- Home

- Prelims

- Mains

- Current Affairs

- Study Materials

- Test Series

EDITORIALS & ARTICLES

EDITORIALS & ARTICLES

India Q2 GDP data: Economy claws back some lost ground, contracts 7.5%

-

For the second quarter in a row, the Indian economy contracted by 7.5 percent during the July-September quarter, and entered a technical recession in the aftermath of the COVID-19 pandemic.

-

Analysts polled by news agencies Reuters and Bloomberg had expected a contraction of 8.8 per cent and 8.2 per cent, respectively, for the second quarter.

Genesis

-

The real GDP for April-June 2020 had contracted 23.9 per cent, the steepest fall ever (and the first contraction in 40 years).

-

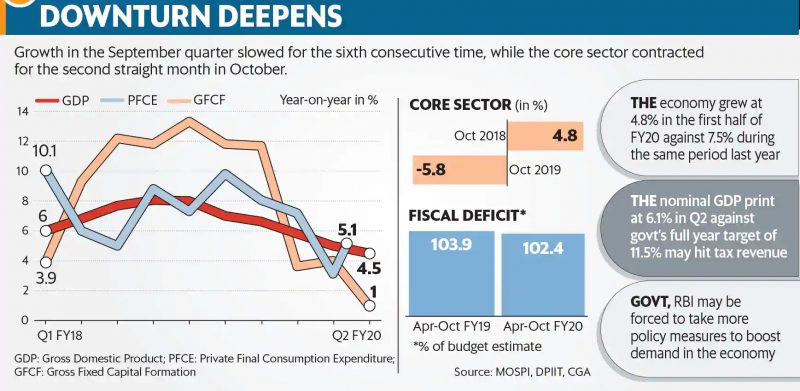

The July-September 2019 quarter had witnessed a GDP growth of 4.4 per cent.

-

The eight core industries growth came at -2.5% in October against -0.1% in September.

-

India's fiscal deficit stood at Rs 9.53 lakh crore during April-October, which is 119.7 percent of Rs 7.96 lakh crore of the budget target.

-

The revenue gap for the same period stood at Rs 7.72 lakh crore vs Rs 5.46 lakh crore on a yearly basis.

A multi-speed climb back

-

Manufacturing has registered a sharp recovery with the sector emerging out of the contraction in Q2FY21, registering a growth of half a percentage point.

-

The jump in manufacturing numbers is even better than Q2FY19, which is unexpected, but a pleasant surprise.

-

Utilities have also registered a sharp recovery as most of the electricity-intensive activities resumed.

-

This trend in electricity consumption was clearly visible in the high-frequency indicators.

-

The construction activity continues in the contraction mode, but with sharp improvement over Q1 contraction as it registered only an 8.6% decline in Q2 as compared to -50.3% in Q1.

-

The jump in construction sector activities is in variance with seasonal trends, when it always declines in Q2 with the onset of the monsoon session.

-

The unexplained surge in construction activities could possibly be then explained by the continued traction in highway construction.

-

The recovery in services, notably the non-essential services was quite impressive.

-

Trade, hotels, transport, communication & services related to broadcasting have recovered sharply from the trough of Q1 on the back of progressive opening up of the economy.

-

The rate was -15.6% from -47% in Q1.

Highlights

-

Overall, the recovery is good but not broad-based.

-

The sectoral adjustment to the “unlock” phases isn’t uniform and displays differential resilience.

-

This remains a matter of concern and if the trend continues the chances of low growth and high inflation are high.

-

Interestingly, the growth in manufacturing coupled with a growth in the transport sub-segment tells an intriguing story of how India coped with the lockdown in Q1.

-

Manufacturing production was ramped up significantly when the economy opened up after lockdown and there was a surge in goods transport across roads, railways, and aviation.

-

Additionally, the communication sub-segment could have done well clearly reflecting the benefits of working from home.

-

This possibly could explain the smart recovery for the trade sub-segment of the GDP, a fall out of a jump in manufacturing production.

Road Ahead

-

With so much liquidity floating around, and bank credit still on the slow growth trajectory, as a matter of policy, RBI should be directing liquidity flow towards the long-end given the excessive fall in short-end yields.

-

One way of achieving this is by advancing the CRR cut which is expiring on March 27, which would lead to the draining of Rs 1.46 lakh crore from the market.

-

To balance that, RBI should announce a simultaneous open market operations of an equivalent amount.

-

Another possibility could be allowing mutual funds to participate in reverse repo in conjunction with a Standing Deposit Facility so that a floor is established.

-

RBI can also introduce a Market Stabilization Scheme as was done earlier in times of excess liquidity conditions during demonetisation.

-

With inflation not going down significantly and excess liquidity in the system, RBI has to pursue active liquidity management to help the economy from overcoming the liquidity trap.

The markets have been awash with liquidity as RBI tried to mitigate the damage done by Covid-19 related disruptions. The transient liquidity conditions show that in October, RBI had to inject liquidity in the market through LAF operations. However, in November again transient liquidity turned positive with Net LAF absorption at Rs 5,54,433 crore as of Nov. 26, with an average surplus of Rs 4,16,99 crore so far in the current fiscal. With the rupee showing strength owing to improved external metrics, RBI has an additional source of excess liquidity to manage. It has already accumulated $97.48 billion in forex reserves so far in the current fiscal.

Latest News

Latest News General Studies

General Studies