- Home

- Prelims

- Mains

- Current Affairs

- Study Materials

- Test Series

India can guide G20's disaster management initiatives

- Recent years have seen an increase in both natural and human-made catastrophes across the globe.

- G20 has endorsed a new working group on disaster risk reduction, to make itself well-positioned to prioritise disaster risk financing to achieve the targets set by the Sendai Framework for 2030.

- G20 has a crucial role to play in supporting countries to strengthen their financial risk management capabilities.

Disasters: Challenges, Impact and Necessity of Reduction

Impacts:

- Disasters exacerbate poverty, thwart development and generate social polarisation across nations and communities.

- Annual disaster losses account for a significant share of GDP in many low-income economies.

Challenges:

- Difficulty in gathering and analyzing hazard and exposure data.

- Need to enhance technical and institutional capacity for risk assessment and modelling, and

- Goal of achieving comprehensive coverage for disaster risks.

Necessity of reductions in disaster risk and losses:

- The IPCC’s Sixth Assessment Report highlights that a significant number of people live in areas that are highly vulnerable to climate change.

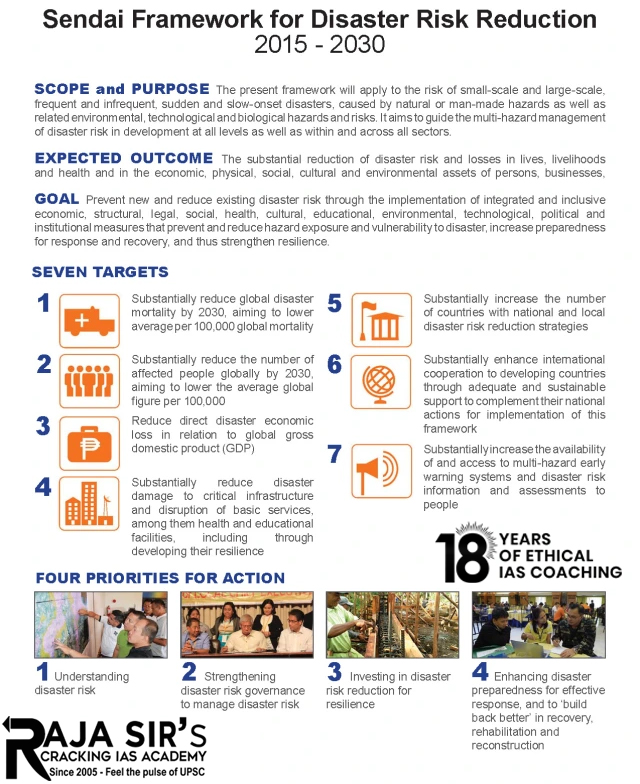

- The Sendai Framework for Disaster Risk Reduction calls for substantial reductions in disaster risk and losses.

- There is a growing recognition that disaster resilience must be a priority.

- However, bridging the gap between high-level objectives and practical investments remains a challenge.

|

Sendai Framework for Disaster Risk Reduction (2015-2030)

Aims:

It works based on 4 priorities:

|

G20’s new Disaster Risk Reduction Working Group (DRRWG)

- DRRWG has recognised the importance of prioritising disaster risk financing.

- It will offer an extensive overview of disaster risk assessment and financing practices across a wide range of economies.

- It will also support the harmonization of definitions and methodologies for data collection and analysis to improve access to international (re)insurance markets.

- It will strive to address all the key components of a comprehensive financial management strategy for disaster risks. These include:

- Disaster risk assessment and modeling

- Affordable and comprehensive insurance coverage of disaster risks

- Financial assistance and compensation for affected individuals and businesses

- Risk transfer mechanisms, including catastrophe bonds and insurance, for the management of fiscal risks

With its vast experience in handling natural disasters, India can take the lead in raising awareness about the financial consequences of such events. it can lead to the development of a regulatory framework that strengthens insurance companies'' ability to handle disaster-related losses.

Latest News

Latest News

General Studies

General Studies