- Home

- Prelims

- Mains

- Current Affairs

- Study Materials

- Test Series

03rd Oct 2021

CHALLENGES APLENTY FOR DIGITAL HEALTH MISSION

Recently, the Centre announced the nationwide rollout of Pradhan Mantri Digital Health Mission (PM-DHM), which is in its pilot stage in six UTs.

ABDM (Ayush Bharat Digital Mission):

- Aim: to give every citizen a unique digital health ID, which involves their health records being digitally protected and making health a “holistic and inclusive model”.

- Under the mission, users can access and link personal records with their unique ID to create a longitudinal health history.

- The model will stress preventive healthcare and, in case of disease, easy, affordable and accessible treatment.

- In order to be a part of the ABDM, citizens will have to create a unique health ID – a randomly generated 14-digit identification number.

- The ID will give the user unique identification, authentication and will be a repository of all health records of a person.

- The ID can also be made by self-registration on the portal, downloading the ABMD Health Records app on one’s mobile or at a participating health facility.

- The beneficiary will also set up a Personal Health Records (PHR) address for the issue of consent, and for future sharing of health records.

- The Digital Ecosystem will enable a host of other facilities like digital consultation, consent of patients in letting medical practitioners access their records, and so forth.

- Records are stored under retention policies and can be accessed only with the consent of users. Besides, users can delete and exit the service any time they want.

- The account could be reactivated after which the user can share the ID at any health facility or share health records over the ABDM network. However, there are concerns according to experts.

- Privacy issues: The citizen’s consent is vital for all access. A beneficiary’s consent is vital to ensure that information is released. The privacy of an individual is a challenge in the implementation of the project.

- India has been unable to standardise the coverage and quality of the existing digital cards like One Nation One Ration card, PM-JAY card, Aadhaar card, etc., for accessibility of services and entitlements.

- The data migration and inter-State transfer are still faced with multiple errors and shortcomings in addition to concerns of data security.

- The defence of data security by expressed informed consent doesn’t work in a country that is plagued by the acute shortage of healthcare professionals to inform the client fully.

- In the Indian context, where public funds for healthcare are perennially short, every extra rupee spent on administrative expenses raises ethical concerns, since these costs don’t directly contribute to improving the health of the population.

- With the minuscule spending of 1.3% of the GDP on the healthcare sector, India will be unable to ensure the quality and uniform access to healthcare that it hoped to bring about.

- The precursor of the Pradhan Mantri Jan Arogya Yojana (PMJAY, the insurance component of ABM), namely the Rashtriya Swasthya Bima Yojana (RSBY), was replete with alleged reports of insurance fraud, such as fake beneficiaries. The PMJAY has not been free of them either.

- Personalised data collected at multiple levels are a “sitting gold mine” for insurance companies, international researchers, and pharma companies.

- Lack of access to technology, poverty, and lack of understanding of the language in a vast and diverse country like India are problems that need to be looked into.

- The power plants will no longer have to specify their target beneficiaries, a deviation from the present system of taking transmission access.

- At present, generating companies apply for long-term access(LTA) based on their supply tie-ups while medium-term and short-term transmission access is acquired within the available margins.

- Based on LTA application, incremental transmission capacity is added.

- The rules will empower State power distribution and transmission companies to determine their transmission requirements and build them accordingly.

- They enable sale, sharing and purchase of transmission capacity by states and generators. This aims to streamline the process of planning, development and recovery of investment in the transmission system.

- The states will be able to purchase electricity on short-term and medium-term contracts and optimise their power purchase costs.

- The rules underpin a system of transmission access which is termed as General Network Access in the inter-State transmission system.

- This provides flexibility to states as well as generating stations to acquire, hold and transfer transmission capacity as per their requirements.

- Transparency in power transmission

- Rationality, responsibility and fairness in process of transmission planning as well as its costs.

- The companies will indemnify the Indian government against future claims and withdraw, pending litigation before any forum in order to settle their retrospective tax cases.

- Issuance of a public notice or press release by the company stating that claims arising out of the relevant orders, judgment, or court order, will include an indemnity against “any claims against the Republic of India or any India affiliate contrary to the undertaking”.

- The companies will have to withdraw any pending litigation before any forum against the levy of the retrospective tax.

- They will file a declaration with income tax authorities along with a legal authorization besides an indemnity bond.

- Submission of an undertaking to withdraw all pending legal proceedings must be done in 45 days.

- The companies must fulfil the condition of indemnity by all interested parties within 60 days.

- The order granting relief must be made within 30 days, after this the refund will be initiated.

- The declarant and all the interested parties shall indemnify, defend, and hold harmless the Republic of India from and against all costs, expenses interest, damages.

- Filing and maintaining of any claim, at any time after the date of furnishing the undertaking.

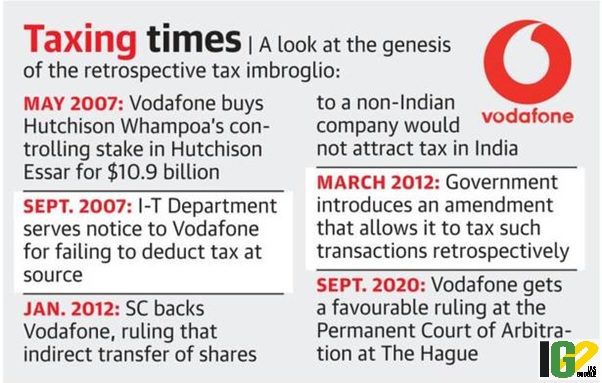

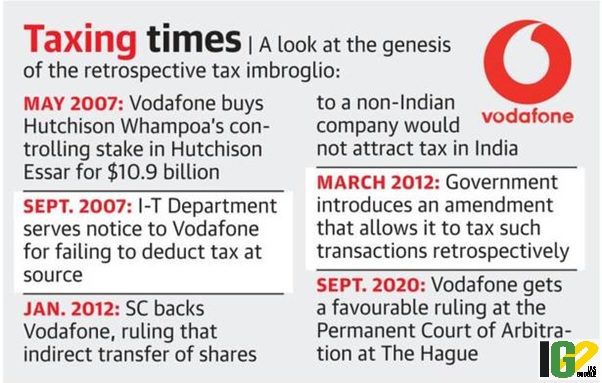

- The Central Government brought in The Taxation Laws (Amendment) Act, 2021.

- It stated no tax demand shall be raised for any indirect transfer of Indian assets if the transaction was undertaken before May 28, 2012.

- The central government amended the Income-tax Act in 2012.

- It was done in response to a Supreme Court verdict, which stated, Vodafone cannot be taxed for a 2007 transaction that involved its purchase of 67 per cent stake in Hutchison Whampoa for $11 billion.

- In 2014 Central government raised tax demand against Cairn Energy Plc for restructuring done in 2006.

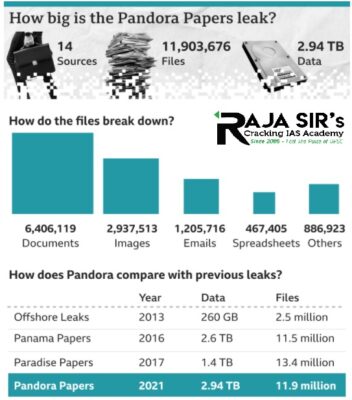

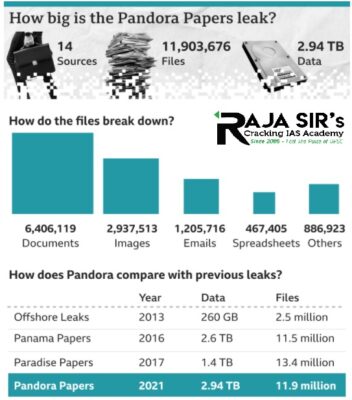

- These are 11.9 million leaked files from 14 global corporate services firms which set up about 29,000 off-the-shelf companies and private trusts.

- These were set up in not only tax haven countries but also in countries such as Singapore, New Zealand, and the United States etc.

- The data was obtained by International Consortium of Investigative Journalists in Washington DC.

- These documents relate to ultimate ownership of assets ‘settled’ (or placed) in private offshore trusts and the investments including cash, shareholding, and real estate properties, held by the offshore entities.

- There are at least 380 persons of Indian nationality in the Pandora Papers, and the investigation is currently ongoing.

- The Pandora Papers reveal how the people involved set up complex multi-layered trust structures for estate planning.

- The objective of the trust was:

- To hide their real identities and distance themselves from the offshore entities so that it becomes near impossible for the tax authorities to reach them.

- To safeguard investments — cash, shareholdings, real estate, art, aircraft, and yachts — from creditors and law enforcers.

- Panama and Paradise Papers dealt largely with offshore entities set up by individuals and corporates respectively.

- Pandora Papers investigation shows how businesses have created a new normal after countries were forced to tighten laws on offshore entities with rising concerns of money laundering, terrorism funding, and tax evasion.

- Pandora Papers reveal how trusts are set up, together with offshore companies for the sole purpose of holding investments.

- A trust can be described as an arrangement where a third party (or trustee) holds assets on behalf of individuals or organisations that are to benefit from it.

- It is generally used for estate planning purposes and succession planning. It helps large business families to consolidate their assets — financial investments, shareholding, and real estate property.

- Settlor — one who sets up, creates, or authors a trust

- Trustee — one who holds the assets for the benefit of a set of people named by the ‘settlor’

- Beneficiaries — to whom the benefits of assets are passed on.

- The Indian Trusts Act, 1882, gives legal basis to the concept of trusts.

- While Indian laws do not see trusts as a legal person/ entity, they recognise trust as an obligation of trustee to manage and use assets settled in the trust for the benefit of beneficiaries.

- India also recognises offshore trusts i.e., trusts set up in other tax jurisdictions.

- There are legitimate reasons for setting up trusts — and many set them up for genuine estate planning.

- A businessperson can set conditions for ‘beneficiaries’to draw income being distributed by the trustee or inherit assets after her/ his demise.

- But trusts are also used as secret vehicles to park illegal money, hide incomes to evade taxes, protect wealth from law enforcers, insulate it from creditors to whom huge moneys are due, and for criminal activities.

- Overseas trusts offer remarkable secrecy because of stringent privacy laws in the jurisdiction they operate in.

- After the Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act, 2015, resident Indians — if they are ‘settlors’, ‘trustees’, or ‘beneficiaries’ — have to report their foreign financial interests and assets.

- NRIs are not required to do so — even though, the Income Tax Department has been sending notices to NRIs in certain cases.

- The I-T Department may consider an offshore trust to be a resident of India for taxation purposes if the trustee is an Indian resident.

- In cases where the trustee is an offshore entity or an NRI, if the tax department establishes the trustee is taking instructions from a resident Indian, then too the trust may be considered a resident of India for taxation purposes.

- i) Maintain a degree of separation:

- Businesspersons set up private offshore trusts to project a degree of separation from their personal assets.

- A ‘settlor’ (one who sets up/ creates/ authors) of a trust no longer owns the assets he places or ‘settles’ in the trust. Hence, he insulates these assets from creditors.

- ii) Hunt for enhanced secrecy:

- Offshore trusts offer enhanced secrecy to businesspersons, given their complex structures.

- Income-Tax Department in India can get the information only by requesting information with the financial investigation agency or international tax authority in offshore jurisdictions, which can take months.

- Businesspersons avoid their NRI children being taxed on income from their assets by transferring all the assets to a trust.

- The ownership of the assets rests with the trust, and the son/ daughter being only a ‘beneficiary’ is not liable to any tax on income from the trust.

- iv) Prepare for estate duty:

- It is feared that the estate duty, which was abolished in 1985 will likely be re-introduced soon.

- Setting up trusts in advance, business families have been advised, will protect the next generation from paying the death/ inheritance tax, which was as high as 85% then.

- India does not have a wealth tax now, most developed countries including the US, UK, France, Canada, and Japan have such an inheritance tax.

- v) Flexibility in a capital-controlled economy:

- India is a capital-controlled economy. Individuals can invest only $250,000 a year under the Reserve Bank of India’s Liberalised Remittance Scheme (LRS).

- To get over this, businesspersons become NRIs, and under FEMA, NRIs can remit $1 million a year in addition to their current annual income, outside India.

- Further, tax rates in overseas jurisdictions are much lower than the 30% personal I-T rate in India plus surcharges.

- The awardees are:

- Assam branch of Kasturba Gandhi National Memorial Trust

- German based Assamese litterateur Dr. Nirod Kumar Barooah

- Shillong Chamber Choir at Srimanta Sankardeva Kalakshetra

- The award carries five lakh rupees each, a citation and an angavastram.

- The Award is named after the first chief minister of Assam after independence and he was a freedom fighter. He was awarded the Bharat Ratna in 1999 posthumously.

- Aim: To support the hiring of nearly one lakh apprentices and assist employers in tapping the right talent and develop it further with training and providing practical skillsets.

- The event is expected to witness participation from more than 2000 organisations operating in more than 30 sectors such as Power, Retail, Telecom, IT/ITeS, Electronics, Automotive and more.

- The aspiring youth will have the opportunity to engage and select from more than 500+trades including Welder, Electrician, Housekeeper, Beautician, Mechanic etc.

- 5th to 12thpass students, Skill Training Certificate holders, ITI students, Diploma holders and graduates are eligible to apply at the Apprenticeship Mela.

- The National Policy of Skill Development and Entrepreneurship, 2015 launched by the Hon’ble Prime Minister on July 15th, 2015 recognises apprenticeship as a means to provide gainful employment to skilled workforce with adequate compensation.

- MSDE has also taken several efforts to increase the number of apprentices hired by enterprises in the country.

- Aim: To fill the gap in supply and demand for skilled workforce and meet the aspirations of the Indian youth through gaining on-the-job training and securing better opportunities for employment.

- This training is under the Apprentices Act, 1961. And support through National Apprenticeship Promotion Scheme.

Latest News

Latest News

General Studies

General Studies