. Delaying these necessary adjustments could lead to more severe economic challenges in the future.

- Vulnerable Households: As governments make fiscal adjustments, it is crucial to protect vulnerable households from the impacts of austerity measures. Well-designed fiscal policies can support economic growth while ensuring that the most affected populations receive assistance.

|

|

GST Overhaul Needed Before 2026 Cess Repayment

- The Goods and Services Tax (GST) system in India, introduced in 2017, was heralded as a landmark reform aimed at simplifying the tax structure and enhancing compliance. However, as the compensation cess repayment deadline approaches in 2026, it has become increasingly clear that an overhaul of the GST framework is essential.

- Introduction to GST: This was followed by the introduction of the GST to replace a complex structure of indirect taxes comprising a variety of state and central taxes. They were; the formation of one market destination; the improvement of tax collection; and the generation of more revenues for both central and state governments. The implementation of GST intended to rationalise the system of tax to eliminate the concept of tax on tax.

- Compensation Cess: In order to compensate those revenue losses which states may encounter in course of exercising GST, the compensation cess came into force. This cess is collected from certain products and services which fall under the 28% tax bracket. The money that accrued from this cess was expected to help offset states’ revenue losses for five years until March, 2026. Nonetheless, this mechanism is viewed as unsustainable and unequitable.

Current Challenges Facing the GST System

- Revenue Shortfalls: Currently there are cited instances of states suffering some form of stagnation or even decline in their GST revenues. Compensation cess has become more or less a routine to finance many States’ demand, and causes fiscal imbalance. The situation has tied a company’s financial prospects to this cess causing a potentially catastrophic business model when the cess might be removed one day.

- Complexity of Compliance: However, in trying to rectify the problem of complex taxation, the GST system has brought in its wake a complicated multi-tax slab structure—currently varying between 0 percent and 28 percent. It is this plurality that causes confusion amongst the business, especially the SMEs as they are caught up in the copious filing requirement.

- Inequitable Distribution of Revenue: The distribution of GST revenue between the states has been more or less unequal. Regions with lower levels of economic activity disappoint in terms of revenue, therefore deepening the inequality between states. This has distorted the principle of cooperative federalism that was supposed to be propounded by the GST.

- Technical Glitches and Administrative Burdens: The GST portal has faced numerous technical glitches that hinder timely filing and compliance. Additionally, businesses encounter delays in receiving Input Tax Credit (ITC) refunds, further complicating their financial management.

Implications of Compensation Cess Repayment

- Financial Strain on States: State excise departments are preparing for the financial pinch as the deadline for compensation cess repayment draws near. The end to this revenue source may result in fiscal doom for many states, mainly those which largely depend on these revenues to fund their activities.

- Need for Sustainable Revenue Sources: As the legal tenure of compensation cess is going to end, it has become mandatory for the states to search for some other sources of revenues. There is a need to have a sustainable taxation system, one which does not cause hardships to consumers or firms.

Proposed Reforms

- Rationalisation of Tax Slabs: Among all the reforms essential, there is the urge to reform the tax slabs in an efficient manner. Lowering the number of slabs and bringing standard rates can make the work of field officers easy besides helping businesses to avoid litigation instances and improving upon the general tax collection. Although the authorities have mooted a maximum rate of 18%, increasing competitiveness in India would be beneficial to international learners and reduce the compliance issues that the sector faces .

- Streamlining Compliance Processes: Reducing the workload of SMEs concerning the simplification of compliance measures is the rationale. Some of the measures include; cutting down the number of returns filed by small businesses and permitting those with low turnover to file the returns on a quarterly basis.

- Enhancing Technology Infrastructure: It is rightly proposed that technology investment greatly enhances efficiency in the context of GST implementation. Reconfigurations to fix the technical issues of the GST portal will enhance ease in the operations and monitoring of compliance.

- Strengthening Cooperative Federalism: Thus to solve the problems of regional disparities in revenue generation, there is needed close cooperation between the central and state governments. There is a need to come up with a better and fairer distribution mechanism that will enable states to have what it takes to facilitate developmental processes.

- Revisiting Compensation Mechanisms: In any change process, it is essential to review the payment regime which states receive after cessation. It may be possible to establish a more transparent structure for fiscal devolution which takes into account the differential needs of different states primarily based on the differential economic conditions prevalent across states and hence ensuring fiscal stability but which does not need recourse to cesses.

|

|

India-Mauritius Bilateral Cooperation

In a notable step towards enhancing bilateral relations, India has extended a Line of Credit (LoC) worth Rs 487.60 crore to the Government of Mauritius. This financial assistance aims to replace approximately 100 kilometers of outdated water pipelines in the island nation. This marks the first-ever rupee-denominated Line of Credit extended by India to any country for project financing under the Indian Development and Economic Assistance Scheme (IDEAS).

Key Details of the Line of Credit

- First Rupee-Denominated Line of Credit: This LoC is the first-ever rupee-denominated Line of Credit extended by India for project financing under the Indian Development and Economic Assistance Scheme (IDEAS).

- Traditionally, India has extended its Lines of Credit in US dollars, but the introduction of a rupee-denominated LOC marks a strategic shift.

- This scheme aims to provide concessional loans to support developmental projects in partner countries.

- Financing Agency: The project will be financed by the State Bank of India (SBI) on concessional terms, ensuring affordable repayment conditions for Mauritius.

- Project Objectives: The primary objective of this financial assistance is to facilitate the replacement of around 100 kilometers of obsolete water pipelines in Mauritius. The existing pipeline infrastructure has been deemed outdated and in need of urgent replacement to ensure efficient water supply and management.

- Impact on Mauritius

- Infrastructure Improvement: The project is expected to enhance the reliability and quality of water supply for the residents of Mauritius.

- Sustainable Development: By improving water infrastructure, India aims to contribute to the sustainable development goals of Mauritius, promoting better health and hygiene standards.

|

India-Mauritius Relationship

- India and Mauritius formally established diplomatic relations in 1948.

- Their shared history and connections go as far back as 1730 through successive Dutch, French and British occupation.

- With over 70% of Mauritius'' 1.2 million population being of Indian origin, the two nations enjoy a deep connection that extends beyond formal diplomatic relations.

- The LOC comes at a time when both countries are celebrating the 75th anniversary of the establishment of diplomatic ties.

- It also aligns with the broader framework of India’s "Act East" policy, under which India has sought to deepen its engagement with countries across Asia and the Indian Ocean region.

What is IDEAS initiative?

- The IDEAS initiative, under which this LOC has been extended, is India’s flagship development assistance programme.

- It aims to support infrastructure, capacity-building, and social welfare projects across Asia, Africa, and the Caribbean.

- By providing concessional loans, India enables recipient nations to tackle pressing developmental challenges while avoiding crippling debt burdens.

|

|

|

Indian Navy''s Next Generation Missile Vessels

- The Indian Ministry of Defence has announced that GE Aerospace will supply LM2500 marine gas turbine engine kits to power six Next Generation Missile Vessels (NGMVs) for the Indian Navy. These vessels will be built by Cochin Shipyard Limited in Kochi.

Key Features of the LM2500 Marine Gas Turbine Engine

- Engine Specifications: The LM2500 marine gas turbine is engineered for high performance, capable of propelling modern naval vessels effectively. It provides a power output that allows ships to achieve high speeds and enhanced operational efficiency.

- Auxiliary Systems: In addition to the engines, GE Aerospace will supply a full range of gas turbine auxiliary systems, essential for optimal engine performance and reliability.

- Existing Applications: The LM2500 engines are already in service in various Indian naval platforms, including:

- Six Shivalik-class frigates

- INS Vikrant, India''s first indigenous aircraft carrier, which is powered by four LM2500 gas turbines.

- Global Reliability: Over 714 vessels worldwide utilize GE Aerospace’s marine gas turbines, underscoring their reliability and availability in naval operations.

Importance of the Next Generation Missile Vessels (NGMVs)

- Design and Capability: The NGMVs will be equipped to launch BrahMos missiles, making them formidable assets for the Indian Navy. They will be capable of reaching speeds up to 35 knots (65 kilometers per hour) and will carry advanced anti-surface weaponry.

- Stealth Requirements: The propulsion system, centered around the LM2500 engine, is designed to meet the stealth requirements necessary for modern naval warfare.

- Historical Significance: The Indian Navy has a strong tradition of conducting successful ship-to-shore missile attacks, notably during the 1971 war against Pakistan. The development of NGMVs aims to strengthen this legacy and enhance the navy''s operational capabilities.

|

|

Mining Dust-Based Carbon Capture: A Sustainable Innovation

- The first pilot company has pioneered a revolutionary technology that uses mining dust to improve carbon capture and reduce climate change impact, turning an environmental nuisance into an opportunity.

Description

- Technology Overview: The company uses a unique method to build a material that will be able to grab CO2 from emissions of industrial facilities and from the air.

- Mining Dust Characteristics: Containing a large number of metal oxides, the surface area and reactivity of mining dusts are similarly desirable for carbon capture.

- Capture Process: The new mining dust will collect CO2 and, after having formed a stable carbonate precipitate, the dust simply remains solid and can be stored or applied.

Significance

- Climate Change Mitigation: New carbon capture technology is vital in reducing global warming.

- Waste Valorization: As good as it is, recycling of mining dust has two major advantages economically and environmentally where удалите liabilities are cut while the economy attracts benefits.

- Circulatory Economy: Taking care of the loop, the industrial waste or emission.

Pros

- Efficient Carbon Capture: The state achieved high capture and rates while experiencing minimal fluctuations.

- Cost-Effective: Incorporates mining dust which is easily accessible thus cutting down many expenses.

- Scalability: spanning across all kinds of industries and types of emission sources.

- Job Creation: New opportunities in CUC.

Cons

- Limited Geographical Applicability: It can be established that the percentage of manganese extraction depends on mining activities and dust availability.

- Potential Environmental Impacts: Accidental burst of dust emission or inadequate containment.

- Regulatory Frameworks: Absence of well-defined framework for the carbon capture and utilisation.

Challenges

- Scalability and Commercialization: Taking laboratory experiments to industrial applications: A reality.

- Public Perception: To cite the problems relating to mining dust use.

- Integration with Existing Infrastructure: Compatibility with the existing industrial processes.

Way Forward

- Research and Development: Improving accuracy of capture, its stability and scaling capabilities.

- Partnerships and Collaborations: Tripartite partnership between industry, government and academia.

- Policy Support: Promoting the use of appropriate legal measures and appropriate rewards for carbon capture and utilisation.

- Public Awareness: Raising awareness of the drivers and the prospects of the adsorption of CO2 by mining dust.

Conclusion

- The utilisation of mining dust in carbon capture may be one of the most effective solutions for reducing climatic change and waste valorization.

- To that end, handling problems and increasing the capacity for the services will be more significant for extensive usage.

|

Moonlight Program

The European Space Agency (ESA) has launched the Moonlight programme, aiming to create a dedicated satellite constellation for telecommunication and navigation services on the Moon.

Features of the Moonlight Program

- Satellite Constellation: The program will consist of five satellites: one for high-data-rate communications and four for navigation.

- Lunar-Earth Connectivity: The satellites will cover a 400,000 km network, connecting the Moon to Earth via three ground stations.

- Coverage: The Moonlight program will offer coverage at the Moon’s south pole, an area of interest due to the presence of polar ice, which could be used for water, oxygen and rocket fuel.

- Significance: The Moonlight initiative aims to make services like satellite navigation, video conferencing, and data sharing as seamless on the lunar surface as they are on Earth.

- Enable precise lunar landings, surface mobility, and establish a high-speed, low-latency communication network between Earth and the Moon.

- The Mission will reduce future lunar mission costs by offering shared communication and navigation infrastructure, eliminating the need for individual setups and is crucial for long-term human presence on the Moon.

- It will create opportunities for private companies by providing commercial data relay services, fostering a growing lunar-related market.

- Partnerships: Moonlight is a collaboration between ESA, Telespazio, and the UK and Italian space agencies.

- ESA is also working with NASA and JAXA on LunaNet, ensuring compatibility with future lunar infrastructure.

- Global Lunar Navigation System: Moonlight will undergo the first lunar navigation interoperability tests in 2029 to support a global communication and navigation system for international space agencies and private entities.

Timeline and Development

- Lunar Pathfinder: The first stage of the Moonlight programme involves launching the Lunar Pathfinder, a communications relay satellite developed by Surrey Satellite Technology Ltd (SSTL), set to begin operations in 2026.

- The Lunar Pathfinder will provide commercial data relay services and test existing Earth-orbiting navigation satellites for lunar use.

- Full Deployment: The complete deployment of Moonlight’s services is expected by 2030.

|

|

Nonylphenol Ethoxylates (NPEs) and Nonylphenol (NP)

Chemical Characteristics:

- NPEs and NP are surfactants contributing to environmental pollution, including frothing in rivers like the Yamuna, indicating high pollutant levels.

- These chemicals are recognized as endocrine disruptors, toxic to aquatic life, and harmful to human health, particularly impacting reproductive and developmental systems.

Regulatory Status:

- Many countries have banned the use of NPEs in detergents.

- India lacks specific regulations for NPEs, though NP was banned in the cosmetics sector in 2009.

- Industrial Usage: NP and NPEs are widely used in industries such as textiles, leather, detergents, cleaning products, paper, food packaging, cosmetics, construction, automotive, agrochemicals, paints, and metalworking fluids.

Health and Ecological Concerns:

- Aquatic Life Toxicity: NP is toxic to fish, plants, and invertebrates, causing poisoning, reduced survival, impaired growth, and reproductive failure.

- Human Health Risks: NP mimics estrogen, leading to hormonal imbalances, reproductive disorders, and increased cancer risks.

- Environmental Persistence: NP is resistant to degradation, remaining in ecosystems for long periods and potentially entering the human food chain.

Recommendations for Safer Alternatives:

- The transition to safer, cost-effective, and viable alternatives to NP and NPEs is recommended, but progress in India has been slow.

|

Latest News

Latest News

General Studies

General Studies