- Home

- Prelims

- Mains

- Current Affairs

- Study Materials

- Test Series

'Corrupt Solar Project': Adani embroiled in US findings

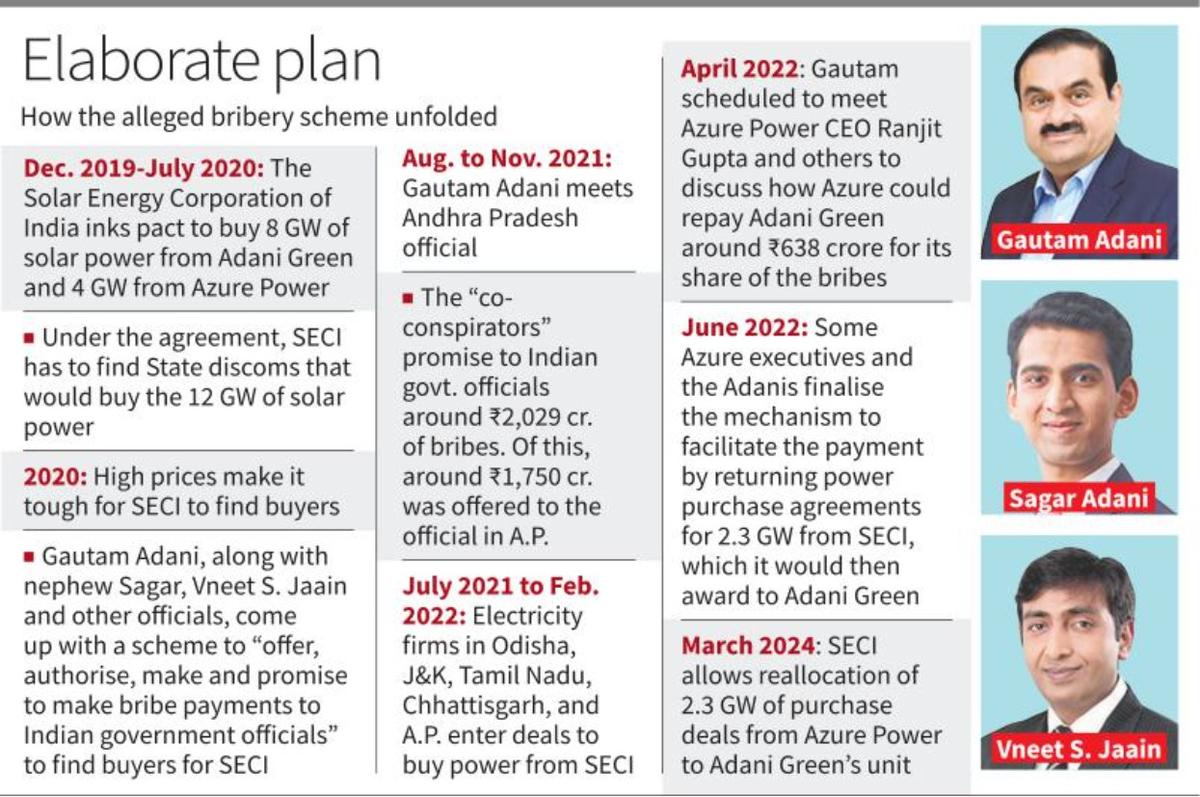

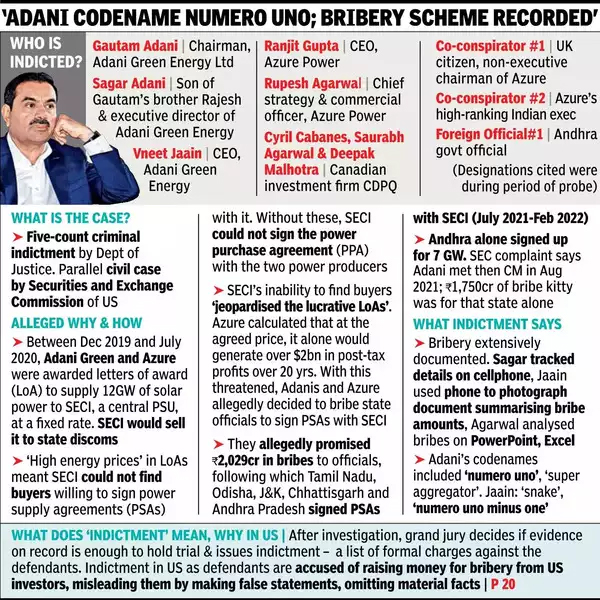

Adani Group Chairman Gautam Adani bribery and fraud case: Adani Group Chairman Gautam Adani, his nephew Sagar Adani and six others were indicted by US prosecutors in New York on 20 November 2024 in an alleged Rs 2,029 crore bribery case. The bribes were allegedly offered to Indian government officials for securing “lucrative solar energy supply contracts” with state electricity distribution companies. “This indictment alleges schemes to pay over $250 million in bribes to Indian government officials, to lie to investors and banks to raise billions of dollars, and to obstruct justice,” a press release issued by the US Attorney’s Office, Eastern District of New York, said quoting US Deputy Assistant Attorney General Lisa H Miller.

What exactly is the case?

- Apart from Gautam Adani and Sagar Adani (the 30-year-old son of his brother Rajesh Adani, and Executive Director of Adani Green Energy Ltd), the other defendants named are: i) Vneet Jaain, CEO of Adani Green Energy Ltd, ii) Ranjit Gupta, CEO of Azure Power Global Ltd between 2019 and 2022, iii) Rupesh Agarwal, who worked with Azure Power between 2022 and 2023; iv, v, vi) Cyril Cabanes, a citizen of Australia and France, and Saurabh Agarwal and Deepak Malhotra, all three of whom worked with a Canadian institutional investor.

- According to the US prosecutors, the “Indian Energy Company” and a “US Issuer” won awards to supply 8 gigawatts and 4 gigawatts of solar power at a fixed rate to state-owned Solar Energy Corporation of India (SCI).

- SECI was supposed to sell the power to state electricity companies. But since SECI could not find buyers, it could not enter into corresponding power purchase agreements with Adani Group and Azure Power.

- It was after this that the defendants came up with a plan to bribe state government officials in India to buy the power from SECI. A press release by the Attorney’s Office of the Eastern District of New York says, “…between approximately 2020 and 2024, the defendants agreed to pay more than $250 million in bribes to Indian government officials to obtain lucrative solar energy supply contracts with the Indian government, which were projected to generate more than $2 billion in profits after tax over an approximately 20-year period (the Bribery Scheme). On several occasions, Gautam S Adani personally met with an Indian government official to advance the Bribery Scheme…”

- The US Securities and Exchange Commission also charged Gautam Adani, Sagar Adani, and Cabanes.

What exactly is an ‘indictment’ in the US?

- An indictment in the US is basically a formal written accusation originating with a prosecutor and issued by a grand jury against a party charged with a crime.

When a person is indicted, they are given formal notice that they are believed to have committed a crime. They can then hire an defence lawyer and take steps to defend themselves.

- If the plan was to bribe Indian officials, why the indictment in the US?

- Adani and the others have been indicted for raising money for the “bribery scheme” from US investors.

- “…Gautam S Adani, Sagar R Adani and Vneet S Jaain lied about the bribery scheme as they sought to raise capital from US and international investors,” Breon Peace, United States Attorney for the Eastern District of New York, said, as per the press release.

- “These offenses were allegedly committed… at the expense of US investors. The Criminal Division will continue to aggressively prosecute corrupt, deceptive, and obstructive conduct that violates US law, no matter where in the world it occurs,” said Miller.

- James Dennehy, FBI Assistant Director in Charge, said, “Adani and other defendants also defrauded investors by raising capital on the basis of false statements about bribery and corruption, while still other defendants allegedly attempted to conceal the bribery conspiracy by obstructing the government’s investigation.”

How has the Adani group reacted?

How has the Adani group reacted?

- An Adani Group spokesperson said the allegations made by the US Department of Justice and the US Securities and Exchange Commission against directors of Adani Green are baseless and denied.

What has been the fallout so far?

- After the allegations came out, the Adani Group cancelled its $600 million bond offering. Adani Green Energy planned to use the bond sale’s proceeds to repay foreign-currency loans.

- Shares of Adani group companies plummeted by up to 20 per cent, with Adani Green Energy down by 18.76 per cent, Adani Energy Solutions by 20 per cent, Adani Enterprises by 10 per cent, Adani Power by 13.98 per cent and Adani Ports by 10 per cent in the morning session.

- Meanwhile, the Congress doubled down on its call for a Joint Parliamentary Committee probe into the various “scams” involving the Adani Group. In a post on X, Congress’s communications in-charge Jairam Ramesh said the indictment “vindicates” the demand for a JPC probe. The Congress leader also called for “a new and credible” SEBI head to be appointed to complete the securities law investigations into the ‘Adani MegaScam’.

Latest News

Latest News

General Studies

General Studies