- Home

- Prelims

- Mains

- Current Affairs

- Study Materials

- Test Series

EDITORIALS & ARTICLES

EDITORIALS & ARTICLES

OPEC+ cut oil production

Recently, The Organisation of the Petroleum Exporting Countries and its allies (OPEC+) has decided to cut oil production by 2 million barrels per day (bpd).

- This is thelargest cut since the beginning of the Covid-19 pandemic.

- US legislation in May 2022 passed theNo Oil Producing and Exporting Cartels (NOPEC) bill, which is intended to protect US consumers and businesses from engineered oil spikes.

Reasons for Slashing Production

- Oil prices skyrocketed after Russia’s invasion of Ukraine and have since begun tosoften over the past few months, before dropping sharply to under USD 90 in September,2022 due to fears of a recession in Europe and reduced demands from China because of its lockdown measures.

- The reductionswould boost prices and be extremely beneficial for the Middle Eastern member states, to whom Europe has turned for oil after levelling sanctions against Russia since it invaded Ukraine.

- OPEC+ members are concerned that a faltering global economy would reduce the demand for oil,and the cuts are seen as a way to protect profits.

- Increased oil prices, which first occurred during the invasion of Ukraine, have helped Saudi Arabia, one of the founding members of OPEC, become one of the world’s fastest-growing economies.

- It is possible that Russia might be influencing OPEC, to makeit more expensive for the West to extend energy sanctions on Russia.

Impact

- Impact on European Countries:

- Recently, the European Union had announced its plan to implement a price cap on oil exports from Russia.

- Under the plan, countries will only be permitted to purchase Russian oil and petroleum products transported via sea that are sold at or below the price cap.

- However, the recent decision to reduce the supply is likely to keep the global oil prices high, allowing Russia to continue aiming for significant revenue from its crude export.

- Impact on the U.S:

- The move is likely to be highly detrimental to the US, which hasrepeatedly asked the organisation to increase oil production.

- Slashes in reduction and subsequently increased oil prices can be particularly dangerous to the US,who is trying to reduce inflation rates before the midterm elections in November 2022.

- Impact on India:

- India imports nearly85% of its crude requirement, the oil import bill will rise on account of the rise in prices. The rise in import bills will not only lead to inflation and a rise in the Current Account Deficit (CAD) and fiscal deficit but also weaken the rupee against the dollar and hurt stock market sentiment

- As per Investment Information and Credit Rating Agency (ICRA), for every $10 per barrel increase in the price of the Indian crude oil basket, the CAD could widen by $14-$15 billion, or 0.4% of GDP.

- India imports nearly85% of its crude requirement, the oil import bill will rise on account of the rise in prices. The rise in import bills will not only lead to inflation and a rise in the Current Account Deficit (CAD) and fiscal deficit but also weaken the rupee against the dollar and hurt stock market sentiment

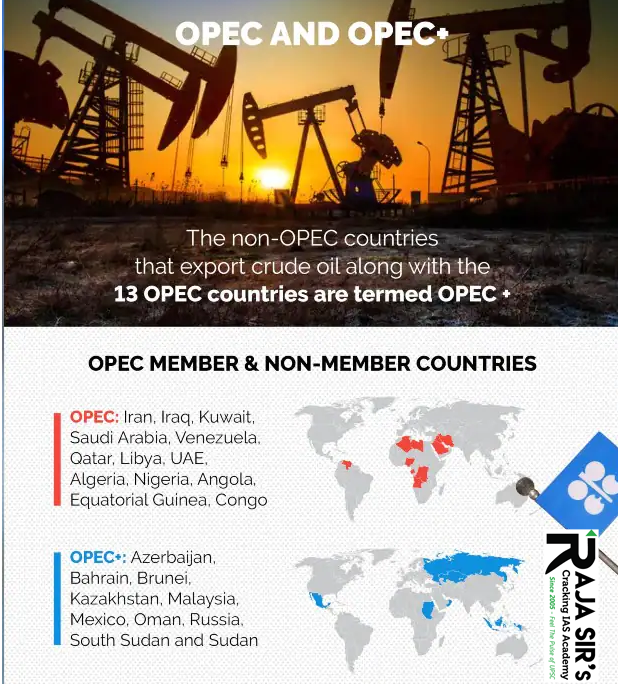

- Established in 1960 by founding members Iran, Iraq, Kuwait, Saudi Arabia and Venezuela, OPEC has since expanded and now has 13 member states.

- Member countries are:Algeria, Angola, Congo, Equatorial Guinea, Gabon, Iran, Iraq, Kuwait, Libya, Nigeria, Saudi Arabia, United Arab Emirates, Venezuela.

- Qatar terminatedits membership on 1st January 2019.

- With the addition of another 10 allied major oil-producing countries,the OPEC is known as OPEC+.

- OPEC+ countries include13 OPEC member countries, Azerbaijan, Bahrain, Brunei, Kazakhstan, Malaysia, Mexico, Oman, Russia, South Sudan and Sudan.

- The objective of the organization is to “coordinate and unify the petroleum policies of its Member Countriesand ensure the stabilisation of oil markets in order to secure an efficient, economic and regular supply of petroleum to consumers, a steady income to producers and a fair return on capital for those investing in the petroleum industry.

- Previously controlled by western-dominated multinational oil companies known as the “Seven Sisters,” OPEC sought to give the oil-producing nations greater influence over the global petroleum market.

- They account for roughly 40 % of the world’s crude oiland 80 % of the globe’s oil reserves, according to estimates from 2018.

- They usually meet every month to determine how much oil the member states will produce.

- However, many allege that OPEC behaves like a cartel,determining the supply of oil and influencing its price in the world market.

Latest News

Latest News General Studies

General Studies