- Home

- Prelims

- Mains

- Current Affairs

- Study Materials

- Test Series

EDITORIALS & ARTICLES

EDITORIALS & ARTICLES

30th Oct 2021

WHAT IS ‘PODU’ LAND ISSUE IN TELANGANA?

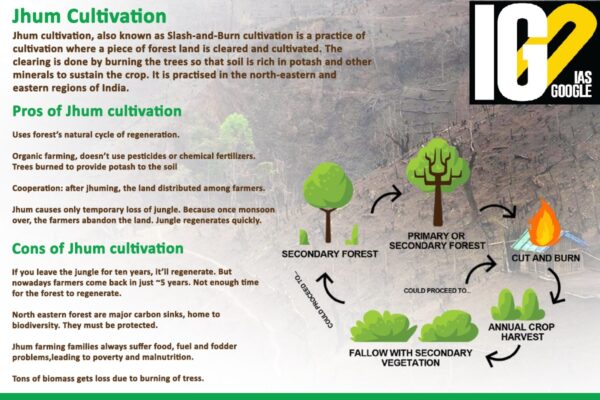

The Telangana government has decided to move landless, non-tribal farmers engaged in shifting cultivation (podu) from forests to peripheral areas in order to combat deforestation.

Shifting Agriculture:

Recently, the defence minister calls for cooperative response to deal with maritime challenges as mandated under UN Convention on the Law of Seas (UNCLOS), 1982.

Indo-Pacific Regional Dialogue (IPRD) 2021:

Recently, the defence minister calls for cooperative response to deal with maritime challenges as mandated under UN Convention on the Law of Seas (UNCLOS), 1982.

Indo-Pacific Regional Dialogue (IPRD) 2021:

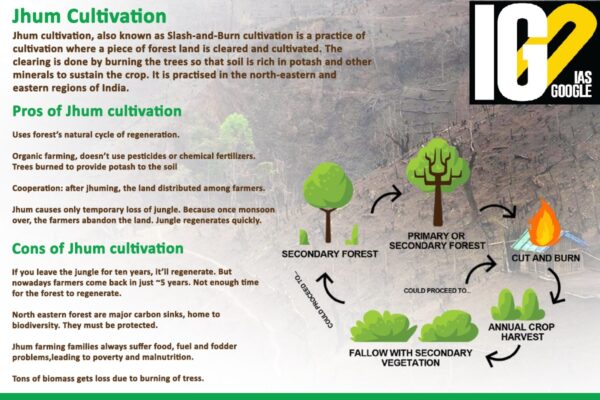

- Shifting agriculture is a system of cultivation that preserves soil fertility by (field) rotation.

- In shifting agriculture, a plot of land is cleared and cultivated for a short period of time;

- It is abandoned and allowed to revert to its natural vegetation while the cultivator moves on to another plot.

- The period of cultivation is usually terminated when the field is overrun by weeds.

- This form of agriculture is one of the most sustainable methods. it helps used land to get back lost nutrients.

- The land can be easily recycled or regenerated, it receives seeds and nutrients from the nearing vegetation or environment.

- It saves a wide range of resources because a small area is usually cleared and the burned vegetation offers many nutrients.

- It helps to ensure more productivity and sustainability of agriculture.

- It is an environmentally friendly mode of farming as it is organic.

- Shift cultivation is a mode or form of weed control.

- It also plays a crucial role in pest control.

- It can lead to deforestation when soil fertility is exhausted

- Farmers move on and clear another small area of the forest.

- Shift farming can cause soil erosion and desertification.

- It destroys water sheds

- Shift farming is uneconomical

- It easily leads to loss of biodiversity

- Water pollution in coastal areas occur because of raw sewage and oil residue.

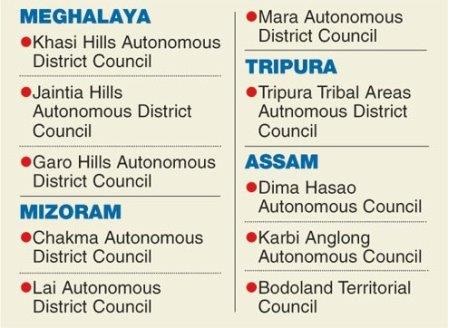

- The Khasi Hills Autonomous District Council (KHADC), will introduce the Khasi Hills Autonomous District Khasi Inheritance of Property Bill, in November 2021.

- KHADC will focus on “equitable distribution” of parental property among siblings including both male and female.

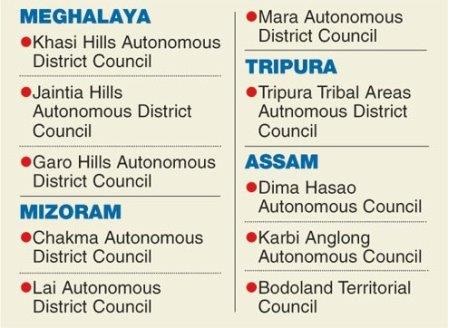

- The Autonomous District Councils (ADCs) are Institutions of local governance created under the Sixth Schedule of the Constitution of India.

- The Sixth Schedule was designed to protect tribal identity, preserve tribal custom and tradition.

- It protects indigenous systems of management over their land, forest, and natural resources.

- The Khasi Hills Autonomous District Council (KHADC) was constituted under the Sixth Schedule to the Constitution of India.

- It comes under Article 244, and 275 of the Constitution with Executive, Legislative and Judicial powers.

- Executive

- The executive committee (EC) of district council carry executive functions like:

- To construct or manage primary schools, dispensaries, markets, roads.

- Water ways, land revenue, and administration of villages and towns.

- The chief executive members (CEM) are elected by district council amongst themselves and by the Governor.

- Legislative

- District councils can make laws for allotment and use of land, other than reserved forests for purpose of

- Agriculture, management of unreserved forests, regulation of shifting cultivation,

- Public health and sanitation, inheritance of property, marriage, and social customs etc.

- The Governor has the power to alter laws or rules passed by district councils.

- The sixth schedule thus makes the Governor the head of the autonomous district council.

- Judiciary

- The council has the power to constitute village and district council courts in autonomous areas to adjudicate customary laws.

- No other court except the High Court and Supreme Court of India have jurisdiction over suits and cases decided by the council courts.

- The Khasis inhabit the eastern part of Meghalaya, in the Khasi and Jaintia Hills.

- They occupy the northern lowlands and foothills are generally called Bhois.

- They are an indigenous ethnic group of Meghalaya with a significant population in Assam.

- The Khasi people form most of the population of Meghalaya with around 48%.

- Under the Constitution of India, the Khasis have been granted the status of Scheduled Tribe.

- Khasis follow a matrilineal system of inheritance.

- It is only the youngest daughter who is eligible to inherit the ancestral property.

- Marriage within a clan is a taboo.

- In the Christian families, marriage is purely a civil contract.

- The major festival celebrated by Khasis is Nongkrem.

- It is a five-day religious festival celebrated in the month of November every year.

- Another major festival is Shad Suk Mynsiem.

- It lasts for three days and celebrated in the month of April.

- Children between nine months and four years riding pillion should be wearing a crash helmet or a bicycle helmet complying with relevant safety standards.

- Riders may also have to ensure sticking to speeds below 40 kmph while carrying children below four years of age.

- While carrying children between 0-4 years of age the rider has to ensure the child is in a harness—a contraption that attaches the pillion with the rider, so that there is no chance of the child falling off the vehicle.

- As many as 11,168 children lost their lives in road crashes in 2019 in India.

- In a World Health Organisation report on road safety in 2014, processed by the government, road traffic injuries have been;

- cited as one of the 15 main causes of death of children between age 1-4 years

- the second most common cause in the death of children aged between five-nine years.

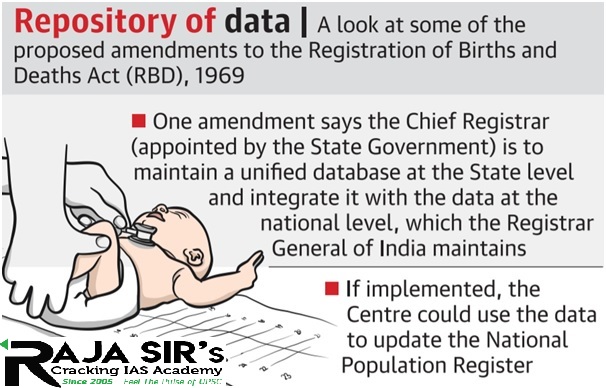

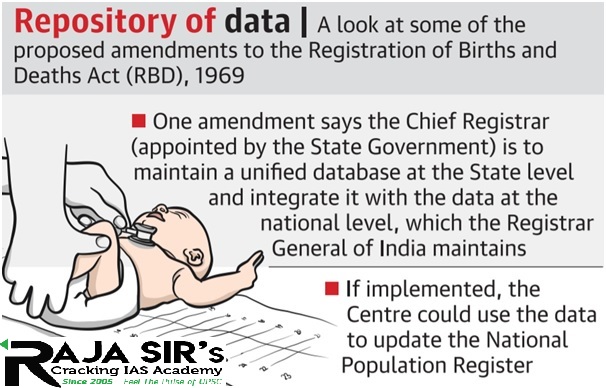

- Presently, the registration of births and deaths is done by the local registrar appointed by States.

- The proposals in the amendment include that:

- Chief Registrar (appointed by the States) would maintain a unified database at the State level and integrate it with the data at the national level, maintained by the Registrar General of India (RGI).

- In other words, the Centre will be a parallel repository of data.

- Appointment of Special Sub-Registrars, in the event of disaster, with any or all of his powers and duties for on-the-spot registration and issuance of deaths certificates.

- The database may be used to update the National Population Register and the electoral register, and Aadhaar, ration card, passport and driving license databases.

- NPR is a register of the usual residents of the country.

- A usual resident is defined as a person who has resided in a local area for the past six months or more or a person who intends to reside in that area for the next six months.

- NPR was first collected in 2010 and then updated in 2015.

- It is prepared at the local (village and sub-town), subdistrict, district, state and national levels under provisions of the Citizenship Act, 1955 and the Citizenship (Registration of Citizens and Issue of National Identity Cards) Rules, 2003.

- It is an Act to provide for the regulation of registration of births and deaths and for matters connected therewith.

- The State Government may, with the approval of the Central Government, by notification in the Official Gazette, make rules to carry out the purposes of this Act.

- The registration of births, deaths and still births are mandatory, in all parts of the Country.

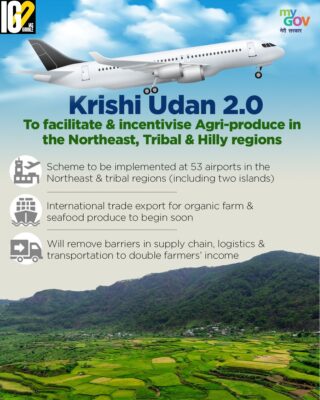

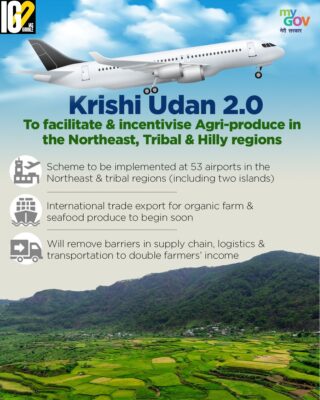

- Aim: To facilitae and incentivize movement of Agri-produce by air transportation in North-east, Hilly, and tribal regions.

- Implementation: At 53 airports across the country, such as Leh, Srinagar, Nagpur, Nashik, Ranchi Bagdogra, Raipur, and Guwahati.

- Facilitating and incentivizing movement of Agri-produce by air transportation:

- Full waiver of Landing, Parking, Terminal Navigational Landing Charges (TNLC), and Route Navigation Facilities Charges (RNFC) charges for Indian freighters and passenger to cargo (P2C) at selected Airports of the Airport Authority of India.

- Primarily, focusing on North-east regions (NER) Hilly, and tribal regions.

- Strengthening cargo-related infrastructure at airports and off airports:

- Facilitating the development of a hub and spoke model and a freight grid.

- Airside transit and transshipment infrastructure will be created at Bagdogra and Guwahati airports.

- Concessions sought from other bodies:

- Seek support and encourage States to reduce Sales Tax to 1% on Airline Terminal Fee (ATF) for freighters / P2C aircraft as extended in UDAN flights.

- Resources-Pooling through establishing Convergence mechanism:

- Collaboration with other government departments and regulatory bodies to provide freight forwarders, airlines, and other stakeholders with Incentives and concessions to enhance air transportation of Agri-produce.

- Technological convergence:

- Development of E-KUSHAL (Krishi UDAN for Sustainable Holistic Agri-Logistics).

- Aim of E-KUSHAL: To facilitate information dissemination to all the stakeholders.

- Integration of E-KUSHAL with the National Agriculture Market (e-NAM) is proposed.

- Development of E-KUSHAL (Krishi UDAN for Sustainable Holistic Agri-Logistics).

- Airports for implementation of KrishiUdan 2.0 are selected to provide benefit to the entire country Opted airports not only provide access to regional domestic market but also connect them to international gateways of the country.

- Laucned in: September 2020

- Under this, air cargo operators are exempted from various charges such as parking charges, terminal navigation landing charges etc.

- It is a viral infection spreads through a bite from an infected animal.

- Caused by: rhabdovirus

- It is zoonotic disease.

- A zoonosis (zoonotic) disease is caused by a pathogen that has jumped from an animal to a human.

- Transmission: Spread through the saliva of infected animals.

- Most common reservoirs of rabies: raccoons, skunks, bats, foxes and Domestic animals such as dogs, cats etc.

- Infects Central Nervous System (CNS).

- Produces acute inflammation of the brain.

- Other Symptoms: Fever, Headache, Nausea, Vomiting, Anxiety, Confusion, Hyperactivity, Difficulty in swallowing, Excessive salivation, Hallucinations, Insomnia, Partial paralysis.

- Furious/encephalitic rabies:

- Symptom- hyperactivity and hydrophobia.

- Paralytic/dumb rabies:

- Symptom-Paralysis

- Human diploid cell vaccine (HDCV) OR

- Purified chick embryo cell culture (PCEC) OR

- Rabies vaccine adsorbed (RVA)

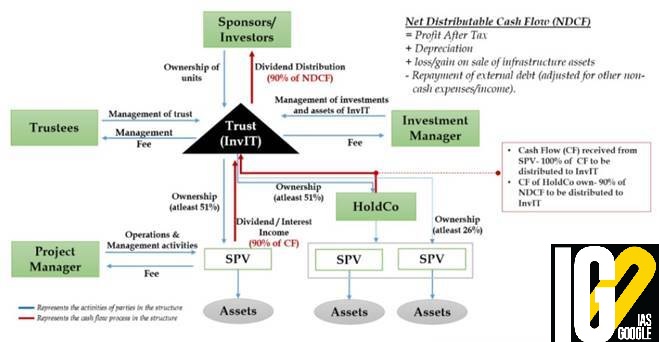

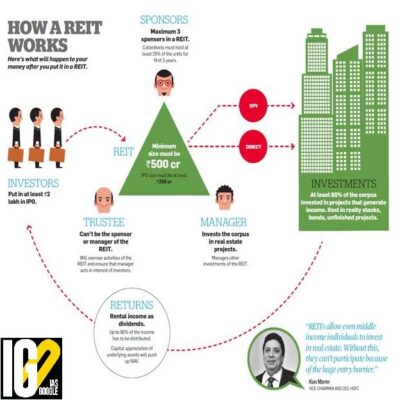

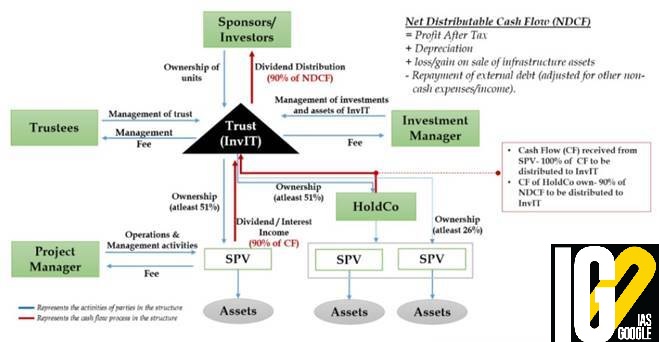

- This move was made by amending the Foreign Exchange Management (Debt Instrument) Regulations, 2021

- It will open up the fundraising avenues as REITs and InvITs have a constant requirement of patient capital for acquisition and to scale their portfolio up.

- Patient capital is another name for long term capital.

- With patient capital, the investor is willing to make a financial investment in a business with aim for the profit in long term.

- It will expand and diversify the potential capital pool for REITs and further reduce the cost of capital for the asset class.

- It will help REITs and InvITs raise debt at competitive rates from foreign investors and also lead to wider participation by institutional investors.

- This will also help in improving business trust unit holders’ risk-adjusted returns due to leveraging.

- Foreign Portfolio Investment (FPI) involves an investor buying foreign financial assets.

- It involves an array of financial assets like fixed deposits, stocks, and mutual funds.

- All the investments are passively held by the investors.

- Investors who invest in foreign portfolios are known as Foreign Portfolio Investors.

- On a macro-level, foreign portfolio investment is part of a country’s capital account and shown on its balance of payments (BOP).

- BOP calculates the amount of money flowing from one country to other countries over a financial year.

- In India, Securities and Exchange Board of India (SEBI) operates the FPIs.

- Foreign Portfolios increase the volatility that leads to increased risk.

- It diversifies the portfolio and get some handsome return on investments.

- Shares of listed Indian Company

- Non-Convertible Debentures

- Units of domestic MF

- Government Securities

- Security Receipts

- Pass Through Certificates

- Derivatives – Exchange traded Futures and Options

- FX forwards and Interest rate swaps

- Investment to be less than 10% of the post issue paid-up share capital of the Indian investee company by a single FPI and 24% on a collective basis.

- Investments by an FPI (including related FPIs) to be less than 50% of any issue of a corporate bond.

- Minimum residual maturity of above 1 year for corporate bond, subject to the condition that short-term Investments in corporate bonds (less than one year residual maturity) shall not exceed 20% of the total investment of that FPI in corporate bonds

- Not treated as Foreign Direct Investment (FDI) or External Commercial Borrowings (ECB)

- No pricing/ sector/coupon restrictions

- Ease in capital repatriation.

- Investment Diversity

- Diversification of portfolio by investing in other countries.

- International Credit

- Investors can get access to increased amounts of credit in foreign countries and can broaden their credit base, thereby securing their line of credit.

- Access to a Bigger Market

- Sometimes, foreign market can be less competitive than the domestic market. Hence, FPI gives you an exposure to a wider market.

- High Liquidity

- Foreign Portfolio Investments provides high liquidity. An investor can buy and sell foreign portfolios seamlessly. This offers buying power for investors to act when good buy opportunities arise.

- Exchange Rate Benefit

- An investor can leverage the dynamic nature of international currencies.

- Category I: This includes investors from the Government sector.

-

- Such as central banks, Governmental agencies, and international or multilateral organizations or agencies.

-

- Category II: This category includes:

-

- Regulated broad-based funds such as mutual funds, investment trusts, insurance/reinsurance companies.

- Also include regulated banks, asset management companies, portfolio managers, investment advisors, and managers.

-

- Category III: It includes those who are not eligible in the first two categories.

-

- It includes endowments, charitable societies, charitable trusts, foundations, corporate bodies, trusts, individuals.

-

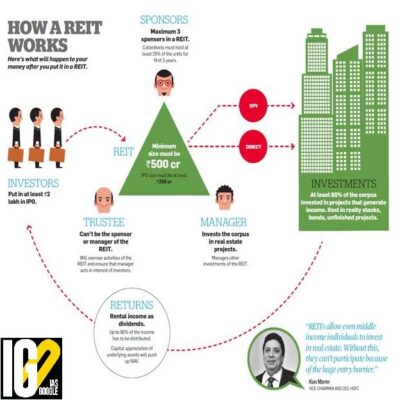

- A real estate investment trust (REIT) is a company that owns, operates, or finances income-generating real estate.

- REITs pool the capital of numerous investors.

- This makes it possible for individual investors to earn dividends from real estate investments—without having to buy, manage, or finance any properties themselves.

- Invest at least 75% of total assets in real estate, cash.

- Derive at least 75% of gross income from rents, interest on mortgages that finance real property, or real estate sales.

- Pay a minimum of 90% of taxable income in the form of shareholder dividends each year.

- Be an entity that's taxable as a corporation.

- Be managed by a board of directors or trustees.

- Have at least 100 shareholders after its first year of existence.

- Have no more than 50% of its shares held by five or fewer individuals.

- Steady dividend income and capital appreciation:

- Investing in REITs is said to provide substantial dividend income and also allows steady capital appreciation over the long term.

- Option to diversify:

- Since most REITS are traded frequently on the stock exchanges, it provides investors with an opportunity to diversify their real estate.

- Transparency in dealing:

- Being regulated by the SEBI, REITs are required to file financial reports audited by professionals. It provides investors with an opportunity to avail information on aspects like taxation, ownership and zoning, hence making the entire process transparent.

- Liquidity:

- Most REITs trade on public stock exchanges and hence are easy to buy and sell, which adds on to their liquidity aspect.

- Accrues risk-adjusted returns: Investing in REITs offers individuals risk-adjusted returns and helps generate steady cash flow. It enables them to have a steady source of income to rely on even when the rate of inflation is high.

- No tax-benefits:

- When it comes to tax-savings, REITs are not of much help. For instance, the dividends earned from REIT companies are subjected to taxation.

- Market-linked risks:

- One of the major risks associated with REITs is that it is susceptible to market-linked fluctuations.

- Low growth prospect:

- The prospect of capital appreciation is quite low in the case of REITs. It is mainly because they return as much as 90% of their earnings to the investors and reinvest just the remainder 10% into their venture.

- An Infrastructure Investment Trust (InvITs) enables direct investment of small amounts of money from possible individual/institutional investors in infrastructure to earn a small portion of the income as return.

- InvITs can be treated as the modified version of REITs designed to suit the specific circumstances of the infrastructure sector.

- InvITs can be established as a trust and registered with Sebi.

- Trustee:

- He inspects the performance of an InvIT certified by Sebi and he cannot be an associate of the sponsor or manager.

- Sponsor(s):

- ‘Sponsors’ are people who promote and refer to any organisation or a corporate entity with a capital of Rs 100 crore, which establishes the InvIT.

- Investment Manager:

- Investment manager is an entity or limited liability partnership (LLP) or organization that supervises assets and investments of the InvIT and guarantees activities of the InvIT.

- Project Manager:

- Project manager refers to the person who acts as the project manager and whose duty is to attain the execution of the project and in case of PPP projects.

- Facilitate external trade and payments.

- Assist orderly development and maintenance of the Indian forex market.

- Defining formalities and procedures for all forex transactions in India.

- Foreign exchange/security.

- Exportation of any commodity and/or service from India to a country outside India.

- Importation of any commodity and/or services from outside India.

- Securities as defined under Public Debt Act 1994.

- Purchase, sale and exchange of any kind (i.e., Transfer).

- Banking, financial and insurance services.

- Any overseas company owned by an NRI (Non-Resident Indian) and the owner is 60% or more.

- Any citizen of India, residing in the country or outside (NRI).

- CERT-In has been undertaking responsible vulnerability disclosure and coordination for vulnerabilities reported to CERT-In in accordance to its vulnerability coordination role as a National CERT since its inception.

- CERT-In has partnered with the Common Vulnerabilities and Exposures (CVE) Program to move a step further in the direction to strengthen trust in “Make in India” as well as to nurture responsible vulnerability research in the country.

- It is the national nodal agency for responding to computer security incidents as and when they occur.

- It comes under Ministry of Electronics and Information Technology.

- It is operational since January 2004.

- After the Information Technology Amendment Act 2008, CERT-In has been designated to serve as the national agency to:

- Collection, analysis and dissemination of information on cyber incidents.

- Forecast and alerts of cybersecurity incidents

- Emergency measures for handling cybersecurity incidents

- Coordination of cyber incident response activities.

- Issue guidelines relating to information security practices and reporting of cyber incidents.

- CVE is an international, community-based effort and relies on the community to discover vulnerabilities.

- The vulnerabilities are discovered then assigned and published to the CVE List from around the world that have partnered with the CVE Program.

- Information technology and cybersecurity professionals use CVE Records to ensure they are discussing the same issue, and to coordinate their efforts to prioritize and address the vulnerabilities.

- CVE Program is aimed to identify, define, and catalogue publicly disclosed cybersecurity vulnerabilities.

- The CVE Records published in the catalogue enable program stakeholders to rapidly discover and correlate vulnerability information used to protect systems against attacks.

- CNAs are organizations responsible for the regular assignment of CVE IDs to vulnerabilities, and for creating and publishing information about the Vulnerability in the associated CVE Record.

- The CVE List is built by CVE Numbering Authorities (CNAs). Every CVE Record added to the list is assigned by a CNA.

- Each CNA has a specific Scope of responsibility for vulnerability identification and publishing.

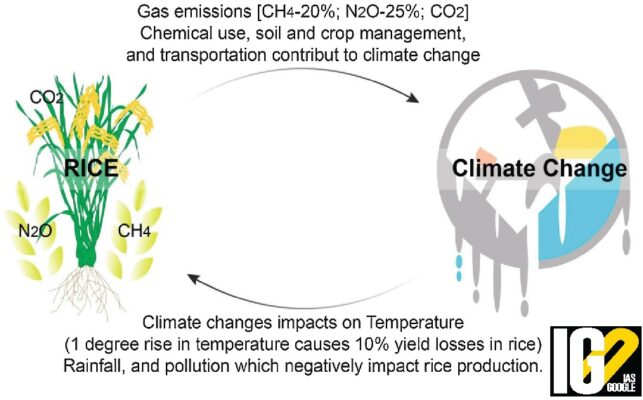

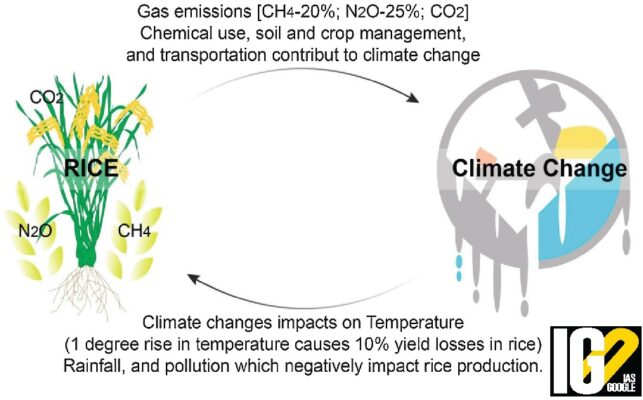

- G20 countries including the wealthiest like the US, European countries, Australia will bear extreme impacts of climate change significantly hitting their economies by the year 2050.

- Without any improvement in coastal protection or infrastructure, in a low emissions scenario, infrastructure losses can be 121.5 billion EUR by mid-century and by 157.3 billion EUR in a high emission scenario.

- Annual damages from riverine flooding by 2050 will be 376.4 billion EUR under a low emissions scenario and rise to 585.6 billion EUR under a high emissions scenario.

- Rising temperatures and intense heat waves could cause severe droughts and deadly fires.

- In India, declines in rice and wheat yields due to climate change could lead to economic losses between 43 and 81 billion EUR (or 1.8-3.4% of GDP) by 2050.

- Among the G20, India is lagging in the process of transformation of its energy sector.

- Agricultural drought will become 48% more frequent by 2036-2065.

- 18 million Indians could be at risk of river flooding by 2050 if emissions are high, compared to 1.3 million today.

- India's marine exclusive economic zone (EEZ) has mostly warm coastal waters with a mosaic of ecosystems such as coral reefs, backwaters, mangroves, and seagrasses meadows which makes it particularly vulnerable.

- Epidemiological risks from dengue and Zika will increase due to future climate change in India.

- The report has measured wealth creation and distribution in 146 countries covering 20 years from 1995-2018.

- In this report, World Bank included gross domestic product, human-produced capital, human capital, and natural capital like renewable and non-renewable natural resources in its measurement of wealth.

- The World Bank defines human capital as earnings over a person’s lifetime.

- South Asia suffers the most among all regions of the world in terms of loss of human capital due to air pollution.

- Human capital is the largest source of worldwide wealth, comprising 64 %of total global wealth in 2018.

- Middle-income countries increased their investment in human capital and turn, saw significant increases in their share of global human capital wealth.

- Human capital in South Asia accounts for 50 %of the region’s wealth which did not change during the survey period from 1995-2018.

- The air pollution badly impacted the wealth generation in south Asia.

- South Asia as a region was the most severely affected by the estimated loss of human capital due to air pollution.

- South Asia’s per capita wealth is among the lowest in the world.

- With the rapid increase in population growth in the same period, per capita, wealth remains among the lowest in the world in south Asia.

- It is an international financial institution that provides loans and grants to the governments of low- and middle-income countries to pursue capital projects.

- Established in: July 1944

- Headquarters: Washington D.C.

- Aim: To grant loans to the governments of low- and middle-income countries to pursue capital projects.

- Total Members: 189 member countries (Including India)

- Countries must first join the International Monetary Fund (IMF) to be eligible to join the World Bank Group.

- IBRD: International Bank for Reconstruction and Development provides loans, credits, and grants.

- IDA: International Development Association provides low- or no-interest loans to low-income countries.

- IFC: The International Finance Corporation provides investment, advice, and asset management to companies and governments.

- MIGA: The Multilateral Guarantee Agency insures lenders and investors against political risk such as war.

- ICSID: The International Centre for the Settlement of Investment Disputes settles investment disputes between investors and countries. India is not a member of ICSID.

- Eradicate Extreme Poverty and Hunger:

- The trend indicates that the world as a whole can meet the goal of halving the percentage of people living in poverty.

- Achieve Universal Primary Education:

- The percentage of children in school in developing countries increased from 80% in 1991 to 88% in 2005

- Promote Gender Equality:

- The tide is turning slowly for women in the labor market, yet far more women than men worldwide more than 60% are contributing but unpaid family workers.

- Reduce Child Mortality:

- An estimated 10 million-plus children under five died in 2005.

- Improve Maternal Health:

- The half-million women who die during pregnancy or childbirth every year live in Sub-Saharan Africa and Asia

- Combat HIV/AIDS, Malaria, and Other Diseases:

- Annual numbers of new HIV infections and AIDS deaths have fallen.

- Ensure Environmental Sustainability:

- Deforestation remains a critical problem, particularly in regions of biological diversity, which continues to decline. Greenhouse gas emissions are increasing faster than energy technology advancement.

- Donors have to fulfill their pledges to match the current rate of core program development. Develop a Global Partnership for Development:

- Emphasis is being placed on the Bank Group's collaboration with multilateral and local partners to quicken progress toward the MDGs' realization.

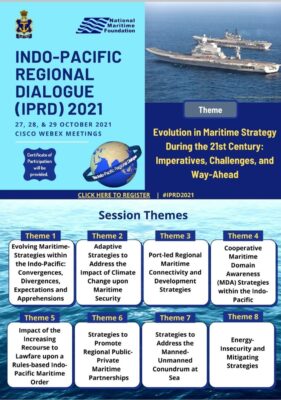

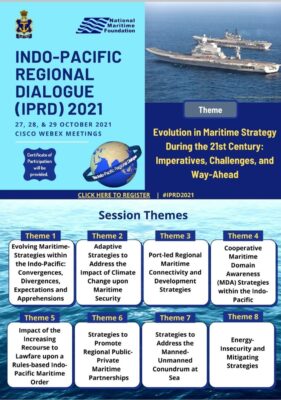

Recently, the defence minister calls for cooperative response to deal with maritime challenges as mandated under UN Convention on the Law of Seas (UNCLOS), 1982.

Indo-Pacific Regional Dialogue (IPRD) 2021:

Recently, the defence minister calls for cooperative response to deal with maritime challenges as mandated under UN Convention on the Law of Seas (UNCLOS), 1982.

Indo-Pacific Regional Dialogue (IPRD) 2021:

- The apex international annual conference of the Indian Navy.

- Aim: To review both opportunities and challenges that arises within the Indo-Pacific.

- Theme for 2021: “Evolution in Maritime Strategy during the 21st Century: Imperatives, Challenges, and, Way Ahead”.

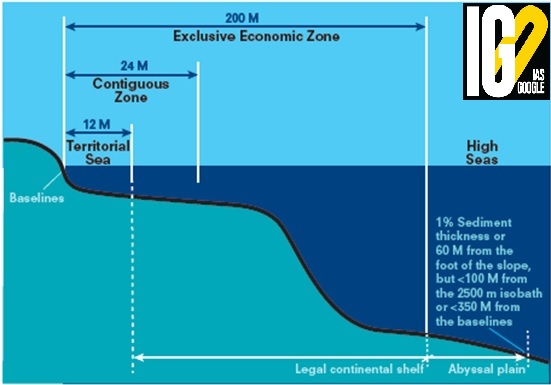

- Also known as Constitution for the oceans.

- Aim: Establishes the rights and responsibilities of the nation’s regarding the use of the world oceans.

- Entered into force on: 16 November 1994.

- Replaced the four Geneva Conventions of April, 1958.

- Signed by 117 states.

- India ratified the convention in Jun 1995.

- The Convention establishes freedom of activity in six spheres: Navigation, Overflight, Laying of cables and pipelines, artificial islands and installations, Fishing and Marine scientific research.

- Objective:

- To provide framework for the development of a specific area of law of the sea.

- To promote the peaceful use of the seas and oceans;

- To facilitate International Communications;

- To enable equitable and efficient utilisation of ocean resources;

- To protect and preserve the marine environment;

- To promote Maritime safety.

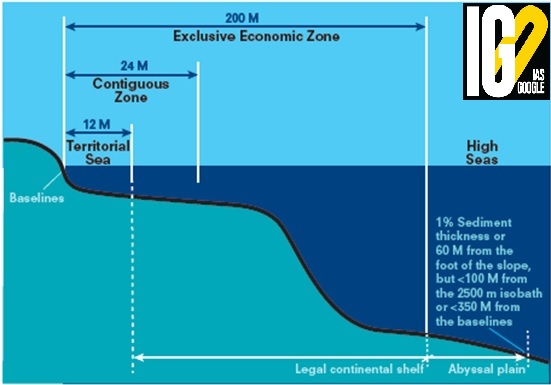

- Internal Waters-

- Territorial Waters

- Contiguous Zone

- Exclusive Economic Zones (EEZs)

- Continental Shelf

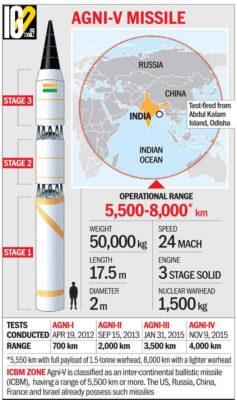

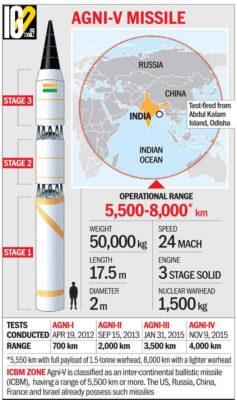

- The test was conducted by the Strategic Forces Command of the Indian Army from the APJ Abdul Kalam Island, Odisha coast.

- It is a surface-to-surface intercontinental ballistic missile (ICBM).

- Developed by: Defence Research & Development Organisation (DRDO) and Bharat Dynamics Limited.

- Speed: 29,401 kmph (24 times faster than the speed of sound).

- The missile is equipped with a ring laser gyroscope inertial navigation system (NavIC) that works with satellite guidance.

- The 1,500-kg warhead will be placed on top of the three-stage rocket boosters powered by solid fuel.

- It can hit its target with pinpoint precision and can be launched from mobile launchers.

- Range: Over 5000 km.

- The missile can range the whole of Asia, Europe, and parts of Africa.

- Once inducted, Agni-V will be maintained by the Strategic Forces command.

- India already has in its armory the Agni missile series

- Agni-I with a range of 700 km

- Agni-II with a range of 2,000 km

- Agni-III and Agni-IV with 2,500 km to 3,500 km range.

- India had recently tested the nuclear-capable ballistic missile Agni-P (Prime) from Dr APJ Abdul Kalam Island of Odisha coast.

- A cigar-shaped underwater missile.

- Can be launched from a submarine, surface vessel, or airplane.

- Previously known as Lightweight Hybrid Torpedo (LHT).

- Function:

- Launched above or below the water surface.

- Self-propelled towards a target.

- Capable of tracking, classifying and attacking underwater targets.

- India plans to use on P-8I patrol aircraft.

- a) Chaff system

- b) Flares

- Part of Counter Measure Dispensing System (CMDS)

- It is a Passive expendable electronic counter measure.

- Made up of small aluminium or zinc coated fibres stored on-board the aircraft in tubes.

- Aim: Protection of the naval ships from enemy's radar and missile seekers based on radio frequency.

- Working: When released/deployed by the target aircraft, it appears as a cloud of small targets to the incoming radar-guided missiles.

- Example: Kavach MOD II

- Hot, burning objects that are released from an aircraft.

- Act as a decoy.

- Used to distract heat-seeking missiles surface-to-air missile or air-to-air missile.

- Aim: to prevent the incoming missile from hitting.

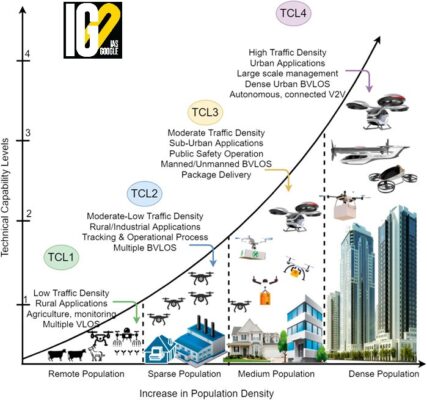

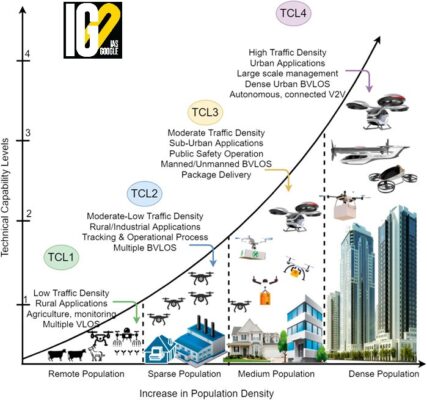

- The framework allows both public and private third-party service providers to manage the unmanned aerial vehicles in lower airspace.

- It allows third-party service providers to give services such as registration, flight planning, dynamic deconfliction and access to supplementary data like weather, terrain and position of manned aircraft.

- All drones (except Nano drones operating in the green zone) shall be required to mandatorily share their real-time location through the network to the Centre either directly or through third-party service providers.

- With rapid technological evolution of unmanned aircraft, the number of aircraft operating in the Indian airspace is poised to increase rapidly.

- It has also taken into consideration the scenarios which will require flying multiple drones near manned aircraft, especially on lower levels of the airspace where drones are allowed to fly.

- Current Air Traffic Management (ATM) systems have not been designed to handle the traffic from unmanned aircraft.

- The creation of a separate, modern, primarily software-based, automated UAS (unmanned aircraft system) Traffic Management (UTM) system, and such systems may subsequently be integrated into traditional ATM systems.

- The integration will be important to continuously separate manned and unmanned aircraft from each other in the airspace.

- A set of supplementary service providers will be permitted under the framework to provide services such as insurance and data analytics to support the UTM ecosystem.

- DigitalSky platform shall continue to be the interface for government stakeholders to provide approvals and permissions to drone operators wherever required.

- The third-party service providers will first be deployed in small geographical areas that could be increased gradually.

- These service providers will be permitted to charge drone operators a service fee and a small portion of it might have to be shared with the Airports Authority of India (AAI).

- The framework allows third-party service providers to deploy highly automated, algorithm-driven software services for managing drone traffic across the country.

- The Centre had on September 15 approved a production-linked incentive (PLI) scheme for drones and drone components with an allocation of ₹120 crore spread over three financial years.

- The civil aviation ministry had on August 25 notified the Drone Rules, 2021 that eased the regulation of drone operations in India by reducing the number of forms that need to be filled to operate them from 25 to 5 and decreasing the types of fees charged from the operator from 72 to 4.

- It is a mass outreach programme, and one-month long initiative under the Ministry of MSME in which students from different colleges/ITIs from all parts of the country will be encouraged by field offices of the Ministry to take up entrepreneurship.

Latest News

Latest News General Studies

General Studies