- Home

- Prelims

- Mains

- Current Affairs

- Study Materials

- Test Series

Strong hints emerge that India is unlikely to take Vodafone tax case

Recently, the Permanent Court of Arbitration at the Hague has finally ruled in favour of the telecom giant Vodafone in an investment treaty arbitration (ITA) dispute against India.

The case was initiated under the India-Netherlands Bilateral Investment Treaty (BIT), which pertains to India’s retrospective demand of Rs 22,100 crore as capital gains and withholding tax imposed on a 2007 deal.

The ruling in favour of Vodafone signals a setback for the country's retrospective taxation policies. It also raises the concern for the ease of doing business and lack of corporate policy framework regarding taxation.

Further, if India really wants to become an international hub of global investment, there is a need for ensuring transparency and certainty in India’s tax regime.

Vodafone Issue

Vodafone Issue

Vodafone Issue

Vodafone Issue

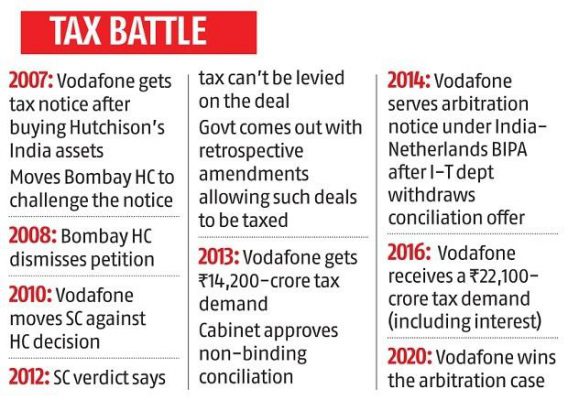

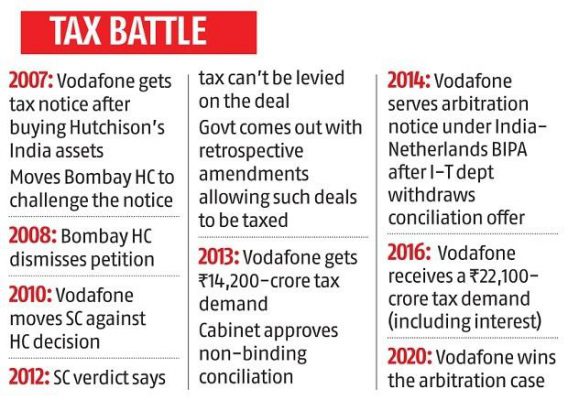

- In May 2007, Vodafone had bought a 67% stake in Hutchison for $11 billion. This included the mobile telephony business and other assets of Hutchison in India.

- In September that year, the India government for the first time raised a demand of Rs 7,990 crore in capital gains and withholding tax from Vodafone.

- However, Vodafone held that, as the stake purchase transaction took place outside India between two overseas entities, it was not liable for any tax relating to the deal.

- Due to this, Vodafone challenged the demand notice in the Bombay High Court which ruled in favour of the Income Tax Department.

- Subsequently, Vodafone challenged the High Court judgment in the Supreme Court in 2012.

- The Supreme Court ruled that Vodafone Group’s interpretation of the Income Tax Act of 1961 was correct and that it did not have to pay any taxes for the stake purchase.

- Following a setback the government of the day, made amendment to the Finance Act in 2012 to give retrospective effect to its claims.

- This was the trigger for Vodafone to seek arbitral recourse.

- In 2014, when the Vodafone Group had initiated arbitration against India at the Court of Arbitration, it had done so under Article 9 of the BIT between India and the Netherlands.

- Retrospective taxation allows a country to pass a rule on taxing certain products, items or services and deals and charge companies from a time behind the date on which the law is passed.

- Countries use this route to correct any anomalies in their taxation policies that have, in the past, allowed companies to take advantage of such loopholes.

- Retrospective tax: The policy of retrospective taxation has acted as an “irritant” and adversely affected the inflow of foreign capital to India.

- Abrupt Policy Changes: There has been a lack of certainty about tariff and taxes. This uncertainty needs to be resolved soon to boost business and investments ties.

- Plethora of Taxation Laws: There have been many taxation laws of the Central and many State Governments which increases complexities and litigation and reduces predictability, fairness and automation.

- Reducing Scope of Litigation: There is a need to focus on signing Advance-pricing Agreements to avoid Transfer pricing disputes.

- Further, revisions in tax treaties with many countries will also help in reducing litigation.

- Need to Bring More Clarity on Tax laws: India has already rolled out Anti-tax avoidance regulations i.e. the General Anti-Avoidance Rules (GAAR) from assessment year 2018-19.

- However, there is a need to bring more transparency for avoiding issues related to retrospective taxation.

- Indian Finance Code: There is a need for simplification of taxation laws in India. In this context there is a need to implement recommendations of the Financial Sector Legislative Reforms Commission.

- The commission proposed Indian Financial Code which would contain new legislation for the Indian financial system as it is considered to be fragmented, with gaps, overlaps, inconsistency and arbitrary.

- Adopting International Best Practice: India may explore the option to revise the standard of treatment clause to align it with international practices and include the traditional standard of protection of fair and equitable treatment.

- Also, must give clarification regarding the open-ended terms in the Model BIT. This could result in India facing fewer disputes and BIT claims.

Latest News

Latest News

General Studies

General Studies