- Home

- Prelims

- Mains

- Current Affairs

- Study Materials

- Test Series

23th Aug 2021

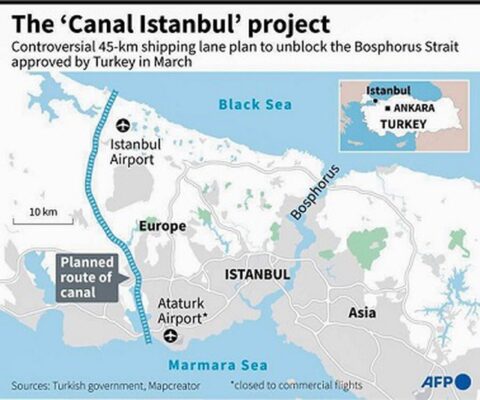

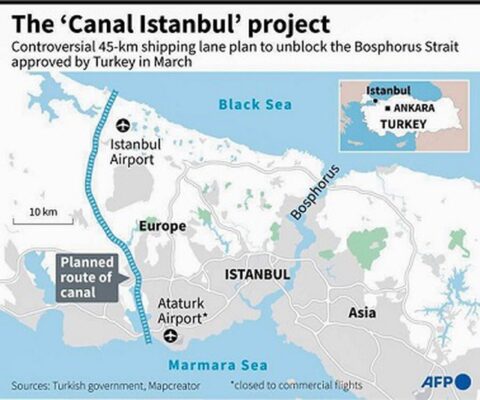

WHAT IS KANAL ISTANBUL, AND WHY IS ERDOGAN KEEN ON SEEING THE PROJECT THROUGH?

Recently, the Kanal Istanbul Project, once described by Erdogan himself as a "crazy project", is being seen as a lifeline for the leader, who has been at Turkey’s helm since 2003.

Kanal Istanbul Project?

- It is an under-construction shipping routerunning parallel to the strategically critical Bosphorus Strait.

- The passage through the Strait has been governed by the Montreux Convention.

- It is a multilateral treaty that allows ships to go across almost free of cost during peacetime, and which tightly restricts the movement of naval vessels.

- It will run on the European side of Bosphorus.

- It will besafer and faster to navigate compared to the Bosphorus and making it a more attractive option for commercial ships, who will pay to pass through.

- In April 2021, 104 retired admirals signed an open letter insisting that the Montreux Convention is sacrosanct and should be left untouched.

- Erdogan’s political opponents blame him for using the project as a ruse for diverting public attention away from Turkey’s pandemic numbers, soaring inflation and unemployment.

- The critics have also pointed to investigative reports exposing real estate deals in which buyers from the Middle East have picked up prime plots of land through which the canal will pass through.

- The Environmental experts fear that the canal would pose a threat to Istanbul’s water supply system of over four centuries, as a wooded area that houses this system would have to be dug up.

- They also fear that the new artificial canal would bring polluted waters of the Black Sea into the Sea of Marmara, and ultimately in the Mediterranean.

- The industry experts have also expressed doubts about the project’s viability, given therecent fall in the number of ships wanting to cross the Bosphorus.

- It is a natural waterway that separates Europe and Asia,which for centuries has served as a key outlet for Russian ships entering the Mediterranean Sea.

- It is located in northwestern Turkey and separates Thrace from Anatolia.

- It is thenarrowest strait in the world, connecting the Black Sea with the Sea of Marmara.

- It is also known as the Strait of Istanbul.

- It links theEuropean part of the city from its Asian part and thus remains as a very strategic waterway in the region.

- It has a significant place in the international maritime map as it is a busy waterway that witnesses the presence of many shipsand oil tankers every day, in addition to the local fishing and passenger boats.

- The name “Bosphorus” was derived from the Ancient Greek word “Bosporos,” meaning “cattle strait” or “ox ford”.

-

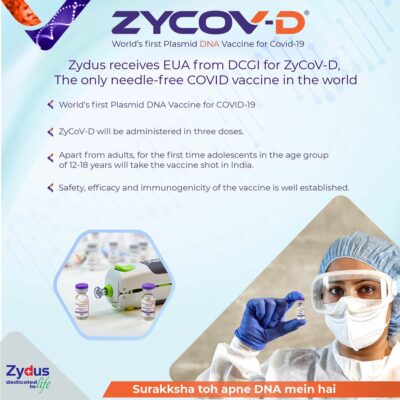

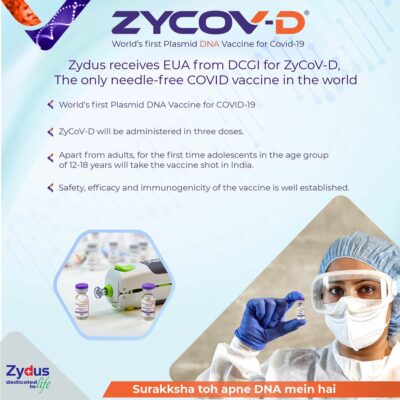

It is a plasmid DNA vaccine that produces the spike protein of the SARS-CoV-2.

- It elicits an immune response mediated by the cellular (T lymphocytes immunity) and humoral (antibody-mediated immunity) arms of the human immune system.

- It has shown the efficacy of 66.6% against symptomatic Covid cases and 100% for moderate disease.

- It is an intradermal vaccine, applied using a ‘needle-free injector’.

- It is the only needle-free Covid vaccine in the world.

- It is a three-dose, intradermal vaccine, which is applied using a needle-free system, Tropis, which can also lead to a significant reduction in any kind of side effects.

- It is delivered via a“painless” intradermal applicator and added that it plans to seek approval for a two-dose regimen of the vaccine.

- It has been developed in partnership with the department under Mission COVID Suraksha.

- It has been supported under theCovid-19 Research Consortia through National Biopharma Mission for preclinical studies.

- It is an Indian COVID-19 Vaccine Development Mission with end-to-end focus from preclinical development through clinical development and manufacturing and regulatory facilitation.

- Under the mission, thegrant will be provided to the Department of Biotechnology (DBT) for Research & Development of Indian COVID-19 vaccines.

- It will help accelerate development of approximately 5-6 vaccine candidatesand ensure that these are brought closer to licensure and introduction in market for consideration of regulatory authorities.

- The important objectives of the fund will be:

- Accelerating pre-clinical & clinical development;

- Licensure of COVID-19 vaccine candidates that are currently in clinical stages or ready to enter clinical stage of development, establishing clinical trial sites;

- Supporting development of common harmonized protocols, trainings, data management systems, regulatory submissions, internal and external quality management systems and accreditations;

- Strengthening the existing immunoassay laboratories, central laboratories; and

- Suitable facilities for animal studies, production facilities and other testing facilities to support COVID-19 vaccine development

- The App is divided into various sectionswhere it talks about the legacy of GSI, the in-house publications of the organization, various case studies on different missions of GSI, the picture gallery etc.

- The E-news division updates masses about the latest news as far as the organization is concerned in terms of work and the career opportunitiesas well as the training facilities that are available with GSI.

- It also deals with various maps, videos and downloadsof GSI work.

- The e-book section wouldgive the masses an idea of the exploration works done by GSI.

- Itconnects the YouTube, Facebook and Twitter pages of GSI from the app as well.

- Through the App, people will become more enlightened about various facetsof GSI activities.

- It is also in line with the Digital India campaign initiated by the Central Government.

- Its purpose is to draw the attention of the student community towards the subject of Geology and its importance in nation building.

- It was set up in 1851 primarily to find coal deposits for the Railways.

- It is headquartered in Kolkata, has six regional offices located in Lucknow, Jaipur, Nagpur, Hyderabad, Shillong and Kolkata.

- It is an attached office to the Ministry of Mines.

- It has grown into a repository of geo-science information required in various fields in the country and has also attained the status of a geo-scientific organization of international repute.

- Its main functions relate to creating and updating of national geo-scientific information and mineral resource assessment.

- Its chief role includes providing objective, impartial and up-to-date geological expertise and geo-scientific information of all kinds, with a focus on policy making decisions, commercial and socio-economic needs.

- It emphasizes on systematic documentation of all geological processes derived out of surface and subsurface of India and its offshore areas.

- Its core competence in survey and mapping is continuously enhanced through accretion, management, co-ordination and utilization of spatial databases.

- It functions as a ‘Repository’ or ‘clearing house’ for the purpose and uses latest computer-based technologies for dissemination of geo-scientific information and spatial data.

- It was announced in 2014 by the Ministry of Rural Development.

- It is a part of the National Rural Livelihood Mission (NRLM), tasked with the dual objectives of adding diversity to the incomes of rural poor families and cater to the career aspirations of rural youth.

- It is uniquely focused on rural youth between the ages of 15 and 35 years from poor families.

- The DDU-GKY has mandated a minimum of 160 hours of training in soft skills, function English and computer literacy.

- Industry interactions have emphasised the need for training in soft skills, team working etc., as more important than domain skills, which they learn on the job.

- Introducing predictability in government process by defining minimum service level benchmarks and standards, controls & audits, defaults and remedial actions to reduce Inspector Raj in an all pervasive quality assurance framework comprising of the Guidelines & Standard Operating Procedures (SOPs).

- The transparency and accountability is fostered through the end-to-end implementation of Public Financial Management System (PFMS) as the channel for fund disbursals and audits.

- It allows DDU-GKY to invest in capacity building of the private sector, front-loading 25% of the training costs so that PIAs are not constrained to invest in quality training centres.

- A Geo-Tagged Time Stamped Biometric Attendance Record serves a dual purpose of being a monitoring tool, and also it also making candidates familiar with modern technology;

- Provision of a Tablet PC per candidate at the training centre which enables candidates to learn at their own pace; and

- Presence of Computer Labs and e-Learning at Training Centres, to ensure that all candidates have access to a wider curricula and adequate learning opportunities

- To reduce poverty by enabling poor for households to access gainful and sustainable employment through employment that provides regular wages.

- There is a strong demand for the economic opportunities among the poor, as well as immense opportunities in term of developing their work abilities.

- Social mobilization as well as a network of strong institutions is essential in order to develop India demographic surplus into a dividend.

- Quality and standards are paramount in the delivery of skilling, in order to make the rural poor desirable to both Indian and global employer.

- DDU-GKY is applicable to the entire country.

- It is a service that will allow the company’s users to lend money to other users and make a 9% interest per annum on the amounts they give out as loan.

- It is the company’s very first initiative in this market and also the first community-driven product that enables the members to earn interest on idle money.

- The Fintech platform partnered with Liquiloans, an RBI-registered P2P non-banking financial company (NBFC) to launch CRED Mint.

- In order to access CRED Mint, be it if a person is an existing user of CRED or if he/she is new to the fold, the person need to register for early access to the feature.

- After registration, the person will be able to make his/her investments in CRED Mint.

- The investments that are made in CRED Mint will be lent out through CRED Cash, which is a lending product created specifically for CRED members.

- It was created in partnership with licensed banks and NBFCs.

- The invested money will then be routed directly to an escrow account that is held by the CRED’s NBFC partner, Liquiloans.

- The members of CRED Mint can invest anywhere between Rs. 100,000 to Rs. 1,000,000 which is commission-free.

- It advertises itself as being completely transparent while allowing the user to track their investments’ progress in real-time.

- It also suggests that the members can quickly and easily withdraw their cash at any time they want.

- This can be done either partially or fully with no penalty, while still retaining the interest that you accumulated for the period that it was invested.

- The entire withdrawal process will be entirely online and the money will be returned to the investors within the working day, according to the company.

- It enables individuals to obtain loans directly from other individuals, cutting out the financial institution as the middleman.

- It is also known as “social lending” or “crowd lending”.

- It is a form of direct lending of money to individuals or businesses without an official financial institution participating as an intermediary in the deal.

- All the transactions are carried out through a specialized online platform. The steps below describe the general P2P lending process:

-

- A potential borrower interested in obtaining a loan completes an online application on the peer-to-peer lending platform.

- The platform assesses the application and determines the risk and credit rating of the applicant. Then, the applicant is assigned with the appropriate interest rate.

- When the application is approved, the applicant receives the available options from the investors based on his credit rating and assigned interest rates.

- The applicant can evaluate the suggested options and choose one of them.

- The applicant is responsible for paying periodic (usually monthly) interest payments and repaying the principal amount at maturity.

- Peer-to-peer lending provides some significant advantages to both borrowers and lenders:

- Higher returns to the investors: P2P lending generally provides higher returns to the investors relative to other types of investments.

- More accessible source of funding: For some borrowers, peer-to-peer lending is a more accessible source of funding than conventional loans from financial institutions. This may be caused by the low credit rating of the borrower or atypical purpose of the loan.

- Lower interest rates: P2P loans usually come with lower interest rates because of the greater competition between lenders and lower origination fees.

- Credit risk: Peer-to-peer loans are exposed to high credit risks. Many borrowers who apply for P2P loans possess low credit ratings that do not allow them to obtain a conventional loan from a bank. Therefore, a lender should be aware of the default probability of his/her counterparty.

- No insurance/government protection: The government does not provide insurance or any form of protection to the lenders in case of the borrower’s default.

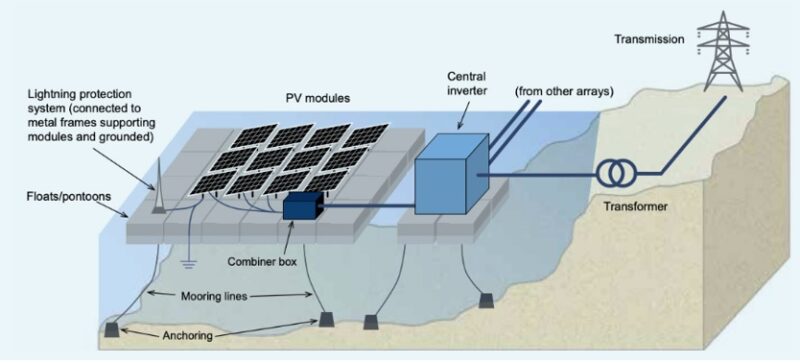

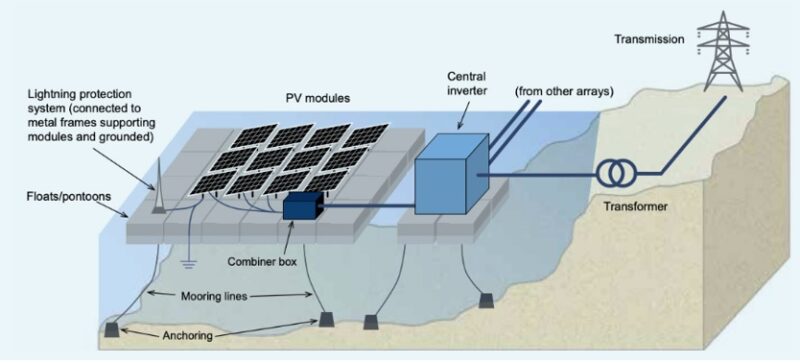

- It has been commissioned by the National Thermal Power Corporation (NTPC) Ltd.

- It is a project of 25MW on the reservoir of its Simhadri thermal station in Visakhapatnam, Andhra Pradesh.

- It is the first solar project to be set up under the Flexibilisation Scheme, notified by the Government of India in 2018.

- The cooling effect of water minimises temperature-related losses, reducing evaporation rate of water bodies, and lowering maintenance costs.

- It has a unique anchoring design is spread over 75 acres in an RW reservoir.

- It has the potential to generate electricity from more than 1 lakh solar PV modules.

- It would not only help to light around 7,000 households but also ensure at least 46,000 tons of CO2 are kept at arm’s length every year during the lifespan of this project.

- It is expected to save 1,364 million litres of water per annum which would be adequate to meet the yearly water requirements of 6,700 households.

- It is considered as a game-changer in India's ambition to create 450 GW (gigawatts) of renewable energy capacity.

- It is also known as the Moplah (Muslim) riots.

- It had been an uprising of Muslim tenants against British rulers and local Hindu landlords.

- The uprising, which began on August 20, 1921, went on for several months marked by many bouts of bloodstained events.

- August 20, 2021 marks the centenary of the Malabar rebellion.

- It largely took the shape of guerrilla-type attacks on janmis (feudal landlords, who were mostly upper caste Hindus) and the police and troops.

- It has often been perceived as one of the first nationalist uprisings in southern India.

- It has been described as a peasant revolt.

- In 1971, the then Kerala government had included the participants of the rebellion in the category of freedom fighters.

- The rebellion of Mappilas inspired by religious ideology and a conception of an alternative system of administration i.e. a Khilafat government, dealt a blow to the nationalist movement in Malabar.

- The fanaticism of rebels, foregrounded by the British, fostered communal rift and enmity towards the Congress.

- The exaggerated accounts of the rebellion engendered a counter campaign in other parts of the country against ‘fanaticism’ of Muslims.

- The thrust of the post-rebellion Muslim reform movement in Malabar was a rigorous campaign against orthodoxy.

- The traumatic experience of the uprising also persuaded educated sections of the Muslim community in Malabar to chalk out ways to save the community from what they saw as a pathetic situation.

- Vinayak Damodar Savarkar was one of the first ones to describe the Moplah rebellion as an anti-Hindu genocide through his semi-fictional novel Moplah.

- According to another book, The Moplah Rebellion, 1921, Haji was an outlaw who played a key role in the rebellion.

- The book, published in 1923, and put together by the then deputy collector of the area, C. Gopalan Nair, is considered to be one of the most authentic accounts of the event.

- It recorded that murders, dacoities, forced conversions and outrages on Hindu women became order of the day.

Latest News

Latest News

General Studies

General Studies