- Home

- Prelims

- Mains

- Current Affairs

- Study Materials

- Test Series

Dec 21, 2021

GOVERNMENT APPOINTS THREE-MEMBER PANEL TO REVIEW EWS QUOTA

A three member-committee set up to examine the income criteria for determining the economically weaker sections (EWS) is expected to submit its report to the Centre within few days.

Why was the committee set up?

Why was the committee set up?

Pradhan Mantri Jan Dhan Yojana (PMJDY)

Pradhan Mantri Jan Dhan Yojana (PMJDY)

Foreign Contribution Regulation (Amendment) Act (FCRA), 2020:

Foreign Contribution Regulation (Amendment) Act (FCRA), 2020:

Global corporate Minimum Tax Rate?

Global corporate Minimum Tax Rate?

Highlights:

Highlights:

Findings:

Findings:

Aurora

Aurora

Highlights:

Highlights:

Why was the committee set up?

Why was the committee set up?

- It was set up to provide an explanation for the basis for fixing an income limit of Rs 8 lakh for granting reservation to EWS.

- The Supreme Court questioned the income criteria for defining EWS, and made an observation that it appeared to be “arbitrary”.

- Reservation for Economically Weaker Sections (EWS) is being implemented in respect of recruitment in government services and admission in educational institutions.

- The revisioning of the criteria is in terms of the provisions of the explanation to Article 15of the Constitution.

- The 10% EWS quota was introduced under the 103rdConstitution (Amendment) Act, 2019 by amending Articles 15 and 16.

- The income limit in the criteria for the determination of the creamy layer of the OBC category and the EWS category is the same - 8 lakhs. The creamy layer in Other Backward Classes (OBC) category is known for excluding a section of the community that has ‘economically progressed’.

- In other words, the income criterion in respect of the OBC category is aimed at exclusion from a class.

- On the other hand, EWS category is identified to include the segment which is ‘poorer’ when compared to the rest of the community.

- In other words, in the case of the EWS category, income criterion is aimed at inclusion.

- Hence, it is arbitrary to provide the same income limit both for the OBC and EWS categories.

- The Centre issued a notification in 2019 implementing reservation criteria for postgraduate medical courses.

- It provided 10% reservation for EWS along with 27% for OBC within the all-India quota.

- It is set by the Department of Personnel and Training (DoPT)based on the 103rd Amendment to the Constitution.

- The 2019 notifications include:

- The criteria for identification of Economically weaker Sections (EWS)

- It also specifies what constitutes income,

- It also excludes some persons from the EWS category if their families possess assets specified in the notification.

- At present, those with an annual income below Rs 8 lakh fall in the EWS category.

- Economically Weaker Section is a section of the society in India that belongs to the un-reserved category and has an annual family income of less than 8 lakh rupees.

- The government of India introduced a 10% reservation to this category of people.

- EWS reservation was granted based on the recommendations of a commission headed by S R Sinho in 2005.

- The Sinho Commission recommended that:

- all below poverty line (BPL) families within the general category as notified from time to time,

- all families whose annual family income from all sources is below the taxable limit, should be identified as EBCs (economically backward classes).

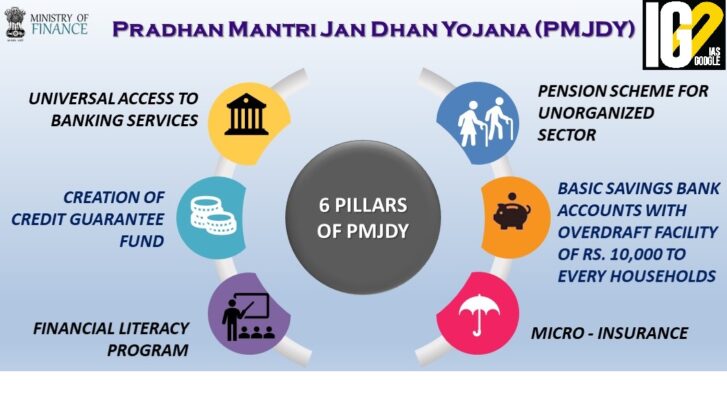

Pradhan Mantri Jan Dhan Yojana (PMJDY)

Pradhan Mantri Jan Dhan Yojana (PMJDY)

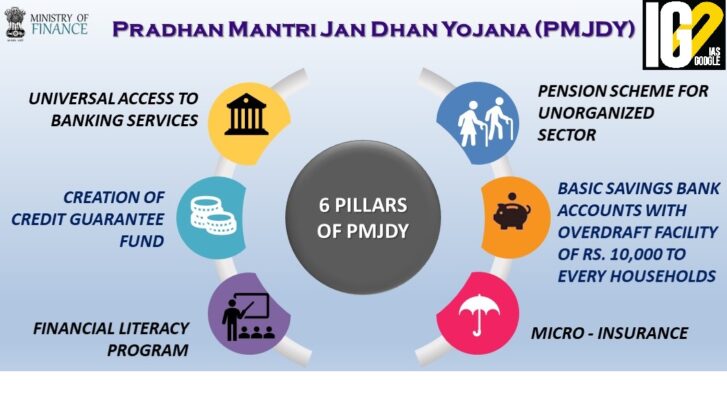

- It is a nationwide scheme launched by the Government of India to ensure financial inclusion of every individual who does not have a bank account in India.

- Aim: To provide access to financial services, like Banking, savings and deposit accounts, remittance, credit, insurance and pension in an affordable manner to all.

- Ensure access of financial products & services at an affordable cost.

- Use of technology to lower cost & widen reach.

- Universal access to banking services.

- Basic savings bank accounts with overdraft facility.

- Financial Literacy Program.

- Creation of Credit Guarantee Fund.

- Insurance against accident and life cover.

- Pension scheme for Unorganized sector.

- The account holders under this scheme will get an accidental insurance cover of Rs 1 lakh and a life cover of Rs 30,000.

- The account holders under this scheme can avail an overdraft facility up to Rs 10,000.

- This is available against one account per household.

- Enabling carrying out transactions through a mobile phone facilitates such account holders in checking of balance and also transferring funds with ease across India.

- In tribal and hilly areas of the country, the telecom network is not reliable and therefore setting up business correspondent in these areas is difficult task.

- There has been a lot of duplicacy exists and sometimes states have not followed the service area approach.

- Parts of North east, Himachal Pradesh, Uttarakhand, J&K and 82 Left wing extremism (LWE) districts face challenges of infrastructure and telecom connectivity.

- There should be engagement between public and private corporates.

- NGO can come forward in each area and also facilitate identification of the people not having bank account.

- Various union like taxi drivers, autorickshaw union can also be engage to help them to open account.

- More communication channels like radio, TV etc... can organised to raise awareness.

Foreign Contribution Regulation (Amendment) Act (FCRA), 2020:

Foreign Contribution Regulation (Amendment) Act (FCRA), 2020:

- The Foreign Contribution Regulation Act (FCRA) registration is mandatory for associations and non-government organizations (NGOs) to receive foreign funds.

- Registered NGOs can receive foreign contribution for five purposes — social, educational, religious, economic and cultural.

- To strengthen the compliance mechanism, enhance transparency and accountability in the receipt and utilization of foreign contribution.

- Facilitate genuine non-governmental organizations or associations, who are working for welfare of the society.

- The amendment has expanded the list of persons, who are prohibited from receiving foreign contribution.

- It has added “public servant”, as defined in the Indian Penal Code, 1860 to this list.

- The amended Act, prohibits persons authorized under FCRA to receive foreign contributions, from transferring such foreign contributions to any person.

- The cap on administrative expenses through foreign contributions have been reduced to 20% from 50%.

- The act empowers the Government to prohibit a person to utilize the fund, if the Government believes that such person has contravened the FCRA.

- Such a restriction can be imposed by the Government, pending further inquiry and before a person is found guilty of such contravention.

- The amended Act requires the recipient of foreign contribution to receive such amount, only in an account designated as “FCRA Account”, opened in a branch of the State Bank of India at New Delhi.

- The Act has given the government power to suspend the registration certificate of a person for up to 360 days, pending an inquiry for cancellation of FCRA registration.

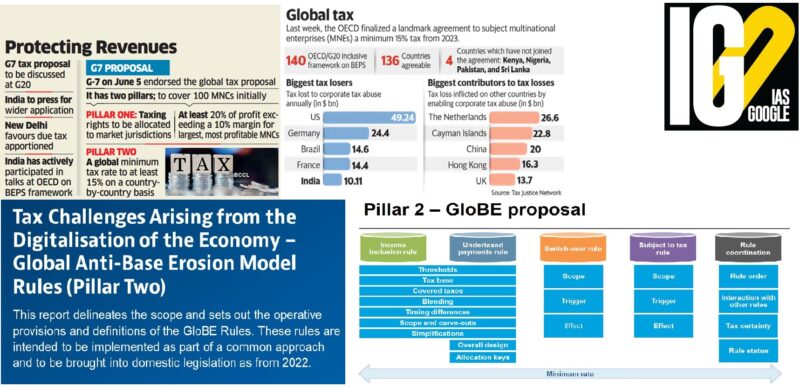

Global corporate Minimum Tax Rate?

Global corporate Minimum Tax Rate?

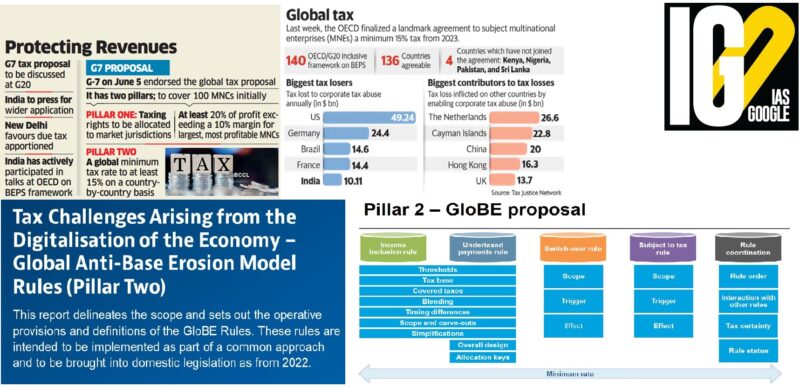

- A global corporate minimum tax is a tax regime established by international agreement.

- The countries adhering to the agreement would impose a specific minimum tax rate on the income of corporations subject to the respective jurisdictions’ tax laws.

- The OECD and G20 countries joined forces and developed an Action Plan to address BEPS (base erosion and profit shifting)

- They created the OECD/G20 Inclusive Framework on BEPS.

- It is signed by 136 countries including India, who agreed to enforce a minimum corporate tax rate of15%.

- Aim: To ensure that large Multinational Enterprises (MNEs) pay tax where they operate and earn profits.

- Pillar One

- It will ensure a fairer distribution of profits and taxing rights among countries with respect to the largest MNEs, including digital companies.

- It would re-allocate some taxing rights over MNEs from their home countries to the markets where they have business activities and earn profits.

- To discourage MNCs from making foreign investment decisions on the basis of low tax rates.

- To address base erosion and profit shifting (BEPS) caused by MNCs’ tax-avoidance practices

- To discourage multinationals from shifting profits and tax revenues to low-tax countries

- It would reduce tax competition and create a fairer distribution of tax revenues.

- To meet challenges created by the increasingly digitalized global economy.

- The Pillar Two model rules provide governments a building-block in the development of a two-pillar solution.

- Aim: To address the tax challenges arising from digitalisation and globalisation of the economy.

- The rules set out the mechanism for Global Anti-Base Erosion (GloBE) rules under Pillar Two:

- It will introduce a global minimum corporate tax rate set at 15% from 2023.

- The minimum tax will apply to MNEs with revenue above EUR 750 million

- It is estimated to generate around USD 150 billion in additional global tax revenues annually.

- The GloBE rules provide for a coordinated system of taxation.

- Aim: To ensure large MNE groups pay this minimum level of taxon income arising in each of the jurisdictions in which they operate.

- The rules create a “top-up tax” to be applied on profits in any jurisdiction whenever the effective tax rate is below the minimum 15% rate.

- The GloBE Rules apply a minimum rate on a jurisdictional basis.

- government entities, international organisations and non-profit organisations

- entities that meet the definition of a pension, investment or real estate fund.

- The new Pillar Two model rules will assist countries to bring the GloBE rules into domestic legislation in 2022.

- They provide for a coordinated system of interlocking rules that:

- define the MNEs within the scope of the minimum tax;

- set out a mechanism for calculating an MNE’s effective tax rate on a jurisdictional basis

- for determining the amount of top-up tax payable under the rules;

- impose the top-up tax on a member of the MNE group in accordance with an agreed rule order.

- It also addresses the treatment of acquisitions and disposals of group members

- It also includes specific rules to deal with particular holding structures and tax neutrality regimes.

- The rules address administrative aspects and provide for transitional rules for MNEs that become subject to the global minimum tax.

- The minimum tax would discourage countries from competing to attract corporations by offering low tax rates.

- The new rules let countries to impose an extra tax on companies not meeting a 15% effective minimum rate.

- It will encourage multinationals to repatriate capital to their country, giving a boost to those economies.

- The Bargi Dam is also known as the Rani Avanti Bai Sagar Irrigation Project.

- It was the first major reservoir to be built on the Narmada River in Madhya Pradesh.

- Two major irrigation projects, named Bargi Diversion Project and Rani Avantibai Lodhi Sagar Project, have been developed by the Bargi Dam administration

- It irrigates 4.37 lakh hectares of land and produces 105 megawatts of hydropower.

- The dam’s backwaters of the dam have been changed into a lake.

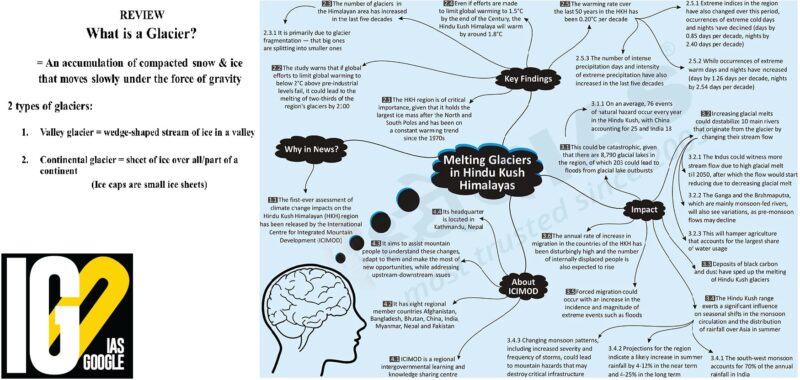

Highlights:

Highlights:

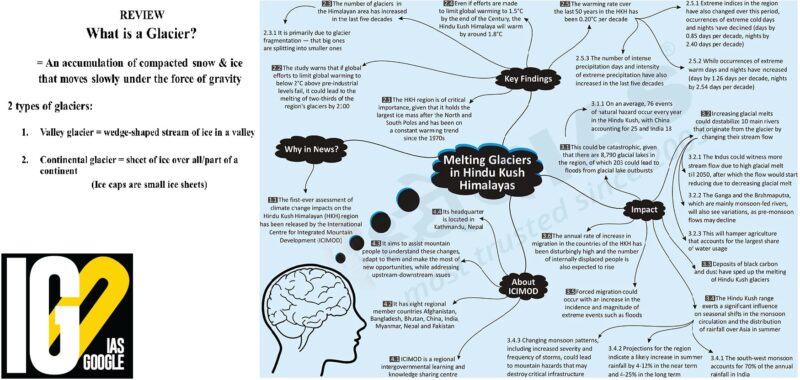

- South Asia region is highly affected due to Avalanches, flooding and other effects of the accelerating loss of ice.

- It threatens the livelihood, agriculture and human life.

- Melting glaciers contributes to sea-level rise, glacial ice loss in the Himalayas also adds to the threat of inundation.

- As the glaciers continue to shrink, the availability of water for irrigation and drinking water could drop steeply.

- Regional climate factors, such as shifts in the South Asian monsoon, may have a role.

- Ice loss from glaciers and polar ice sheets results from rising global temperatures caused by greenhouse-gas emissions from the burning of fossil fuels.

- Research also viewed that human activity as a cause of rising global temperatures.

- A glacier is a persistent body of dense ice that is constantly moving under its own weight.

- A glacier forms where the accumulation of snow exceeds its ablation over many years, often centuries.

- On Earth, 99% of glacial ice is contained within vast ice sheets (also known as "continental glaciers") in the polar regions.

- Glacial ice is the largest reservoir of fresh water on Earth, holding with ice sheets about 69 percent of the world's freshwater.

- These glaciers develop in high mountainous regions, often flowing out of icefields that span several peaks or even a mountain range.

- The largest mountain glaciers are found in Arctic Canada, Alaska, the Andes in South America, and the Himalaya in Asia.

- Commonly originating from mountain glaciers or icefields.

- These glaciers spill down valleys, looking much like giant tongues.

- Valley glaciers may be very long, often flowing down beyond the snow line, sometimes reaching sea level.

- These are valley glaciers that flow far enough to reach out into the sea. In some locations, tidewater glaciers provide breeding habitats for seals.

- Piedmont glaciers occur when steep valley glaciers spill into relatively flat plains, where they spread out into bulb-like lobes.

- Malaspina Glacier in Alaska is one of the most famous examples of this type of glacier, and is the largest piedmont glacier in the world.

- When a major valley glacier system retreats and thins, sometimes the tributary glaciers are left in smaller valleys high above the shrunken central glacier surface. These are called hanging glaciers.

- If the entire system has melted and disappeared, the empty high valleys are called hanging valleys.

- Cirque glaciers are named for the bowl-like hollows they occupy, which are called cirques.

- They are found high on mountainsides and tend to be wide rather than long.

- Rock glaciers are combinations of ice and rock.

- Although these glaciers have similar shapes and movements as regular glaciers, their ice may be confined to the glacier core, or may simply fill spaces between rocks.

- Rock glaciers may form when frozen ground creep's downslope.

- They may also accumulate ice, snow, and rocks through avalanches or landslides.

- AgNext Technologies, in partnership with Spices Board of India has deployed its innovative curcumin testing technology for assessment of Lakadong turmeric, which is grown in the Jaintia Hills, Meghalaya.

- Lakadong turmeric is globally considered to be one of the best quality turmeric.

- It has high curcumin content (between 7-12 %) compared to other varieties of turmeric which have an average curcumin content of 3-5 %.

- Curcumin is the key quality testing parameter of turmeric.

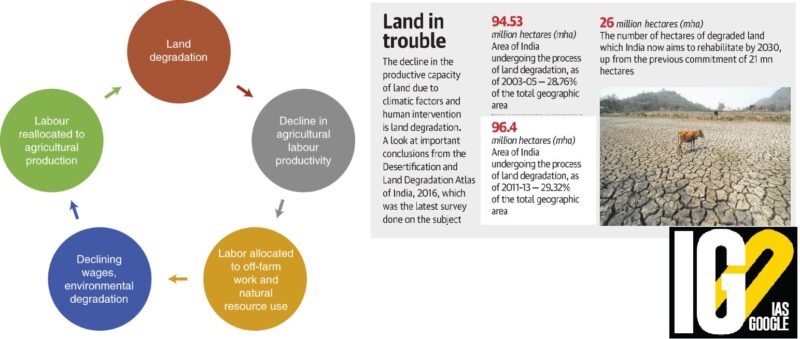

Findings:

Findings:

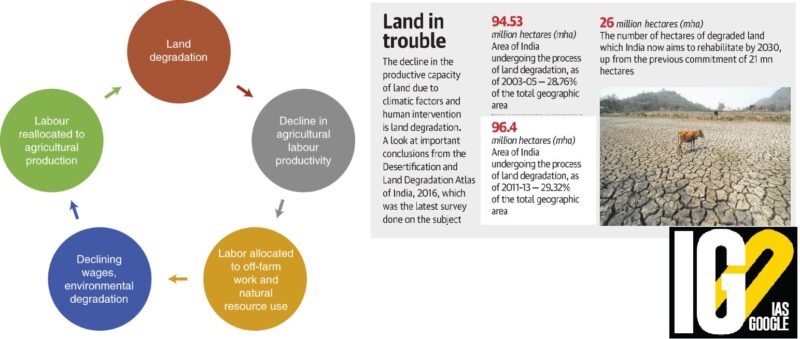

- The degradation of land is posing a threat to the Thar desert ecology.

- Sandstorms from the desert will travel as far as the National Capital Region (NCR) in the years to come.

- The gradual destruction of the Aravali ranges leads to the expansion of Thar desert in western Rajasthan.

- Sandstorms will become intense with the erosion of the Aravali hills, which act as a ‘natural green wall’ between the desert and the plains.

- It is a large arid region in the northwestern part of the Indian subcontinent that covers an area of 200,000 km².

- It forms a natural boundary between India and Pakistan.

- Population Density: It is the most densely populated desert in the world, having a human population density of over 80 people per km2.

- The northeastern part of the Thar Desert lies between the Aravalli Hills.

- The desert stretches:

- To Punjab and Haryana in the north.

- To the Great Rann of Kutch along the coast.

- To the alluvial plains of the Indus River in the west and northwest.

- The climate in Thar is arid and subtropical.

- The mean average temperature varies from a minimum of 24 degrees C to 26 degrees C in summer to 4 degrees C to 10 degrees C in winter.

- The average annual rainfall of the region varies from 100 to 500 mm.

- (New point) It is distributed very erratically, occurring mostly between July and September.

- Flora: Vachellia jacquemontii, Balanites roxburghii, Ziziphus zizyphus, Ochthochloa

- Fauna: Blackbuck, chinkara, and Indian wild ass.

- Land degradation is a process in which the value of the biophysical environment is affected by a combination of human-induced processes acting upon the land.

- It can be termed as the loss of the productive capacity of the soils for present and future use.

- It is a global challenge that affects everyone through food insecurity, higher food prices, climate change, environmental hazards, and the loss of biodiversity and ecosystem services.

- In India currently, 85 million hectares (mha) of land, which is equal to an area 2.5 times the size of India’s largest state Rajasthan has already been degraded.

- Of this, 3.32 mha an area 22 times the size of Delhi has been added in the 15 years between 2003-05 and 2018-19.

- Rajasthan accounts for almost 22 % of the degraded land in the country.

- It reclaimed almost 388,000 ha, an area roughly 2.6 times the size of Delhi.

- Uttar Pradesh has 285,665hectares area (ha) and Telangana has 19,974 (ha) together reclaimed degraded land twice the size of Delhi during the period.

- Deforestation:

- Forests help bind up soil particles with the help of roots of vegetation. Therefore, cutting оf forests will affect the soil adversely.

- Excessive Use of Fertilizers and Pesticides:

- Excessive use of fertilizers is causing an imbalance in the number of certain nutrients in the soil, which imbalance adversely affects the vegetation.

- Salination:

- An increase in the concentration of soluble salts in the soil is called salination. India has about six million hectares of saline land.

- Poor Drainage of Soil:

- Salts dissolved in irrigation water accumulate on the soil surface due to inadequate drainage, especially during the flood.

- Desertification:

- It is a destruction of the biological potential of land which leads to ultimately to desert-like conditions.

Aurora

Aurora

- Aurora is natural light displayed in Earth's sky.

- It is predominantly seen in high-latitude regions (around the Arctic and Antarctic).

- Auroras are the result of disturbances in the magnetosphere caused by solar wind.

- The disturbances alter the trajectories of charged particles in the magnetospheric plasma. These particles, mainly electrons, and protons precipitate into the upper atmosphere.

- The resulting ionization and excitation of atmospheric constituents emit light of varying color and complexity.

- The form of the aurora, occurring within bands around both polar regions, is also dependent on the amount of acceleration imparted to the precipitating particles.

- Auroras occur in a band known as the "auroral zone".

- It is typically 3° to 6° wide in latitude and between 10° and 20° from the geomagnetic poles at all local times (or longitudes), most clearly seen at night against a dark sky.

- It is a region that currently displays an aurora is called the "auroral oval", a band displaced by the solar wind towards the night side of Earth.

- The geomagnetic connection comes from the statistics of auroral observations.

- In northern latitudes, the effect is known as the aurora borealis or the northern lights.

- The southern counterpart, the aurora australis or the southern lights, has features almost identical to the aurora borealis and changes simultaneously with changes in the northern auroral zone.

- Auroras are occasionally seen in latitudes below the auroral zone when a geomagnetic storm temporarily enlarges the auroral oval.

- A mild glow, near the horizon. These can be close to the limit of visibility but can be distinguished from moonlit clouds because stars can be seen undiminished through the glow.

- Patches, that looks like a cloud.

- Arcs - It is the curve across the sky.

- Rays - are light and dark stripes across arcs, reaching upwards by various amounts.

Highlights:

Highlights:

- It is a Nation-wide campaign:

- to Redress the Public Grievances

- to promote citizen centric governance

- to improve Service Delivery

- Objective: To translate the vision of the Prime Minister for Next Generation Administrative Reforms across all Districts and Tehsils of India.

- Aim: To motivate women and adolescent girls to use sanitary napkins as well as to bring awareness related to their dignity, safety, and menstruation.

- 12 sanitary napkins per month will be distributed free of cost to every adolescent and female beneficiary in the age group of 10 to 45 years at anganwadi centres on each block.

- There would be one stop centre buildings for:

- If a woman suffers any kind of violence,

- Medical support,

- Legal aid,

- Temporary living space,

- Mental and emotional support.

Latest News

Latest News

General Studies

General Studies