- Home

- Prelims

- Mains

- Current Affairs

- Study Materials

- Test Series

EDITORIALS & ARTICLES

EDITORIALS & ARTICLES

Dec 30, 2021

RBI RELEASES REPORT ON TREND AND PROGRESS OF BANKING IN INDIA

The Reserve Bank of India had recently released a report on "Trend and Progress of Banking in India 2020-21".

Highlights:

Highlights:

Banks Board Bureau

Banks Board Bureau

Report:

Report:

Highlights of order

Highlights of order

Highlights:

Highlights:

The Ken-Betwa River Interlinking (KBRIL) Project:

The Ken-Betwa River Interlinking (KBRIL) Project:

Trincomalee Oil Tank Farms:

Trincomalee Oil Tank Farms:

Blockchain Technology:

Blockchain Technology:

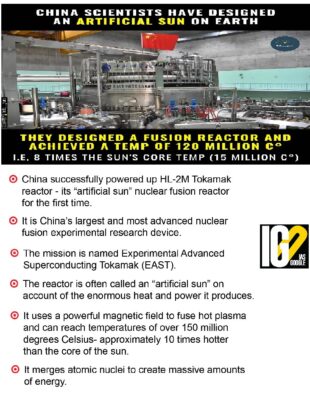

Experimental Advanced Superconducting Tokamak (EAST)

Experimental Advanced Superconducting Tokamak (EAST)

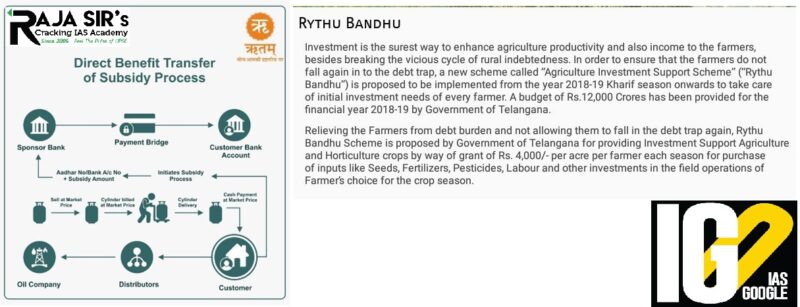

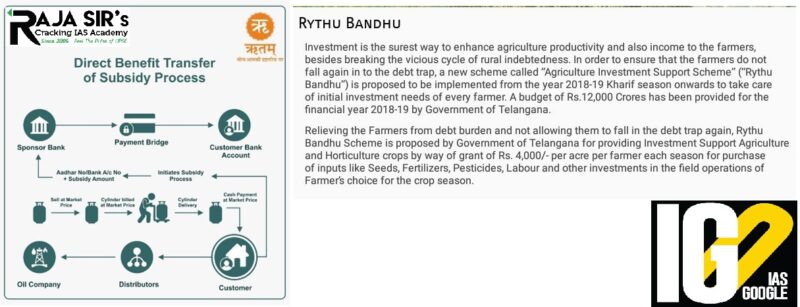

Direct Benefit Transfer (DBT):

Direct Benefit Transfer (DBT):

Operational Guidelines:

Operational Guidelines:

Industrial Livestock Production:

Industrial Livestock Production:

Atal Ranking of Institutions on Innovation Achievements (ARIIA)

Atal Ranking of Institutions on Innovation Achievements (ARIIA)

Judicial review

Judicial review

BIS Act:

BIS Act:

Molnupiravir:

Molnupiravir:

National Pension System

National Pension System

Negotiable Warehouse Receipt System

Negotiable Warehouse Receipt System

Impact of covid-19

Impact of covid-19

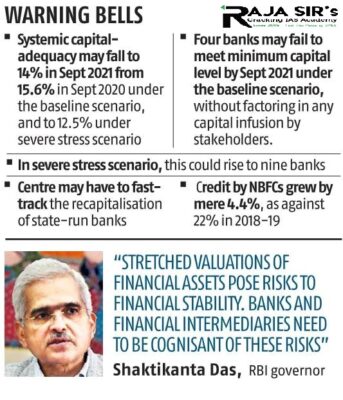

Financial Stability Report

Financial Stability Report

Highlights:

Highlights:

- The consolidated balance sheet of scheduled commercial banks (SCBs) expanded in size in 2020-21 despite of the coronavirus pandemic and economic recession.

- The capital to risk-weighted assets (CRAR) ratio of SCBs has been strengthened from 8% in 2020 to 16.3% in March 2021 and further to 16.6% at the end of September 2021.

- Capital to risk weighted assets (CRAR) ratio is also known as the capital adequacy

- It is calculated by dividing a bank's capital by its risk-weighted assets.

- Reason- It was aided by higher retained earnings, recapitalization of Public Sector Bank (PSBs) and capital raising from the market by both PSBs and private sector banks.

- The gross non-performing assets (GNPA) ratio of SCBs declined from 2% at end of March 2020 to 6.9% at end-September 2021.

- Gross non-performing assets refer to the sum of all the loans that have been defaulted by the borrowers within the provided period.

- The profitability of state co-operative banks and district central co-operative banks improved while their asset quality deteriorated in 2019-20.

- The introduction of Central bank digital currency (CBDC) has the potential to enhance the efficiency of cross-border payments and it can provide an alternative to correspondent banks.

- It can offer benefits to users in terms of liquidity, scalability, acceptance, ease of transactions with anonymity, and faster settlement.

- Reason- to help in selection and appointment of directors on the boards of public sector insurance companies.

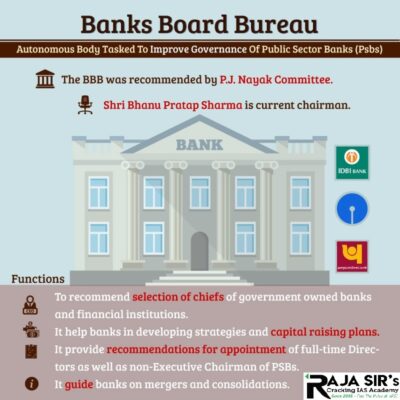

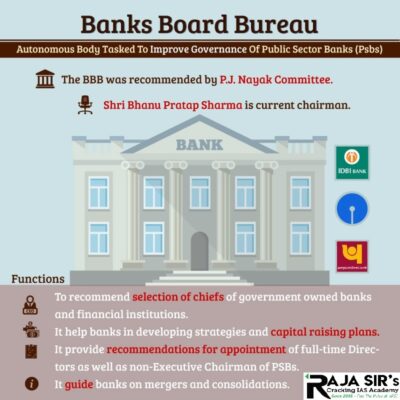

Banks Board Bureau

Banks Board Bureau

- It is an autonomous advisory body created by the government.

- It was created after the recommendations of the Committee to Review Governance of Boards of Banks in India (Chairman -PJ Nayak Committee – 2014).

- Aim- to enhance the governance of the Public Sector Banks and state-owned financial institutions.

- Established- 2016

- Chairman

- Ex-officio members (3)-

- Secretary of Department of Public Enterprises,

- Secretary of the Department of Financial Services

- Deputy Governor of the Reserve Bank of India,

- Expert members (5)- out of which two are from the private sector.

- To promote excellence in Corporate Governance in Public Sector Financial Institutions.

- To make recommendations for appointment of whole-time directors as well as non-executive chairpersons of Public Sector Banks (PSBs) and state-owned financial institutions.

- To the formulate and enforce of a code of conduct and ethics for managerial personnel in mandated institutions.

- To help banks in terms of developing business strategies and capital raising plan.

Report:

Report:

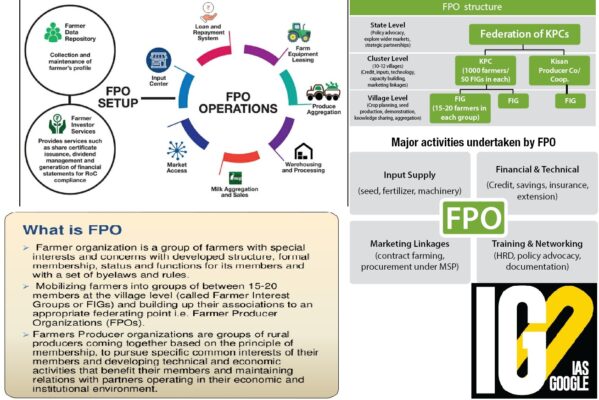

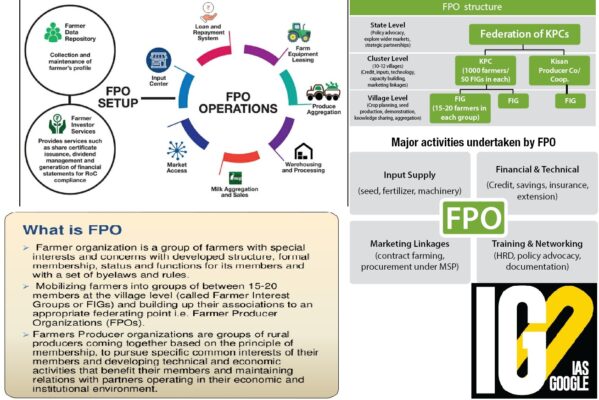

- The State of India's Livelihoods (SOIL) Report is an annual Report released at the Summit.

- It analyzed only farmer producer companies (FCP — FPOs registered under The Companies Act, 2013), since they make up a large majority of the organisations started in recent years.

- The number of Farmer Producer Organizations (FPOs) registered as cooperatives or societies is very small.

- Low Funding:

- Farmer Producer Organizations (FPO) have received only 1-5 per cent funding under central government schemes.

- Low grant sanctions:

- Only 5 per cent of the total producer companies have been able to secure the grants.

- States which received highest number of cases are in the order: Maharashtra (144), Tamil Nadu (104) and Uttar Pradesh (96).

- Under Credit Guarantee scheme:

- It provides risk cover to banks that advance collateral-free loans to FPCs up to Rs 1 crore.

- Only 1 per cent of registered producer companies have been able to avail the benefits.

- Under Equity Grant scheme:

- Equity grants up to a maximum of Rs 15 lakh in two tranches within a period of three years since 2014.

- Only a miniscule number of FPOs have been able to secure the grants.

- Under 10,000 Farmer Producer Organization Policy:

- It played an important role in bringing attention to the importance of collectivising small and marginal farmers

- Farmers Producer Organization is a legal entity whose members are farmers.

- Aim: To ensure a better income for the producers through an organization of their own.

- It is incorporated under the Companies Act or Co-operative Societies Act of the concerned States.

- Farmer Producer Organization is promoted under “One District One Product” to promote the specialization and better branding, marketing, processing and exports by FPO.

- Small Farmers’ Agribusiness Consortium (SFAC) is providing support for promotion of FPOs.

- Aim: To enhance the farmers’ competitiveness and to increase their advantage in emerging the market opportunities.

- It is formed to leverage collectives through economies of scale in production and marketing of agricultural and allied sectors.

- It will aid in the primary producers availing the benefit of the economies of scale.

- Farmers Producers have better bargaining power in the form of bulk buyers of produce and bulk suppliers of inputs.

- They supply seed, machinery, market linkages & fertilizers.

- They provide end-to-end support and services to the small farmers, cover technical services, marketing, processing, and others aspects of cultivation inputs.

- They engage in the process of value addition like cleaning, grading, packing, and also farm level processing facilities at a user charge basis on a reasonably cheaper rate.

- They facilitate logistics services such as storage, transportation, loading/unloading, etc. on a shared cost basis.

- Small Farmers Agri-business Consortium (SFAC) set up by the Ministry of Agriculture, Government of India.

- National Cooperative Development Corporation (NCDC)

- National Bank for Agriculture and Rural Development (NABARD)

- It provides an amount equivalent to the equity contribution done by the members in the FPCs.

- The scheme will be addressed by the SFAC which affords the maximum amount of Rs. 10 lakhs per FPC in two payments

- Aim: To strengthen the financial base of FPOs and help them to get credit from financial institutions for the projects and working capital requirements for business development

- The Government is providing credit guarantee cover:

- to accelerate the flow of institutional credit to FPOs by minimizing the risk of financial institutions for granting loans to FPOs

- to improve their financial ability to execute better business plans leading increased profits.

- Formation and Promotion of 10,000 Farmer Producer Organization Policy is a Central Sector scheme.

- It provided well defined training for capacity building of FPOs including their skill development in marketing, processing and export.

- Launched by Ministry of Food Processing Industries (MOFPI).

- It is for providing financial, technical and business support for upgradation of existing micro food processing enterprises.

- Aim: To support Farmer Producer Organizations (FPOs), Self Help Groups (SHGs) and Producers Cooperatives along their entire value chain.

- It is an initiative of Agricultural and Processed Food Products Export Development Authority (APEDA)

- Aim:

- To facilitate export facility by providing a platform for FPOs/FPCs, Cooperatives to connect with exporters.

- To facilitate and integrate the activities of Farmers and aggregators in the form of FPOs with Exporters through the assistance of ICT platform.

Highlights of order

Highlights of order

- Anchor investors to lock in 50 per cent of their investment for 90 days and 30 days for remaining 50%.

- Investors holding over 20% stake can sell a maximum of 50% of their shares through offer for sale.

- Regulator has tightened disclosures around IPO objectives.

- Amount for general corporate purpose (GCP) will not exceed 25 per cent of the total amount being raised.

- Credit rating agencies (CRAs)will be permitted to act as monitoring agency instead of Scheduled Commercial Banks and Public Financial Institutions for utilisation of issue proceeds, including GCP.

- A third of IPO allocations under NII (Non-institutional investors) category reserved for application size of Rs 2 lakh to Rs 1 million and two-thirds for applications higher than Rs 1 million.

- Mandated valuation reports if preferential issue allotments result in a change of control.

- Issuer companies have to adhere to guidelines provided under their Articles of Association for pricing of preferential issue, in addition to pricing guidelines.

- An additional requirement for a valuation report from a registered independent valuer shall be required in case of change in control/allotment of more than 5 per cent of post issue fully diluted share capital of the issuer company to an allottee or to allottees acting in concert.

- Rationalised the time period for filing settlement applications by entities to 60 days from the date of receiving show-cause notice.

- Introduced provisions relating to appointment or re-appointment of persons who fail to get elected as directors, including whole-time directors, managing directors and managers, at the general meeting of a listed entity.

- No mutual fund (MF) in India will be able to wind up any of its schemes unless the unitholders give their consent through a voting process.

- Voting process is simple and it is one vote per unit.

- Voting results need to be published within 45 days of the publication of notice of circumstances leading to the winding up.

- In case the trustees fail to obtain consent, the scheme should open for business activity from the second business day after the publication of the results of the voting.

- A mutual fund is a type of investment vehicle consisting of a portfolio of stocks, bonds, or other securities.

- Mutual funds give small or individual investors access to diversified, professionally managed portfolios at a low price.

- Hedge funds are actively managed alternative investments that typically use non-traditional and risky investment strategies or asset classes.

- Hedge funds charge much higher fees than conventional investment funds and require high minimum deposits.

- It is a simpler method of share sale through the exchange platform for listed companies.

- OFS mechanism is used only when existing shares are put on the block.

- Only promoters or shareholders holding more than 10 per cent of the share capital in a company can come up with such an issue.

- Anchor investors are institutional investors who are offered shares in an IPO a day before the offer opens.

- SEBI introduced the concept of anchor investors in IPOs in 2009.

- Each anchor investor has to put a minimum of ₹10 crores in the issue.

- Institutions that want to subscribe for more than Rs 2 lakh are called non-institutional investors.

- NII need not to register with SEBI.

- Preference shares (preferred stock) are company stock with dividends that are paid to shareholders before common stock dividends are paid out.

- There are four types of preferred stock - cumulative (guaranteed), non-cumulative, participating and convertible.

- Preference shares are ideal for risk-averse investors and they are callable (the issuer can redeem them at any time).

- An initial public offering (IPO) refers to the process of offering shares of a private corporation to the public in a new stock issuance.

- Companies must meet requirements by exchanges and the Securities and Exchange Commission (SEC) to hold an IPO.

- IPOs provide companies with an opportunity to obtain capital by offering shares through the primary market.

- Companies hire investment banks to market, gauge demand, set the IPO price and date, and more.

- It was established in 1988 and given Statutory Powers in 1992 through the SEBI Act, 1992

- It is a regulatory body for securities and commodity market in India under the ownership of Ministry of Finance, Government of India.

- Headquarter-Mumbai, Maharashtra.

- To approve by−laws of Securities exchanges.

- To require the Securities exchange to amend their by−laws.

- Inspect the books of accounts and call for periodical returns from recognised Securities exchanges.

- Inspect the books of accounts of financial intermediaries.

- Compel certain companies to list their shares in one or more Securities exchanges.

- Registration of Brokers and sub-brokers.

Highlights:

Highlights:

- The secret passage beneath Panama holds the clue that rocks from Earth's mantle are found over 1,609 kilometer's from where they originated.

- It is believed that South American and Caribbean tectonic plates collided around 15 million years ago.

- It caused volcanic activity that eventually formed a thin strip of land linking the Americas and separating the Pacific and Atlantic oceans.

- The forging of the Americas resulted in a mass migration of animals.

- The separation of the two oceans transformed the world’s climate and prompted the development of new species.

- The Cocos tectonic plate is diving down and pushing oceanic crust under the continental crust of North America.

- Cocos is a young oceanic tectonic plate beneath the Pacific Ocean off the west coast of Central America, named for Cocos Island

- It has the capacity to cause large earthquakes.

- Location- 1000 km off Ecuador’s coast in the Pacific Ocean.

- Ecuador is a country in north western South America, bordered by Colombia on the north, Peru on the east and south, and the Pacific Ocean on the west.

- It is a group of islands.

- The islands are formed at the meeting point of three tectonic plates—the Nazca, Cocos, and Pacific.

- They are situated at the crossroads of three major Pacific currents: Cold South Equatorial Current, Warm Panama Current and Deep-Sea Cromwell Current.

- It is also known as the “Columbus Archipelago” or “Isla Galápagos”.

- Islands are formed by volcanic activity covering 97%of the land area and the remaining 3% are inhabited islands like Santa Cruz, San Cristobal, Isabela and Floreana Islands.

- Legal Status:

- National park- 1959

- UNESCO World Heritage Site -1978

- Climate- a mixture of a tropical savanna, semi-arid and tropical rainforest.

- Vegetation-

- Semi desert Vegetation including shrublands, grasslands, and dry forest.

- It is home to humid-climate forests and shrublands, and montane grasslands (pampas).

- Fauna- giant tortoises, finches, flightless cormorants, Galápagos lava lizards and marine iguanas.

- The giant tortoises found here – ‘Galápagos’– give the islands its name.

The Ken-Betwa River Interlinking (KBRIL) Project:

The Ken-Betwa River Interlinking (KBRIL) Project:

- KBRIL aims to transfer surplus water from the Ken River (Madhya Pradesh) to the Betwa river (Uttar Pradesh).

- A dam, called Dudhan dam, will be made.

- KBRIL will help to irrigate the drought-prone Bundelkhand region.

- It is designated as the National Project.

- If a project gets designated as National Project, then the Union government will share 90 % cost of the project and the State government will only share 10% cost.

- In the KBRIL project, the Union government will share 90% cost and the rest 10% will be shared by Uttar Pradesh and Madhya Pradesh together.

- It is estimated that the project may submerge around 58 KM sq area (10%) of the critical tiger habitat (CTH) area of the Panna Tiger Reserve (PTR).

- Indirectly, the project will result in a loss of more than 100sq km of CTH of PTR.

- The total area submerged due to the project would be around 86 sq km, of which 57sq km lies within PTR. It means 65% of total submergence due to the project lies in PTR.

- This would also result in the loss of 2 million trees, habitat fragmentation, displacement, and loss of connectivity due to the submergence.

- Both, the Ken and the Betwa river are tributaries of the Yamuna River.

- Both rivers drain the Eastern Malwa plateau. Chambal river, the largest tributary of Yamuna River drains the central part of the Malwa plateau.

- Ken river tributaries:

- Alona, Bearma, Sonar, Mirhasan, Shyamari, Banne, Kutri, Urmil, Kail and Chandrawal rivers.

- Sonar river is the largest tributary of Ken.

- Betwa river tributaries:

- Jamni, Halali and Dhasan rivers

- Ken river tributaries:

- Location:

- Panna and Chhatarpur districts, Madhya Pradesh.

- Geographically, it is located in the Vindhya hills of MP.

- Panna National Park was established in 1981.

- In 1994, a portion of PNP was declared as the 22nd Tiger reserve of India.

- PNP was Included in the list of Global Network of Biosphere Reserves by the United Nations Educational, Scientific, and Cultural Organisation (UNESCO) in 2020.

- The UNESCO has cited PTR as a critical tiger habitat.

- The ken river flows from the park from south to north.

- Animals: Bengal tiger, Indian leopard, chital, chinkara, nilgai, Sambar deer and sloth bear, rusty-spotted cat, Asian palm civet.

- Birds: Bar-headed goose, crested honey buzzard, red-headed vulture, blossom-headed parakeet, changeable hawk-eagle, Indian vulture.

- Ken river and its tributary Shyamari River, flows in the park.

- Ken river is home for Gharial and Mugger.

- Sanctuaries part of PNP:

- Panna (Gangau) Sanctuary

- Ken Ghariyal Sanctuary

- Trincomalee Oil Tank Farms are located in China Bay.

- The facility was built by the British as a refuelling station during Second World War.

- It has 99 storage tanks with a capacity of 12,000 kiloliters each.

- Proposal for the development of oil tank farms was finalized in the Indo-Lanka Accord of 1987.

- Indian Oil Corporation set up Lanka IOC, its Sri Lankan subsidiary in 2003 to manage oil tanks.

- The LIOC currently runs 15 tanks. The recent agreement is regarding development of remaining oil tanks.

- Trincomalee harbour is the second deepest natural harbour in the world.

- In 2003, the LIOC obtained $1,00,000 to develop the oil tank farm spanning 850 acres in the north-eastern tip of the island.

- However, the agreement remained dormant for years.

- Due to its strategic location in the Indian Ocean, a well-developed oil storage facility and refinery adjacent to the Trincomalee Port would have a global draw.

- From India’s viewpoint, is an important counterbalance to the southern Hambantota Port backed by China.

- Developing the upper tank farm in Trincomalee would help the coastal towns of Sri Lanka to become a regional petroleum hub.

- The India’s first indigenous Class 70 140-feet double-lane modular bridge was inaugurated at the height of 11,000 feet at Flag Hill Dokala, Sikkim.

- Chisumle-Demchok road at Umling La Pass is located at the height of 19,000 feet in Ladakh. It is the world’s highest motorable road.

- Border roads are a Crucial connectivity network in the border area to provide better transport mobility in difficult terrains. Moreover, they provide access to the north and north-eastern borders.

- Therefore, a strong infrastructure in border areas is essential in today’s “uncertain times” as it strengthens strategic capabilities.

- The infrastructure plays a crucial role in strengthening security as well as promoting the economic development of the respective states through improved connectivity.

- Strengthened border infrastructure serves multiple purposes of stepping up India’s Act East engagement and aiding the Indian military to undertake rapid deployment on the Sino-Indian border.

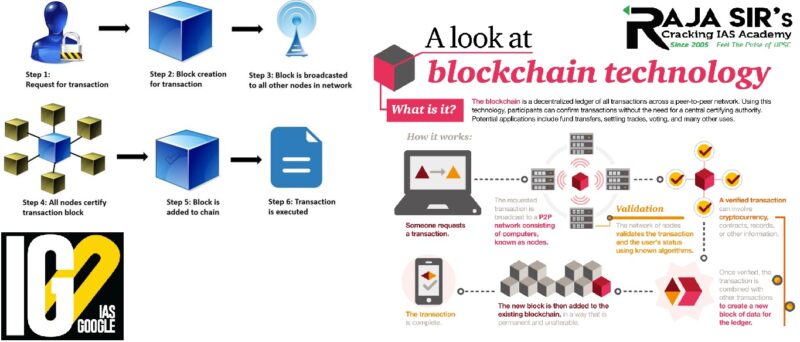

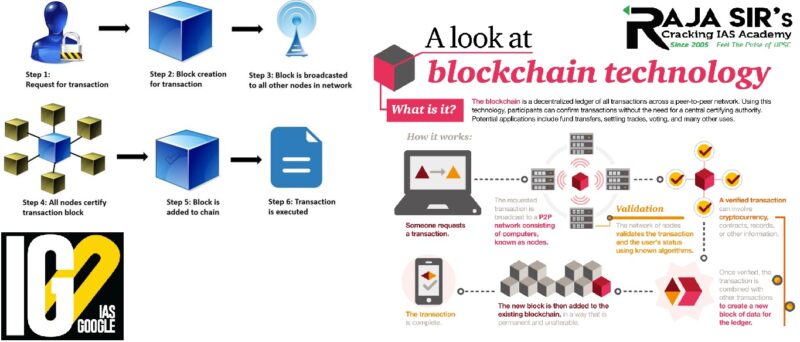

Blockchain Technology:

Blockchain Technology:

- A blockchain is a database that stores encrypted blocks of data then chains them together to form a chronological single-source-of-truth for the data.

- Blockchain is one type of Distributed Ledger Technology (DLT).

- It makes the history of any digital asset unalterable and transparent through the use of decentralization and cryptographic hashing.

- The three key principles of blockchain technology are transparency, decentralization and accountability.

- In this, digital assets are distributed instead of copied or transferred, creating an immutable record of an asset

- The asset is decentralized, allowing full real-time access and transparency to the public.

- A transparent ledger of changes preserves integrity of the document, which creates trust in the asset.

- Every chain consists of multiple blocks and each block has three basic elements:

- The data in the block.

- A 32-bitwhole number called a

- Nodes can be any kind of electronic device that maintains copies of the blockchain and keeps the network functioning.

- Miners create new blocks on the chain through a process called mining.

- The principle of decentralization means that the control is not in the hands of a central agency, but to a distributed network of nodes.

- This will help in keeping the data safe even if any specific node is compromised.

- The information in a blockchain is recorded and stored sequentially along with an exact timestamp.

- The previous information can’t be altered, only amended by adding a new block.

- This makes tampering with a transcript very hard.

- A blockchain-based process can facilitate third-party oversight of transactions and provide greater objectivity and uniformity through automated contracts.

- There also would be more transparency and accountability of transactions and participants.

- Blockchain is a way to increase efficiency in land title registries.

- Blockchain-based land registries could provide a secure, decentralized, publicly verifiable, and immutable record system where people could prove their land rights.

- Governments are considering blockchain-based voting platforms due to concerns about election security, voter registration integrity, poll accessibility, and voter turnout.

- Blockchain’s information security qualities could help address election tampering and increase poll accessibility.

- A limitation would be blockchain’s vulnerability to cyberattacks and other security issues.

- Blockchain can develop central registries to help track conflicts of interest and criminal activity.

- It also could provide transparency and disclosure.

- However, there are several limitations as most countries don’t require companies to maintain beneficial ownership information themselves.

- Also, a blockchain-based registry would require buy-in from politicians, lawyers, banks, and big business, which may be a heavy lift in some locations.

- Blockchain could reduce the number of actors and managers, could streamline the process, and improve verification.

- A limitation would be among the less technologically savvy who might be excluded from grant disbursement processes.

- Security is one of the primary challenges of using the blockchain technology for any purpose.

- It also eliminates the possibility of modifying student records for legitimate purposes.

- There is a limitation with scaling the system beyond a certain level.

- Increasing the network means adding more blocks, which will slow down the speed of transaction as each transaction requires peer-to-peer verification.

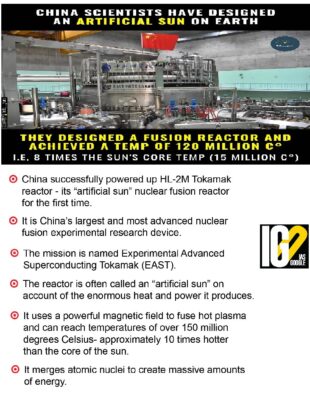

- During an experiment in ten seconds, the temperature of this artificial Sun can reach are 16 crore degrees Celsius, which made it hotter than the real sun.

Experimental Advanced Superconducting Tokamak (EAST)

Experimental Advanced Superconducting Tokamak (EAST)

- EAST is an advanced nuclear fusion experimental research device.

- It is located at the Institute of Plasma Physics of the Chinese Academy of Sciences (ASIPP) in Hefei, China.

- Aim: To replicate the process of nuclear fusion, which is the same reaction that powers the sun.

- The EAST is one of three major domestic tokamaks that are presently being operated across China.

- Apart from the EAST, China is currently operating the HL-2Areactor as well as J-TEXT.

- The artificial Sun experiment is being developed through a reactor, with the help of nuclear fusion.

- Nuclear fusion is a reaction in which two or more atomic nuclei are combined to form one or more different atomic nuclei and subatomic particles (neutrons or protons).

- It occurs when two positively charged nuclei merge.

- To create a fusion reaction on earth requires heating gasses to more than 100 million degrees Celsius and holding them in place with lasers or powerful magnets.

- Fusion is also the process that powers active or main sequence stars and other high-magnitude stars, where large amounts of energy are released.

- A nuclear fusion process that produces nuclei lighter than iron-56 or nickel-62 will generally release energy.

- The EAST Tokamak device is designed to replicate the nuclear fusion process carried out by the sun and stars.

- Due to nuclear fusion, tremendous heat and pressure are applied to hydrogen atoms so that they fuse.

- The nuclei of deuterium and tritium both found in hydrogen are made to fuse to create a helium nucleus, a neutron along with a whole lot of energy.

- The paintings were discovered from three caves: Yedoorlagayi, Siddhulagayi, and Gurralapadah.

- It is assumed that the painting dates back to the Megalithic Period (1500 to 500 BC) and early Historical period (500 BC to 600 AD).

- These sites have rock art in black, red, and white pigments, along with cupules or cup marks of varying sizes.

- These cupules were made on gneissic granite, a very hard and erosion-resistant rock type.

- Under Rythu Bandhu, the state is crediting Rs 5000 per acre per season into bank accounts of land-owning farmers ahead of Rabi and Kharif seasons.

Direct Benefit Transfer (DBT):

Direct Benefit Transfer (DBT):

- DBT is a Government of India Scheme aimed to improve subsidy administration.

- DBT is also known as cash benefit transfer.

- It was started in 2013.

- Under DBT, funds released by government bodies are directly transferred into the bank account of beneficiaries by digital way.

- Initially, DBT Mission was created in the Planning Commission. But from 2015 has been placed in Cabinet Secretariat under Secretary (Co-ordination & PG).

- Though JAM Trinity e. Jan Dhan, Aadhaar, and Mobile are DBT enablers, Aadhaar is not mandatory in DBT schemes.

- It includes Beneficiary Account Validation System, a robust payment and reconciliation platform integrated with RBI, NPCI, Public & Private Sector Banks, Regional Rural Banks and Cooperative Banks (core banking solutions of banks, settlement systems of RBI, Aadhaar Payment Bridge of NPCI) etc.

- Direct Benefit Transfer (Central / State Government schemes)

- DBT on LPG (Pahal scheme)

- DBT under MGNREGA (MGNREGA covered under DBT)

- It will bring efficiency, effectiveness, transparency, and accountability to the Government system. It will also infuse the confidence of citizens in the governance by reducing fraud.

- Quick and easy delivery of services, reducing the burden of government, etc, have been possible due to DBT.

- Due to DBT, support to Indian masses at a large scale was possible, in Covid times.

- The use of Information Technology (IT) tools under DBT will also ensure Maximum Governance Minimum Government.

- Low Aadhar seeding rate (i.e., linking Aadhaar number with Personal Identification Documents or Benefit Cards)

- Negligence of population towards banking practice in India.

- Poor implementation and slow grievance redressal

- Poor Center state co-ordination

- Barriers in automation and digitalization

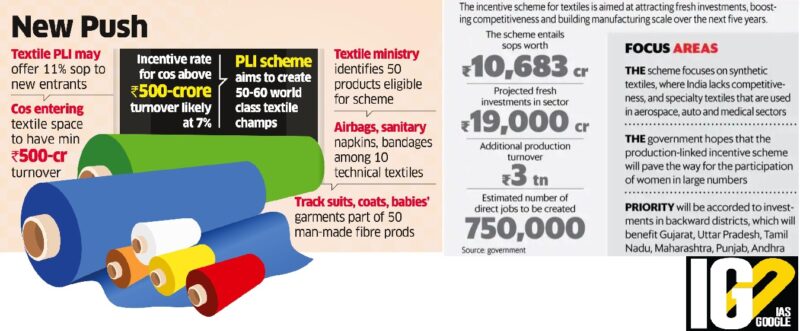

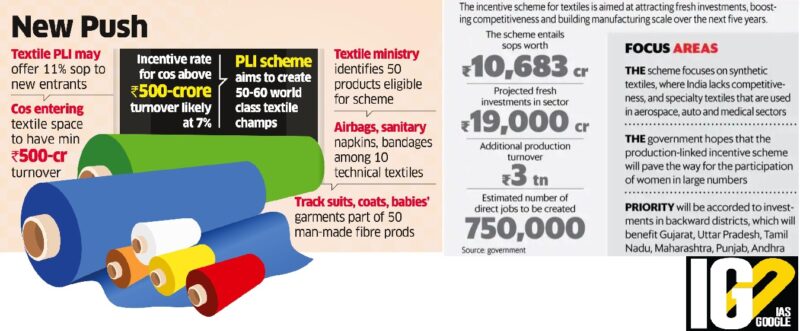

Operational Guidelines:

Operational Guidelines:

- The Applicant will have to form a new company under the Companies Act, 2013before commencement of investment.

- There will be no restriction for making higher investment for enhancing manufacturing capabilities and achieving growth target.

- Only one project under PLI will be approved for any group of companies.

- In case of multiple applications, the entity will have to indicate their preference for proposal taken forward at the time of selection.

- Participating company have to do minimum value addition in their own registered factory premises

- The Participant, while dispatching Notified Products shall ensure to put “Made in India” tag on each product.

- Production Linked Incentive (PLI) Scheme for promotion of Man-Made Fiber (MMF) Apparel, MMF Fabrics and Products of Technical Textiles was launched in September 2021.

- Incentives under the scheme are available for five years with a budgetary outlay of Rs. 10,683 crores.

- To promote production of MMF apparel & fabrics and technical textiles products in the country.

- To become competitive and to create employment opportunities for people.

- Any person including Company/Firm/ /Trust willing to create a separate manufacturing company under Companies Act 2013, and invest minimum ₹300 Crore to manufacture Notified Products.

- Such company will be eligible to get incentive when they achieve a minimum of ₹600 Crore turnover by manufacturing andselling the notified products by the first Performance Year.

- Any person including Company/Firm/LLP/Trust willing to create separate manufacturing company under Companies Act 2013, and invest minimum ₹100 Crore to manufacture notified products.

- Such company will be eligible to get incentive when they achieve a minimum of ₹200 Crore turnover by manufacturing and selling the notified products by the first Performance Year.

- The Participant shall be eligible for the incentives on achieving investment and incremental turnover by the first performance year.

- In case the conditions are not met in time, the incentive will be available from the year these are met, but rate of incentive will be applicable as prescribed to first year of the scheme.

- Manufacture and sale of textile products will be considered as permitted activities.

- It will help Indian Army for its sustained operations in glacier and Himalayan peaks.

- Three layered ECWCS designed to provide thermal insulation between +15° to -50° Celsius.

- It with improved thermal insulation and physiological comfort based on the insulation.

Industrial Livestock Production:

Industrial Livestock Production:

- Industrial livestock production generally refers to a modern type of agriculture wherein densely populated groups of animals are confined to cages, barns or feedlots.

- Industrialised livestock production endangers planet’s ecosystems, natural resources, livelihoods, human health and animal welfare.

- The livestock sector is projected to account for up to 81 per cent of the 1.5 degrees Celsius emissions budget by 2050 if production continues unabated.

- Industrial production can create enormous pollution problems because it brings in large quantities of nutrients and then has to dispose of the manure to nearby land which quickly becomes saturated.

- As a result, land and groundwater are polluted.

- The impact of injuries, illness and trauma affects the individual worker and has devastating effects on their families and communities.

- New strains of bird and swine flu, which have the potential to become zoonotic diseases, emerge each year posing a major threat to human health.

- Meat-packing jobs inflicts daily reports of amputations, burns, head injuries and psychological trauma.

- Many of the workers at meat packing plants are from racialized communities and already face multiple socio-economic challenges.

- Nearly half of front-line meat-processing workers in the United States are categorised as low-income workers, 80 per centare people of colour, and 52 per cent are

- Plant based operations include processes on foods mainly available from plants.

- This includes not only fruits and vegetables, but also nuts, seeds, oils, whole grains, legumes, and beans.

- Plant based operations creates safer, healthier, more equitable, gender parity jobs.

- The transition protects the climate and the farmer’s land.

- As per the recent study, plant-based food system will create thrice as much employment than the meat-based food system presently provides.

- The Apatani weave comes from the Apatani tribe of Arunachal Pradesh.

- The woven fabric of this tribe is known for its geometric and zigzag patterns and also for its angular designs.

- Technique: Different leaves and plant resources for organic dying the cotton yarns.

Atal Ranking of Institutions on Innovation Achievements (ARIIA)

Atal Ranking of Institutions on Innovation Achievements (ARIIA)

- Atal Ranking of Institutions on Innovation Achievements (ARIIA) is an initiative of the Ministry of Education (MoE), Govt. of India.

- Aim: To systematically rank all major higher educational institutions and universities in India on indicators related to “Innovation and Entrepreneurship Development” amongst students and faculties.

- Budget & Funding Support.

- Infrastructure & Facilities.

- Awareness, Promotions & support for Idea Generation & Innovation.

- Promotion & Support for Entrepreneurship Development.

- Innovative Learning Methods & Courses.

- Intellectual Property Generation, Technology Transfer & Commercialization.

- Innovation in Governance of the Institution.

- Institute of National Importance, Central Universities & CFTIs

- In government and government-aided universities

- Govt. and Govt. Aided College/Institutes

- The Institute of National Importance is a status that may be conferred on a premier public higher education institution in India by an act of Parliament of India.

- It serves as a pivotal player in developing highly skilled personnel within the specified region of the country/state.

- These institutions are largely funded and supervised, if not governed, by the Government of India, mostly through the Ministry of Education.

- Such institutes are academically autonomous and are not under any state or central university.

- These institutions also enjoy certain tax-related advantages.

- The institutes receive scholarships schemes provided by the government of India that only apply to the institutes of National Importance.

- It becomes easier to obtain ‘Research and Development Grants (R & D Grants) if the proposal is from such an institution.

- Soya meal is used as a raw material in the poultry feed industry.

- It is produced from the residue left after oil extraction.

- It was enacted in 1955.

- Objective: To regulate the production, supply, and distribution of a whole host of commodities that the government declares essential.

- The government can also fix the minimum support price (MSP) of any packaged product that it declares an “essential commodity”.

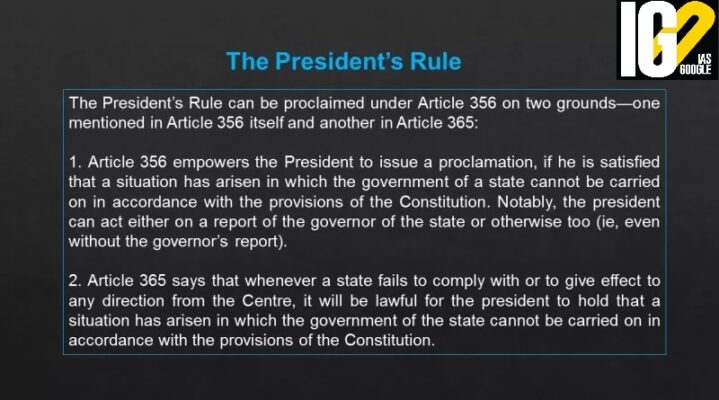

- In a parliamentary system, to form a government, political parties have to get a clear majority in any state election.

- In some cases, when no single political party or pre-poll alliance gets a majority, it is called a hung assembly.

- In such situations, a coalition government may be formed in which parties might enter into alliances after the elections.

- The government may be formed with outside support of parties and independent MLAs.

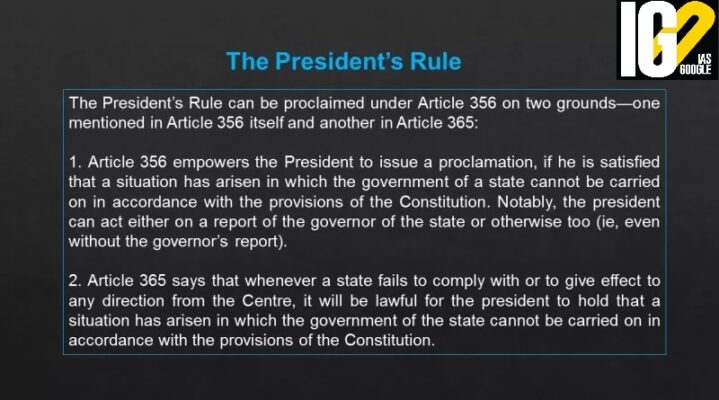

- In case, no government is formed then President’s Rule could be imposed by the state governor under Article 356 of the Constitution.

- In India, President's rule is the suspension of state government and imposition of direct Union government rule in a state.

- Under Article 356, if a state government is unable to function according to Constitutional provisions, the Union government can take direct control of the state machinery.

- Executive authority is exercised through the centrally appointed governor, who has the authority to appoint other administrators to assist them.

Judicial review

Judicial review

- It is the power of the courts of a country to examine the actions of the legislative, executive, and administrative arms of the government and to determine whether such actions are consistent with the constitution.

- Article 372(1) said that Judicial review of the pre-constitutional laws that were in force before the commencement of the Constitution of India.

- Article 13(2) is about any law made by the parliament after the commencement of the constitution shall be declared null and void by the Court.

- Article 251 and 254 states that if there is any inconsistency between the union and state law, the law of union shall prevail and the state law shall be deemed void.

- Under Article 32 or Article 226 of the constitution If any person’s Fundamental right is violated he/she can approach the court.

- Court for the first time explained on its power to review amendments to the constitution.

- In this case, Judicial Review was added to the list of Basic Structure of the constitution.

- In this case the court held that any act inserted in Schedule 9 can be judicially scrutinized but only those enactments which are inserted after 24th April 1973.

- Judicial review is necessary to uphold the principle of supremacy of the constitution.

- The provision of judicial review prevents the misuse of power by the legislature and executive.

- It maintains the equilibrium between the centre and state, thereby maintaining federal equilibrium.

- The provision protects the fundamental rights of the citizens.

- This provision ensures the principle of the independence of the judiciary.

- The said law infringes upon the fundamental rights guaranteed by the constitution.

- The said law goes against the provisions listed in the constitution.

- The law that has been enacted goes beyond the competency of the authority that has framed it.

- A “money bill” is beyond the power of Judicial Review.

- Article 212 of the constitution of India provides that the Courts cannot inquire proceedings of the Legislature on the ground of any alleged irregularity of procedure.

- Latakia is a seaport located on the Mediterranean Sea in the city of Latakia.

- Syria’s ally, Russia, operates a naval base in the port of Tartus, 85 kilometers to the south of Latakia port.

BIS Act:

BIS Act:

- Central Government directs conformity to standard and compulsory use of standard mark under Section 16 of BIS Act.

- These directions are published in form of Quality Control Orders (QCO).

- Aim: To protect consumers from risk of suffering injury, harm and ensure required safety & technical standards to be followed.

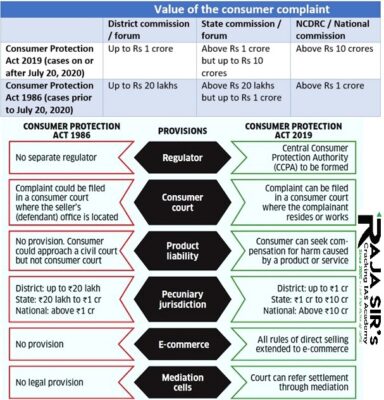

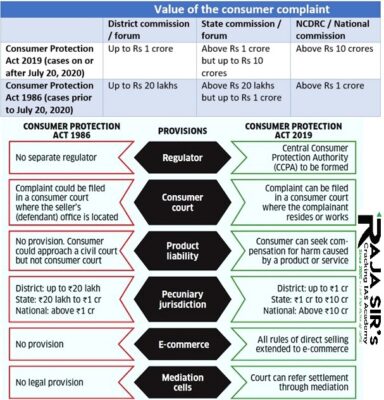

- CCPA was established in 2020 as per the Consumer Protection Act, 2019.

- Aim: To promote, protect and enforce the rights of consumers as a class.

- To conduct investigations into violation of consumer rights.

- Institute complaints / prosecution.

- Order recall of unsafe goods and services.

- Order discontinuation of unfair trade practices and misleading advertisements.

- Impose penalties on manufacturers/endorsers/publishers of misleading advertisements

- The Consumer Protection (General) Rules, 2020

- The Consumer Protection (Central Consumer Protection Council) Rules, 2020.

- The Consumer Protection (Consumer Disputes Redressal Commissions) Rules, 2020.

- The Consumer Protection (Mediation) Rules, 2020.

- The Consumer Protection (Salary, allowances and conditions of service of President and Members of the State Commission and District Commission) Model Rules, 2020.

- The Consumer Protection (Qualification for appointment, method of recruitment, procedure of appointment, term of office, resignation and removal of the President and members of the State Commission and District Commission) Rules, 2020.

- The Consumer Protection (E-Commerce) Rules, 2020.

- The Consumer Protection (Consumer Commission Procedure) Regulations, 2020.

- The Consumer Protection (Administrative Control over the State Commission and the District Commission) Regulations, 2020.

- The Consumer Protection (Mediation) Regulations, 2020.

Molnupiravir:

Molnupiravir:

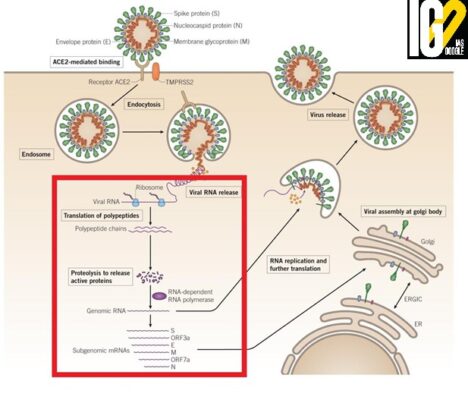

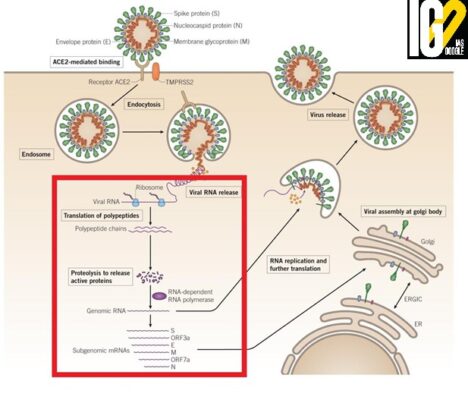

- Molnupiravir (MK-4482, EIDD-2801) is an oral anti-viral pill.

- It was developed initially to treat influenza. Now it is also being used to treat Covid-19 patients.

- It works by introducing errors into the SARS-CoV-2 virus’ genetic code. Due to this, the virus is stopped from further replicating.

National Pension System

National Pension System

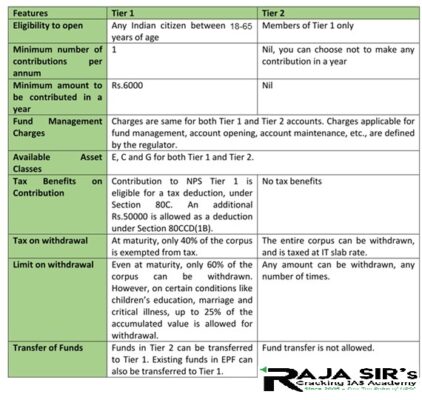

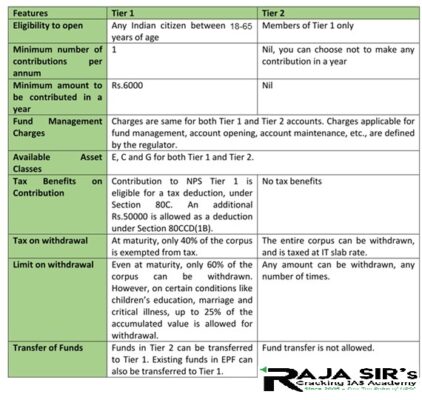

- e National Pension System (NPS) is being administered and regulated by Pension Fund Regulatory and Development Authority (PFRDA) set up under PFRDA Act, 2013.

- Under NPS, a unique Permanent Retirement Account Number (PRAN)is generated and maintained by the Central Recordkeeping Agency (CRA) for an individual subscriber.

- On retirement, a minimum of 40% of the corpus is mandatorily utilized to procure a pension for life by purchasing an annuity from a life insurance company.

- The balance corpus is paid as a lump sum.

- Tier-I account is the pension account having restricted withdrawals.

- Tier-II is a voluntary account that offers liquidity of investments and withdrawals.

- Applicant must be a citizen of India.

- Applicant should be between 18 - 70 years of age as of the date of submission of his/her application to the Point of Presence - Service Providers (POP/ POP-SP).

- Flexible: NPS offers a range of investment options and choices of Pension Fund Manager (PFMs) for planning the growth of your investments reasonably and seeing money grow.

- Portable: NPS provides seamless portability across jobs and locations, unlike all current pension plans, including that of the EPFO.

- Ease of Access: The NPS account is manageable online. An NPS account can be opened through the eNPS portal.

- PFRDA is the regulatory body under the jurisdiction of the Ministry of Finance, Government of India for overall supervision and regulation of pension in India.

- The Pension Fund Regulatory & Development Authority Act was passed in 2013 and the same was notified on 1 February 2014.

- Aim: To be a model Regulator for the promotion and development of an organized pension system to serve the old age income needs of people on a sustainable basis.

- Structure: The Authority consists of a Chairperson and not more than six members, of whom at least three shall be whole-time members, to be appointed by the Central Government.

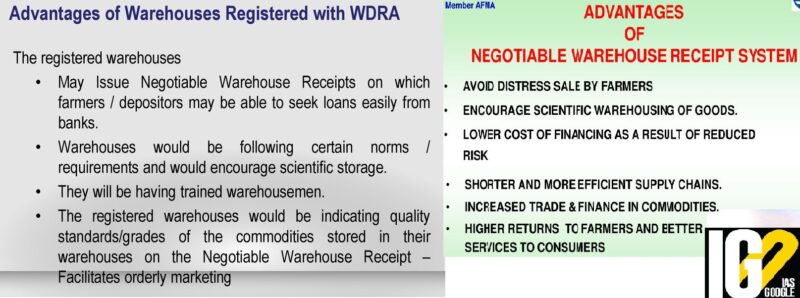

Negotiable Warehouse Receipt System

Negotiable Warehouse Receipt System

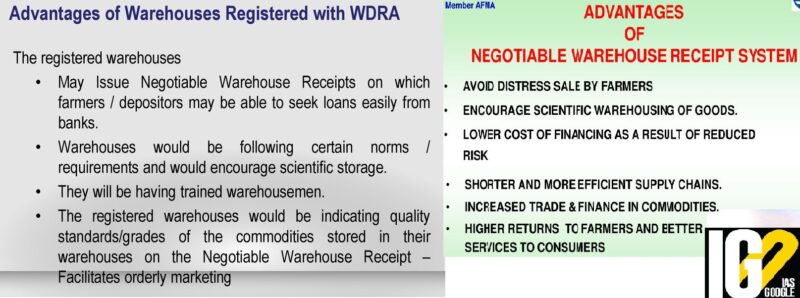

- They are documents issued by warehouses to depositors against the commodities deposited in the warehouses.

- Warehouse Receipts may be either non-negotiable or negotiable.

- The term ‘negotiable warehouse receipt’ is defined in Section 2(m) of the Warehousing (Development and Regulation) Act, 2007.

- A negotiable instrument can be transferred to any number of persons before maturity.

- It can be traded, sold, swapped and used as collateral to support borrowing.

- NWRs issued by registered warehouses help farmers to seek loans from banks against NWR.

- It provide farmers with an instrument that allows them to extend the sales period of modestly perishable products well beyond the harvesting season.

- It can avoid distress sale of agricultural produce by the farmers in the peak marketing season when there is glut in the market.

- It allow transfer of ownership of that commodity stored in a warehouse without having to deliver the physical commodity.

- These receipts is also beneficial to other stakeholders such as, banks, financial Institutions, insurance companies, trade, commodity exchanges as well as consumers.

- It is a Statutory Authority under the Department of Food and Public Distribution.

- Aim: To ensure implementation of the provisions of the Warehousing (Development & Regulation) Act, 2007.

- Commodities notified under Warehousing (Development & Regulation) Act, 2007: 123 agricultural commodities including cereals, pulses, oil seeds etc for issuing negotiable warehouse receipts and 26 horticultural commodities for cold storage.

- To implement the national food security Act 2013, throughout the country.

- To undertake price support operations through efficient procurement of wheat, paddy and coarse gains.

- To Strength the Targeted Public Distributions Systems.

- To encourage scientific warehousing of goods.

- To promote shorter and efficient supply chains.

- To specify the qualifications, code of conduct and practical training for warehousemen and staff engaged in warehousing business.

- To make regulations laying down the standards for approval of certifying agencies for grading of goods.

- To conduct enquiries and investigation including audit of the warehouses and accreditation agencies.

- To renew, modify, withdraw, suspend or cancel certificate of registration of warehouse.

- The Authority consists of a chairperson and two Members appointed by the Central Government.

Impact of covid-19

Impact of covid-19

- The pandemic-led boom in demand for gig workers has had two significant implications on the contractual labour ecosystem.

- It has created new business models to cater to the growing requirement for on-demand staffing.

- Put the spotlight on the labour codes that recognise gig workers and provide for a universal minimum wage.

- As per the World Economic Forum, it is defined by its focus on workforce participation and income generation via “gigs”, single projects or tasks for which a worker is hired.

- The gig economy is based on flexible, temporary, or freelance jobs, often involving connecting with clients or customers through an online platform.

- Gig workers are much more likely to be part-time workers and to work from home.

- The gig economy can benefit workers, businesses, and consumers by making work more adaptable to the needs of the moment and demand for flexible lifestyles.

- India’s gig workforce comprises 15 million workers employed across industries such as software, shared services and professional services.

- This number is expected to grow to around 24 million in the near-medium term and to 90 million in the long term.

- The Code on Wages, 2019, provides for universal minimum wage and floor wage across organised and unorganised sectors, including gig workers.

- The Code on Social Security, 2020, recognises gig workers as a new occupational category.

- It defines gig worker as a person who performs work or participates in work arrangement and earns from such activities, outside of the traditional employer-employee relationship.

- Lack of benefits: A gig worker won't have health insurance or other benefits they would get from working as full-time employee.

- Lack of income: Income depend on the nature of job, so it is difficult to maintain consistent income.

- Career opportunity: Because temporary employees are cheaper to hire, the gig economy may make it harder for full-time employees to develop their careers.

- Job security: Job security is a biggest issue because these jobs are on contract basis.

- Life imbalance: Work-life balance can be disrupted if the worker isn't used to making their own schedules.

- Regulatory issue: With no regulation to control platforms enabling gig work, they can fall into complacency and seek to increase shareholder value by such means that may jeopardize the wellbeing of workers.

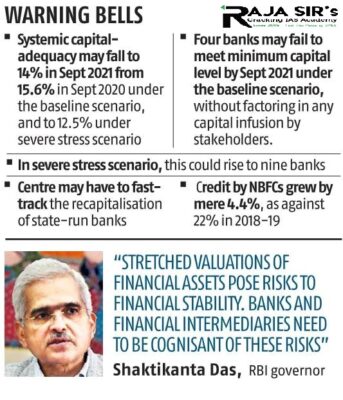

Financial Stability Report

Financial Stability Report

- It is released in bi-annually.

- Report reflects the risks to financial stability and the resilience of the financial system.

- Report is published on three standards: baseline stress scenario, medium stress, severe stress scenario.

- Under the baseline scenario, the gross non-performing assets (NPAs) of banks may increase from 6.9% in September 2021 to 8.1% by September 2022 and under a severe stress scenario it could be 9.5%.

- For public sector banks, the gross NPA ratio may rise from 8.8% currently to 10.5%by September 2022, under the baseline scenario.

- For private banks, bad loans may rise from 4.6% to 5.2%over this period.

- Global economic recovery has been losing momentum in the second half of 2021 due to:

- Resurfacing Covid-19 infections and the new variant Omicron

- Supply disruptions and bottlenecks

- Elevated inflationary levels

- Shifts in monetary policy stances and actions across advanced economies and emerging market economies.

- Stressed on close monitoring of micro, small and medium enterprises (MSME).

- For Scheduled commercial banks

- The capital to risk-weighted assets ratio (CRAR)rose to a new peak of 16.6%.

- CRAR is expressed as a percentage of a bank's risk-weighted credit exposures.

- Provisioning coverage ratio (PCR) stood at 68.1% in September 2021.

- PCR is the percentage of funds that a bank sets aside for losses due to bad debts.

- The capital to risk-weighted assets ratio (CRAR)rose to a new peak of 16.6%.

- RBI flagged a relatively high risk include consumer lending and microloans.

- In the case of consumer loans, bad loans have stabilised after rising in the immediate aftermath of the Covid crisis. However, delinquencies are still at elevated levels.

- Across individual consumer loan categories, education loans had the highest delinquency rate at 7.1%, while housing loans had the lowest rate at 1.9%.

- They straddle many different (non-financial) lines of business with sometimes opaque overarching governance structures.

- They have the potential to become dominant players in financial services.

- Big techs already have a huge customer base and can become dominant players, giving little room to smaller firms.

- A non-performing asset (NPA) is a loan or advance for which the principal or interest payment remained overdue for a period of 90 days.

- NPAs are recorded on a bank's balance sheet after a prolonged period of non-payment by the borrower.

- NPAs place financial burden on the lender; a significant number of NPAs over a period of time may indicate to regulators that the financial fitness of the bank is in jeopardy.

- NPAs can be classified as a substandard asset, doubtful asset, or loss asset, depending on the length of time overdue and probability of repayment.

- Substandard asset- an asset classified as an NPA for less than a period of 12 months.

- Doubtful asset- an asset that has been non-performing for more than a period of 12 months.

- Loss assets- loans with losses that need to be fully written off.

- Lenders have options to recover their losses, including taking possession of any collateral or selling off the loan at a significant discount to a collection agency.

- Overdraft and cash credit (OD/CC) accounts left out-of-order for more than 90 days.

- Agricultural advances whose interest or principal installment payments remain overdue

- for two crop/harvest seasons for short duration crops.

- For one crop season for long duration crops.

- Expected payment on any other type of account is overdue for more than 90 days.

- Creation of DRT or Debt Recovery Tribunals.

- Impetus to Asset Reconstruction Companies to proliferate.

- Introduced corporate debt restricting and the Insolvency and Bankruptcy Code.

- Mission Indradhanush to bring about reforms in the public sector banks.

- SAMADHAN scheme introduced fir asset management and debt change structure.

- Asset Quality Review in Banks.

Latest News

Latest News General Studies

General Studies