- Home

- Prelims

- Mains

- Current Affairs

- Study Materials

- Test Series

Feb 18, 2022

NEW DELHI NON-COMMITTAL ON FUNDING CURBS ON U.K. NGOs

Recently, the United Kingdom officials discussed foreign funding restrictions placed on the Oxfam and other British NGOs with the Indian government.

About SMILE

About SMILE

Ebola Virus

Ebola Virus

What is Havana Syndrome?

What is Havana Syndrome?

Ultra-processed Food:

Ultra-processed Food:

Pradhan Mantri Fasal Bima Yojana

Pradhan Mantri Fasal Bima Yojana

Wholesale Price Index (WPI)?

Wholesale Price Index (WPI)?

- It requested the Union Home Ministry to reconsider its decision to deny Oxfam India’s registration renewal application under the Foreign Contribution Regulations Act (FCRA).

- India had given the British side no assurances on whether the cases would be reviewed, as the MHA had decided to do with the Missionaries of Charity, whose registration request was denied around the same time, but subsequently restored.

- India expressed concern regarding “anti-India activities of certain extremists and radical elements in the U.K.

- According to diplomatic sources, the delegation had also raised the denial of FCRA registration to UK-NGO Freedom Fund, which was one of 10 American, Australian, British and European NGOs dealing with environmental, climate change and child labour issues, who had lost their licenses due to what the government called “adverse inputs” on their partnerships in India.

- The FCRA was enacted during the Emergency in 1976 in an atmosphere of apprehension that foreign powers were interfering in India’s affairs by pumping in funds through independent organisations.

- These concerns had been expressed in Parliament as early as in 1969.

- The law sought to regulate foreign donations to individuals and associations so that they functioned “in a manner consistent with the values of a sovereign democratic republic”.

- An amended FCRA was enacted under the UPA government in 2010 to “consolidate the law” on utilisation of foreign funds, and “to prohibit” their use for “any activities detrimental to national interest”.

- The law was amended again by the current government in 2020, giving the government tighter control and scrutiny over the receipt and utilisation of foreign funds by NGOs.

- Broadly, the FCRA requires every person or NGO wishing to receive foreign donations to be registered under the Act, to open a bank account for the receipt of the foreign funds in State Bank of India, Delhi, and to utilise those funds only for the purpose for which they have been received and as stipulated in the Act.

- They are also required to file annual returns, and they must not transfer the funds to another NGO.

- The Act prohibits receipt of foreign funds by candidates for elections, journalists or newspaper and media broadcast companies, judges and government servants, members of legislature and political parties or their office-bearers, and organisations of a political nature.

- NGOs that want to receive foreign funds must apply online in a prescribed format with the required documentation. FCRA registrations are granted to individuals or associations that have definite cultural, economic, educational, religious, and social programmes.

- Following the application, the MHA makes inquiries through the Intelligence Bureau into the antecedents of the applicant, and accordingly processes the application.

- Under the FCRA, the applicant should not be fictitious or benami; and should not have been prosecuted or convicted for indulging in activities aimed at conversion through inducement or force, either directly or indirectly, from one religious’ faith to another.

- The applicant should also not have been prosecuted for or convicted of creating communal tension or disharmony; should not have been found guilty of diversion or misutilisation of funds; and should not be engaged or likely to be engaged in the propagation of sedition.

- The MHA is required to approve or reject the application within 90 days. In case of failure to process the application in the given time, the MHA is expected to inform the NGO of the reasons for the same.

- Once granted, FCRA registration is valid for five years.

- NGOs are expected to apply for renewal within six months of the date of expiry of registration.

- In case of failure to apply for renewal, the registration is deemed to have expired, and the NGO is no longer entitled to receive foreign funds or utilise its existing funds without permission from the ministry.

- Architects, heritage enthusiasts, State government officials and diplomats have on several occasion in the past few years visited the crumbling building located on the strand opposite Rani Ghat jetty on the banks of Hooghly and have assured about the restoration of the structure.

- French Ambassador to India Emmanuel Lenain, who recently visited Kolkata, expressed hope that the restoration of the Registry Building was “moving forward nicely”.

- A memorandum of understanding (MoU) was signed in February 2019 between France and the West Bengal government on the side lines of the Bengal Global Business Summit to work to restore the French era buildings for adaptive reuse.

- Chandernagore or Chandannagar was the first trading post on the eastern bank of the Hooghly, set up by the French in 1696.

- There are several buildings in the town that are a reflection of the rich architectural heritage of the town.

- Other than the buildings and structures that have been given the heritage tag there was a total 99 Indo-French heritage structures have been identified (by the French) in Chandernagore that needs to be resorted.

- Chandan agar was a French colony between 1678 and 1950 (when it was called Chandernagor) and still has many of the old buildings.

- The Registry Building, also known as Chander Bari, which is now in rather dilapidated condition, was the first French court house in India, built around 1875.

- Apart from the Strand on the River Ganga, the town is known for the Sacred Heart Church (inaugurated in 1884), Institute de Chandernagore (former home of French Governor Dupleix) which now includes a museum and a school to learn French language, an elegant mansion called Patal Bari (where you have subterranean rooms), several temples, including the terracotta built Nandadulal Temple, etc.

- The analysts expect the IPO of the Life Insurance Corporation of India (LIC) to be India's largest to date, potentially earning the government more than $10 billion.

- After the listing, which is expected in March, LIC will be one of India's biggest publicly listed companies alongside giants such as Reliance and TCS.

- LIC was created in 1956 and was synonymous with life insurance in post-independence India until private firms were allowed entry in 2000.

- The company holds a two-thirds share in the domestic life insurance market.

- It manages assets of 36.7 trillion rupees ($491 billion), which equates to nearly 16 per cent of India's gross domestic product.

- It has more than 100,000 employees and one million insurance agents.

- LIC's real estate assets include big offices at prime locations in various Indian cities, including a 15-storey building in the southern city of Chennai and a distinctively curved head office in the heart of Mumbai's financial district.

- The firm is also believed to own a large collection of rare and valuable artwork that includes paintings by MF Hussain -- known as the Pablo Picasso of India.

- Asia's third-largest economy was already grappling with a prolonged slowdown even before the start of the coronavirus pandemic. India has recorded its worst recession since independence due to the Covid-19 crisis.

- Efforts to contain the spread of the virus, such as through stringent lockdowns, created a significant budget deficit and pushed millions into joblessness and poverty.

- The IPO of LIC will give a boost to the government's efforts to raise much-needed cash through privatisations, which are running badly behind schedule.

- The government has raised just 120.3 billion rupees by selling stakes in various state-owned entities this financial year, well short of its target of 780 billion rupees.

- LIC is a household name in India and has a strong grip on the life insurance market in the vast South Asian nation despite the entrance of private players.

- The company is offering its millions of policyholders the opportunity to invest in the IPO at a discount, promoting the offer through television advertisements and full-page newspaper ads.

- Analysts expect retail investors, including many first-timers, to show a strong appetite for snaring a stake in the venerable company.

- Further, the Government of India has approved the Financial Assistance Policy for Indian Shipyards on 9th December 2015 for grant of financial assistance to Indian Shipyards for shipbuilding contracts signed between April 1, 2016 to March 31, 2026.

- These initiatives particularly focus on operational efficiency improvement, port-driven industrialization and creating safe and sustainable world class ports to address the growing trade volume needs, as well as reducing logistics cost through better evacuation and cost-effective processes.

- Analyse current and future challenges to define initiatives.

- Drive innovation by utilizing the latest technology.

- Create a time-bound action plan.

- Benchmark to understand current standing and adopt best-in-class practices.

- Address capability building and human resources.

- Explore ideas to achieve “Waste to Wealth”.

- Develop best-in-class Port infrastructure.

- Drive E2E Logistics Efficiency and Cost Competitiveness.

- Enhance Logistics Efficiency through Technology and Innovation.

- Strengthen Policy and Institutional Framework to Support all Stakeholders.

- Enhance Global Share in Ship Building, Repair and Recycling.

- Enhance Cargo and Passenger Movement through Inland Waterways.

- Promote Ocean, Coastal and River Cruise Sector.

- Enhance India’s Global stature and Maritime Co-operation.

- Lead the World in Safe, Sustainable &Green Maritime Sector.

- Become Top Seafaring Nation with World Class Education, Research & Training.

- The Radio Frequency Identification Device (RFID) solution has been implemented at all major ports to enable seamless movement of traffic across port gates, including substantial reductions in documentation checks. All Major ports have already implemented Radio Frequency Identification Device (RFID).

- Up gradation and integration with recent technologies- IoT, Block Chain to ease transaction and real time basis tracking has been envisaged in Maritime India Vision 2030.

- Logistics Data Bank Service under Delhi Mumbai Industrial Corridor Development Corporation Ltd. (DMICDC), for enabling track & trace movement of EXIM container has been implemented in all the Container handling Major Ports.

- An Enterprise Business System (EBS) is being implemented at 5 Major Ports to provide a digital port ecosystem that will adopt leading International Practices without losing its alignment to existing local needs.

- In order to bring all regulators near port area, the Port has allotted the office space to Participating Government Agencies (PGAs) like Animal Quarantine, Textile Commission and Asst. Drug Controller. Port has also allotted the land to FSSAI & Drug controller for setting up of laboratories.

- Empowering women in the maritime community providing an opportunity to raise awareness of the importance of gender equality within the sector.

- It reduces the logistics costs massively and also cuts down the delivery time.

- It will contribute towards the blue economy.

- The growth in international trade and the removal of trade barriers enabled developing countries like India to concentrate on infrastructural improvement.

- Port connectivity enhancement, coastal community development, port modernization, new port development, and port-linked industrialization.

- India is the 16th largest maritime country in the world. In order to augment the Indian tonnage in the shipping industry and to promote the objective of Atamanirbhar Bharat, factors like safe shipping, increased seaborne trade, and the use of greener fuels will further drive India’s maritime logistics industry growth. The maritime logistics industry has a bright future with technological advancements and the government’s multiple projects already in place.

- Besides the gamut of initiatives, pursuing ‘Make in India’ will further increase tremendous opportunities, especially in the ship repair industry. The shipbuilding policy will further encourage Indian shipyards to get more foreign orders. In tandem with the increasing awareness about being environmentally conscious, the maritime industry is pushing towards using alternate cleaner fuels to reduce carbon emissions as much as possible.

- The Ministry has allocated 365 crore rupees for the scheme from 2021-22 to 2025-26.

About SMILE

About SMILE

- This umbrella scheme, designed by Department of Social Justice & Empowerment.

- Each and every need of Transgender community and persons engaged in the act of begging are taken care of in most professional way.

- The provision of National Portal & Helpline will provide necessary information and solutions to the problems of the Transgender community and the people engaged in the act of begging’.

- It includes two sub-schemes –

- ‘Central Sector Scheme for Comprehensive Rehabilitation for Welfare of Transgender Persons’.

- ‘Central Sector Scheme for Comprehensive Rehabilitation of persons engaged in the act of Begging.

- The scheme strengthens and expands the reach of the Rights that give the targeted group the necessary legal protection and a promise to a secured life.

- It provides Scholarships for Transgender Students studying in IX and till post-graduation to enable them to complete their education.

- It has provisions for Skill Development and Livelihood under PM-DAKSH scheme.

- Through Composite Medical Health it provides a comprehensive package in convergence with PM-JAY supporting Gender-Reaffirmation surgeries through selected hospitals.

- The Housing facility in the form of ‘Garima Greh’ ensures food, clothing, recreational facilities, skill development opportunities, recreational activities and medical support etc. to the Transgender community and the people engaged in the act of begging.

- The Provision of Transgender Protection Cell in each state will monitor cases of offences and to ensure timely registration, investigation and prosecution of offences.

- It will focus on Survey and identification, Mobilisation, Rescue/ Shelter Home and Comprehensive resettlement.

- Besides, pilot projects have been initiated on Comprehensive Rehabilitation in ten cities namely Delhi, Bangalore, Chennai, Hyderabad, Indore, Lucknow, Mumbai, Nagpur, Patna and Ahmedabad.

- PM-DAKSH Yojana is a National Action Plan for skilling of marginalized persons covering SCs, OBCs, EBCs, DNTs, Sanitation workers including waste pickers.

- But still, on 25 June 2020, when the epidemic was finally declared over, it had become the largest Ebola outbreak ever to affect the DRC. It was also the second largest and longest globally to date, claiming 2,287 lives across a 23-month period.

Ebola Virus

Ebola Virus

- Ebola virus disease (EVD), formerly known as Ebola haemorrhagic fever, is a rare but severe, often fatal illness in humans.

- The virus is transmitted to people from wild animals and spreads to the human population through human-to-human transmission.

- The average EVD case fatality rate is around 50%. Case fatality rates have varied from 25% to 90% in past outbreaks.

- Community engagement is key to successfully controlling outbreaks.

- Vaccines to protect against Ebola have been developed and have been used to help control the spread of Ebola outbreaks in Guinea and in the Democratic Republic of the Congo (DRC).

- Early supportive care with rehydration, symptomatic treatment improves survival.

- Two monoclonal antibodies (Inmazeb and Ebanga) were approved for the treatment of Zaire ebolavirus (Ebolavirus) infection in adults and children by the US Food and Drug Administration in late 2020.

- Pregnant and breastfeeding women with Ebola should be offered early supportive care.

- Likewise, vaccine prevention and experimental treatment should be offered under the same conditions as for non-pregnant population.

- The 2014–2016 outbreak in West Africa was the largest Ebola outbreak since the virus was first discovered in 1976.

- The outbreak started in Guinea and then moved across land borders to Sierra Leone and Liberia.

- The virus family Filoviridae includes three genera:

- Cuevavirus,

- Marburgvirus, and

- Within the genus Ebolavirus, six species have been identified: Zaire, Bundibugyo, Sudan, Taï Forest, Reston and Bombali.

- antibody-capture enzyme-linked immunosorbent assay (ELISA)

- antigen-capture detection tests

- serum neutralization test

- reverse transcriptase polymerase chain reaction (RT-PCR) assay

- electron microscopy

- Virus isolation by cell culture.

- Reducing the risk of wildlife-to-human transmission.

- Reducing the risk of human-to-human transmission from direct or close contact with people with Ebola symptoms, particularly with their bodily fluids.

- Outbreak containment measures, including safe and dignified burial of the dead, identifying people who may have been in contact with someone infected with Ebola and monitoring their health for 21 days.

- Reducing the risk of possible sexual transmission, based on further analysis of ongoing research and consideration by the WHO Advisory Group on the Ebola Virus Disease Response.

- It has a 25-mile (40-km) coastline on the Atlantic Ocean but is otherwise landlocked. It is the second largest country on the continent.

- The capital, Kinshasa, is located on the Congo River.

- It borders nine countries: Angola, Burundi, the Central African Republic, the Republic of Congo, Rwanda, South Sudan, Tanzania, Uganda, and Zambia.

- The oldest national park in Africa is the Congo’s Virunga National Park. It is home to rare mountain gorillas, lions, and elephants.

- The DRC is among the most resource-rich countries on the planet, with an abundance of gold, tantalum, tungsten, and tin – all minerals used in electronics such as cell phones and laptops – yet it continues to have an extremely poor population.

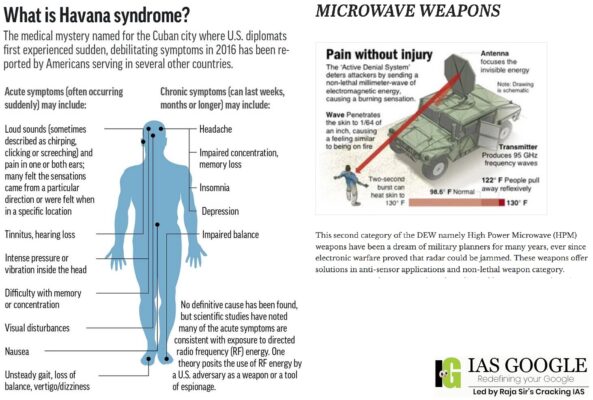

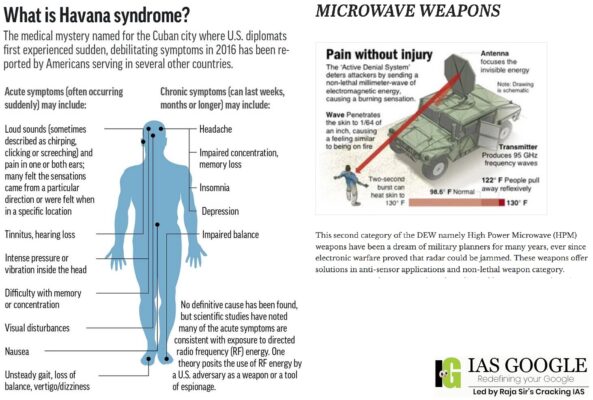

What is Havana Syndrome?

What is Havana Syndrome?

- ‘Havana Syndrome’ is a colloquial name given to a set of symptoms such as dizziness, hearing loss, headaches, vertigo, nausea, memory loss and possible brain injuries first reported by 16 U.S. Embassy staff and their family members in Havana, Cuba, in 2016-17. There have been other instances of the phenomenon, which has mostly impacted U.S. officials.

- ‘Havana Syndrome’ cases could have been caused by pulsed electromagnetic energy in the radio frequency.

- The symptoms included nausea, severe headaches, fatigue, dizziness, sleep problems, and hearing loss, which have since come to be known as Havana Syndrome.

- The more chronic problems suffered by Havana personnel included mainly vestibular processing and cognitive problems as well as insomnia and headache.

- While the symptoms have resolved for some of the affected employees, for others, the effects have lingered and posed a significant obstacle to their work and affected the normal functioning of lives.

- These are supposed to be a type of direct energy weapons, which aim highly focused energy in the form of sonic, laser, or microwaves, at a target.

- Microwave weapons release electromagnetic radiation which cause sensations in the human body.

- Major countries across the world are believed to possess these microwave weapons. Including China and the US themselves.

- These weapons are a cause of concern as they can affect both machines and human beings.

- These weapons can cause long-term damage without leaving a single mark on the human body.

- Microwaves can knock out electronic gadgets, Wi-Fi and even drones. Exposure to high levels of microwaves can cause a painful burn in humans.

- There’s no evidence that a microwave weapon exists, despite more than five decades of research on microwave technology.

Ultra-processed Food:

Ultra-processed Food:

- The term “ultra-processed food” is clearly defined in the NOVA framework as “formulations of ingredients, mostly of exclusive industrial use, that result from a series of industrial processes”. The framework puts foods into four categories according to their degree of processing.

- Ultra-processed food products include many soft drinks, biscuits, processed meats, instant noodles, frozen meals, flavoured yoghurts and bread products. Consumption of ultra-processed food has been linked to health and environmental harms.

- Ultra-processed foods are made mostly from substances extracted from foods, such as fats, starches, added sugars, and hydrogenated fats.

- They may also contain additives like artificial colors and flavors or stabilizers. Examples of these foods are frozen meals, soft drinks, hot dogs and cold cuts, fast food, packaged cookies, cakes, and salty snacks.

- Ultra-processed foods are the main source (nearly 58%) of calories eaten in the US, and contribute almost 90% of the energy we get from added sugars.

- The effects of an ultra-processed diet to the effects of an unprocessed diet on calorie intake and weight gain.

- First, dietary guidelines can provide examples of less obvious ultra-processed foods. While soft drinks and fast foods are common examples, others include processed breads, flavoured yoghurts, sauces, breakfast cereals and ready meals.

- Second, dietary guidelines can provide more explanation about how to identify ultra-processed foods based on the nature and purpose of processing.

- Powerful food companies, which are often headquartered in high-income countries, are driving the global expansion of ultra-processed foods into industrialising countries such as South Africa and China. Greater scrutiny of the practices used to promote them is an important step towards reducing their consumption.

- Finally, policy makers can use dietary guidelines to inform the development of other food policies to support citizens to reduce consumption of ultra-processed foods.

- It is also important to enable consumption of minimally processed foods, such as through subsidies or other initiatives, to make them more affordable and accessible. This could include support for living wages paid to workers in the food system, such as Australia’s recent initiative to pay farm workers the minimum wage.

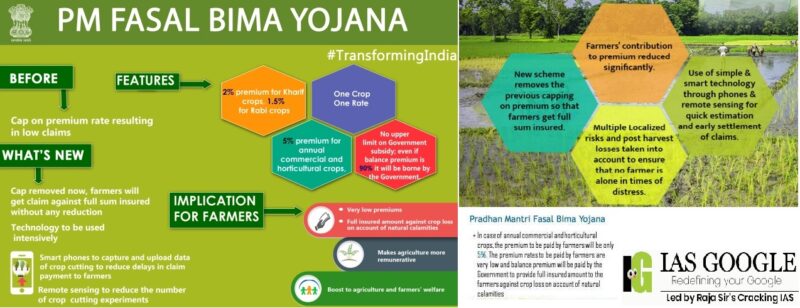

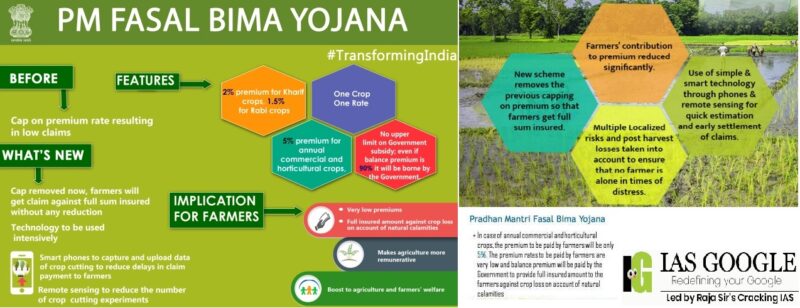

- The government is in an agreement with insurance companies under PMFBY, which will end by next year, he noted. “The state government can take steps then.”

Pradhan Mantri Fasal Bima Yojana

Pradhan Mantri Fasal Bima Yojana

- There will be a uniform premium of only 2% to be paid by farmers for all Kharif crops and 5% for all Rabi crops. In case of annual commercial and horticultural crops, the premium to be paid by farmers will be only 5%. The premium rates to be paid by farmers are very low and balance premium will be paid by the Government to provide full insured amount to the farmers against crop loss on account of natural calamities.

- There is no upper limit on Government subsidy. Even if balance premium is 90%, it will be borne by the Government.

- Earlier, there was a provision of capping the premium rate which resulted in low claims being paid to farmers. This capping was done to limit Government outgoing on the premium subsidy. This capping has now been removed and farmers will get a claim against full sum insured without any reduction.

- The use of technology will be encouraged to a great extent. Smart phones will be used to capture and upload data of crop cutting to reduce the delays in claim payment to farmers. Remote sensing will be used to reduce the number of crops cutting experiments.

- PMFBY is a replacement scheme of NAIS / MNAIS, there will be exemption from Service Tax liability of all the services involved in the implementation of the scheme. It is estimated that the new scheme will ensure about 75-80 per cent of subsidy for the farmers in insurance premium.

- There are Two Schemes under the said operational Guidelines

- Pradhan Mantri Fasal Bima Yojana (PMFBY)

- Revised Weather Based Crop Insurance Scheme (RWBCIS)

- Providing financial support to farmers suffering crop loss/damage arising out of unforeseen events.

- Stabilizing the income of farmers to ensure their continuance in farming

- Encouraging farmers to adopt innovative and modern agricultural practices

- Ensuring flow of credit to the agriculture sector which will contribute to food security, crop diversification and enhancing growth and competitiveness of agriculture sector besides protecting farmers from production risks.

- All farmers who have been sanctioned Seasonal Agricultural Operations (SAO) loans (Crop Loans) from Financial Institutions (FIs), i.e., loanee farmers, for the notified crop(s) season would be covered compulsorily.

- The Scheme is optional for non-loanee farmers.

- The insurance coverage will strictly be equivalent to sum insured/hectare, as defined in the Govt. notification or /and on National Crop Insurance Portal multiplied by sown area for notified crop.

- Yield Losses (standing crops, on notified area basis). Comprehensive risk insurance is provided to cover yield losses due to non-preventable risks, such as Natural Fire and Lightning, Storm, Hailstorm, Cyclone, Typhoon, Tempest, Hurricane, Tornado. Risks due to Flood, Inundation and Landslide, Drought, Dry spells, Pests/ Diseases also will be covered.

- In cases where majority of the insured farmers of a notified area, having intent to sow/plant and incurred expenditure for the purpose, are prevented from sowing/planting the insured crop due to adverse weather conditions, shall be eligible for indemnity claims up to a maximum of 25 per cent of the sum-insured.

- In post-harvest losses, coverage will be available up to a maximum period of 14 days from harvesting for those crops which are kept in “cut & spread” condition to dry in the field.

- For certain localized problems, Loss / damage resulting from occurrence of identified localized risks like hailstorm, landslide, and Inundation affecting isolated farms in the notified area would also be covered.

- Opportunities for agricultural insurance in India are numerous and insurance can be a risk transfer mechanism for Indian farmers that depend heavily on rains especially with the increasing influence of climate change.

- There is room for experiments and expansion of new insurance products since penetration is low and there is also a favourable political environment for insurance and support of agricultural livelihoods.

- Provides comprehensive insurance coverage against crop loss on account of non-preventable natural risks, thus helping in stabilizing the income of the farmers and encouraging them for adoption of innovative practices.

- Increased risk coverage of Crop cycle – pre-sowing to post-harvest losses.

- Area approach for settlement of claims for widespread damage. Notified Insurance unit has been reduced to Village/Village Panchayat for major crops.

- Various constraints include the mindset of farmers and states, finances, technology, logistics, convenience, transparency, and the role of insurers.

- One of the major challenges that remain is: How to segregate insurance and disaster relief. Insurance products have a commercial basis whereas the disaster relief for small and marginal farmers has a social implication.

- There are data constraints that also greatly limit the use of insurance. Additional yield data and farm gate data, data on land holdings, crops grown and damage calculations are needed.

- Lack of adequate databases for determining premiums and indemnities and lack of adequate infrastructure create constraints in implementing crop insurance in India, particularly in backward states.

- There is also a lack of public awareness of agricultural insurance. In particular, backwards regions are still facing lack of development in getting the benefits of government programs.

- There is a strong need for awareness drive among farming families, especially small and marginal farmers.

- Technology usage will be critical both for design and usage by farmers and India do possess strong IT capacity.

- Measures can be taken to improve weather insurance products including involvement of international experts, using satellite imagery with innovative computer models, and creation and usage of specialized indices like Normalized Difference Vegetation Index.

- The credibility of Crop Cutting Experiments (CCEs) should be improved using a digital confirmation and auditing process and the State should ensure the use of General Packet Radio Service (GPRS) enabled and camera-fitted mobile phones while conducting CCEs.

- Development of a web portal could make data on land records for all states available to financial institutions for speeding the insurance processing.

- Community-Based Insurance with farmer producer organizations (FPOs) needs to be encouraged to reduce the high transaction costs in the existing model. FPOs, through Private Public Partnerships (PPP) can promote mobile technology use for money transfer both for premium collection and compensation payments.

- Investment in agricultural infrastructure/research would be more equitable as opposed to subsidies to crop insurance and may yield more long-term benefits. Farmers deserve the chance to farm on their own. They know the weather better than anyone—it is their greatest foe and their greatest friend. The concept of index-based contracts for natural disasters in place of crop insurance has been recently introduced. Farmers would purchase a contract and be compensated when a certain event or natural disaster occurs.

- A better option would be an income guarantee not based upon yield, crop grown, or farm size. Farmers could be given an income guarantee not based on yield, price, or area planted. Considering the various subsidies that are given to farmers through various means–fertilizers, seed, price supports, etc.–an income guarantee should not be an unfeasible option. Farmers need to be able to respond to market forces and develop their own risk-management tools.

- The model of crop insurance in place in Gujarat’s Beed district is being studied by a central government panel set up to suggest suitable working models for PMFBY.

- In the Beed model, there is a cap on the profit of the insurance companies. If the claims exceed the insurance cover, the state government pays the bridge amount. If the claims are less than the premium collected, the insurance company keeps 20 per cent of the amount as handling charges and reimburses the rest to the state government.

- “The Beed model will reduce the state’s subsidy burden but we have to see if it is benefitting the farmers,” stated the agriculture official.

- The high rate of inflation in January, 2022 is primarily due to rise in prices of mineral oils, crude petroleum & natural gas, basic metals, chemicals and chemical products, food articles etc as compared the corresponding month of the previous year.

Wholesale Price Index (WPI)?

Wholesale Price Index (WPI)?

- A wholesale price index (WPI) is an index that measures and tracks the changes in the price of goods in the stages before the retail level.

- This refers to goods that are sold in bulk and traded between entities or businesses (instead of between consumers).

- Usually expressed as a ratio or percentage, the WPI shows the included goods' average price change; it is often seen as one indicator of a country's level of inflation.

- A wholesale price index (WPI) measures and tracks the changes in the price of goods before they reach consumers: goods that are sold in bulk and traded between entities or businesses (rather than consumers).

- Wholesale price indexes (WPIs) are one indicator of a country's level of inflation.

- The inflation rate calculated on the basis of the movement of the Wholesale Price Index (WPI) is an important measure to monitor the dynamic movement of prices.

- As WPI captures price movements in a most comprehensive way, it is widely used by Government, banks, industry and business circles.

- The movement of WPI serves as an influential determinant, in the formulation of trade, fiscal and other economic policies by the Government of India.

- The WPI indices are also used for the purpose of escalation clauses in the supply of raw materials, machinery and construction work.

- WPI is used as a deflator of various nominal macroeconomic variables, including Gross Domestic Product (GDP).

- The Consumer Price Index (CPI) is a measure that examines the weighted average prices of a basket of consumer goods and services, such as transportation, food, and medical care.

- It is calculated by taking price changes for each item in the predetermined basket of goods and average them. Changes in the CPI are used to assess price changes associated with the cost of living.

- The CPI is one of the most frequently used statistics for identifying periods of inflation or deflation.

- WPI measures the average change in prices of goods at the wholesale level while CPI calculates the average change in prices of goods and services at the retail level.

- WPI data is published by the Office of Economic Adviser, Ministry of Commerce and Industry, while CPI data is published by the National Statistical Office (NSO), Ministry of Statistics and Programme Implementation (MoSPI).

- The base year for WPI is 2011-12 while the base year for CPI is 2012.

- WPI takes into account the change in price of goods only, while CPI takes into account the change in process of both goods and services.

Latest News

Latest News

General Studies

General Studies