- Home

- Prelims

- Mains

- Current Affairs

- Study Materials

- Test Series

EDITORIALS & ARTICLES

EDITORIALS & ARTICLES

26th Aug 2021

RBI PANEL SUGGESTS 4-TIER STRUCTURE FOR URBAN CO-OP BANKS

Recently, the Reserve Bank of India’s (RBI’s) expert committee on urban co-operative banks (UCBs) has suggested a four-tiered structure to regulate them, based on size of deposits.

- The committee is headed by former RBI Deputy Governor NS Vishwanathan.

- The committee has proposed setting up an umbrella organisation (UO) to oversee co-operative banks.

- The UO should be financially strong and be well governed by a professional board and senior management, both of which are fit and proper.

- The Committee preferred smaller banks acquiring scale via the network of the UO, which is one of the successful models of a strong financial cooperative system globally.

- The minimum capital for the UO should be Rs 300 crore with CRAR and regulatory framework akin to the largest segment of NBFCs.

- It also suggested that the UCBs should be allowed to open more branches if they meet all regulatory requirements.

- The panel said the RBI should not hesitate to use the route of mandatory merger to resolve UCBs that do not meet the prudential requirements.

- The committee also recommended that the limit for home loans, gold loans and unsecured loans should be fixed as per the bank category.

- The general banking rules should be applicable to large urban cooperative banks which includes capital raising and all other conditions.

- It has suggested that the minimum Capital to Risk-Weighted Assets Ratio (CRAR) for them could vary from 9 per cent to 15 per cent and for Tier-4 UCBs the Basel III prescribed norms.

- It should follow a twin-indicator approach i.e. it should consider only asset quality and capital measured through NNPA and CRAR instead of triple indicators at present.

- The objective of the SAF should be to find a time-bound remedy to the financial stress of a bank.

- If a UCB remains under more stringent stages of SAF for a prolonged period, it may have an adverse effect on its operations and may further erode its financial position.

- According to the committee, based on the cooperativeness’ of the banks, availability of capital and other factors, UCBs may be categorized into four tiers for regulatory purposes:

- Tier 1with all unit UCBs and salary earner’s UCBs (irrespective of deposit size) and all other UCBs having deposits up to Rs 100 crore;

- Tier 2with UCBs of deposits between Rs 100 crore and Rs 1,000 crore;

- Tier 3with UCBs of deposits between Rs 1,000 crore and Rs 10,000 crore; and

- Tier 4 with UCBs of deposits more than Rs 10,000 crore

- Urban Co-operative Banks (UCBs) occupies an important place among the Non-Agricultural Credit Society.

- The UCBs provide various kinds of Banking facilities like Commercial and Nationalized Bank to their members and customers.

- The main objectives of the UCBs are:

- To attract deposits from members as well as non-members.

- To advance loan to Members.

- To act as the age for the joint purchase of domestic and other requirements of the members.

- To undertake collection of bills, accepted or endorsed by member.

- To arrange for the safe custody of valuable documents of members.

- To provide other facilities as provided by commercial banks.

- The main functions of the urban co-operative banks are to accept deposits from the members and non-members.

- In September 2020, the Parliament passed amendments to the Banking Regulation Act and brought co-operative banks under the RBI’s supervision.

- In the event of failure of UCBs, deposits with them are covered by the Deposit Insurance and Credit Guarantee Corporation of India up to a sum of ₹1 lakh per depositor.

- With the Taliban takeover of Afghanistan, the history of the minuscule but important Sikh community in the country could be on the verge of its end.

- The Sikh community is in fact indigenous to Afghanistan and has a long and deep-rooted history in the region.

- The book, ‘Afghan Hindus and Sikhs: History of a thousand years' (2019) suggested that the history of Sikhism in Khurasan (medieval Afghanistan) begins with the founder of the Sikh religion, Guru Nanak.

- In 2011, a research paper explained that the Sikh population in the region consisted of those members of the indigenous population who resisted the process of conversion from Buddhism to Islam.

- In 1504, the Mughal emperor Babur captured Kabul and by 1526 he was the master of Northern India.

- Kabul became one of the provinces of Hindustan and was referred to as ‘Hindustan’s own market’ by Babur.

- It remained part of Hindustan till 1738 when it was conquered by the Persian ruler Nadir Shah.

- During this period the Sikh chroniclers record a number of names and instances when Sikh followers in Kabul came to the region now known as East Punjab, to pay respect to the Sikh Gurus.

- The 18th-century text, Mahima Prakash, written by Sarup Das Bhalla, mentions the name of ‘Kabuli wali Mai’ (lady from Kabul) who did seva (voluntary service) while digging a stepwell at Gondiawal in East Punjab.

- The same text also mentions Bhai Gonda who was sent to Kabul to propagate the teachings of the seventh Sikh Guru and that he also established a Gurudwara there.

- For about 101 years the Afghans and Sikh empire were neighbours and mostly antagonists.

- By the early decades of the 19th century, the Sikh empire under Maharaja Ranjit Singh had annexed large parts of the Durrani Empire under the Afghans.

- During the Second Anglo-Sikh war of 1848-49, however, the Sikhs were supported by the Afghans, even though they lost out to the British.

- In the late 19th and early 20th century, in reaction to the Christian proselytising activities following the annexation of the Sikh empire by the British, the Singh Sabha movement, a Sikh reform movement was established.

- The impact of the movement was felt across Afghanistanas Akali Kaur Singh spent a year in Afghanistan, going from house to house to spread the Sikh doctrine.

- The first major exodus of the Afghan Sikhs and Hindus happened during the reign of Amir Abdur Rahman Khan in the late 19th century.

- His rule in Afghanistan was termed by the British as the‘reign of terror’.

- He is known to havejudicially executed close to 100,000 people.

- Several Hindus and Sikhs had emigrated during this period and the Afghan Sikh community of Patiala in Punjab is known to have been established then.

- It was in 1992 when the Mujahideen took over Afghanistan that the most extensive exodus of the Sikhs and Hindus started.

- Before the Mujahideen took over, in 1988, on the first day of Baisakhi, a man with an AK-47 stormed into a gurdwara and gunned down 13 Sikhs.

- In 1989, Gurdwara Guru Teg Bahadur Singhin Jalalabad was attacked by rockets fired by the Mujahideen, leading to the death of 17 Sikhs.

- More than a hundred Afghan Sikhs died during the six month period when the Mujahideen targeted mainly the Sikh residential area of the city.

- In October 2020, the Ministry of Defence signed a contract with Nagpur-based private company Economic Explosives Limited.

- The contract was signed to supply 10 lakh Multi-Mode Hand Grenades to the Indian Army at an approximate cost of Rs 409 crore.

- It is a flagship project showcasing public-private partnership under the aegis of Government of India.

- It is manufactured by Economic Explosives Limited Co following Transfer of Technology from a DRDO lab.

- It has a highly accurate delay time, very high reliability in usage and safe for carriage.

- It will replace Grenade No 36 of World War I vintage design, which had been continuing in service till date.

- The Grenade No 36 finds its origin in Mills Bomb, a popular name for a series of British Hand Grenade made by William Mills in 1915.

- It has a distinctive design that gives flexibility of employment in both defensive (fragmentation) and offensive (stun) modes.

- It has a minimum shelf life of 15 years from manufacturing under normal storage conditions, proving that it is stable and can be used for a long time.

- These grenades can be fired from the rifle too.

- The grenade offers multiple advantages to soldiers in terms of safety and penetration attack as compared to the vintage hand grenades.

- It is an important milestone in defence manufacturing and a big step towards ‘AatmaNirbhar Bharat’.

- It is an example of increasing collaboration between the public and private sectors in defence manufacturing.

- It is the first instance of ammunition being manufactured by the private industry in India.

- Saroop is a physical copy of Sri Guru Granth Sahib, also called Bir in Punjabi.

- Every Bir has 1,430 pages, which are referred to as Ang.

- The verses on every pageremain the same.

- The Sikhs consider the Saroop of Guru Granth Sahib a living guru and treat it with utmost respect.

- They believe that all the 10 Gurus were the same spirit in different bodies, and the Guru Granth Sahib is their eternal physical and spiritual form.

- It was the fifth Sikh master, Guru Arjan Dev, who compiled the first Bir of the Guru Granth Sahib in 1604, and installed it at the Golden Temple in Amritsar.

- The tenth Sikh master, Guru Gobind Singh, added verses penned by the ninth master, his father Guru Tegh Bahadur, and compiled the Bir for the second and last time.

- It was in 1708 that Guru Gobind Singh declared the Guru Granth Sahib the living Guru of the Sikhs.

- Guru Granth Sahib is acompendium of hymns written by six Sikh gurus,15 saints, including Bhagat Kabir, Bhagat Ravidas, Sheikh Farid and Bhagat Namdev, 11 Bhatts (balladeers) and four Sikhs.

- The installation and transportation of Guru Granth Sahib is governed by a strict code of conduct called 'rehat maryada'.

- Under ideal circumstances, five baptised Sikhs are required to transfer the Guru Granth Sahib from one place to another.

- As a mark of respect, the Bir of the Guru Granth Sahib is carried on the head, and the person walks barefoot.

- Whenever a devout sees the Bir of Guru Granth Sahib passing by, s/he removes her shoes and bows.

- A ceremonial whisk is waved high over the Guru Granth Sahib either on the move or while reading from it.

- Gurdwaras have a separate resting place for the Saroop, called ‘Sukh Asan Sthan’ or ‘Sachkhand’ where the Guru rests at night.

- There was a tradition among Punjabis, both Sikhs and Hindus, to copy the Guru Granth Sahib by hand and produce multiple copies.

- The Udasi and Nirmla sects also played a role in making handwritten copies of the Birs until the British introduced the printing press.

- The British also published several small copies of the Guru Granth Sahib for their Sikh soldiers so that they could carry these with them in the battlefield.

- The Shiromani Gurdwara Parbandhak Committee (SGPC) has the sole rights to publish the Birs of the Guru Granth Sahib, and this is done at Amritsar.

- Old and worn Birs of the Guru Granth Sahib are brought to Goindwal Sahib in Tarn Taran district, where they are cremated.

- These days, only printed Birs are cremated as the SGPC and other Sikh bodies have been trying to protect the few handwritten Birs that remain.

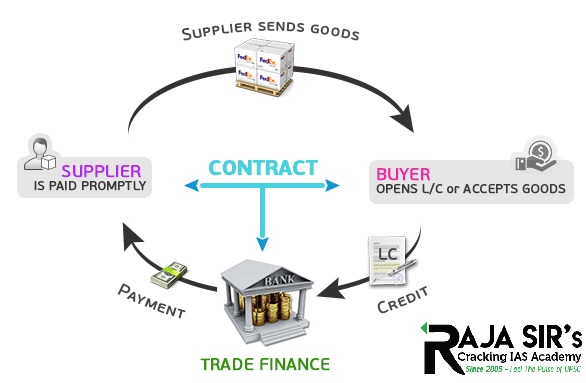

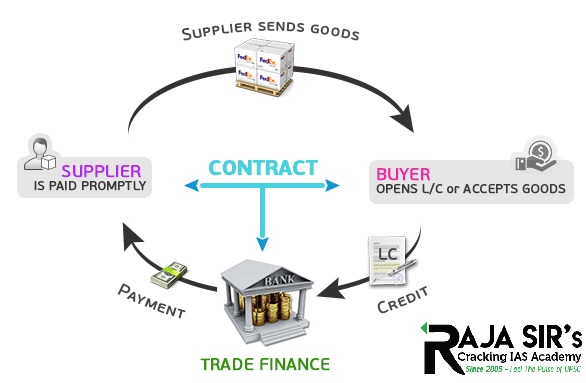

- It would be an electronic platform for facilitating the trade finance requirements of exporters and importers by providing access to multiple financiers.

- The ITFS platform will function from GIFT IFSC for providing trade financing services.

- The framework shall apply to the entities seeking permission to set up ITFS under this framework.

- The operations on ITFS shall be conducted only in a freely convertible foreign currency.

- The ITFS shall not assume any credit risk on the transactions carried out on its platform.

- An entity desirous of setting up and operating the ITFS in an IFSC shall fulfil the following criteria:

- The parent entity or the promoters/promoter groups of the company applying to set up a company as ITFS in an IFSC should have a minimum net worth of USD 1 million.

- The company proposed to be set up as ITFS shall have minimum paid up equity capital of USD 0.2 millionor equivalent in any other freely convertible currency.

- The Parent or the promoters/promoter groups of such company should be domiciled and regulated or registered in jurisdiction not identified in the public statement of Financial Action Task Force as ‘High Risk Jurisdictions’ subject to a ‘Call for Action’.

- Exporters, Importers, Financiers and Insurance/Credit Guarantee Institutions and other eligible entities will be the direct participants in the ITFS.

- It will enable Exporters and Importers to avail various types of trade finance facilities at competitive terms, for their international trade transactions through a dedicated electronic platform.

- It will help in their ability to convert their trade receivables into liquid funds and to obtain short term funding.

- It will also provide an opportunity to the participants to avail trade finance facilities for trade transactions such as:

- Export Invoice Trade Financing,

- Reverse Trade Financing

- Bill discounting under Letter of Credit,

- Supply Chain Finance for Exporters,

- Export Credit (Packing Credit),

- Insurance/ Credit Guarantee,

- Factoring and any other eligible product

- It will play an instrumental role in arranging credit for exporters & importers from global institutions through Factoring, Forfaiting and other trade financing services at competitive cost.

- It is expected to be leveraged by exporters and importers across the world for availing trade finance services, thereby making GIFT IFSC a preferred location for international trade financing.

- It has been established as a unified regulator to develop and regulate financial products, financial services, and financial institutions in the IFSCs in India.

- It has been established in April 2020 under the International Financial Services Centres Authority Act, 2019.

- It is headquartered at GIFT City, Gandhinagar in Gujarat.

- It is the maiden international financial services centre in India.

- Its primary objective is to develop a strong global connect and focus on the needs of the Indian economy.

- It will serve as an international financial platform for the entire region and the global economy as a whole.

- The strategic objectives of IFSCA are as follows:

- To position the IFSC as a leading internationally recognized centre with trusted business and tax regulation, and judicial & dispute resolution system.

- To become a gateway for global capital flows into and out of India.

- To emerge as a regional/global hub for international financial services.

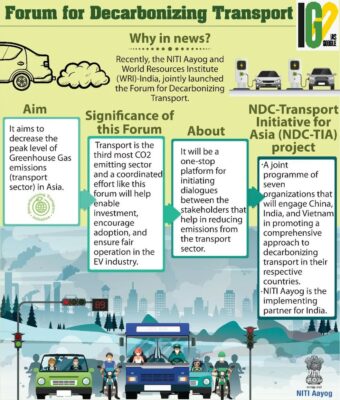

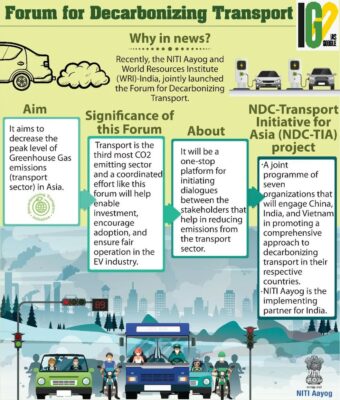

- India has a massive and diverse transport sector, which is also the third most CO2 emitting sector.

- The data from International Energy Agency (IEA) suggests that within the transport sector, road transport contributes to more than 90% of the total CO2 emissions.

- The Government of India is continuously working towards the decarbonisation of road transport, with a major focus on the adoption of electric vehicles (EVs) in the country.

- India has a great opportunity to decarbonize its urban transport sector through promotion of walking, cycling and public transport coupled with electrification of motor vehicles.

- The forum will work in close coordination with all the stakeholders to formulate strategies and develop appropriate business models to accelerate electric mobility in India.

- The forum will provide a platform to initiate dialogues for the development of uniform policies and help achieve specific results in reducing emissions from the transport sector.

- The forum will bring together CEOs, researchers, academics, multilateral agencies, financial institutions as well as the Central and state government on a common platform.

- The forum will help in the development of innovative business models resulting in targeted results and the holistic growth of the electric mobility space in India.

- It is a joint programme of seven organisations that will engage China, India, and Vietnam in promoting a comprehensive approach to decarbonizing transport in their respective countries.

- It is part of the International Climate Initiative (IKI).

- The Federal Ministry for the Environment, Nature Conservation and Nuclear Safety (BMU) support the initiative on the basis of a decision adopted by the German Bundestag.

- NITI Aayog is the implementing partner for the India component of the project.

- It is funded by the International Climate Initiative (IKI) of the German Ministry for the Environment, Nature Conservation and Nuclear Safety (BMU).

- It aims at bringing down the peak level of GHG emissions (transport sector) in Asia (in line with a well below 2-degree pathway), resulting in problems like congestion and air pollution.

- It focuses on developing a coherent strategy of effective policies and the formation of a multi-stakeholder platform for decarbonizing transport in the country.

- It aims to facilitate a paradigm shift to zero-emission transport across Asia.

- Havana Syndrome is a mysterious illness that was first detected at the US Embassy in Havana, Cuba in 2016.

- In late 2016, US diplomats and other employees stationed in Havana reported feeling ill after hearing strange sounds and experiencing odd physical sensations in their hotel rooms or homes.

- From 2016 to 2017, diplomats and staff suddenly developed surprising symptoms like hearing loss, dizziness, and other neurological issues.

- Most people who have had Havana Syndrome heard a loud noise and felt an intense pressure or vibration in their head, dizziness, and pain in their ear or head.

- The neurologic symptoms reported in Havana syndrome are commonly seen in concussions.

- The symptoms go away soon for some people, but others have experienced chronic insomnia, headaches, and even brain damage.

- The NAS study does point out that the Soviet Union researched the effects of pulsed radio frequency energy more than 50 years ago.

- The committee felt that many of the distinctive and acute signs, symptoms, and observations reported by employees are consistent with the effects of directed, pulsed radio frequency energy.

- The US has come to believe there is a “very strong possibility” the syndrome is intentionally caused.

- The Federal Bureau of Investigation, CIA, US military, National Institutes of Health, and Centers for Disease Control and Preventionhave investigated the incidents without coming out with anything conclusive.

- In December 2020, a report by the National Academies of Sciences (NAS) found “directed energy beams” as a “plausible” cause of the Havana Syndrome.

- The NAS report examined four possibilities to explain the symptoms i.e. infection, chemicals, psychological factors and microwave energy.

- The report concluded that directed pulsed radio frequency (RF) energy appears to be the most plausible mechanism in explaining these cases among those that the committee considered.

- The report warned about the possibility of future episodes and recommended that the State Department establish a response mechanism for similar incidents.

- The workers will be issued an e-Shram card containing a 12 digit unique number.

- The e-Shram card will help in including them insocial security schemes.

- It aims to register 38 crore unorganised workers, such as construction labourers, migrant workforce, street vendors and domestic workers, among others.

- A national toll free number i.e.14434 will also be launched to assist and address the queries of workers seeking registration on the portal.

- A worker can register on the portal using his/her Aadhaar card number and bank account details, apart from filling other necessary details like date of birth, home town, mobile number and social category.

- The registration of workers on the portal will be coordinated by the Labour Ministry, state governments, trade unions and CSCs.

- The awareness campaigns would be planned across the country to enable nationwide registration of workers.

- The workers from the unorganised sector can begin their registration from the same day following the launch of the portal.

Latest News

Latest News General Studies

General Studies