- Home

- Prelims

- Mains

- Current Affairs

- Study Materials

- Test Series

EDITORIALS & ARTICLES

EDITORIALS & ARTICLES

Can Universal Basic Income tackle India's poverty?

- The International Labour Organization (ILO) has highlighted global issues of jobless growth, worsened by automation and Artificial Intelligence (AI).

- Rising inequality and youth unemployment, particularly in India, have reignited debates around UBI as a tool to provide a social safety net.

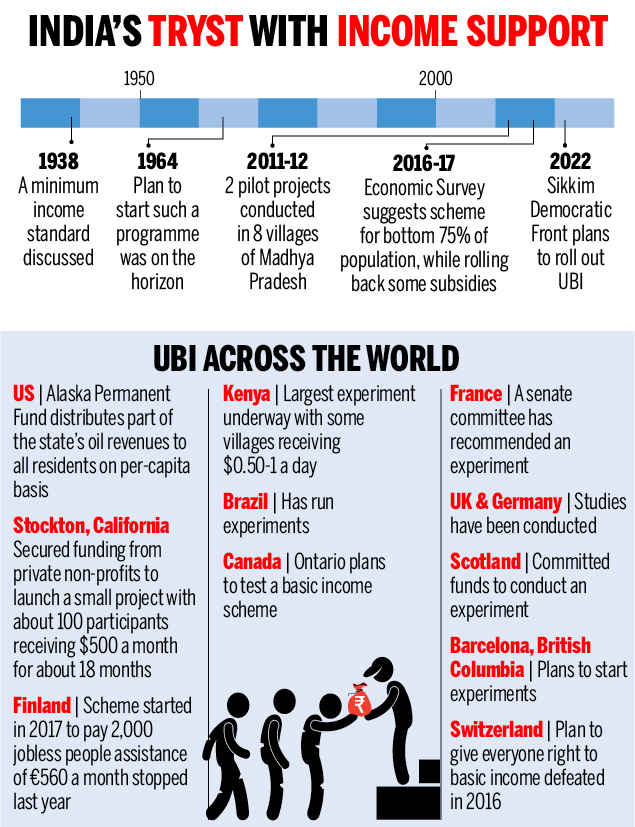

UBI gained momentum in India after the 2016-17 Economic Survey, which proposed considering UBI to replace inefficient welfare schemes.

- The development of JAM (Jan-Dhan, Aadhaar, Mobile) infrastructure has enhanced the feasibility of implementing Direct Benefit Transfers (DBTs) for UBI.

UBI as a Safety Net Policy

- UBI should be viewed as a social safety net policy rather than a solution to employment growth or economic development. It helps individuals manage the consequences of unemployment and poverty.

- Policies need to be evaluated based on their objectives. UBI is designed to provide basic income support, not directly solve structural economic issues like job creation.

Benefits of Universal Basic Income (UBI)

- UBI provides a direct cash transfer to all citizens, ensuring a minimum income floor. This can lift people out of poverty, particularly in regions with high poverty rates, by providing basic financial security.

- Universal transfers ensure fewer intermediaries, reducing administrative costs and minimizing exclusion errors.

- With basic income support, individuals, especially in lower-income groups, will have more purchasing power. This can stimulate aggregate demand, boosting consumption and potentially driving economic growth, especially in times of economic downturn.

- UBI can provide essential financial support to vulnerable populations like the elderly, disabled, and unemployed, who may not benefit from work-based welfare programs like MGNREGS.

- With guaranteed financial support, families are more likely to invest in better healthcare and education for their children, improving overall human development indicators in the long run.

- A guaranteed basic income can reduce the stress and mental health issues associated with financial insecurity. It can also reduce crime rates, as people with stable income are less likely to resort to criminal activities out of desperation.

Feasibility vs. Desirability

- Feasibility: UBI may not be financially viable for India, given budgetary constraints.

- Desirability: UBI is desirable as it can provide universal income support, reducing inequality and offering a minimal consumption guarantee.

- A key question is whether a modified UBI that is less ambitious but financially feasible can be explored.

State and Central Government Schemes:

- Rythu Bandhu (Telangana) and KALIA (Odisha) are state-level schemes providing unconditional payments to farmers. The national-level PM-KISAN scheme offers ₹6,000 per year to farmers, aiming to cover 10 crore farming households.

- Challenges: These programs face issues like inclusion and exclusion errors due to logistical challenges (Aadhaar verification, bank rejections).

Financial Feasibility of UBI in India:

- Large-scale UBI proposals range from 3.5% to 11% of GDP, requiring significant budgetary resources or cutting other anti-poverty programs.

- A more feasible approach is a limited UBI, pegged at 1% of GDP, providing around ₹144 per month to every citizen (or ₹500 per household). This amount, while small, can be scaled up gradually, building on programs like PM-KISAN.

Concerns and challenges associated with implementing a Universal Basic Income (UBI)

- One of the primary concerns about UBI is the significant financial burden it places on the government.

- If UBI is implemented by replacing current welfare schemes, there’s a risk that targeted programs that are crucial for vulnerable populations (such as food distribution via the Public Distribution System or MGNREGS) might be eliminated, leaving certain groups worse off.

- Providing a universal cash transfer could potentially lead to inflation, particularly in rural or underdeveloped areas where an increase in demand for basic goods might outpace supply.

- There is concern that UBI could create a disincentive to work, as individuals receiving guaranteed income may opt out of the labor force.

- Biometric failures and network issues have already plagued existing welfare schemes in India, such as PM-KISAN, leading to exclusion errors.

- While UBI may provide short-term financial relief, it does not address the structural issues related to unemployment, education, healthcare, or inequality in the long run.

Road ahead

- Implementing a full-scale UBI may not be feasible in India due to financial constraints. Therefore, a modified UBI, starting with specific vulnerable groups (such as women, the elderly, the disabled, and landless laborers), could be an effective compromise.

- UBI can be integrated into existing frameworks like MGNREGS (Mahatma Gandhi National Rural Employment Guarantee Scheme) and Public Distribution System (PDS) to ensure comprehensive coverage.

- The JAM (Jan-Dhan, Aadhaar, Mobile) infrastructure is crucial for the smooth rollout of UBI. The government must continue improving banking access in remote areas, addressing issues with Aadhaar-based verification, and ensuring stable internet and mobile connectivity.

- UBI is not a solution to structural unemployment; hence, it must be paired with policies that promote job creation and boost economic growth.

UBI has merit as a tool to address poverty and inequality, but its large-scale implementation faces budgetary challenges. A modified UBI, gradually rolled out and combined with existing programs, offers a viable strategy for India, ensuring a balanced and comprehensive social safety net for all citizens.

Latest News

Latest News General Studies

General Studies