While the Monetary Policy refers to the actions undertaken by a nation’s central bank to control the money supply to achieve macroeconomic goals that promote sustainable economic growth, while the Fiscal Policy refers to the use of government spending and tax policies to influence economic conditions, especially macroeconomic conditions, including aggregate demand for goods and services, employment, inflation, and economic growth.

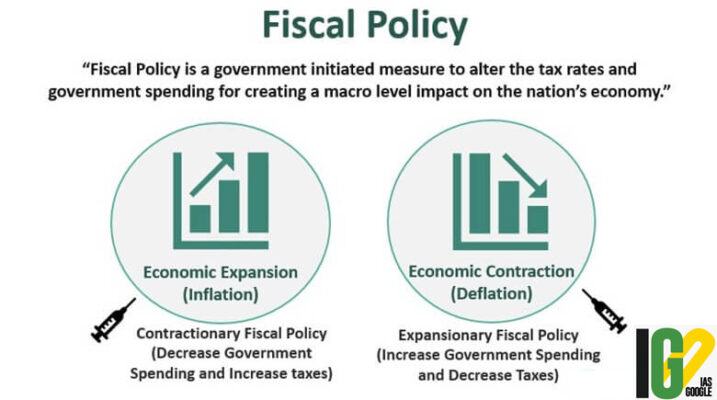

Fiscal Policy When the government of a country employs its tax revenue and expenditure policies to influence the overall demand and supply for commodities and services in the nation’s economy is known as Fiscal Policy. It is a strategy used by the government to maintain the equilibrium between government receipts through various sources and spending over different projects. The fiscal policy of a country is announced by the finance minister through budget every year. If the revenue exceeds expenditure, then this situation is known as fiscal surplus, whereas if the expenditure is greater than the revenue, it is known as the fiscal deficit. The main objective of the fiscal policy is to bring stability, reduce unemployment and growth of the economy. The instruments used in the Fiscal Policy are the level of taxation & its composition and expenditure on various projects. There are two types of fiscal policy, they are:- Expansionary Fiscal Policy: The policy in which the government minimises taxes and increase public spending.

- Contractionary Fiscal Policy: The policy in which the government increases taxes and reduce public expenditure.

Monetary Policy

Monetary Policy

Monetary Policy is a strategy used by the Central Bank to control and regulate the money supply in an economy. It is also known as credit policy. In India, the Reserve Bank of India looks after the circulation of money in the economy.

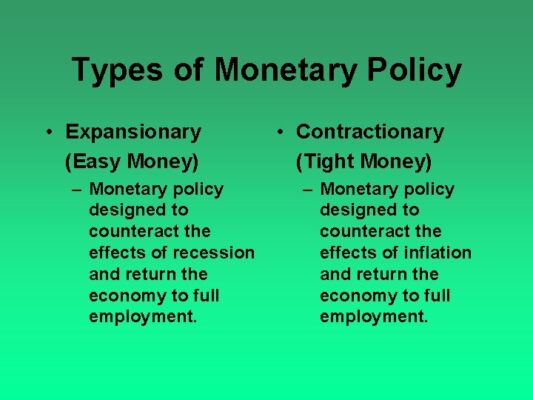

There are two types of monetary policies, i.e. expansionary and contractionary. The policy in which the money supply is increased along with minimization of interest rates is known as Expansionary Monetary Policy. On the other hand, if there is a decrease in money supply and rise in interest rates, that policy is regarded as Contractionary Monetary Policy.

The primary purposes of the monetary policy include bringing price stability, controlling inflation, strengthening the banking system, economic growth, etc. The monetary policy focuses on all the matters which have an influence on the composition of money, circulation of credit, interest rate structure. The measures adopted by the apex bank to control credit in the economy are broadly classified into two categories:

Monetary Policy is a strategy used by the Central Bank to control and regulate the money supply in an economy. It is also known as credit policy. In India, the Reserve Bank of India looks after the circulation of money in the economy.

There are two types of monetary policies, i.e. expansionary and contractionary. The policy in which the money supply is increased along with minimization of interest rates is known as Expansionary Monetary Policy. On the other hand, if there is a decrease in money supply and rise in interest rates, that policy is regarded as Contractionary Monetary Policy.

The primary purposes of the monetary policy include bringing price stability, controlling inflation, strengthening the banking system, economic growth, etc. The monetary policy focuses on all the matters which have an influence on the composition of money, circulation of credit, interest rate structure. The measures adopted by the apex bank to control credit in the economy are broadly classified into two categories:

- General Measures (Quantitative Measures):

- Bank Rate

- Reserve Requirements i.e. CRR, SLR, etc.

- Repo Rate Reverse Repo Rate

- Open market operations

- Selective Measures (Qualitative Measures):

- Credit Regulation

- Moral persuasion

- Direct Action

- Issue of directives

- The policy of the government in which it utilizes its tax revenue and expenditure policy to influence the aggregate demand and supply for products and services the economy is known as Fiscal Policy. The policy through which the central bank controls and regulates the supply of money in the economy is known as Monetary Policy.

- Fiscal Policy is carried out by the Ministry of Finance whereas the Monetary Policy is administered by the Central Bank of the country.

- Fiscal Policy is made for a short duration, normally one year, while the Monetary Policy lasts longer.

- Fiscal Policy gives direction to the economy. On the other hand, Monetary Policy brings price stability.

- Fiscal Policy is concerned with government revenue and expenditure, but Monetary Policy is concerned with borrowing and financial arrangement.

- The major instrument of fiscal policy is tax rates and government spending. Conversely, interest rates and credit ratios are the tools of Monetary Policy.

- Political influence is there in fiscal policy. However, this is not in the case of monetary policy.

| S. No. | Monetary Policy | Fiscal Policy |

|---|---|---|

| 1 | The monetary policy addresses interest rates and the supply of money in circulation, and it is generally managed by a central bank. | The fiscal policy addresses taxation and government spending, and it is generally determined by government legislation. |

| 2 | Monetary Policy is announced by the monetary authority of the country (Central Bank). | Fiscal policy is announced by the Ministry of Finance. |

| 3 | Monetary policy is more of a blunt tool in terms of expanding and contracting the money supply to influence inflation and growth and it has less impact on the real economy. | The fiscal policy generally has a greater impact on consumers than monetary policy, as it can lead to increased employment and income. |

| 4 | The monetary policy seeks to spark economic activity. | The fiscal policy seeks to address either total spending, the total composition of spending, or both. |

| 5 | Expansionary monetary policy can have limited effects on growth by increasing asset prices and lowering the costs of borrowing, making companies more profitable. | If the economy is near full capacity, expansionary fiscal policy risks sparking inflation. |

| 6 | Monetary policy can boost consumer spending through lower interest rates that make borrowing cheaper on everything from credit cards to mortgages. | Fiscal policy involves tax and spending decisions set by the government and will impact individuals’ tax bills or provide them with employment from government projects. |

Latest News

Latest News

General Studies

General Studies