- Home

- Prelims

- Mains

- Current Affairs

- Study Materials

- Test Series

EDITORIALS & ARTICLES

EDITORIALS & ARTICLES

Jan 05, 2022

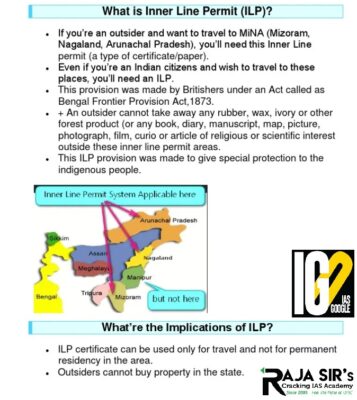

SC NOTICE ON PLEA CHALLENGING INNER LINE PERMIT IN MANIPUR

Recently, Supreme Court sought the responses of the Centre and the Manipur government to a petition challenging the constitutional validity of the inner line permit (ILP) system.

Inner Line Permit system

Inner Line Permit system

Tariff in Hospitals:

Tariff in Hospitals:

What is IMPS?

What is IMPS?

Central Board of Indirect Taxes and Customs-CBIC

Central Board of Indirect Taxes and Customs-CBIC

What is Unemployment?

What is Unemployment?

Khanij Bidesh India (KABIL)

Khanij Bidesh India (KABIL)

Special Drawing Rights (SDR):

Special Drawing Rights (SDR):

Highlights:

Highlights:

Multi Agency Centre (MAC):

Multi Agency Centre (MAC):

What is Aquamation?

What is Aquamation?

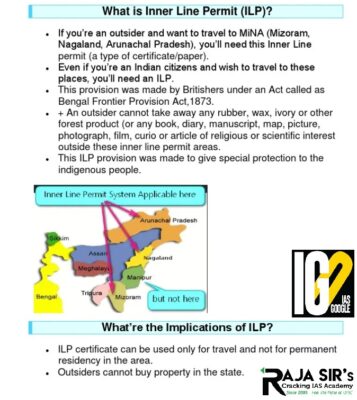

Inner Line Permit system

Inner Line Permit system

- It is a document that allows an Indian citizen to visit or stay in a state that is protected under the ILP system.

- Aim: To prevent settlement of other Indian nationals in the States where ILP regime is prevalent, in order to protect the indigenous or tribal population.

- The system is in force in North eastern states- Arunachal Pradesh, Nagaland, Manipur and Mizoram. It is also mandatory for Lakshadweep.

- No Indian citizen can visit any of these states unless he or she belongs to that state, nor can he or she overstay beyond the period specified in the ILP.

- An ILP is issued by the state government

- It can be obtained after applying either online or physically.

- It states the dates of travel and also specifies the particular areas in the state which the ILP holder can travel to.

- It can be issued for travel purposes solely. Visitors are not allowed to purchase property in these regions.

- Under the Bengal Eastern Frontier Regulation Act, 1873, the British framed regulations restricting the entry and regulating the stay of outsiders in designated areas.

- This was to protect the Crown’s own commercial interests by preventing British subjects (Indians) from trading within these regions.

- In 1950, the Indian government replaced British subjects with Citizen of India.

- This was to address concerns about protecting the interests of the indigenous people from outsiders belonging to other Indian states.

Tariff in Hospitals:

Tariff in Hospitals:

- Tariff in hospitals is the price of hospital services set by regulating authorities.

- Purchasers i.e., government, health insurer, patients, etc., must pay that financial amount to the hospital authorities in exchange of receiving services.

- The hospital service tariff affects health system costs, hospital efficiency, access to health services, and the satisfaction of both patients and hospital service providers.

- Health care schemes and private insurance have individual hospital empanelment process, which replicates various activities and contributes to inefficiency and duplication of processes.

- Hospitals keep changing tariffs on a regular basis.

- There is no body to regulate them on tariff structure and grading.

- The regulator does not allow insurance companies to raise premium every year though there is around 10-15 per cent inflation of hospital charges at present.

- IRDAI doesn’t have the infrastructure to regulate hospitals.

- IRDAI recommended to have common empanelment portal which can be utilized by all the schemes/insurance companies with standardized empanelment criteria.

- IRDAI has proposed that either there must be a separate regulator for the healthcare segment or IRDAI must be allowed to regulate hospitals.

- IRDAI is striving for standardization of charges of medical procedures.

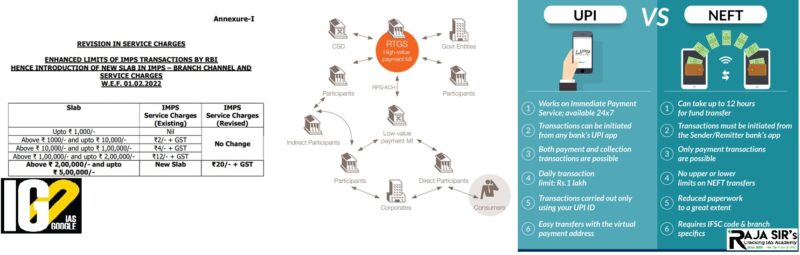

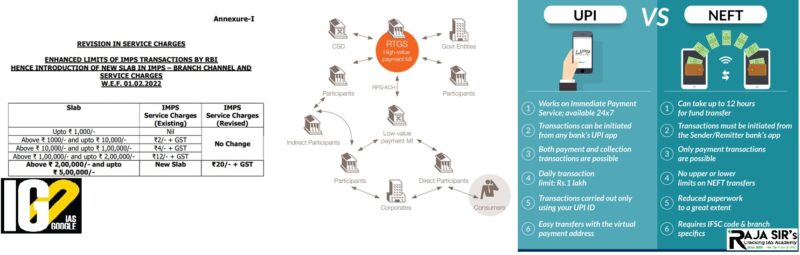

What is IMPS?

What is IMPS?

- Immediate Payment Service (IMPS) is an interbank electronic fund transfer service.

- IMPS transactions are channel independent and can be initiated from Mobile, Internet, or ATM channels.

- It is managed by National Payments Corporation of India (NPCI), and comes under the purview of the Reserve Bank of India (RBI).

- Instant Fund Transfer: It allows transferring of funds instantly within banks across India which is not only safe but also economical.

- Fast and Inexpensive: Transaction can be done using only the mobile no. and MMID of the beneficiary.

- Mobile Money Identification Number (MMID) is a seven-digit number of which the first four digits are the unique identification number of the bank offering IMPS.

- Accessible: This feature is available even on holidays and weekends.

- Remitter (Sender)

- Beneficiary (Receiver)

- Banks

- National Financial Switch-NPCI

- To enable bank customers to use mobile instruments as a channel for accessing their banks accounts and remit funds.

- Making payment simpler just with the mobile number of the beneficiary.

- To sub-serve the goal of Reserve Bank of India (RBI) in electronification of retail payments.

- To build the foundation for a full range of mobile based Banking services.

- Real-Time Gross Settlement (RTGS) is a fund transfer system based on a gross settlement concept where money is moved from one bank to another in real-time.

- It is designed for high transaction amounts for payments that needs to be processed immediately.

- Quick : It allows transfer in real time with no need of waiting.

- Wider Boundaries: The money can be sent to any RTGS-enabled bank branch in India.

- Secure:

- Smart user authentication to ensure safety of transactions.

- It is used by central banks worldwide to minimize the risks related to high-value payment settlements among financial institutions.

- High-value transactions

- Amounts greater than ₹ 2 lakhs.

- No upper limit for RTGS transactions from branches.

- For Online transaction, the maximum amount of funds that can be transferred per day is as per the customer's TPT (Third Party Transfer) limit (Maximum upto Rs. 50 Lakh).

- National Electronics Fund Transfer (NEFT) is a country-wide electronic fund transfer system.

- It allows for sending money from one bank account to another in a safe and hassle-free manner.

- It can be assessed on all days of the year.

- It provides secure transaction by sending positive confirmation to the remitter by SMS / e-mail on credit to beneficiary account.

- It provides Pan-India coverage through large network of branches of all types of banks.

- It also provides penal interest provision for delay in credit or return of transactions.

- Charges are not levied by RBI from banks.

- No charges are levied to savings bank account customers for online NEFT transactions.

- It can be used for a variety of Payment transactions including payment of credit card dues to the card issuing banks, payment of loan EMI, inward foreign exchange remittances, etc.

- It is also available for one-way funds transfers from India to Nepal.

Central Board of Indirect Taxes and Customs-CBIC

Central Board of Indirect Taxes and Customs-CBIC

- It is a part of the Department of Revenue under the Ministry of Finance, Government of India.

- The Board is the administrative authority for its subordinate organizations, including Custom Houses, Central Excise and Central GST Commissionerate and the Central Revenues Control Laboratory.

- It deals with the tasks of formulation of policy concerning levy and collection of taxes: Customs, Central Excise duties, Central Goods & Services Tax and IGST.

- It also deals with the framing of licensing policy for cultivation of Opium poppy, production of opium and export and pricing of opium.

- It makes policy for the prevention of smuggling and administration of matters relating to Narcotics.

- Administration of sales tax laws (Validation) Act, 1956, Central Sales Tax, State-level Value Added Tax (VAT), Indian Stamp Act, 1989 etc.

- Recommending projects of social and economic welfare to the Central Government.

- Coordinating and strengthening of the intelligence gathering activities.

- To coordinate and strengthen collection and sharing of financial intelligence to combat money laundering and related crimes.

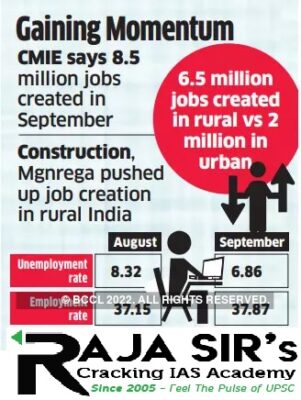

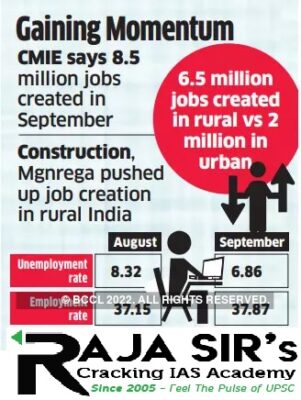

- Urban employment rate touched the 9.3% while rural employment rate rose to 7.3%.

What is Unemployment?

What is Unemployment?

- Unemployment is a term referring to individuals who are employable and actively seeking a job but are unable to find a job.

- It is a key economic indicator because it signals the ability (or inability) of workers to readily obtain gainful work to contribute to the productive output of the economy.

- It occurs when people voluntarily change jobs within an economy.

- This type of unemployment is usually short-lived.

- An example is a worker who recently quit or was fired and is looking for a job in an economy that is not experiencing a recession.

- It happens when the skills set of a worker does not match the skills demanded by the jobs available.

- Alternatively, when workers are available but are unable to reach the geographical location of the jobs.

- It comes about through technological changes in the structure of the economy in which labor markets operate.

- It is the variation in the number of unemployed workers over the course of economic upturns and downturns.

- Unemployment rises during recessionary periods and declines during periods of economic growth.

- It results from long-term or permanent institutional factors and incentives in the economy.

- The following can contribute to institutional unemployment:

- Government policies, such as high minimum wage floors, generous social benefits programs, and restrictive occupational licensing laws.

- Labor market phenomena, such as efficiency wages and discriminatory hiring.

- Voluntary unemployment happens when a worker decides to leave a job because it is no longer financially compelling.

- It is a situation in which more people are doing work than actually required.

- It occurs when productivity is low and too many workers are filling too few jobs.

- If unemployment continues to be a long-term feature of a country, it is called chronic unemployment.

- Often, the underdeveloped economies suffer from the chronic unemployment.

- It is the result of certain changes in the techniques of production which may not warrant much labour.

- Typically, the technological unemployment occurs with the introduction of new machinery, and it said to be temporary or short-lived.

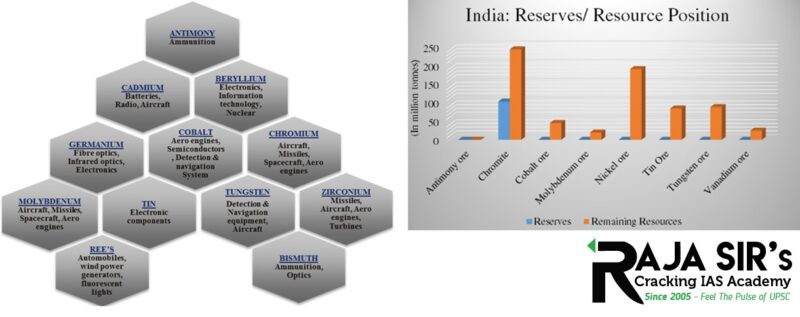

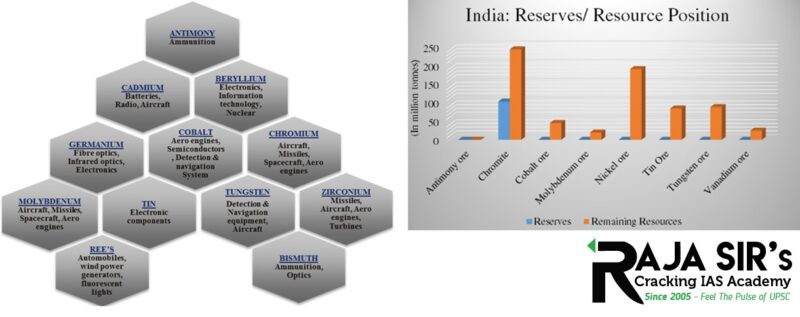

- Aim: To ensure India’s mineral security as well as to attain self-reliance in the area of critical and strategic minerals.

- This will fulfil the requirements of crucial sectors especially for renewable energy (RE) and e-mobility sectors.

Khanij Bidesh India (KABIL)

Khanij Bidesh India (KABIL)

- The Mines Ministry has created a joint venture (JV) company Khanij Bidesh India (KABIL)with participating interest from National Aluminium Company (NALCO), Hindustan Copper (HCL) and Mineral Exploration Corporation (MECL).

- Each company participation is 40:30:30, respectively.

- Vision: To promote international cooperation and seeking investment opportunity to build business partnership in strategic mineral sector.

- Identify, explore, acquire, develop overseas mineral assets of critical and strategic nature such as Lithium, Cobalt etc.

- To support “Make in India” and Atmanirbhar Bharat Abhiyan.

- These are metals and non-metals that are considered vital for the economic well-being of world.

- These are important for socio- economic development of nation.

- Strategic minerals are needed for military, industrial or commercial purposes that are essential to renewable energy, national defense equipment, medical devices, etc.

- Some examples of strategic minerals are tin, silver, antimony, cobalt, manganese, tungsten, zinc, titanium, platinum, chromium, bauxite, and diamonds.

- The paucity of strategic minerals in India has been a serious concern for the last several decades.

- India is highly dependent on imports for the supply of strategic minerals.

- India is having resources worth 87.39 million tonnes of Tungsten, 24.63 million tonnes of Vanadium, 189 million tonnes of Nickel.

- According to Atomic Minerals Directorate (AMD) in Marlagalla–Allapatna area in Mandya district of Karnataka there is presence of Lithium resources of 1,600 tonnes (inferred category).

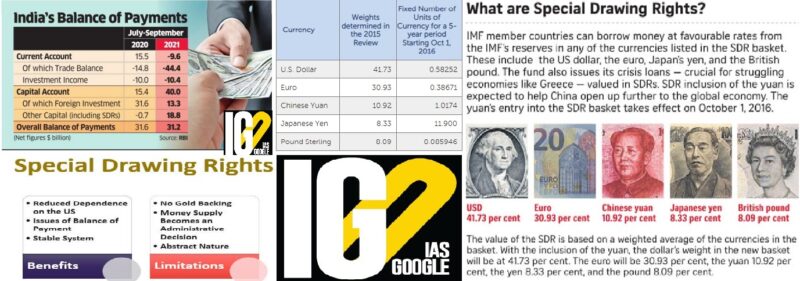

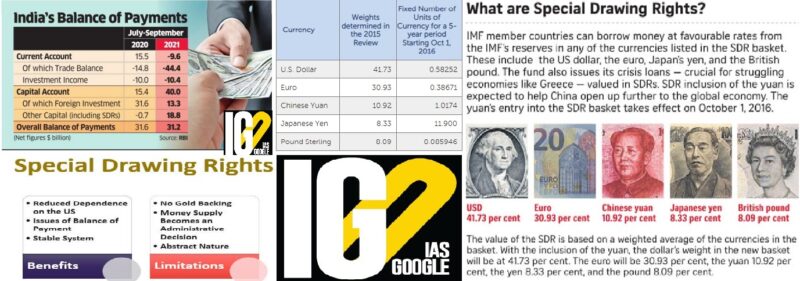

Special Drawing Rights (SDR):

Special Drawing Rights (SDR):

- The SDR is an international reserve asset, created by the International Monetary Fund (IMF) in 1969.

- The SDR is neither a currency nor a claim on the IMF and cannot be used directly in market transactions.

- It is a potential claim on the freely usable currencies of IMF members.

- They can be used by countries to gain access to hard currency and can also be used for repaying loans to the IMF.

- Holders of SDRs can obtain hard currencies in exchange for their SDRs by voluntarily exchanging them with other members.

- IMF can designate members with large holdings of reserves to purchase SDRs from members who need reserves.

- Currencies included in the SDR basket have to meet two criteria: the export criterion and the freely usable criterion.

- A currency meets the export criterion if its issuer is an IMF member or a monetary union that includes IMF members, and is also one of the top five world exporters.

- For a currency to be determined “freely usable” by the IMF, it has to be widely used to make payments for international transactions and widely traded in the principal exchange markets.

- The value of the SDR is determined daily based on market exchange rates.

- SDR allocations can play a role in providing liquidity and supplementing member countries’ official reserves.

- It serves as the unit of account of the IMF and other international organizations.

- The IMF has the authority to issue general allocations of SDRs to all members of the IMF in proportion to their quotas within the Fund.

- The quota is based largely on a country’s relative position in the global economy.

- A new issuance of SDRs represents an increase in the global money supply.

- Any SDR allocation must be approved by an 85 per cent majority of the total voting power, which gives the US a veto over issuance of SDRs.

Highlights:

Highlights:

- The dedicated window for bond houses called primary dealers has been offered by the Reserve bank of India.

- A special Switch window will be opened for primary dealers (PD)every month.

- PD’s may switch the illiquid/semi-liquid securities acquired through the Request for Quotes segment from Retail Direct Gilt accountholders with liquid securities from RBI at market prices.

- Retail Direct Gilt account: Account will allow individuals to buy Government securities directly in the primary market (auctions) as well as buy/sell in the secondary market.

- Primary dealers are registered entities with the RBI who have the license to purchase and sell government securities.

- PD’s aims to resell them to other buyers. Therefore, the Primary Dealers create a market for government securities.

- The Primary Dealers system in the government securities market was introduced by the RBI in 1995.

- Commit participation as Principals in Government of India issues through bidding in auctions.

- Provide underwriting services.

- Offer firm buy-sell / bid-ask quotes for T-Bills & dated securities.

- Development of Secondary Debt Market.

- A subsidiary of scheduled commercial bank/s and All India Financial Institutions.

- Subsidiaries/ joint ventures set up in India by entities incorporated abroad.

- The company was incorporated under the Companies Act, 1956, and does not fall under the above two conditions.

- The applicant for PD should register as an NBFC for at least one year before the submission of the application.

- The RBI instructs PDs to have a minimum turnover ratio, bidding ratio, underwriting ratio, secondary market participation.

- RBI ensures that they are active in supporting the trade in government securities.

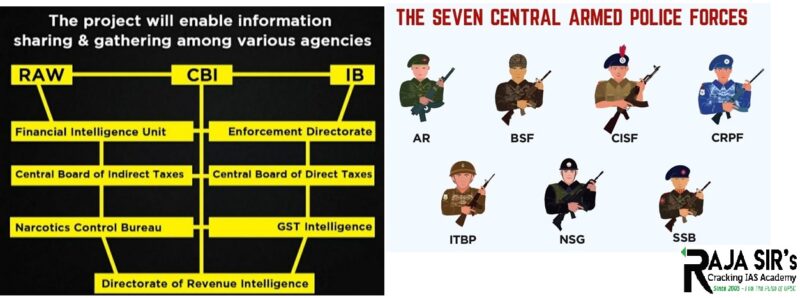

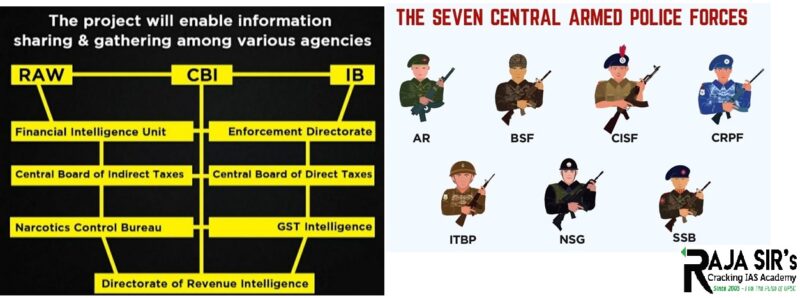

Multi Agency Centre (MAC):

Multi Agency Centre (MAC):

- It was established by Intelligence Bureau (IB) in 2001.

- It is the nodal body for sharing intelligence inputs.

- It functions on 24x7 basis for real time collation and sharing of intelligence with other central Intelligence Agencies and all state polices.

- Establishment of MAC was suggested by Kargil Review Committee, 1999.

- The IB, established in 1887, is an Indian domestic internal security and counter-intelligence agency. It includes counter-terrorism tasks too.

- The Research and Analysis Wing (RAW), established in 1968, specifically deals with foreign intelligence.

- It is working under the aegis of Ministry of Home Affairs, Government of India.

- IB Officers are either directly recruited or are deputed from Central Armed Police Forces (CAPFs) and Indian Army.

- IB is headed by a director, called Director of IB.

- NATGRID is an intelligence master database for counter-terrorism

- It was established in 2009, in aftermath of 26/11 attacks in Mumbai (2008).

- It is functioning under the aegis of Ministry of Home Affairs, Government of India.

- These data sources include records related to immigration entry and exit, banking and financial transactions, telecommunication records etc. currently 21 agencies are part of it.

- The NATGRID database will be accessible by main federal agencies including,

- Central Bureau of Investigation (CBI),

- Directorate of Revenue Intelligence (DRI),

- Enforcement Directorate (ED),

- Central Board of Indirect Taxes and Customs

- Central Board of Direct Taxes (for Income Tax Department) (CBDT)

- Cabinet Secretariat, Intelligence Bureau (IB),

- Directorate General of GST Intelligence,

- Narcotics Control Bureau (NCB),

- Financial Intelligence Unit

- National Investigation Agency (NIA) etc.

What is Aquamation?

What is Aquamation?

- Aquamation or alkaline hydrolysis consists of cremation by water rather than fire.

- The deceased's body is immersed for three to four hours in a mixture of water and potassium hydroxide in a pressurised metal cylinder and heated to around 150 degrees Celsius.

- The entire body is liquefied, except for the bones.

- The bones are dried in an oven and then reduced to dust.

- The process was developed in 1888 by Amos Herbert Hanson.

- It was first used in the funeral industry, at two funeral homes in USA.

- Substituting aquamation for fire-based cremation cuts a funeral’s

- greenhouse gas emissions by 35 percent.

- energy use by 90 percent compared with cremation by flame.

- It completely hydrolyzes both RNA and DNA and destroys all pathogens.

- It converts any drugs in the body to harmless biodegradable derivatives.

- The cost of both flame-based cremation and aquamation is similar.

Latest News

Latest News General Studies

General Studies