- Home

- Prelims

- Mains

- Current Affairs

- Study Materials

- Test Series

EDITORIALS & ARTICLES

EDITORIALS & ARTICLES

06th Aug 2021

ADMINISTRATIVE REFORMS AIM TO ENCOURAGE GREATER EFFICIENCY, TRANSPARENT AND CORRUPTION FREE GOVERNANCE, ACCOUNTABILITY AND REDUCE SCOPE FOR DISCRETION

Recently, the Union Minister of State Personnel, Public Grievances and Pensions have said that Administrative reforms are a continuous process and the Government follows the maxim “Minimum Government - Maximum Governance”.

Major Administrative Reforms by Government

Mission Karmayogi

- It is a new capacity-building scheme for civil servants aimed at upgrading the post-recruitment training mechanism of the officers and employees at all levels.

- It will be delivered by setting up a digital platform called iGOTKarmayogi.

- The iGOT platform will act as a launchpad for the National Programme for Civil Services Capacity Building (NPCSCB), which will enable a comprehensive reform of the capacity building apparatus at the individual, institutional and process levels.

- NPCSCB will be governed by the Prime Minister’s Human Resource Council, which will also include state Chief Ministers, Union Cabinet ministers and experts.

- A wholly-owned Special Purpose Vehicle (SPV) will be set up under Section 8 of the Companies Act, 2013 to govern the iGOT-Karmayogi platform.

- The SPV will be a “not-for-profit” company and will own and manage iGOT-Karmayogi platform.

- A sum of Rs 510.86 crore will be spent over a period of 5 years from 2020-21 to 2024-25 in order to cover 46 lakh central employees.

- It is a Digital Governance Platform for Easy, Instant and Secure Exchange of Information.

- It is a real time, on-line system for monitoring of follow-up action on the decisions taken during the meetings/presentations made by different Departments to the Department of Public Enterprises.

- It is online monitoring and compliance mechanism which has been developed to fast track the compliance of pending action-points/proposals /issues/projects/schemes/targets, etc. of various implementing agencies.

- It aims to support Governance by ushering in more effective and transparent inter and Intra-Government processes.

- The vision of e-Office is to achieve a simplified, responsive, effective and transparent working of all Government Offices.

- The Open Architecture on which eOffice has been built, makes it a reusable framework and a standard reusable product amenable to replication across the Governments, at the Central, State and District levels.

- It was launched, which assesses the Status of Governance and impact of various interventions taken up by the State Government and Union Territories (UTs).

- The objectives of GGI are to provide quantifiable data to compare the state of governance in all States and UTs.

- It enable States and UTs to formulate and implement suitable strategies for improving governance and shift to result oriented approaches and administration.

- It provides a platform for government to engage with experts, intellectuals from industry and academic institutions to exchange experiences relating to e-Governance initiatives

- It is jointly organised by Department of Administrative Reforms & Public Grievances (DARPG), Ministry of Personnel, Public Grievances & Pensions, and Ministry of Electronics and Information Technology (MeitY).

- It aims at assessing the States, UTs and Central Ministries on the efficiency of e-Governance service delivery.

- The purpose of this survey is to gain insight on the citizens’ experience in availing e-services from their respective States/UTs.

- Centralized Public Grievance Redress and Monitoring System (CPGRAMS)

- It is an online web-enabled system over NICNET developed by NIC, in association with Directorate of Public Grievances (DPG) and Department of Administrative Reforms and Public Grievances (DARPG).

- The Government is undertaking CPGRAMS reforms in the top grievance receiving Ministries/ Departments by enabling questionnaire guided registration process.

- It is a month-long campaign to increase the pace of implementation of Jal Jeevan Mission in Ladakh.

- It aims to inform and engage village communities on the importance of clean water.

- It will run at the Block and Panchayat level in two phases.

- The first phase will run from 1st to 14th August and the second phase will run from 16th to 30th August, 2021.

- It will adopt a three-pronged approach i.e. focussing on water quality testing, planning and strategizing water supply, and seamless functioning of Pani Sabha in villages.

- The village communities will be encouraged to send water samples to water quality laboratories for quality checks and monitoring under Pani Maah Campaign.

- The phase 1 will focus on Swachhta Sarvekshan and Sanitation drives by Village Water and Sanitation Committee (VWSC)/ Pani Samiti members.

- During this phase water sample will be collected from all identified sources and service delivery points for testing.

- The first phase will also include awareness and sensitisation campaigns.

- Phase two of ‘Pani Maah’ will focus on organizing the Pani Sabhas/ Gram Sabhas/ Block level meetings and door to door visits for effective communication on water quality and service delivery under JJM.

- During this phase, Jal Jeevan Mission implementation, water quality test reports and analysis will be discussed with the villagers in an open forum.

- A village/ block-wise schedule have also been prepared for water sample collection and the Gram Sabhas to ensure maximum participation of villagers in the campaign.

- It was launched in 2016 by the then Union Minister of Textiles.

- It is an initiative of Ministry of Textiles to register and provide Identity (ID) cards to handicraft artisans and link them to a national database.

- Pahchan cards scheme is a new upgraded ID card for artisans that will be linked with their Aadhaar numbers and bank accounts so that they can receive direct cash transfer benefit.

- It has the information of handicrafts artisans viz. name & address, Aadhaar Card number, mobile number and craft practiced.

- The ID card will enable the artisans to avail easy loan at nominal interest rate.

- The ID cardholders will get the benefit of life insurance and Rs.1200 per year for their children studying between Class IX and Class XII.

- The patent certificate was issued to KVIC’s Kumarappa National Handmade Paper Institute (KNHPI), Jaipur.

- The idea of developing plastic-mixed handmade paper was invented in 2018 and the project was executed by the team of scientists at KNHPI.

- The plastic-mixed handmade paper was developed under Project REPLAN (REducing PLAstic from Nature).

- The production of waste-plastic mixed handmade paper is likely to serve the twin objectives of protecting the environment alongside creating sustainable employment.

- The technology developed by KVIC uses both high & low density waste polythene that not only adds extra strength to the paper but also reduces the cost by up to 34%.

- The product is recyclable and eco-friendly.

- It is the first of its kind project in India, where plastic waste is de-structured, degraded, diluted and used with paper pulp while making handmade paper and thus reduces plastic waste from nature.

- It was launched in 2018 in line with Prime Minister’s ‘Swachh Bharat Abhiyaan’ (Clean India Mission).

- It is a call for fighting the menace of single-use plastic.

- Its primary objective is to remove the existing waste plastic material from nature and use it in a semi-permanent manner.

- Under Project REPLAN, the waste plastic from nature is collected, de-structured and de-gradated and then mixed with paper pulp in a ratio of 80 is to 20.

- The meaning of the word ‘retrospective’ is ‘looking backward’.

- It relates to thinking about the past, ‘looking back over the past’, etc.

- In terms of taxation, retrospective tax means giving effect to the amendment in the present law before the date on which the changes were brought in.

- It taxes a transaction that took place prior to the law being framed.

- A retrospective tax is one that is charged for transactions in the long past.

- It can be a new or additional charge on transactions done in the past.

- The retrospective tax is to make adjustments when policies in the past and the present are so vastly different that tax paid before under the old policy could be said to have been less.

- Retrospective taxation allows a nation to implement a rule to impose a tax on certain products, goods or services and deals and charge companies from a time before the date on which the law is passed.

- The countries use this form of taxation to rectify any deviations in the taxation policies that, in the past, allowed firms to take benefit from any loophole.

- Such retrospective amendments militate against the principle of tax certainty and damage India's reputation as an attractive destination.

- It would reignite the choice of India as a favourable investment destination which already has low tax rates.

- It recognises the importance of certainty in tax laws, which is key in ensuring confidence in India as an attractive investment destination.

- It could help restore India's reputation as a fair and predictable regime apart from helping put an end to unnecessary, prolonged and expensive litigation.

- It could favourably impact foreign direct investment (FDI) inflows into the country and will have a trickle-down effect on the secondary markets.

- The MPC has kept Repo rate (the RBI’s lending rate to banks) unchanged at four per cent for the seventh time in a row, and reverse repo rate (the RBI’s borrowing rate from banks) at 3.35 per cent.

- The panel has also raised the inflation target for fiscal 2001-22 but maintained the growth forecast at 9.5 per cent.

- The MPC has decided to continue with an accommodative stance as long as necessary to revive and sustain growth on a durable basis and continue to mitigate the impact of Covid-19 on the economy.

- The RBI panel says the nascent and hesitant recovery in the economy needs to be nurtured through fiscal, monetary and sectoral policy levers.

- The elevated inflation level and delayed recovery in the economy would have prompted the panel to keep rates steady.

- The input prices are rising across manufacturing and services sectors and weak demand and efforts towards cost cutting are tempering the pass-through to output prices.

- A calibrated reduction of the indirect tax component of pump prices by the Centre and states can help to substantially lessen cost pressures with crude oil prices at elevated levels.

- The RBI Governor has said that the crude oil prices are volatile with implications for imported cost pressures on inflation.

- The combination of elevated prices of industrial raw materials, high pump prices of petrol and diesel with their second-round effects, and logistics costs continue to impinge adversely on cost conditions for manufacturing and services.

- The Inflation may remain close to the upper tolerance band up to Q2 of 2021-22, but these pressures should ebb in Q3 of 2021-22 on account of Kharif harvest arrivals and as supply side measures take effect.

- The MPC has retained the real GDP growth at 9.5 per cent in 2021-22 consisting of 21.4 per cent in Q1, 7.3 per cent in Q2, 6.3 per cent in Q3 and 6.1 per cent in Q4 of 2021-22.

- The Real GDP growth for Q1 of 2022-23 is projected at 17.2 per cent.

- The measures to be adopted to kick-start a long-awaited revival:

- Improving capacity utilization;

- Rising steel consumption;

- Higher imports of capital goods;

- Congenial monetary and financial conditions; and

- The economic packages announced by the Central Government

- The innovation and working models adopted during the pandemic by businesses will continue to reap efficiency and productivity gains even after the pandemic recedes.

- The high-frequency indicators suggest that consumption (both private and Government), investment and external demand are all on the path of regaining traction.

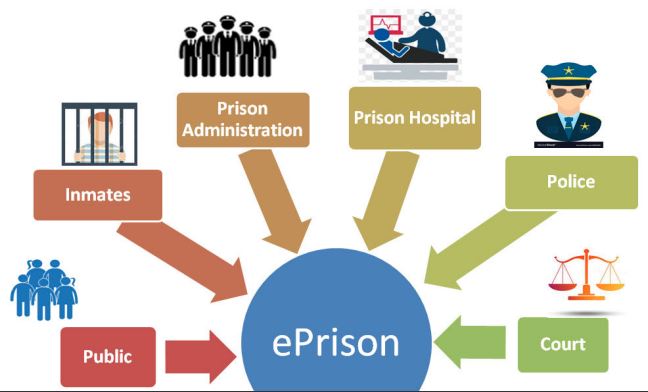

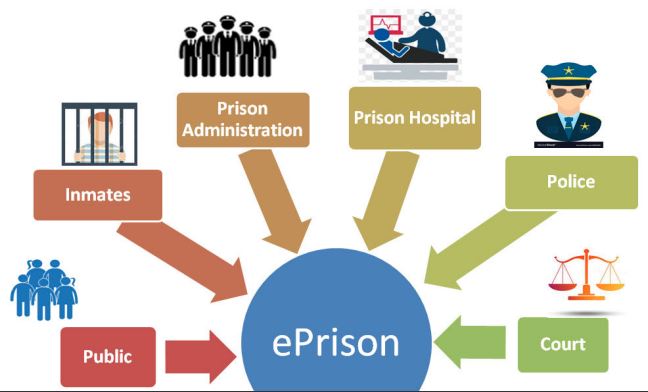

- It aims at computerization of the functioning of prisons in the country.

- It has been operationalised in all States and Union Territories.

- It is developed by National Informatics Centre (NIC), Ministry of Electronics & IT (MeitY).

- It is cloud based product designed with easy to use GUI and embedded with a comprehensive security features.

- It can be easily adopted by any state prisons department with minimum customization efforts since all the possible customization features are parameterized and can be configured by the users.

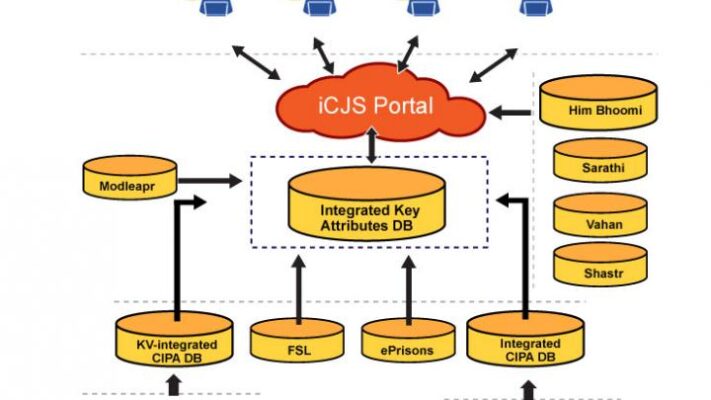

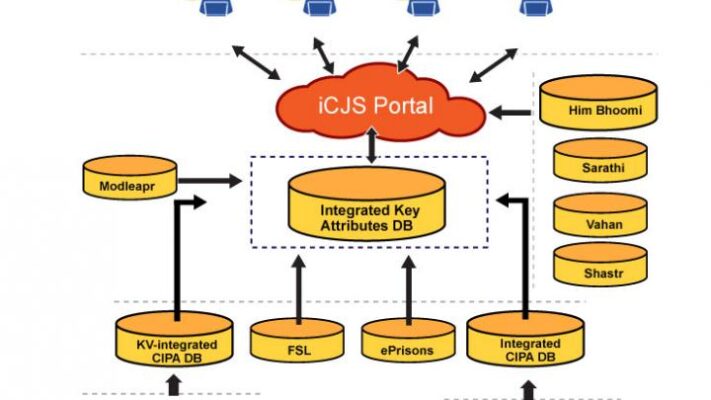

- The e-Prisons data has been integrated with Police and Court system under the Inter-operable Criminal Justice System.

- The e-Prisons uses data maintained by the States and Union Territories on the National Prisons Information Portal as per protocols notified for e-Prisons.

- The system can be accessed through the secure National Informatics Centre (NIC) network, exclusively by the authorized officials of Law Enforcement Agencies and Prisons, through Inter-operable Criminal Justice System (ICJS).

- The scope of this project is to computerize and integrate all the activities related to prison and prisoner management in the jail.

- It provides vital information about the inmates, lodged in the prisons, in real time environment to the prison officials and other entities, involved in Criminal Justice System.

- It also facilitates online visit request and grievance redressal.

- e-Prisons MIS: Management Information System used at the prisons for their day to day regular activities; The major modules of ePrisons MIS are:

- Prisoner Information Management System (PIMS);

- Visitor Management System (eVisitor);

- Hospital Management System (eHospital);

- Legal Aid Management System;

- Inventory Management System;

- Prison Management System (PMS);

- Police Intelligence System;

- Court Monitoring; and

- Kiosk Information

- NPIP: National Prisons Information Portal is a citizen centric portal showing statistical data of various prisons in the country

- Visitors can book there visit request to meet their ward inside the prison through this portal;

- Grievances with respect to their wards inside the prisons can also submitted through the portal; and

- This portal also provides with inmate tracking facilities in a secured way to various investigating agencies.

- Kara Bazaar: Portal for showcasing and selling the products manufactured in various prisons of the country by inmates.

- Necessary platform required for on boarding for all the state prison departments are in place.

- It is a common platform for information exchange and analytics of all the pillars of the criminal justice system comprising of Police, Forensics, Prosecution, Courts & Prisons.

- It enables a nationwide search on police, prisons & courts databases across all States/ UTs in the country.

- It is invested under the CCTNS project of the Ministry of Home Affairs.

- Its aim is to reduce errors and time taken in sharing of necessary information between the pillars, which often lead to larger challenges.

- The Ministry has classified all its major programmes under three umbrella schemes i.e. Mission Poshan 2.0, Mission Vatsalya and Mission Shakti, for their better implementation.

- Mission VATSALYA will look into child protection services and child welfare services.

- The central government has allocated Rs. 900 crores in the budget 2021-2022 for Mission Vatsalya.

- It is erstwhile known as Integrated Child Protection Scheme (ICPS).

- It is a flagship programme to provide preventive and statutory care, and rehabilitation services to children in need of care

- It provides protection to those in conflict with the law as defined under the Juvenile Justice (Care and Protection of Children) Act, 2015.

- It is a centrally sponsored scheme aimed at building a protective environment for children in difficult circumstances, as well as other vulnerable children, through Government-Civil Society Partnership.

- It brings together multiple existing child protection schemes of the Ministry under one comprehensive umbrella, and integrates additional interventions for protecting children and preventing harm.

- It was brought under the Umbrella Integrated Child Development Services (ICDS) scheme as one of its sub-schemes in 2017-18.

- Institutional services: Care, shelter and rehabilitation to both children in conflict with the law and children in need of care and protection through Child Care Institutes (CCIs). CCIs include Open Shelters, Children Homes, and Specialised Adoption Agencies (SAAs).

- Family based non-institutional care: The JJ Act provides for the rehabilitation and reintegration of children through sponsorship, foster care, adoption and aftercare. The ‘aftercare’ services are supposed to be provided to those in the 18 to 21 years age group.

- Emergency outreach service through ‘Childline’: The ‘Childline’ is a 24-hour emergency phone outreach service for children needing care and protection, linking them to long-term care and rehabilitation services.

- General grant-in-aid for need-based or innovative interventions: A grant-in-aid is given to states depending on the geographic locality and socio-economic status, among other considerations.

Latest News

Latest News General Studies

General Studies