- Home

- Prelims

- Mains

- Current Affairs

- Study Materials

- Test Series

Why oil prices are crashing and what it means?.

Recently, the global price of crude oil (black gold) has crashed. The two major oil indices: West Texas Intermediate (WTI) dropped to below -$40/barrel (lowest in history) in the US and the price of Brent crude traded below $20/barrel (prices dropped almost two-third of its value than those at the start of 2020).

According to Bloomberg, this fall in WTI, is the lowest crude oil price ever recorded, even surpassing the previous lowest which was immediately after World War II.

This fall in prices is triggered by multiple factors viz. demand reduction due to the Covid-19 induced global lockdowns, massive oversupply due to price war, and storage space running out both on the land and the seas.

This fall in oil prices provides an opportunity for India. However,to take advantage of falling oil prices, it is high time for India to undertake much needed energy sector reforms.

How is the price of crude oil determined?

- The global oil pricing is by no stretch an example of a well-functioning competitive market. In fact, it depends on cartels of oil exporters acting in consort.

- In the recent past, OPEC (led by Saudi Arabia-single-handedly exporting 10% of the global demand) has been working with Russia, as OPEC+, to fix the global prices and supply.

- These cartels could bring down prices by increasing oil production and raise prices by cutting production.

Why Crash In Oil Prices

The fall in oil prices can be attributed to the mismatch in demand and supply of crude oil in the global market.

Too Much Supply

- Recently, there was a price war going on between Russia and Saudi Arabia, where both disagreed to lower-oil production so that the price of oil can be stabilised upwards.

- It must be understood that cutting production or completely shutting down an oil well is a difficult decision, because restarting it is both immensely costly and cumbersome.

- Moreover, if one country cuts production, it risks losing market share if others do not follow suit.

- The US is also producing oil aggressively, making it tough for other oil exporting countries (in West Asia ) to cut its oil production.

Too Little Demand

- Over-supply of oil is an unsustainable pricing strategy under normal circumstances but it is even more calamitous during Covid-19 pandemic..

- The pandemic sharply reduced economic activity and the demand for oil.

- A recent Goldman Sachs report estimated that Covid-19 had lowered the world crude consumption by 28 million barrels per day.

Running Out of Space to Store

- According to reports, the mismatch (too much supply and too little demand) resulted in almost all storage capacity being exhausted.

- Trains and ships, which were typically used to transport oil, too, were used up just for storing oil.

- This lack of storage was the immediate reason for negative oil prices in WTI.

Impact of Low Oil Prices

Geo-Political Impact

- This crash in oil prices may undermine the political stability of several regimes in West Asia, impact Russia’s plan to revive its crippled economy and destroy the US’s shale oil industry.

Affecting Clean-Energy Alternatives

- The profound and highly visible impact of the lockdown-induced reduction in mobility on air quality in polluted cities around the world could give a significant impetus to the search for non-polluting transportation alternatives.

- This will have significant implications for investments in clean and renewable energy sources like solar and wind power.

- On the negative side, developing countries (who don’t have technology for renewable energy) may tend to use cheap oil for its developmental needs and neglecting clean energy alternatives.

Impact on India

The ways in which this lower price can help India.

- If the government passes on the lower prices to consumers, this will boost public consumption and may help in economic recovery in a post-lockdown scenario.

- If, on the other hand, governments (both at the Centre and the states) decide to levy higher taxes on oil, it can boost government revenues.

- India being the world’s third largest importer of crude oil, a sharp and prolonged decline in oil prices helps in reducing current account deficit.

On the negative side, the Gulf’s lower oil revenues also presage decreased bilateral trade and investments as well as expatriates’ remittances — all of them adding to India’s current financial stress.

Road ahead

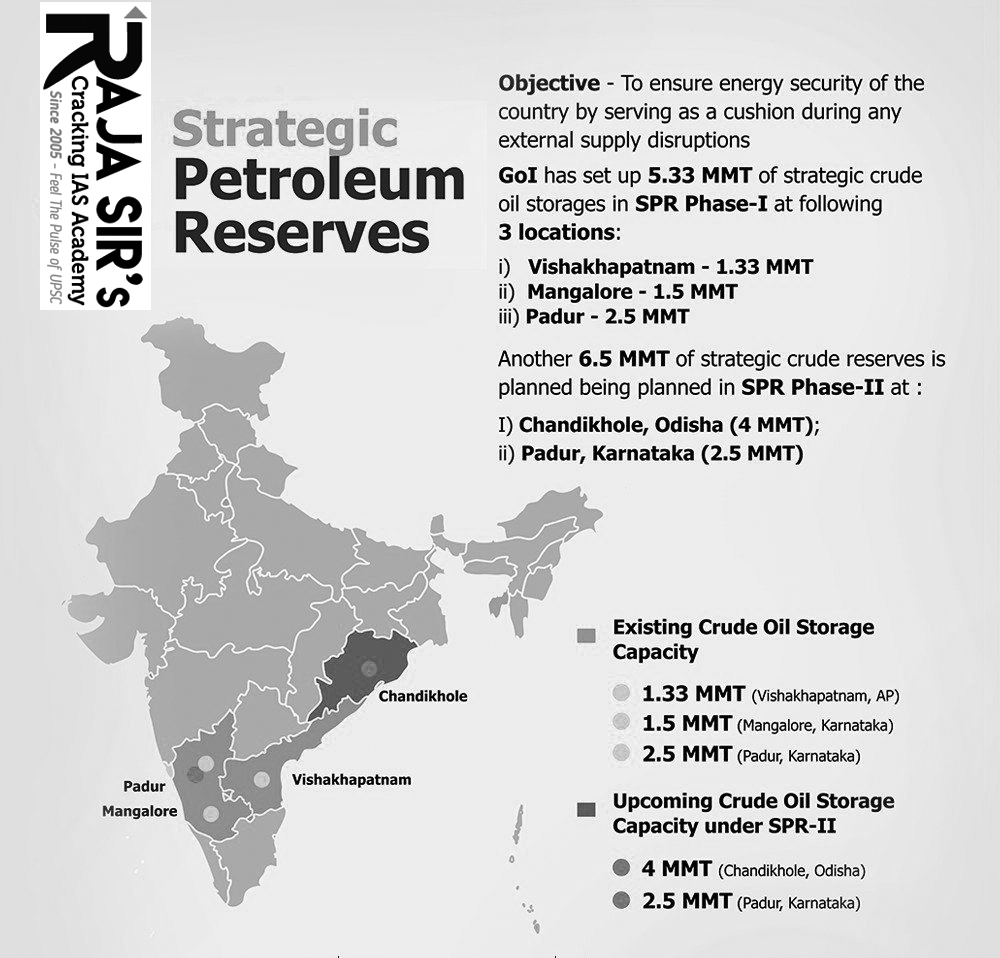

Building Strategic Petroleum Reserves

- Storing oil at low prices will enhance the country’s

energy security, given India’s high import dependency. Therefore, India must

seize this opportunity to build on its strategic petroleum reserves

(SPR).

- Currently, India has three strategic petroleum reserves at Vizag (1.3 million tonnes), Mangaluru (1.5 million tonnes) and Padur (2.5 million tonnes), amounting to 9.5 days of its crude oil requirements.

- There is a need to speed up two additional SPR facilities which will add another 6.5 MMT or about 11.57 days of the country’s crude requirements.

- India should be working on IEA protocol, where each member country has to hold emergency oil stocks equivalent to at least 90 days of imports.

New drivers for the India-Gulf Synergy

- The Gulf region is immensely important for India, from a strategic, commercial and energy security perspective. Therefore, India-Gulf economic ties must be diversified to protect them from such shocks.

- New areas of cooperation may include healthcare and gradually extend outward towards pharmaceutical research and production, petrochemical complexes, building infrastructure in India and in third countries, agriculture, education and skilling.

Need for Energy Sector Reforms

- With the world’s largest expansion in energy markets imminent in the country, India must become the nerve center for innovation in technologies such as clean coal, underground gasification, gas hydrates, carbon dioxide sequestration, nonconventional extraction, and renewables.

- In order to reduce import dependency, there is a need to

promote private sector engagement in fuel extraction domestically.

- In this context, policy and regulation, whether for all statutory clearances, land acquisition, or administration of contracts and regulations, must be applied in a non-discriminatory manner, for the private sector.

- If energy sector reforms are to succeed, regulatory authorities must be given autonomy, which can unshackle them from unwarranted political and bureaucratic control.

Also Read the articles below:-

https://www.bloombergquint.com/business/three-signs-of-stress-emerging-in-indias-debt-markets

Latest News

Latest News

General Studies

General Studies